Overview

Income-Based Repayment (IBR) is one of the many Income-Driven Repayment (IDR) plans, often confused with the broader IDR category.

While IBR hasn’t been the most popular option in recent years, it’s expected to become the go-to plan for higher-earning physicians starting on July 1, 2024, as the Pay As You Earn (PAYE) plan will no longer be available for new borrowers.

After this date, IBR is likely to offer the lowest monthly student loan payments for many newly practicing doctors with higher incomes.

Though IBR and PAYE share many features, let’s dive into how the IBR Repayment Plan is calculated and why it may be the best option moving forward.

Overview

Income-Based Repayment (IBR) is one of the many Income-Driven Repayment (IDR) plans, often confused with the broader IDR category.

While IBR hasn’t been the most popular option in recent years, it’s expected to become the go-to plan for higher-earning physicians starting on July 1, 2024, as the Pay As You Earn (PAYE) plan will no longer be available for new borrowers.

After this date, IBR is likely to offer the lowest monthly student loan payments for many newly practicing doctors with higher incomes.

Though IBR and PAYE share many features, let’s dive into how the IBR Repayment Plan is calculated and why it may be the best option moving forward.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Income-Based Repayment (IBR)

Income-Based Repayment (IBR) is an Income-Driven Repayment (IDR) plan that determines your monthly student loan payment based on your income and family size, unlike the 10-Year Standard Repayment plan, which calculates payments based on your loan balance and interest rate.

For higher-earning physicians, the Pay As You Earn (PAYE) plan has historically been the preferred option. However, after July 1, 2024, new borrowers will no longer be able to enroll in PAYE, making IBR the go-to repayment plan.

Why is IBR beneficial?

It features a payment cap — a limit on the maximum amount you will pay each month. This cap is especially valuable for high-earning physicians pursuing Public Service Loan Forgiveness (PSLF), as it helps keep monthly payments low, maximizing the amount forgiven after 120 qualifying payments.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, IBR and PAYE are likely your best option due to this payment cap.

Income-Based Repayment (IBR)

Income-Based Repayment (IBR) is an Income-Driven Repayment (IDR) plan that determines your monthly student loan payment based on your income and family size, unlike the 10-Year Standard Repayment plan, which calculates payments based on your loan balance and interest rate.

For higher-earning physicians, the Pay As You Earn (PAYE) plan has historically been the preferred option. However, after July 1, 2024, new borrowers will no longer be able to enroll in PAYE, making IBR the go-to repayment plan.

Why is IBR beneficial?

It features a payment cap — a limit on the maximum amount you will pay each month. This cap is especially valuable for high-earning physicians pursuing Public Service Loan Forgiveness (PSLF), as it helps keep monthly payments low, maximizing the amount forgiven after 120 qualifying payments.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, IBR and PAYE are likely your best option due to this payment cap.

☁️ Poverty Line Deduction: 150%

☁️ Payment & Timeline:

-

-

New borrowers with loans taken out on or after July 1, 2014 (New IBR): 10% of your discretionary income for 20 years

-

Older borrowers with loans taken out before July 1, 2014 (Old IBR): 15% of your discretionary income for 25 years

-

☁️ Payment Cap: Yes, the 10-Year Standard Repayment Plan

☁️ Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

☁️ Interest Subsidy: No

☁️ Poverty Line Deduction: 150%

☁️ Payment & Timeline:

-

New borrowers with loans taken out on or after July 1, 2014 (New IBR): 10% of your discretionary income for 20 years

-

Older borrowers with loans taken out before July 1, 2014 (Old IBR): 15% of your discretionary income for 25 years

☁️ Payment Cap: Yes, the 10-Year Standard Repayment Plan

☁️ Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

☁️ Interest Subsidy: No

☁️ The following Direct Federal Loans qualify for IBR:

-

-

Subsidized Direct Loans

-

Unsubsidized Direct Loans

-

Direct Grad PLUS Loans

-

FFEL (Federal Family Education Loan) Loans

-

Direct Consolidation Loans

-

☁️ However, the following types of loans do not qualify for IBR:

-

-

Parent PLUS Loans

-

Direct Loans in Default

-

Private Student Loans

-

It’s worth noting that Parent PLUS Loans can also qualify through the Double-Consolidation Loophole, involving two separate consolidations. If you are a Parent PLUS loan borrower, it is highly recommended to consult with someone who specializes in student loan planning.

Partial Financial Hardship is a requirement for IBR eligibility and is determined by your income-to-debt ratio. To qualify, your monthly IBR payment must be lower than the monthly payment under the 10-Year Standard Repayment plan. It’s important for residents to enroll in IBR BEFORE their income increases as an attending, as failure to do so may make them ineligible to enroll in IBR.

☁️ The following Direct Federal Loans qualify for IBR:

-

Subsidized Direct Loans

-

Unsubsidized Direct Loans

-

Direct Grad PLUS Loans

-

FFEL (Federal Family Education Loan) Loans

-

Direct Consolidation Loans

☁️ However, the following types of loans do not qualify for IBR:

-

Parent PLUS Loans

-

Direct Loans in Default

-

Private Student Loans

It’s worth noting that Parent PLUS Loans can also qualify through the Double-Consolidation Loophole, involving two separate consolidations. If you are a Parent PLUS loan borrower, it is highly recommended to consult with someone who specializes in student loan planning.

Partial Financial Hardship is a requirement for IBR eligibility and is determined by your income-to-debt ratio. To qualify, your monthly IBR payment must be lower than the monthly payment under the 10-Year Standard Repayment plan. It’s important for residents to enroll in IBR BEFORE their income increases as an attending, as failure to do so may make them ineligible to enroll in IBR.

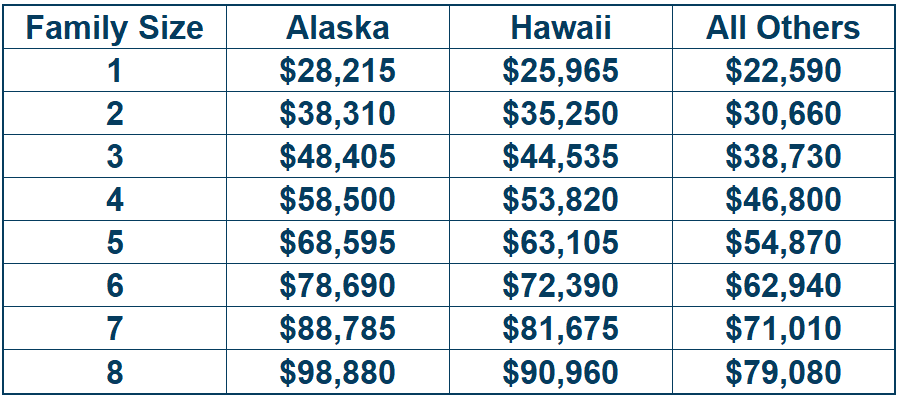

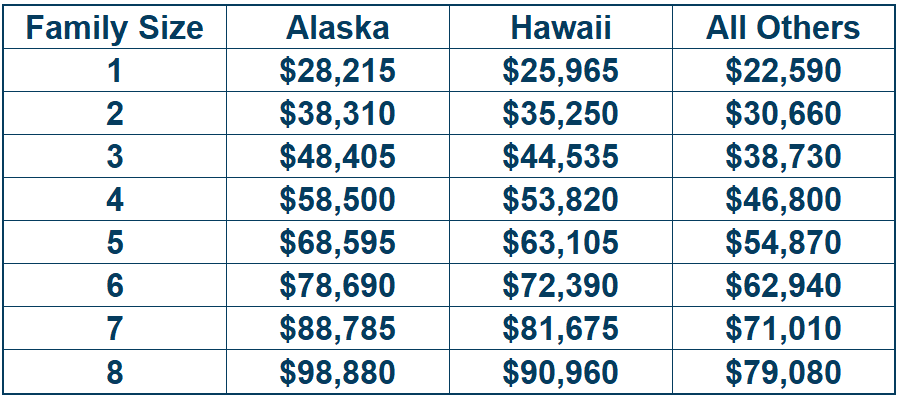

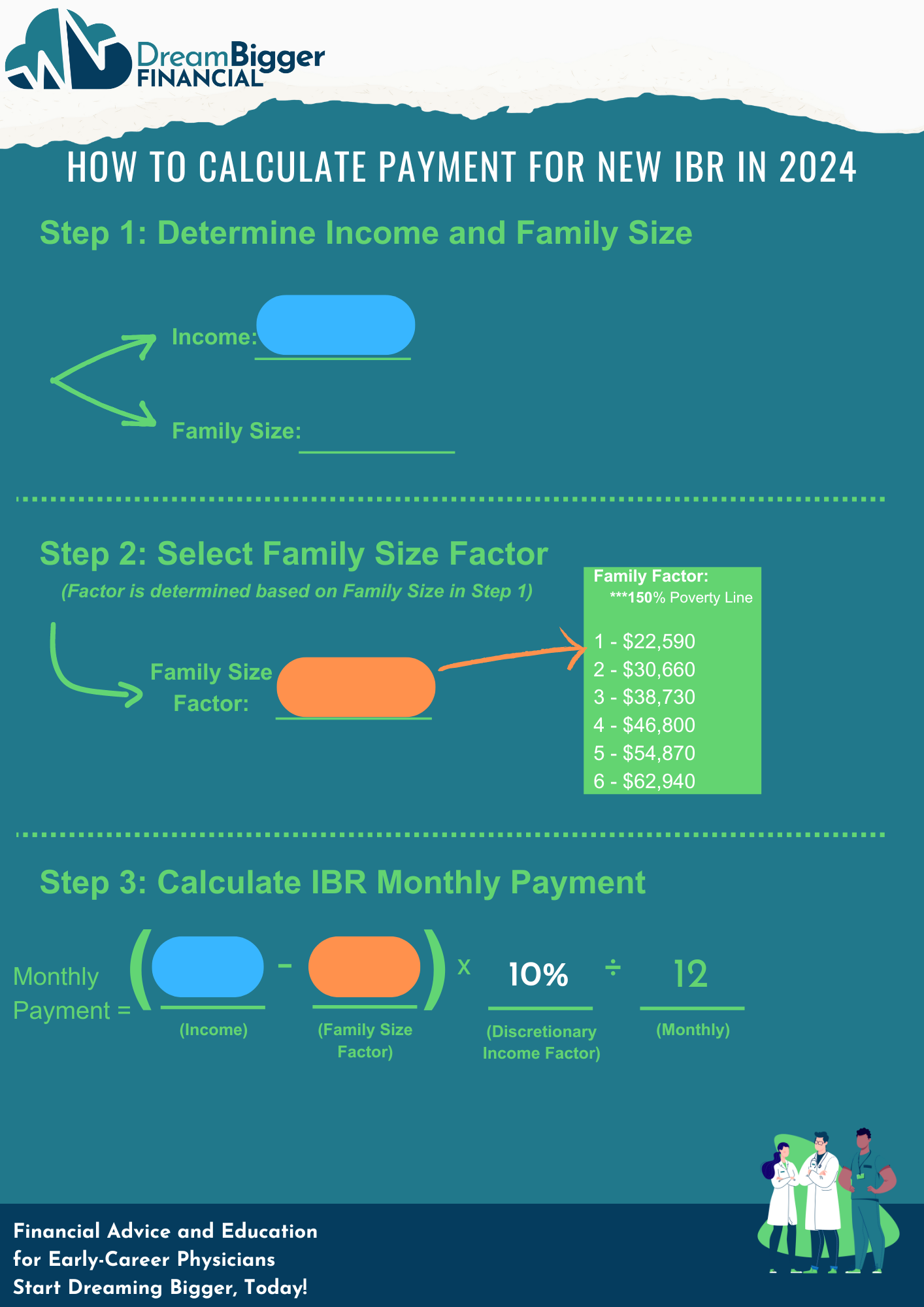

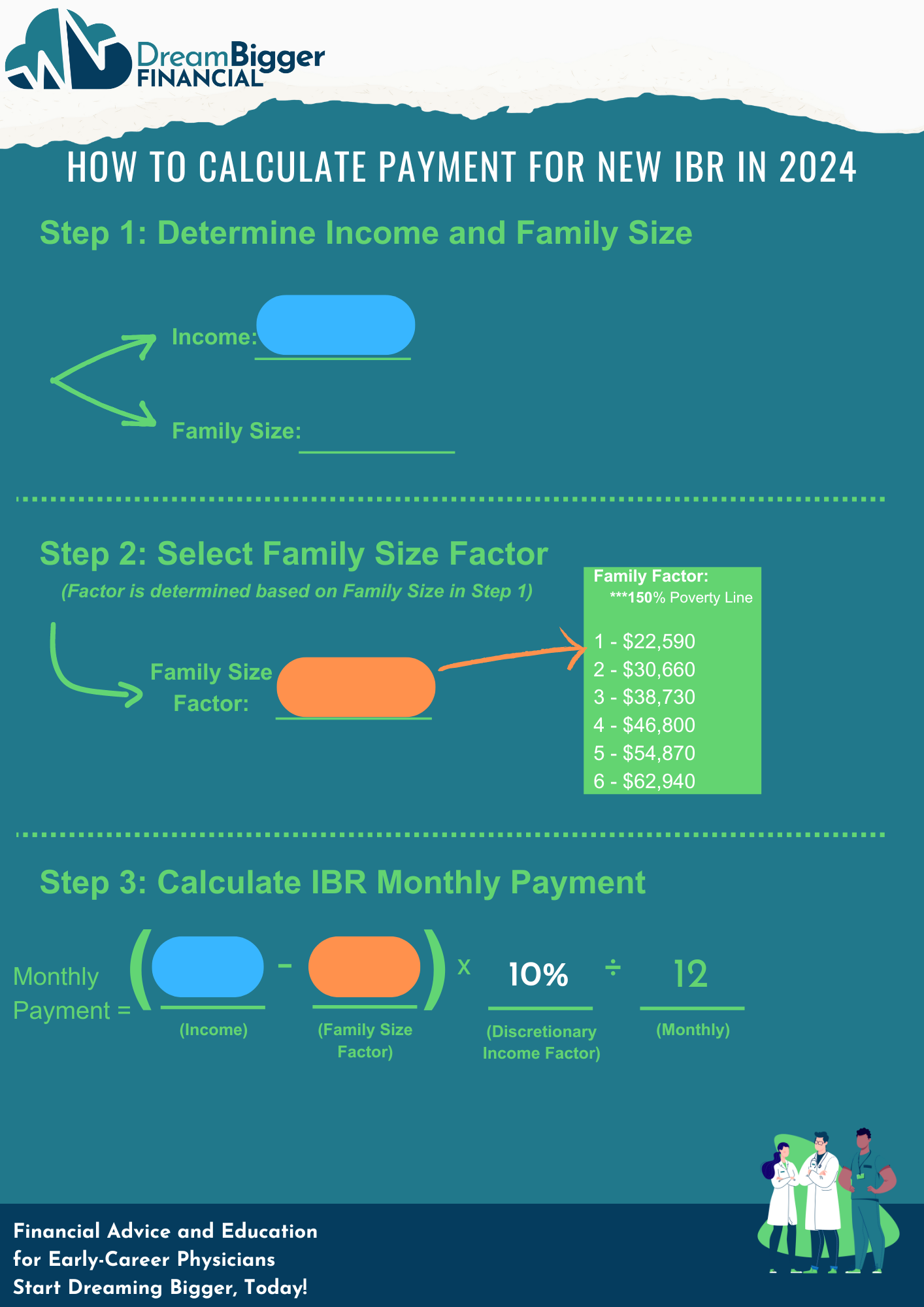

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

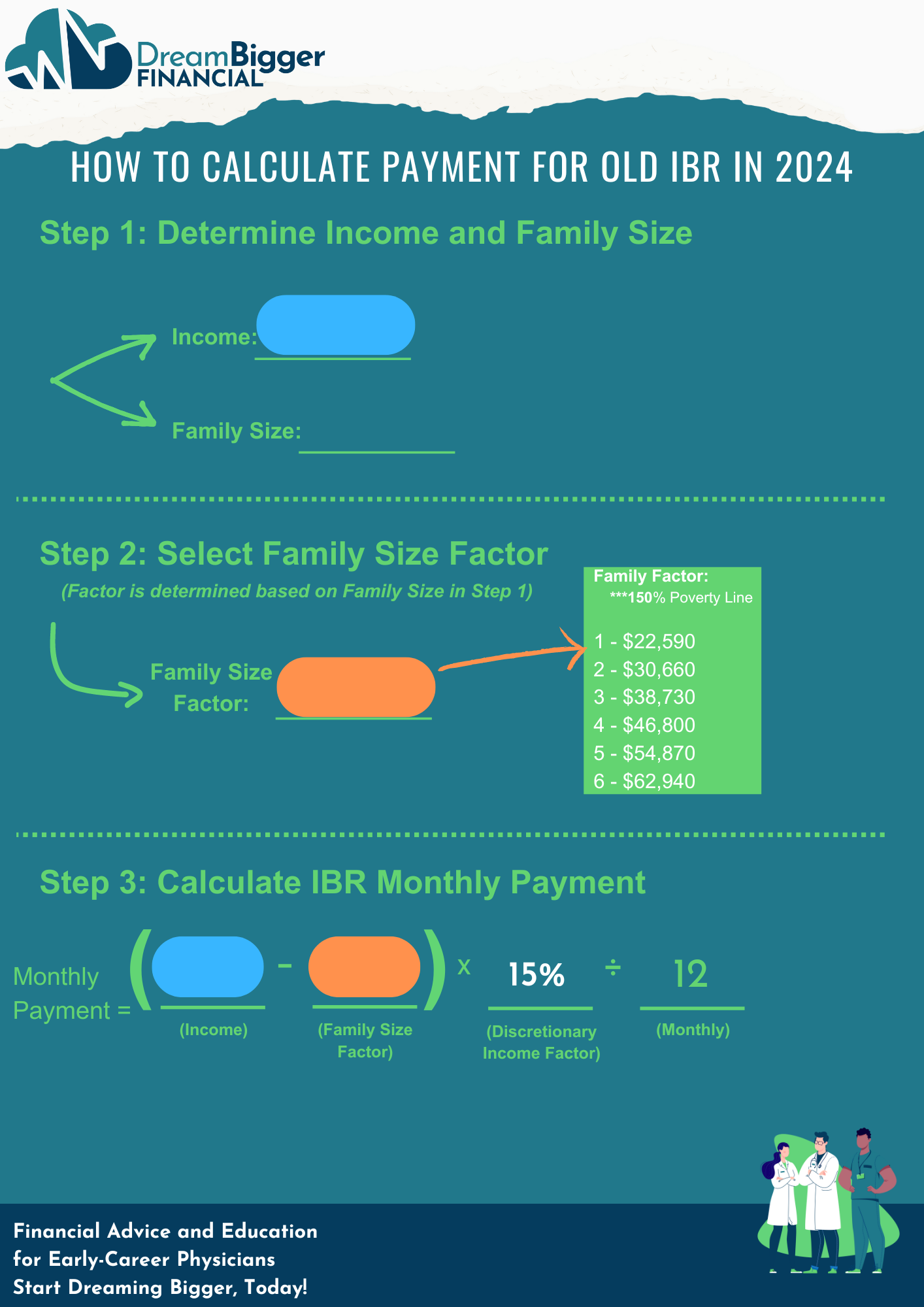

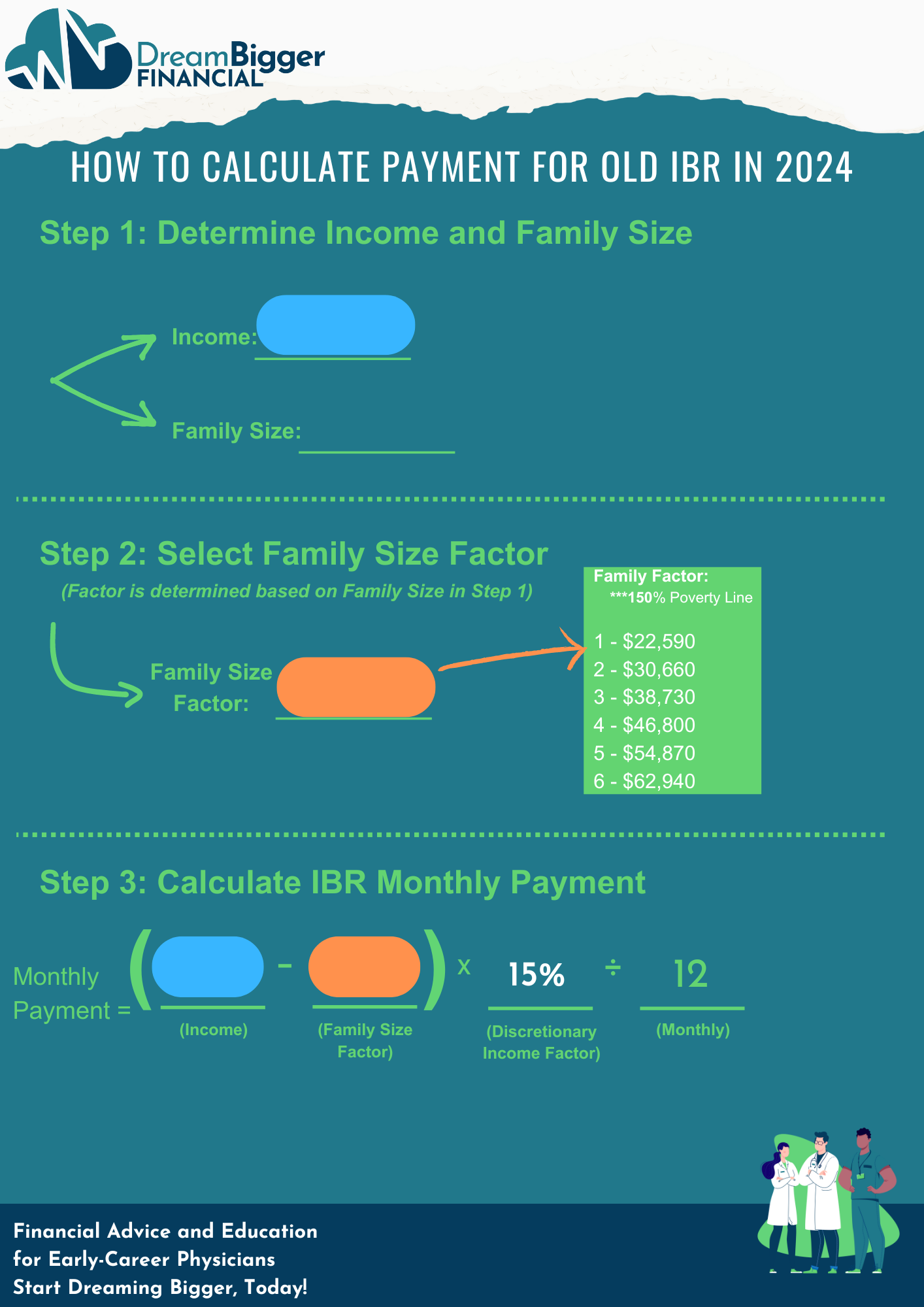

The Family Size Factor is calculated by multiplying the Poverty Guideline by 150%. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

The Family Size Factor is calculated by multiplying the Poverty Guideline by 150%. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

IBR – Payment & Timeline

Income-Based Repayment (IBR) plan:

-

-

New IBR: You pay 10% of your discretionary income for undergraduate and graduate loans, with a repayment term of 20 years. After 20 years, any remaining balance is forgiven, but this forgiveness may be taxable.

-

-

-

Old IBR: You pay 15% of your discretionary income, with a repayment term of 25 years. Any balance left after 25 years is also forgiven, potentially resulting in a taxable event.

-

While the IBR plan offers forgiveness after 20 years for New IBR and 25 years for Old IBR, those working for a non-profit or a 501(c)(3) hospital can qualify for Public Service Loan Forgiveness (PSLF). This program allows for loan forgiveness after just 10 years of payments — tax-free.

Since many physicians will pay off their loans before reaching the 20 or 25-year mark, PSLF is an attractive option for eligible borrowers.

IBR – Payment & Timeline

Income-Based Repayment (IBR) plan:

-

-

New IBR: You pay 10% of your discretionary income for undergraduate and graduate loans, with a repayment term of 20 years. After 20 years, any remaining balance is forgiven, but this forgiveness may be taxable.

-

-

-

Old IBR: You pay 15% of your discretionary income, with a repayment term of 25 years. Any balance left after 25 years is also forgiven, potentially resulting in a taxable event.

-

While the IBR plan offers forgiveness after 20 years for New IBR and 25 years for Old IBR, those working for a non-profit or a 501(c)(3) hospital can qualify for Public Service Loan Forgiveness (PSLF). This program allows for loan forgiveness after just 10 years of payments — tax-free.

Since many physicians will pay off their loans before reaching the 20 or 25-year mark, PSLF is an attractive option for eligible borrowers.

IBR – Payment Cap

The Payment Cap is the maximum monthly payment under Income-Driven Repayment plans, specifically for IBR and PAYE. This cap is especially beneficial for higher-earning physicians.

For example, if you have a $260,000 student loan balance at a 6.8% interest rate, your monthly payment under the 10-Year Standard Repayment Plan would be $2,992. By enrolling in IBR or PAYE, you ensure that your monthly payment never exceeds this amount.

In contrast, the Saving on a Valuable Education (SAVE) Income-Driven Repayment plan does not have a payment cap, meaning your monthly payments could be significantly higher, particularly if you’re a high-earning physician.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, IBR and PAYE are likely your best option due to this payment cap.

IBR – Payment Cap

The Payment Cap is the maximum monthly payment under Income-Driven Repayment plans, specifically for IBR and PAYE. This cap is especially beneficial for higher-earning physicians.

For example, if you have a $260,000 student loan balance at a 6.8% interest rate, your monthly payment under the 10-Year Standard Repayment Plan would be $2,992. By enrolling in IBR or PAYE, you ensure that your monthly payment never exceeds this amount.

In contrast, the Saving on a Valuable Education (SAVE) Income-Driven Repayment plan does not have a payment cap, meaning your monthly payments could be significantly higher, particularly if you’re a high-earning physician.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, IBR and PAYE are likely your best option due to this payment cap.

If you’re enrolled in IBR, you can choose to file your taxes separately from your partner, which is a strategy many physicians use to reduce their monthly payments.

When filing Married Filing Separately (MFS), you cannot claim any dependents that someone else has already claimed. This opens up various planning opportunities.

Filing as Married Filing Jointly (MFJ) provides a straightforward calculation for family size. However, if you opt for MFS to lower your student loan payments, it’s crucial that the spouse with the student loans claims the dependents. Otherwise, you might end up paying more on your loans.

For example, consider a family of four where Spouse 1 has $260,000 in student loans, and Spouse 2 has none. If they file MFS, it’s beneficial for Spouse 1 to claim the children. Under the Income-Driven Repayment plan, a larger family size leads to a lower monthly payment.

If Spouse 2 claims the kids, Spouse 1’s family size is 1, resulting in a deduction of $22,590 for their student loan payment under IBR. However, if Spouse 1 claims the kids, their family size increases to 3 (excluding Spouse 1), yielding a deduction of $38,730. This switch can save Spouse 1 about $135 per month, or $1,620 per year!

If you find yourself in this situation, it’s wise to consult a financial professional specializing in student loans, as this strategy is often misunderstood by many tax professionals.

If you’re enrolled in IBR, you can choose to file your taxes separately from your partner, which is a strategy many physicians use to reduce their monthly payments.

When filing Married Filing Separately (MFS), you cannot claim any dependents that someone else has already claimed. This opens up various planning opportunities.

Filing as Married Filing Jointly (MFJ) provides a straightforward calculation for family size. However, if you opt for MFS to lower your student loan payments, it’s crucial that the spouse with the student loans claims the dependents. Otherwise, you might end up paying more on your loans.

For example, consider a family of four where Spouse 1 has $260,000 in student loans, and Spouse 2 has none. If they file MFS, it’s beneficial for Spouse 1 to claim the children. Under the Income-Driven Repayment plan, a larger family size leads to a lower monthly payment.

If Spouse 2 claims the kids, Spouse 1’s family size is 1, resulting in a deduction of $22,590 for their student loan payment under IBR. However, if Spouse 1 claims the kids, their family size increases to 3 (excluding Spouse 1), yielding a deduction of $38,730. This switch can save Spouse 1 about $135 per month, or $1,620 per year!

If you find yourself in this situation, it’s wise to consult a financial professional specializing in student loans, as this strategy is often misunderstood by many tax professionals.

IBR – Interest Rate Subsidy

Interest Rate Subsidies: IBR and PAYE vs. SAVE

Unlike IBR and PAYE, the SAVE offers a 100% interest rate subsidy. This feature often makes SAVE the preferred choice for early-career physicians and those still in training.

Under the SAVE plan, if your monthly payment doesn’t cover the full interest owed, the remaining unpaid interest is completely forgiven.

For instance, if your calculated payment under SAVE is $300 but the actual interest is $1,000, the $700 difference is fully forgiven. This forgiven interest does not add to your student loan balance, keeping it stable even if your payment is less than what you owe.

This feature is particularly beneficial for physicians who are not pursuing Public Service Loan Forgiveness (PSLF) and for those in training. The key advantage is that unpaid interest does not increase your loan balance, allowing you to pay less toward your student loans without worrying about accruing additional interest.

Important Note: In contrast, if you are enrolled in IBR or PAYE and have a shortfall (like the $700 in our example), that amount accumulates on your student loan balance, increasing the total amount you owe. However, if you are pursuing PSLF, this is less of a concern since your full remaining balance is forgiven tax-free after 120 qualifying payments.

IBR – Interest Rate Subsidy

Interest Rate Subsidies: IBR and PAYE vs. SAVE

Unlike IBR and PAYE, the SAVE offers a 100% interest rate subsidy. This feature often makes SAVE the preferred choice for early-career physicians and those still in training.

Under the SAVE plan, if your monthly payment doesn’t cover the full interest owed, the remaining unpaid interest is completely forgiven.

For instance, if your calculated payment under SAVE is $300 but the actual interest is $1,000, the $700 difference is fully forgiven. This forgiven interest does not add to your student loan balance, keeping it stable even if your payment is less than what you owe.

This feature is particularly beneficial for physicians who are not pursuing Public Service Loan Forgiveness (PSLF) and for those in training. The key advantage is that unpaid interest does not increase your loan balance, allowing you to pay less toward your student loans without worrying about accruing additional interest.

Important Note: In contrast, if you are enrolled in IBR or PAYE and have a shortfall (like the $700 in our example), that amount accumulates on your student loan balance, increasing the total amount you owe. However, if you are pursuing PSLF, this is less of a concern since your full remaining balance is forgiven tax-free after 120 qualifying payments.

Old IBR – Calculating Your Monthly Payment

Old IBR – Calculating Your Monthly Payment

New IBR – Calculating Your Monthly Payment

New IBR – Calculating Your Monthly Payment

IBR – How to Calculate Income

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

You have two ways to calculate your income for an IDR Plan: Adjusted Gross Income (AGI) or an Alternative Documentation of Income, usually your paystub.

Way 1: Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

Important Note for MS4s!

Even if you had no income during medical school, e-Filing a tax return in your MS4 year showing as little as $1 of income is a elite student loan planning strategy. This often enables tou to qualify for $0/month student loan payments intern year!

For married individuals, the household income is taken into account when calculating payments. You might consider filing taxes as Married Filing Separately (MFS) to potentially lower your student loan payments. However, it’s essential to carefully weigh the pros and cons of this strategy before proceeding.

Click here to learn more about this strategy.

Way 2: Alternative Documentation of Income

If you didn’t file a tax return, you’ll need to use Alternative Documentation of Income, usually a paystub, to certify your income. Your paystub serves as the basis for extrapolating your income for a full year, determining the income used in calculating your monthly student loan payment. As a PGY1, if your salary is $60,000, this amount becomes the cornerstone for your student loan payment calculation in an IDR plan.

IBR – How to Calculate Income

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

You have two ways to calculate your income for an IDR Plan: Adjusted Gross Income (AGI) or an Alternative Documentation of Income, usually your paystub.

Way 1: Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

Important Note for MS4s!

Even if you had no income during medical school, e-Filing a tax return in your MS4 year showing as little as $1 of income is a elite student loan planning strategy. This often enables tou to qualify for $0/month student loan payments intern year!

For married individuals, the household income is taken into account when calculating payments. You might consider filing taxes as Married Filing Separately (MFS) to potentially lower your student loan payments. However, it’s essential to carefully weigh the pros and cons of this strategy before proceeding.

Click here to learn more about this strategy.

Way 2: Alternative Documentation of Income

If you didn’t file a tax return, you’ll need to use Alternative Documentation of Income, usually a paystub, to certify your income. Your paystub serves as the basis for extrapolating your income for a full year, determining the income used in calculating your monthly student loan payment. As a PGY1, if your salary is $60,000, this amount becomes the cornerstone for your student loan payment calculation in an IDR plan.

IBR – How to Determine Your Family Size

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is calculated based on your income and family size.

In simple terms: the bigger your family, the smaller your monthly student loan payment; the smaller your family, the bigger your monthly student loan payment.

Your family size for the purposes of Income-Driven Repayment plans includes: You, your spouse, any dependents/family that receives more than half of their support from you. Additionally, any unborn children also count when calculating your family size.

IBR – How to Determine Your Family Size

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is calculated based on your income and family size.

In simple terms: the bigger your family, the smaller your monthly student loan payment; the smaller your family, the bigger your monthly student loan payment.

Your family size for the purposes of Income-Driven Repayment plans includes: You, your spouse, any dependents/family that receives more than half of their support from you. Additionally, any unborn children also count when calculating your family size.

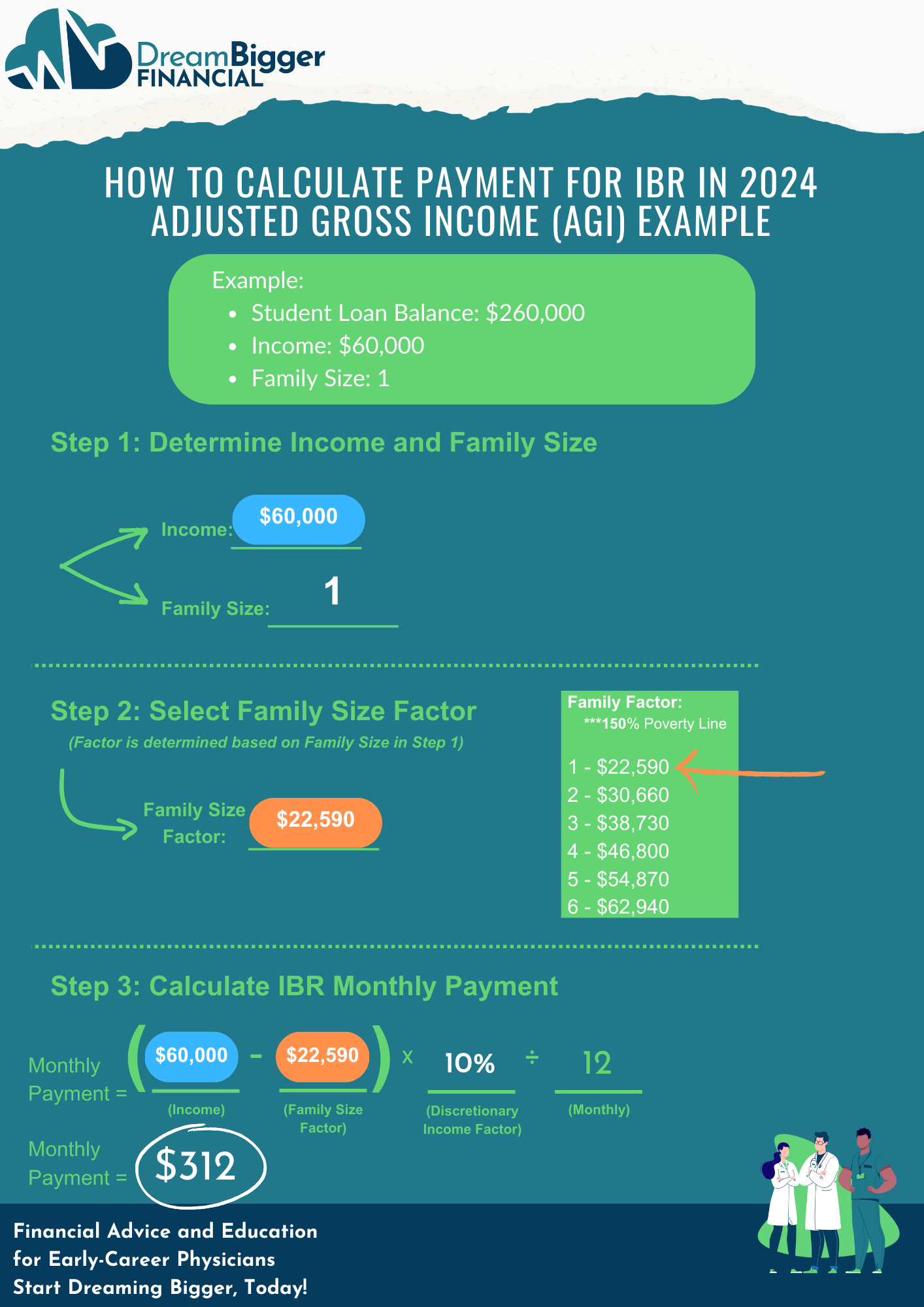

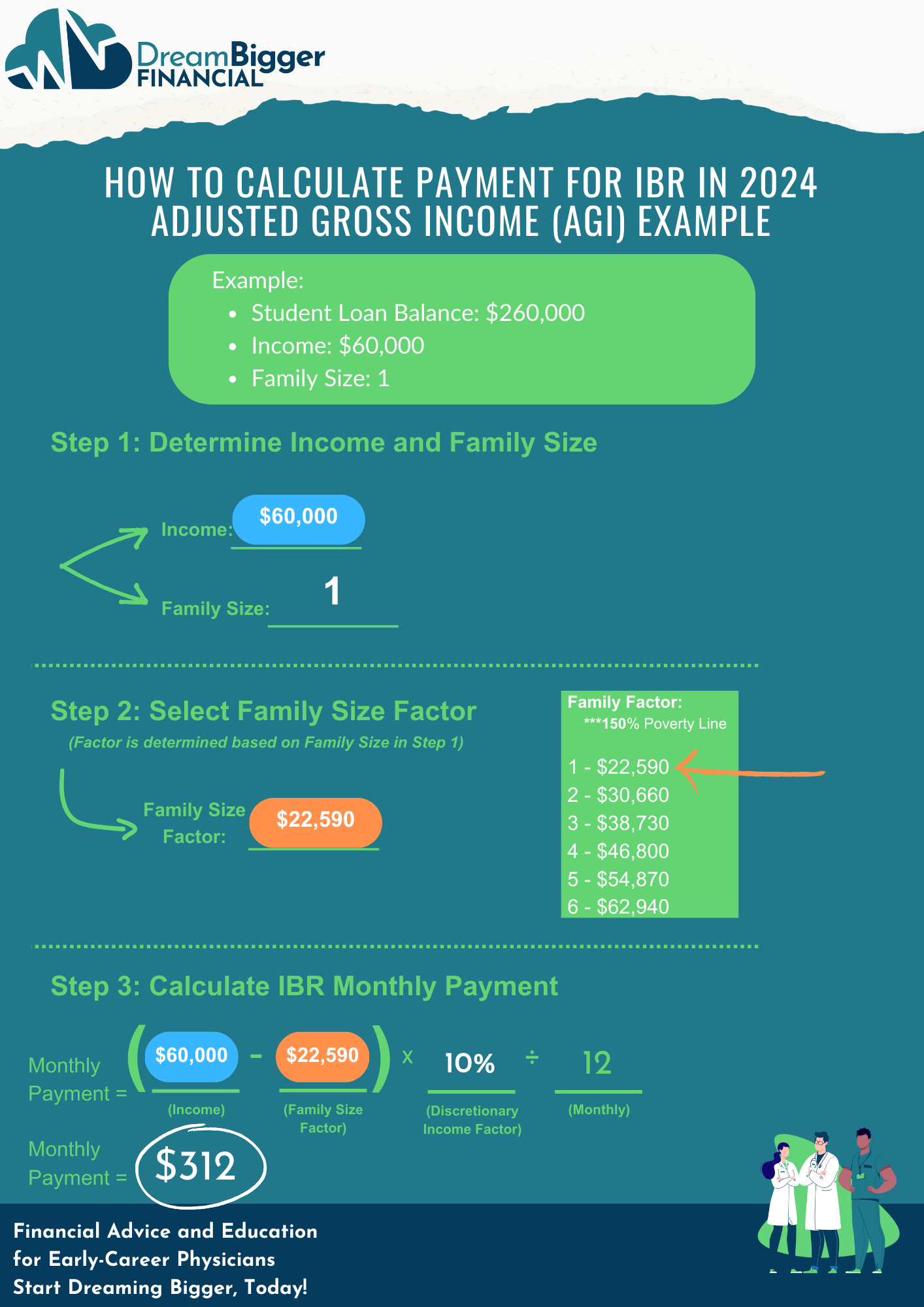

IBR Example

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $260,000

-

Average Interest Rate: 6.8%

-

Income (PGY1): $60,000

-

Family Size: 1

-

New borrowers with loans taken out on or after July 1, 2014 (New IBR): 10% of his discretionary income for 20 years

-

Dr. Don, a recent medical school graduate, was initially burdened with a monthly student loan payment of $2,992 under the 10-Year Standard Repayment plan, considering his $260,000 loan balance and a 6.8% interest rate.

In search of a more manageable option, Dr. Don explored New IBR.

Considering his income ($60,000) and family size (1), his IBR payment significantly dropped to $312/month, leading to substantial savings of $2,680/month!

As a reminder, the $318/month payment under IBR may not reduce Dr. Don’s student loan balance, and any unpaid interest accumulates on his $260,000 student loan balance.

Note: If Dr. Don took out loans before July 1, 2014 (Old IBR), he would pay 15% of his discretionary income for a repayment term of 25 years. Additionally, if he lives in Alaska or Hawaii, he will use a different family size factor, which will affect his payment calculation.

IBR Example

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $260,000

-

Average Interest Rate: 6.8%

-

Income (PGY1): $60,000

-

Family Size: 1

-

New borrowers with loans taken out on or after July 1, 2014 (New IBR): 10% of his discretionary income for 20 years

-

Dr. Don, a recent medical school graduate, was initially burdened with a monthly student loan payment of $2,992 under the 10-Year Standard Repayment plan, considering his $260,000 loan balance and a 6.8% interest rate.

In search of a more manageable option, Dr. Don explored New IBR.

Considering his income ($60,000) and family size (1), his IBR payment significantly dropped to $312/month, leading to substantial savings of $2,680/month!

As a reminder, the $318/month payment under IBR may not reduce Dr. Don’s student loan balance, and any unpaid interest accumulates on his $260,000 student loan balance.

Note: If Dr. Don took out loans before July 1, 2014 (Old IBR), he would pay 15% of his discretionary income for a repayment term of 25 years. Additionally, if he lives in Alaska or Hawaii, he will use a different family size factor, which will affect his payment calculation.

Conclusion

Income-Based Repayment (IBR) offers a flexible way to manage your student loan payments based on your income and family size.

By understanding how IBR works, including the potential for $0 payments early in your career and the importance of tax filing strategies, you can navigate your student loan repayment journey more effectively.

Consider consulting a financial professional specializing in tax management and student loan planning to tailor your repayment strategy to your unique situation and goals.

If you’re looking for a personalized plan, our team is here to help!

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Conclusion

Income-Based Repayment (IBR) offers a flexible way to manage your student loan payments based on your income and family size.

By understanding how IBR works, including the potential for $0 payments early in your career and the importance of tax filing strategies, you can navigate your student loan repayment journey more effectively.

Consider consulting a financial professional specializing in tax management and student loan planning to tailor your repayment strategy to your unique situation and goals.

If you’re looking for a personalized plan, our team is here to help!

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.