Overview

For most early-career physicians, the Saving on a Valuable Education (SAVE) Income-Driven Repayment plan offers the lowest monthly student loan payments and is the go-to plan during training.

An often overlooked aspect of Income-Driven Repayment plans is that you’re not bound to your initial choice throughout the loan duration. Student loan planning involves adapting your strategy as your personal and financial situations change.

For higher-earning physicians in SAVE, nearing the end of training prompts consideration of enrolling in Pay As You Earn (PAYE) or Income-Based Repayment (IBR). Waiting until your attending income kicks in may be too late!

Let’s explore what Partial Financial Hardship entails and why high-earning physicians seeking forgiveness should understand how enrolling in PAYE or IBR can save them a significant amount of money.

Overview

For most early-career physicians, the Saving on a Valuable Education (SAVE) Income-Driven Repayment plan offers the lowest monthly student loan payments and is the go-to plan during training.

An often overlooked aspect of Income-Driven Repayment plans is that you’re not bound to your initial choice throughout the loan duration. Student loan planning involves adapting your strategy as your personal and financial situations change.

For higher-earning physicians in SAVE, nearing the end of training prompts consideration of enrolling in Pay As You Earn (PAYE) or Income-Based Repayment (IBR). Waiting until your attending income kicks in may be too late!

Let’s explore what Partial Financial Hardship entails and why high-earning physicians seeking forgiveness should understand how enrolling in PAYE or IBR can save them a significant amount of money.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Partial Financial Hardship

Partial Financial Hardship occurs when your monthly student loan payments are significantly high compared to your income.

In simpler terms, a Partial Financial Hardship is when your monthly payment under an Income-Driven Repayment plan is less than the Standard 10-Year Repayment plan.

As per studentaid.gov: “Partial financial hardship is an eligibility requirement under the Income-Based Repayment (IBR) and Pay As You Earn Repayment (PAYE) plans. It is a circumstance in which the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan, exceeds 15 percent (for IBR) or 10 percent (for Pay As You Earn) of the difference between your adjusted gross income (AGI) and 150 percent of the poverty line for your family size in the state where you live.”

For IBR and PAYE plans, your discretionary income is calculated by the federal government as the difference between your adjusted gross income (AGI) and 150% of the poverty line for your family size and state.

When determining partial financial hardship, the following percentages are used:

☁️ 10% of your discretionary income for PAYE.

☁️ 15% of your discretionary income for IBR.

You need a Partial Financial Hardship to be enroll in PAYE or IBR. However, once you are on one of the plans, you no longer have to show a Partial Financial Hardship to remain on the plan. What ultimately will happen is your maximum monthly payment under PAYE and IBR gets capped at the Standard 10-Year Repayment plan.

Note: While payments under New IBR would be 10% of your discretionary income for new borrowers as of July 1, 2014, 15% is the threshold for all borrowers when calculating partial financial hardship for IBR. Additionally, enrolling in SAVE does not require a financial hardship.

Partial Financial Hardship

Partial Financial Hardship occurs when your monthly student loan payments are significantly high compared to your income.

In simpler terms, a Partial Financial Hardship is when your monthly payment under an Income-Driven Repayment plan is less than the Standard 10-Year Repayment plan.

As per studentaid.gov: “Partial financial hardship is an eligibility requirement under the Income-Based Repayment (IBR) and Pay As You Earn Repayment (PAYE) plans. It is a circumstance in which the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan, exceeds 15 percent (for IBR) or 10 percent (for Pay As You Earn) of the difference between your adjusted gross income (AGI) and 150 percent of the poverty line for your family size in the state where you live.”

For IBR and PAYE plans, your discretionary income is calculated by the federal government as the difference between your adjusted gross income (AGI) and 150% of the poverty line for your family size and state.

When determining partial financial hardship, the following percentages are used:

☁️ 10% of your discretionary income for PAYE.

☁️ 15% of your discretionary income for IBR.

You need a Partial Financial Hardship to be enroll in PAYE or IBR. However, once you are on one of the plans, you no longer have to show a Partial Financial Hardship to remain on the plan. What ultimately will happen is your maximum monthly payment under PAYE and IBR gets capped at the Standard 10-Year Repayment plan.

Note: While payments under New IBR would be 10% of your discretionary income for new borrowers as of July 1, 2014, 15% is the threshold for all borrowers when calculating partial financial hardship for IBR. Additionally, enrolling in SAVE does not require a financial hardship.

Partial Financial Hardship – Calculation

☁️ Step 1: Calculate Your Monthly Payment Under the Standard 10-Year Repayment Plan

☁️ Step 2: Determine Your Adjusted Gross Income (AGI): Find your AGI, which is your total income minus specific deductions.

☁️ Step 3: Identify the Poverty Line for Your Family Size and State: Determine 150% of the poverty line for your family size in the state where you live. This is a key factor in the calculation.

☁️ Step 4: Calculate Your Discretionary Income: Subtract 150% of the poverty line from your AGI to find the difference.

☁️ Step 5: Determine the Threshold Percentage:

-

-

For PAYE, the threshold is 10%.

-

For IBR, the threshold is 15%.

-

☁️ Step 6: Calculate the Percentage of Your Discretionary Income: Multiply the difference from step 3 by the threshold percentage.

☁️ Step 7: Compare to Your Annual Loan Amount Due: Assess whether the calculated percentage is higher or lower than the annual amount due on your eligible loans as calculated under a 10-year Standard Repayment Plan.

If the percentage exceeds the specified threshold, you may qualify for a Partial Financial Hardship under Income-Driven Repayment plans like PAYE or IBR.

Partial Financial Hardship – Calculation

☁️ Step 1: Calculate Your Monthly Payment Under the Standard 10-Year Repayment Plan

☁️ Step 2: Determine Your Adjusted Gross Income (AGI): Find your AGI, which is your total income minus specific deductions.

☁️ Step 3: Identify the Poverty Line for Your Family Size and State: Determine 150% of the poverty line for your family size in the state where you live. This is a key factor in the calculation.

☁️ Step 4: Calculate Your Discretionary Income: Subtract 150% of the poverty line from your AGI to find the difference.

☁️ Step 5: Determine the Threshold Percentage:

-

For PAYE, the threshold is 10%.

-

For IBR, the threshold is 15%.

☁️ Step 6: Calculate the Percentage of Your Discretionary Income: Multiply the difference from step 3 by the threshold percentage.

☁️ Step 7: Compare to Your Annual Loan Amount Due: Assess whether the calculated percentage is higher or lower than the annual amount due on your eligible loans as calculated under a 10-year Standard Repayment Plan.

If the percentage exceeds the specified threshold, you may qualify for a Partial Financial Hardship under Income-Driven Repayment plans like PAYE or IBR.

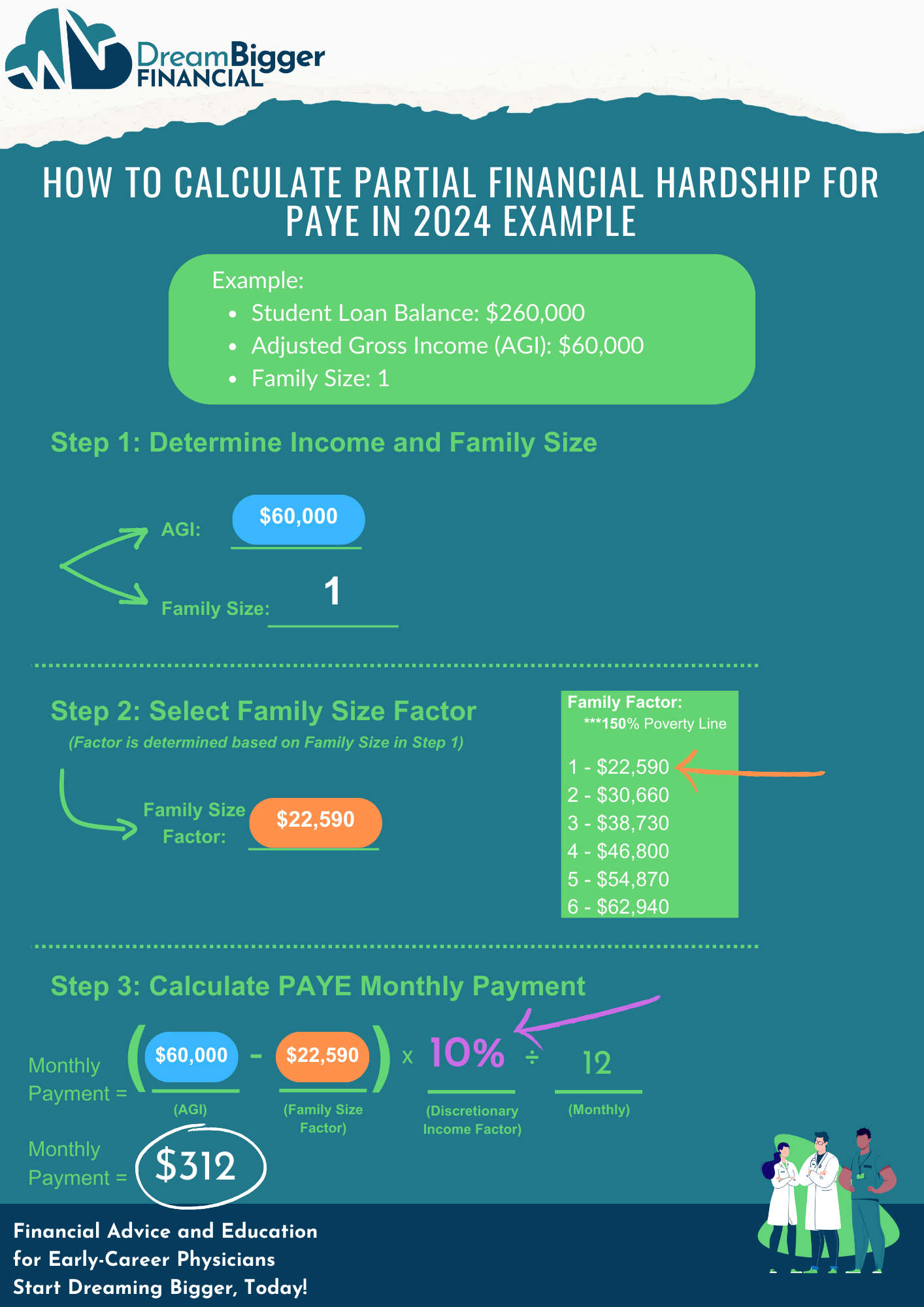

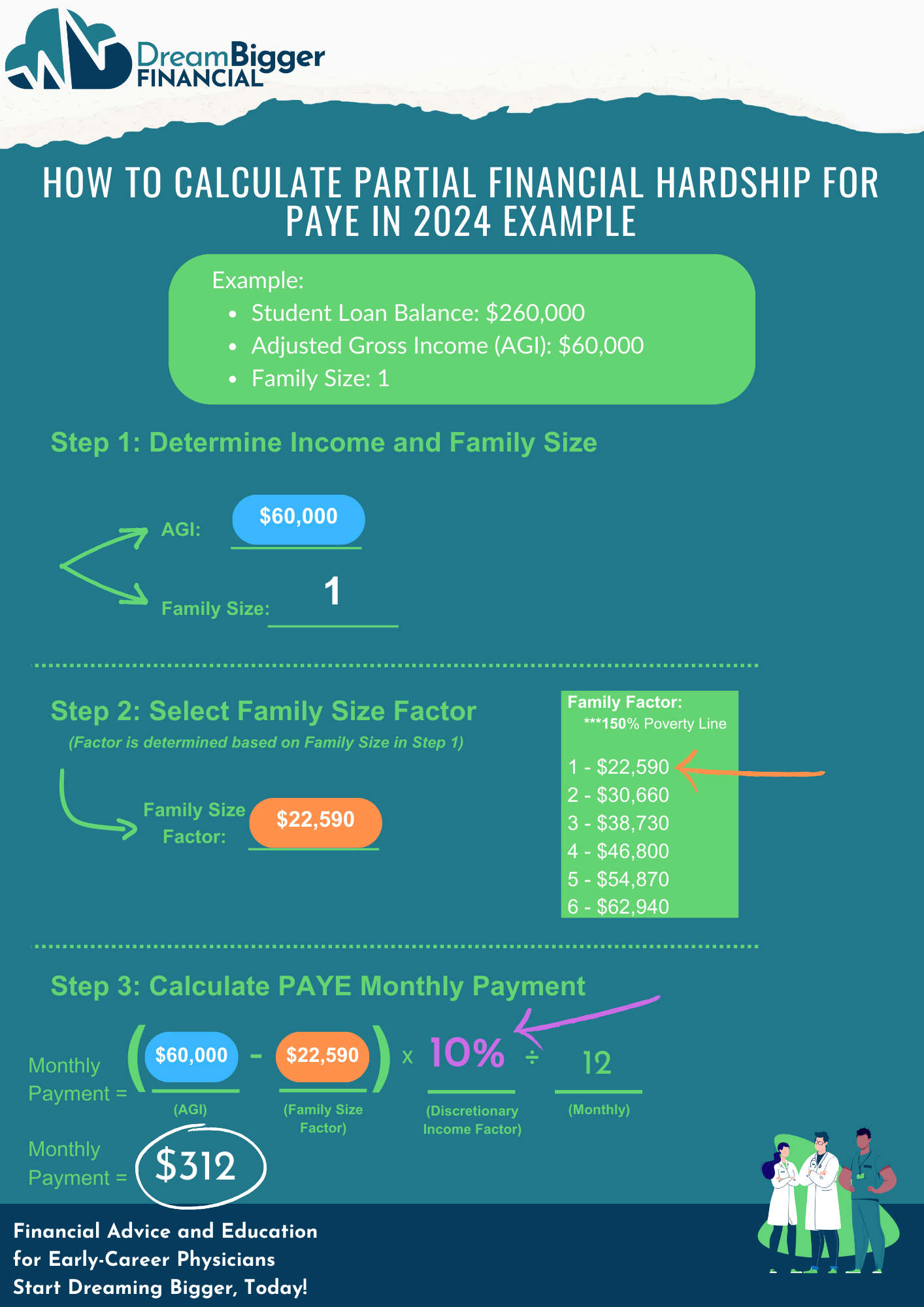

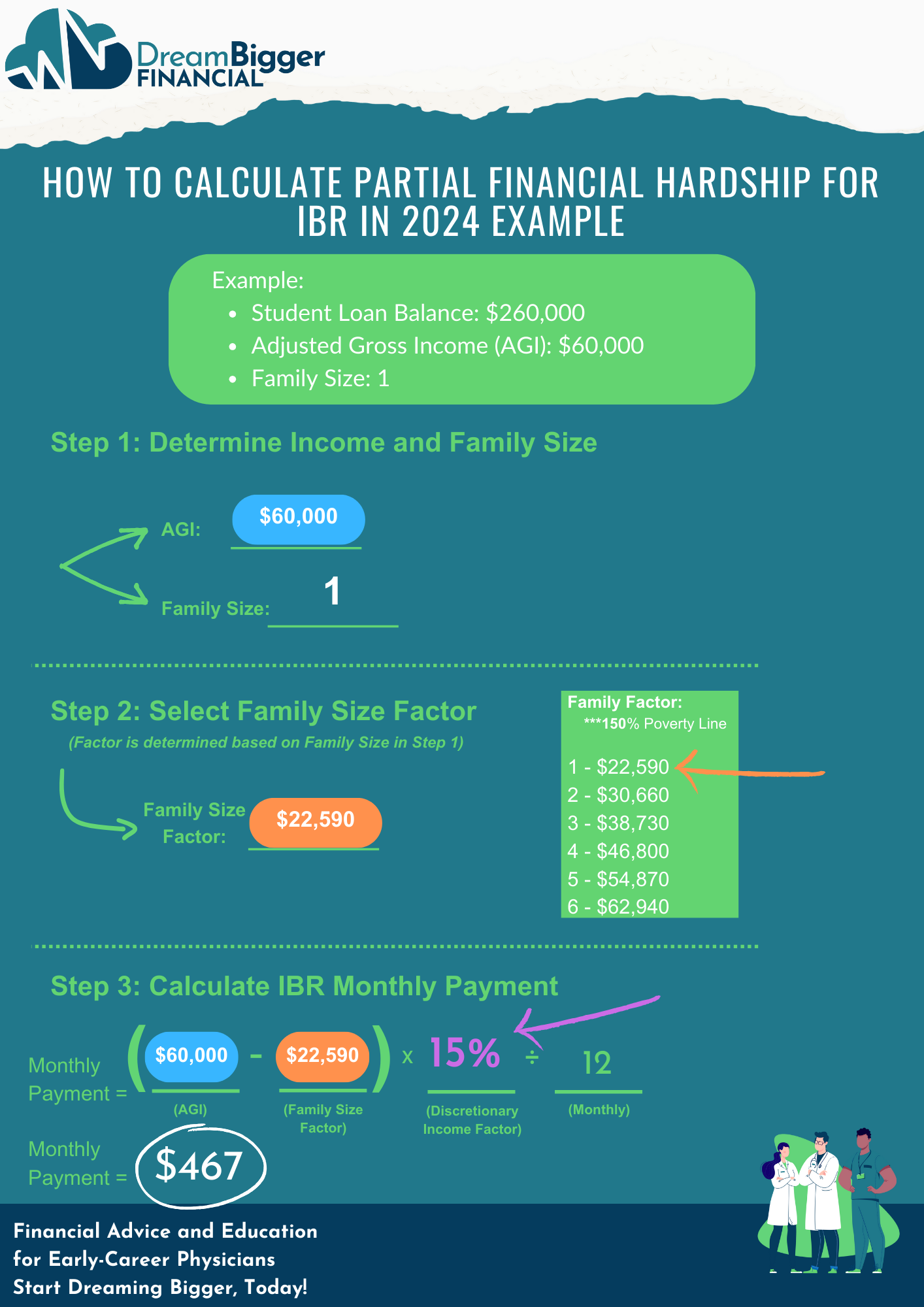

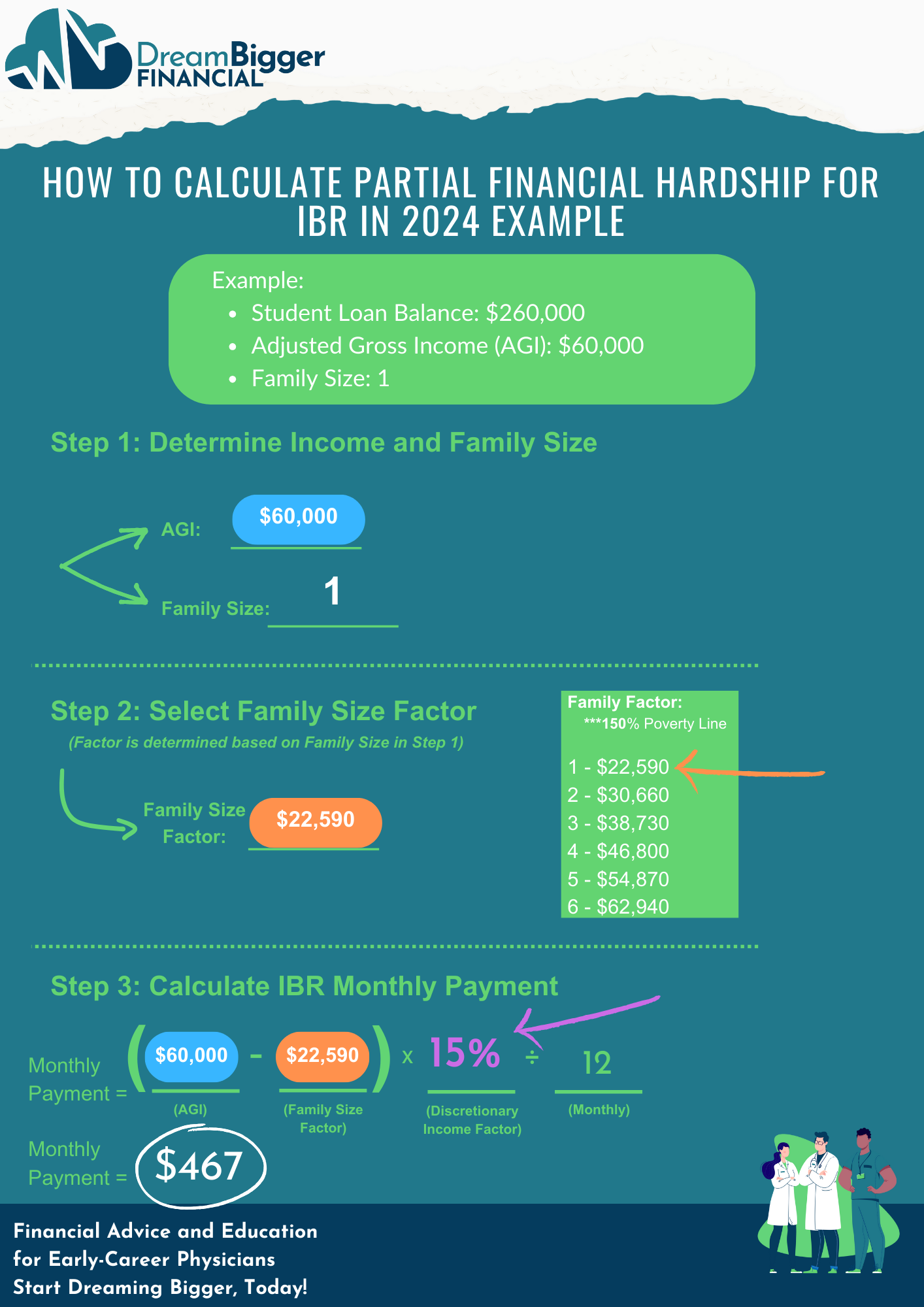

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $260,000

-

Average Interest Rate: 6.8%

-

Prior Year’s Adjusted Gross Income: $60,000

-

Family Size: 1

-

Introducing Dr. Don!

Dr. Don’s Details:

-

Loan Balance: $260,000

-

Average Interest Rate: 6.8%

-

Prior Year’s Adjusted Gross Income: $60,000

-

Family Size: 1

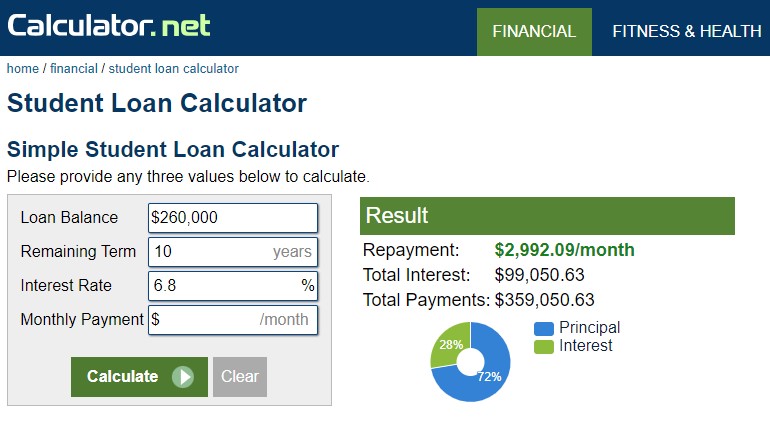

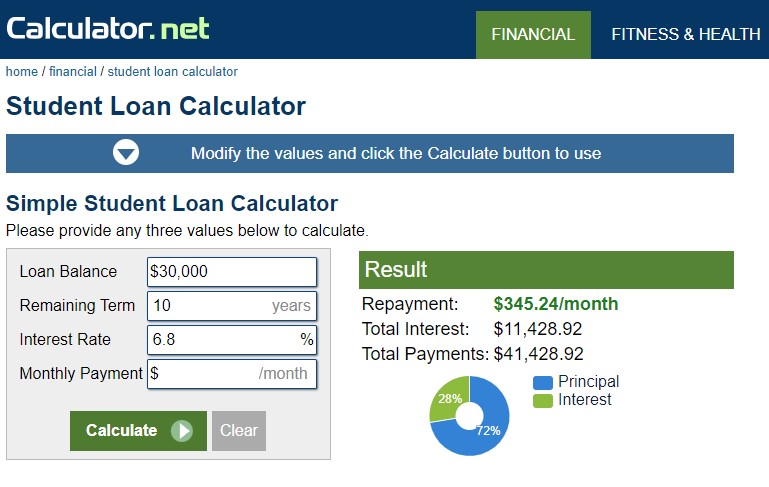

Similar to a mortgage, the Standard 10-Year Repayment plan determines a fixed monthly payment to pay off your entire loan balance in 10 years. This calculation is based on your student loan balance and interest rate.

There are various methods to compute your monthly payment using this plan. The simplest approach is to input your student loan balance and interest rate into an online student loan calculator, such as the one available at Calculator.net. This tool quickly provides your monthly payment.

In our example, Dr. Don has a $260,000 student loan balance with an average interest rate of 6.8%. By utilizing a student loan calculator, the calculated monthly payment for Dr. Don would be $2,992.

Similar to a mortgage, the Standard 10-Year Repayment plan determines a fixed monthly payment to pay off your entire loan balance in 10 years. This calculation is based on your student loan balance and interest rate.

There are various methods to compute your monthly payment using this plan. The simplest approach is to input your student loan balance and interest rate into an online student loan calculator, such as the one available at Calculator.net. This tool quickly provides your monthly payment.

In our example, Dr. Don has a $260,000 student loan balance with an average interest rate of 6.8%. By utilizing a student loan calculator, the calculated monthly payment for Dr. Don would be $2,992.

Unlike the Standard 10-Year Repayment plan that uses your student loan balance and interest rate to calculate your monthly student loan payment. On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

In our example, it was given that Dr. Don’s Adjusted Gross Income (AGI) is $60,000.

Unlike the Standard 10-Year Repayment plan that uses your student loan balance and interest rate to calculate your monthly student loan payment. On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

In our example, it was given that Dr. Don’s Adjusted Gross Income (AGI) is $60,000.

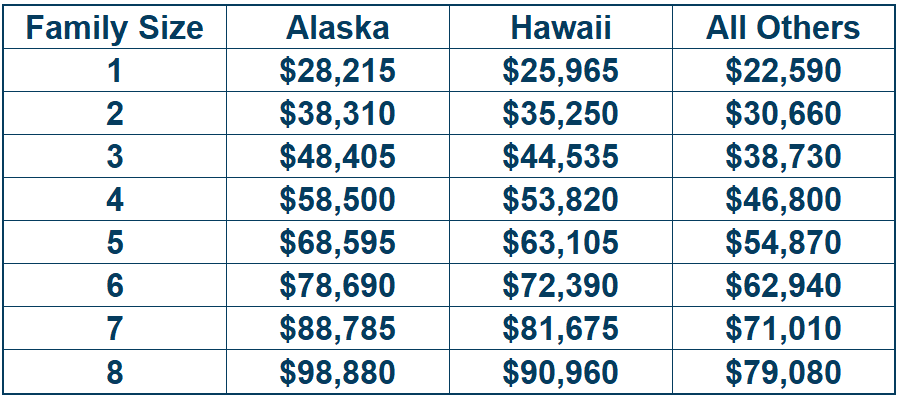

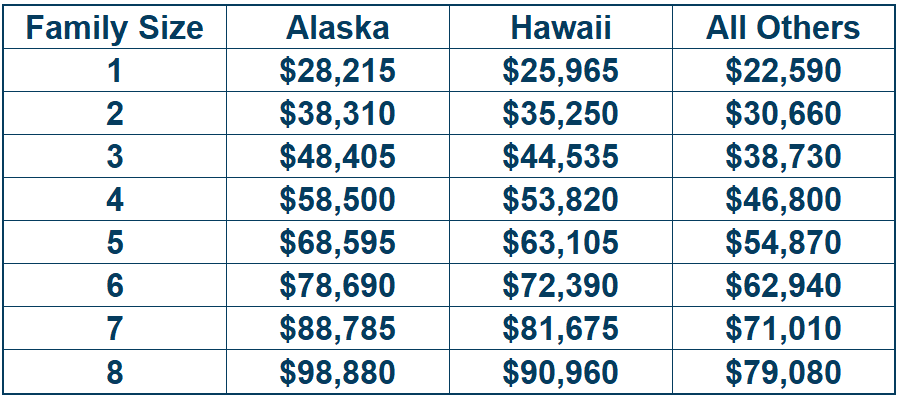

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

The Family Size Factor is calculated by multiplying the Poverty Guideline by 150%. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

The Family Size Factor is calculated by multiplying the Poverty Guideline by 150%. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

Subtract 150% of the poverty line from your Adjusted Gross Income (AGI).

***See the example below for an illustration of how this works.

Subtract 150% of the poverty line from your Adjusted Gross Income (AGI).

***See the example below for an illustration of how this works.

☁️ For PAYE, the threshold is 10%.

☁️ For IBR, the threshold is 15%.

***See the example below for an illustration of how this works.

☁️ For PAYE, the threshold is 10%.

☁️ For IBR, the threshold is 15%.

***See the example below for an illustration of how this works.

Multiply the difference obtained in step 3 by the threshold percentage.

***See the example below for an illustration of how this works.

Multiply the difference obtained in step 3 by the threshold percentage.

***See the example below for an illustration of how this works.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for PAYE, Dr. Don’s monthly payment under PAYE is $312, calculated using 10% of his discretionary income.

Given that Dr. Don’s $312/month PAYE payment is less than his $2,992/month payment on the Standard 10-Year Repayment plan, he qualifies for a Partial Financial Hardship and is eligible to enroll in PAYE.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for PAYE, Dr. Don’s monthly payment under PAYE is $312, calculated using 10% of his discretionary income.

Given that Dr. Don’s $312/month PAYE payment is less than his $2,992/month payment on the Standard 10-Year Repayment plan, he qualifies for a Partial Financial Hardship and is eligible to enroll in PAYE.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for IBR, Dr. Don’s monthly payment under IBR is $467, calculated using 15% of his discretionary income.

Given that Dr. Don’s $467/month IBR payment is less than his $2,992/month payment on the Standard 10-Year Repayment plan, he qualifies for a Partial Financial Hardship and is eligible to enroll in IBR.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for IBR, Dr. Don’s monthly payment under IBR is $467, calculated using 15% of his discretionary income.

Given that Dr. Don’s $467/month IBR payment is less than his $2,992/month payment on the Standard 10-Year Repayment plan, he qualifies for a Partial Financial Hardship and is eligible to enroll in IBR.

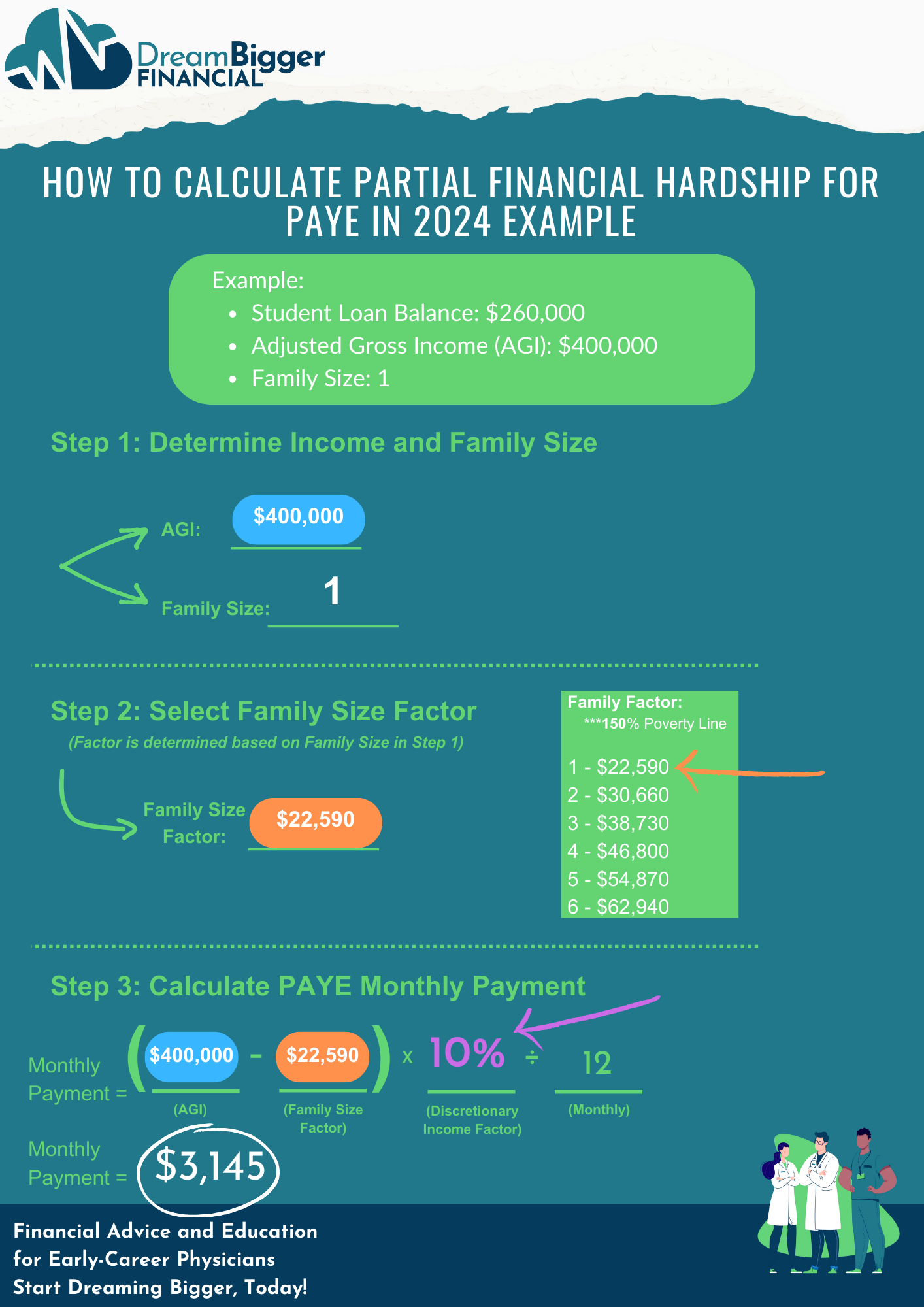

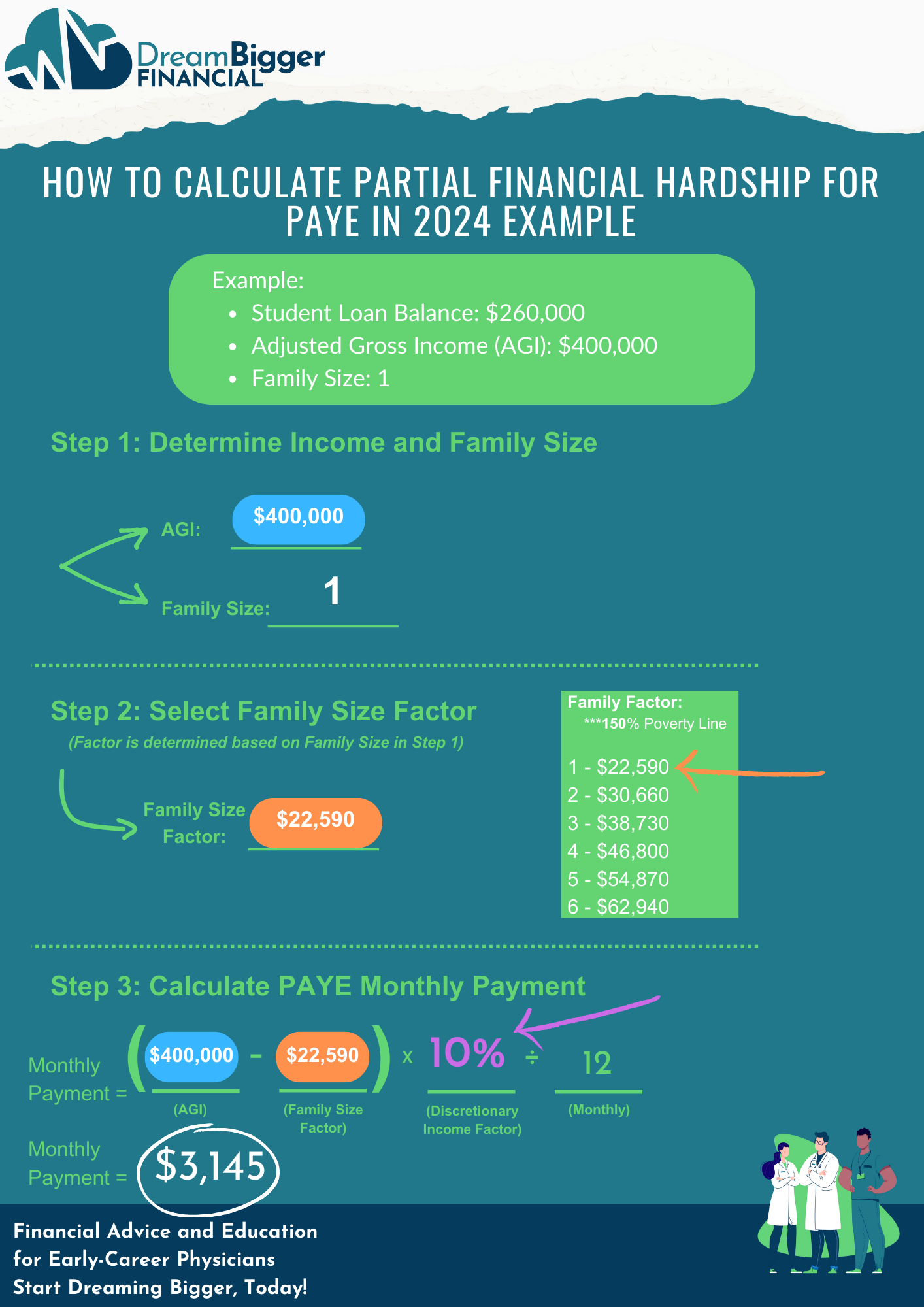

Let’s revisit Dr. Don’s scenario:

In this example, Dr. Don, now an attending Anesthesiologist, is fortunate that his employer qualifies for Public Service Loan Forgiveness (PSLF). His primary goal is to minimize payments because any remaining student loan balance after 10 years of qualifying payments (120 payments) is forgiven tax-free.

Since transitioning from residency to attending status, Dr. Don has experienced a significant income increase. Let’s see if Dr. Don can still qualify for Partial Financial Hardship and potentially enroll in PAYE or IBR.

Dr. Don’s Details:

-

Loan Balance: $260,000

-

Average Interest Rate: 6.8%

-

Prior Year’s Adjusted Gross Income: $400,000

-

Family Size: 1

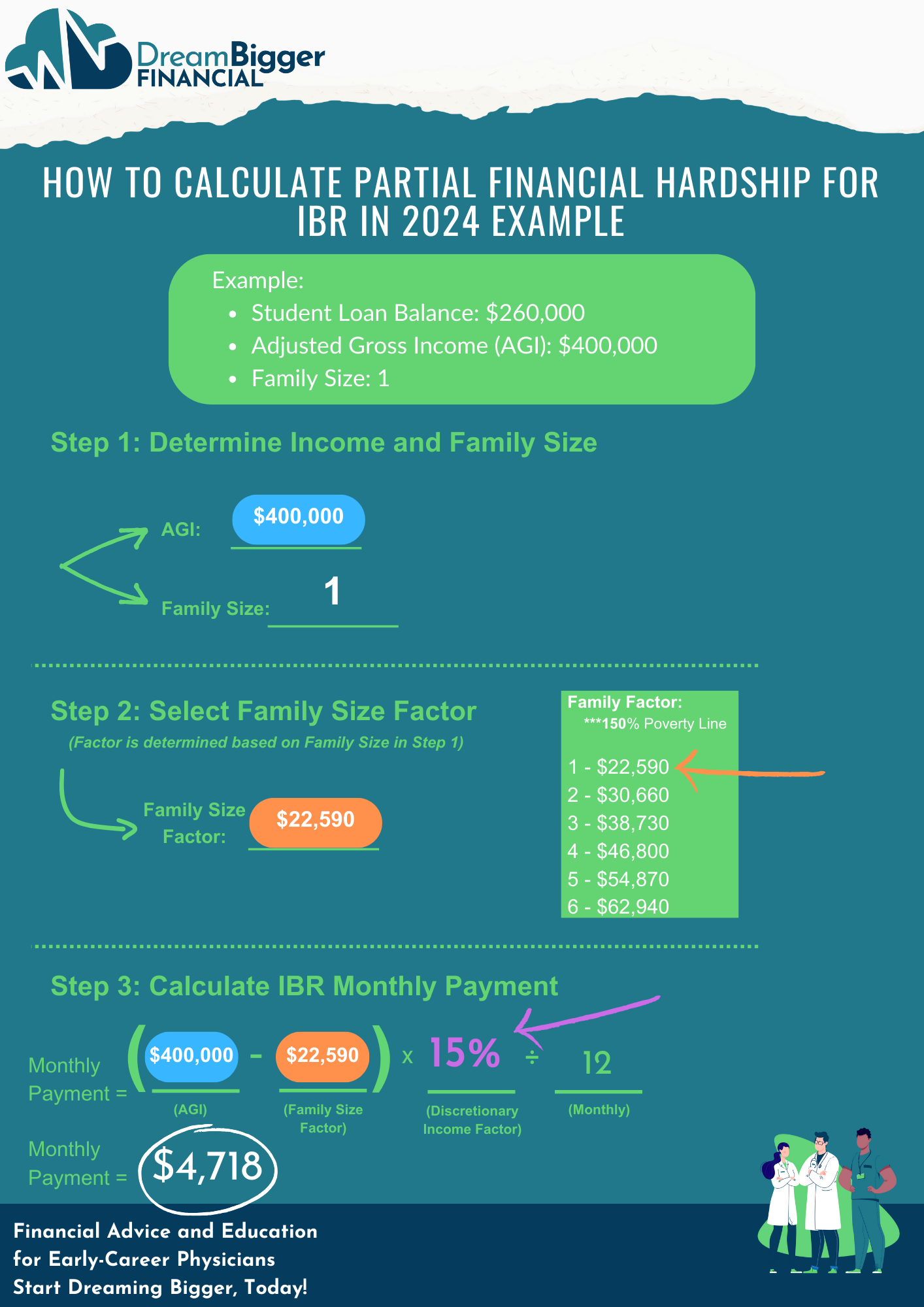

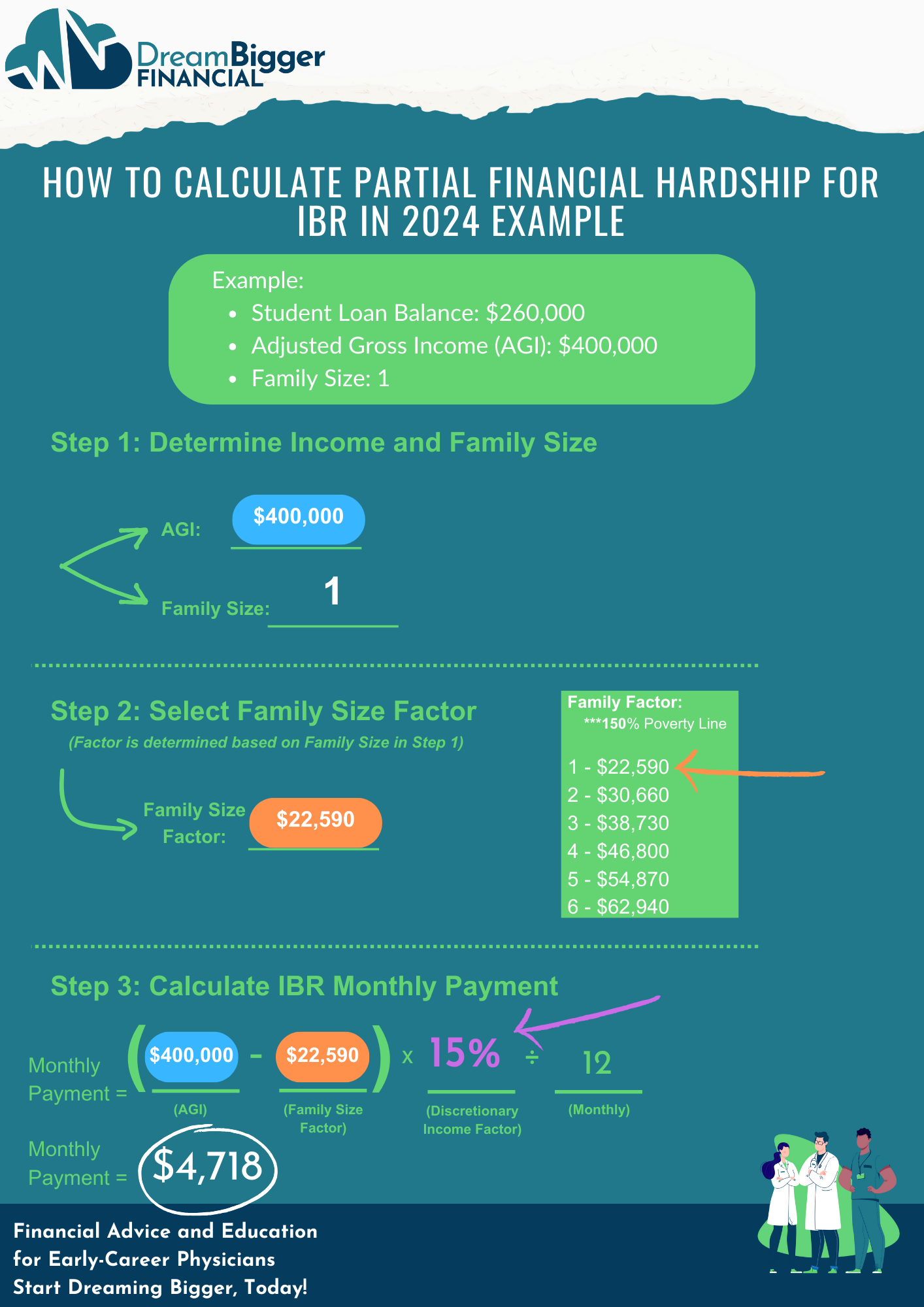

Let’s revisit Dr. Don’s scenario:

In this example, Dr. Don, now an attending Anesthesiologist, is fortunate that his employer qualifies for Public Service Loan Forgiveness (PSLF). His primary goal is to minimize payments because any remaining student loan balance after 10 years of qualifying payments (120 payments) is forgiven tax-free.

Since transitioning from residency to attending status, Dr. Don has experienced a significant income increase. Let’s see if Dr. Don can still qualify for Partial Financial Hardship and potentially enroll in PAYE or IBR.

Dr. Don’s Details:

-

Loan Balance: $260,000

-

Average Interest Rate: 6.8%

-

Prior Year’s Adjusted Gross Income: $400,000

-

Family Size: 1

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for PAYE, Dr. Don’s new monthly payment under PAYE is $3,145, calculated using 10% of his discretionary income.

Given that Dr. Don’s $3,145/month PAYE payment is greater than his $2,992/month payment on the Standard 10-Year Repayment plan, he does NOT qualifies for a Partial Financial Hardship and is NOT eligible to enroll in PAYE.

Important Note: Partial Financial Hardship is a prerequisite for PAYE/IBR eligibility, determined by your income-to-debt ratio. To qualify, your monthly PAYE/IBR payment must be lower than the monthly payment under the Standard 10-Year Repayment plan. For residents, timely enrollment in PAYE/IBR BEFORE their income increases as an attending is crucial. Failure to do so may result in ineligibility for PAYE/IBR enrollment.

Consider this strategy for higher-earning physicians like Dr. Don: If enrolled in PAYE during residency, his monthly payment would be capped at $2,992/month (Standard 10-Year Repayment plan), not the calculated $3,145/month for PAYE. Enrolling in PAYE during residency could lead to a monthly savings of $153.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for PAYE, Dr. Don’s new monthly payment under PAYE is $3,145, calculated using 10% of his discretionary income.

Given that Dr. Don’s $3,145/month PAYE payment is greater than his $2,992/month payment on the Standard 10-Year Repayment plan, he does NOT qualifies for a Partial Financial Hardship and is NOT eligible to enroll in PAYE.

Important Note: Partial Financial Hardship is a prerequisite for PAYE/IBR eligibility, determined by your income-to-debt ratio. To qualify, your monthly PAYE/IBR payment must be lower than the monthly payment under the Standard 10-Year Repayment plan. For residents, timely enrollment in PAYE/IBR BEFORE their income increases as an attending is crucial. Failure to do so may result in ineligibility for PAYE/IBR enrollment.

Consider this strategy for higher-earning physicians like Dr. Don: If enrolled in PAYE during residency, his monthly payment would be capped at $2,992/month (Standard 10-Year Repayment plan), not the calculated $3,145/month for PAYE. Enrolling in PAYE during residency could lead to a monthly savings of $153.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for IBR, Dr. Don’s new monthly payment under IBR is $4,718, calculated using 15% of his discretionary income.

Given that Dr. Don’s $4,718/month IBR payment is greater than his $2,992/month payment on the Standard 10-Year Repayment plan, he does NOT qualifies for a Partial Financial Hardship and is NOT eligible to enroll in IBR.

Important Note: Partial Financial Hardship is a prerequisite for PAYE/IBR eligibility, determined by your income-to-debt ratio. To qualify, your monthly PAYE/IBR payment must be lower than the monthly payment under the Standard 10-Year Repayment plan. For residents, timely enrollment in PAYE/IBR BEFORE their income increases as an attending is crucial. Failure to do so may result in ineligibility for PAYE/IBR enrollment.

Consider this strategy for higher-earning physicians like Dr. Don: If enrolled in New IBR during residency, his monthly payment would be capped at $2,992/month (Standard 10-Year Repayment plan), not the calculated $3,145/month for New IBR. Enrolling in New IBR during residency could lead to a monthly savings of $153.

Important Reminder: For new borrowers as of July 1, 2014, payments under IBR would be 10% of discretionary income. However, the threshold for all borrowers when calculating partial financial hardship for IBR is 15%. This explains why Dr. Don’s IBR payment is $3,145/month, not the $4,718/month used to assess if he had a Partial Financial Hardship. It’s crucial to be aware of these distinctions in calculating IBR payments and hardship eligibility.

Determine whether the calculated percentage is higher or lower than the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan.

Recall our example with Dr. Don, whose Standard 10-Year Repayment monthly payment is $2,992. Using the Partial Financial Hardship calculation for IBR, Dr. Don’s new monthly payment under IBR is $4,718, calculated using 15% of his discretionary income.

Given that Dr. Don’s $4,718/month IBR payment is greater than his $2,992/month payment on the Standard 10-Year Repayment plan, he does NOT qualifies for a Partial Financial Hardship and is NOT eligible to enroll in IBR.

Important Note: Partial Financial Hardship is a prerequisite for PAYE/IBR eligibility, determined by your income-to-debt ratio. To qualify, your monthly PAYE/IBR payment must be lower than the monthly payment under the Standard 10-Year Repayment plan. For residents, timely enrollment in PAYE/IBR BEFORE their income increases as an attending is crucial. Failure to do so may result in ineligibility for PAYE/IBR enrollment.

Consider this strategy for higher-earning physicians like Dr. Don: If enrolled in New IBR during residency, his monthly payment would be capped at $2,992/month (Standard 10-Year Repayment plan), not the calculated $3,145/month for New IBR. Enrolling in New IBR during residency could lead to a monthly savings of $153.

Important Reminder: For new borrowers as of July 1, 2014, payments under IBR would be 10% of discretionary income. However, the threshold for all borrowers when calculating partial financial hardship for IBR is 15%. This explains why Dr. Don’s IBR payment is $3,145/month, not the $4,718/month used to assess if he had a Partial Financial Hardship. It’s crucial to be aware of these distinctions in calculating IBR payments and hardship eligibility.

Conclusion

Understanding Partial Financial Hardship is essential when navigating Income-Driven Repayment (IDR) plans like IBR and PAYE.

This hardship arises when your monthly payments under these plans are lower than what you’d pay under a 10-year Standard Repayment plan, offering more manageable repayment terms.

Although demonstrating financial hardship is required to initially qualify for IBR or PAYE, you won’t need to continue proving it to remain enrolled.

For higher-earning physicians, enrolling in PAYE or IBR before your income rises is crucial. If your income grows too high, you may lose eligibility due to the Partial Financial Hardship requirement.

For example, enrolling in New IBR during residency could result in significant savings once your income increases, as payments would be capped at the 10-year repayment amount — potentially saving you hundreds, if not thousands, of dollars each month.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Conclusion

Understanding Partial Financial Hardship is essential when navigating Income-Driven Repayment (IDR) plans like IBR and PAYE.

This hardship arises when your monthly payments under these plans are lower than what you’d pay under a 10-year Standard Repayment plan, offering more manageable repayment terms.

Although demonstrating financial hardship is required to initially qualify for IBR or PAYE, you won’t need to continue proving it to remain enrolled.

For higher-earning physicians, enrolling in PAYE or IBR before your income rises is crucial. If your income grows too high, you may lose eligibility due to the Partial Financial Hardship requirement.

For example, enrolling in New IBR during residency could result in significant savings once your income increases, as payments would be capped at the 10-year repayment amount — potentially saving you hundreds, if not thousands, of dollars each month.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.