Introduction

Navigating student loans as a 4th-year medical student (MS4) can feel overwhelming, especially with residency just around the corner.

Fortunately, there’s a powerful (and surprisingly simple) move you can make right now that could save you thousands of dollars during training: e-filing a tax return that reports $0 income.

By doing this in 2025, for your 2024 tax year, you can qualify for $0 monthly payments under an Income-Driven Repayment (IDR) plan during your first year of residency.

Even if you didn’t earn income in 2024 and aren’t required to file a tax return, e-filing one allows you to officially prove your $0 income to your student loan servicer.

This step is one of the most effective ways to reduce financial stress, preserve flexibility, and stay focused on your training.

Introduction

Navigating student loans as a 4th-year medical student (MS4) can feel overwhelming, especially with residency just around the corner.

Fortunately, there’s a powerful (and surprisingly simple) move you can make right now that could save you thousands of dollars during training: e-filing a tax return that reports $0 income.

By doing this in 2025, for your 2024 tax year, you can qualify for $0 monthly payments under an Income-Driven Repayment (IDR) plan during your first year of residency.

Even if you didn’t earn income in 2024 and aren’t required to file a tax return, e-filing one allows you to officially prove your $0 income to your student loan servicer.

This step is one of the most effective ways to reduce financial stress, preserve flexibility, and stay focused on your training.

MS4? Intern?

🎓 Get Your Free Student Loan Guide!

The one you’ll want to share with your classmates.

Everything you need to avoid costly student loan mistakes, lock in $0 payments during residency, and set yourself up for forgiveness success.

By signing up, you’ll also get the Dream Bigger: Physician Edition Newsletter.

Get quick, actionable tips + timely student loan updates made just for busy residents.

📌 Important: Use your personal email (not your med school address) so you don’t miss time-sensitive updates, especially during graduation and your transition to residency.

MS4? Intern?

🎓 Get Your Free Student Loan Guide!

The one you’ll want to share with your classmates.

Everything you need to avoid costly student loan mistakes, lock in $0 payments during residency, and set yourself up for forgiveness success.

By signing up, you’ll also get the Dream Bigger: Physician Edition Newsletter.

Get quick, actionable tips + timely student loan updates made just for busy residents.

📌 Important: Use your personal email (not your med school address) so you don’t miss time-sensitive updates, especially during graduation and your transition to residency.

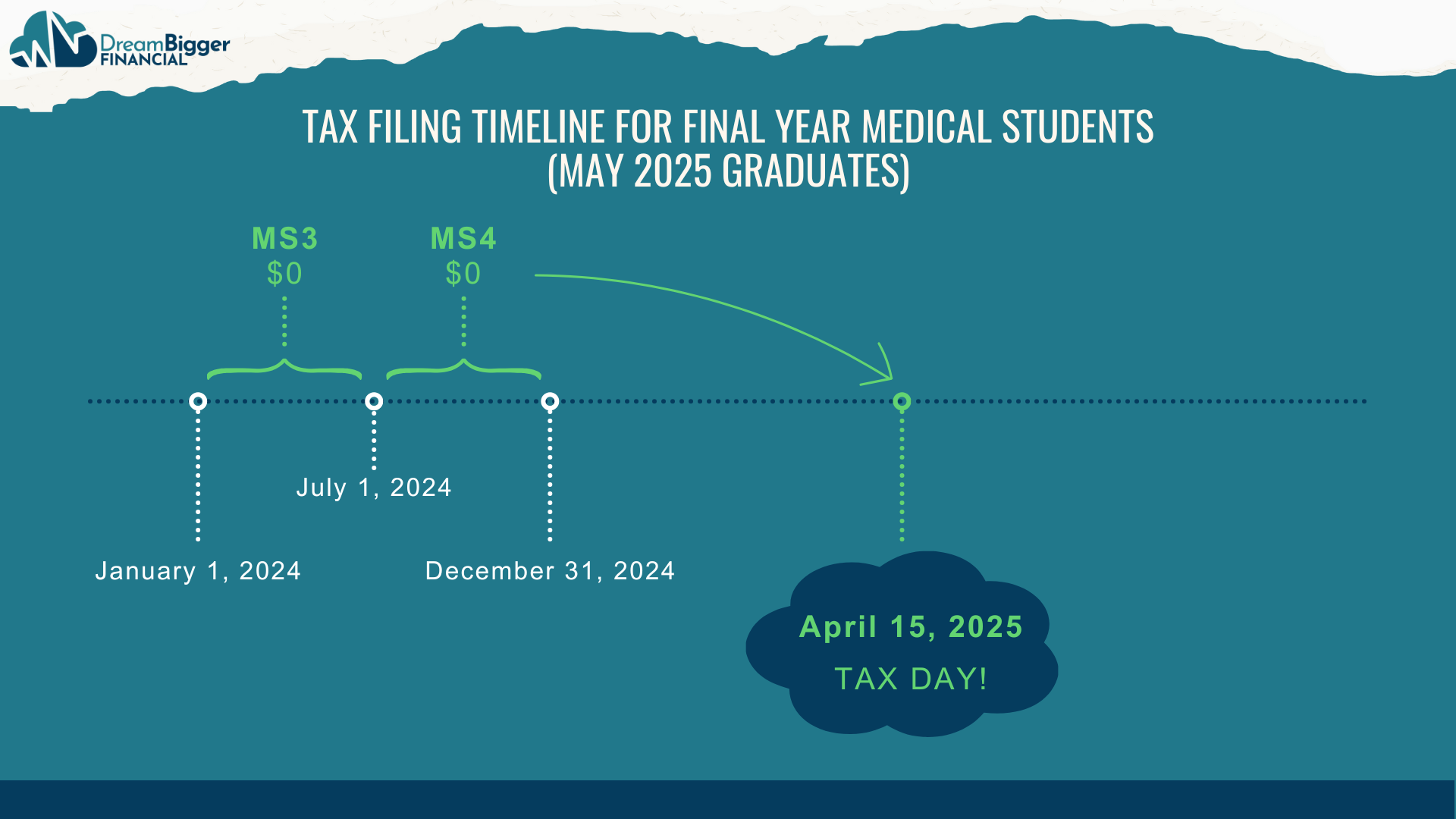

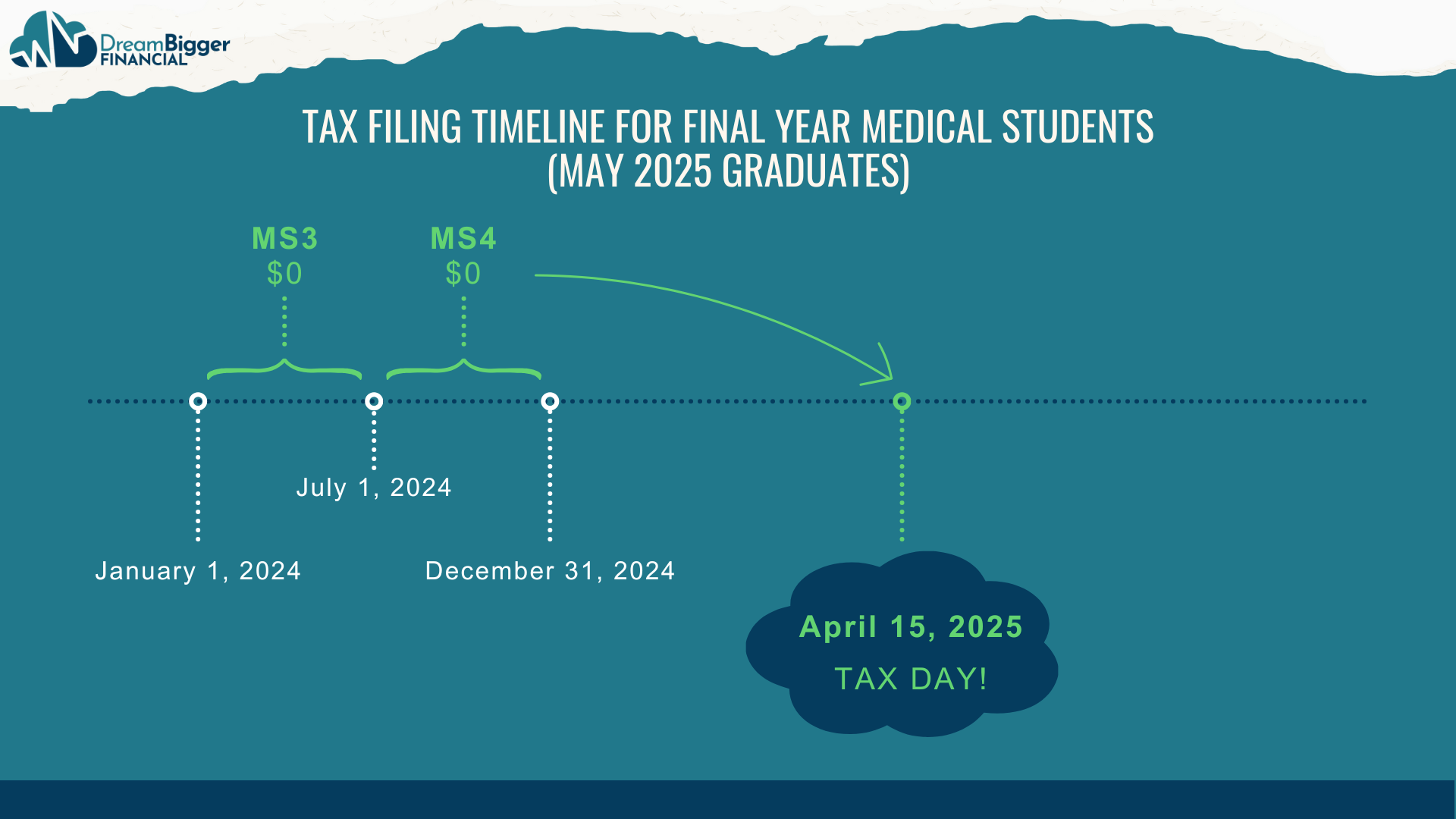

Filing a Tax Return: What You Need to Know

Each year, you’re required to file a tax return to report your income from the previous year.

For example, by April 15, 2025, you must file a return reflecting income earned between January 1 and December 31, 2024.

If your income is below the standard deduction, you may not be required to file.

But filing anyway can be strategic, especially for IDR purposes.

Filing a Tax Return: What You Need to Know

Each year, you’re required to file a tax return to report your income from the previous year.

For example, by April 15, 2025, you must file a return reflecting income earned between January 1 and December 31, 2024.

If your income is below the standard deduction, you may not be required to file.

But filing anyway can be strategic, especially for IDR purposes.

💡 Bonus Note: Timing Tip for Future You

The tax deadline to file your 2024 return is April 15, 2025.

But if you’re filing just to qualify for $0 student loan payments (not because you owe taxes), you technically don’t need to file by the deadline.

That means this still works even if it’s after April 15, 2025.

If you’re reading this later in the year, you can file your return a few weeks before enrolling in an IDR plan, and still use it to qualify for $0 monthly payments.

💡 Bonus Note: Timing Tip for Future You

The tax deadline to file your 2024 return is April 15, 2025.

But if you’re filing just to qualify for $0 student loan payments (not because you owe taxes), you technically don’t need to file by the deadline.

That means this still works even if it’s after April 15, 2025.

If you’re reading this later in the year, you can file your return a few weeks before enrolling in an IDR plan, and still use it to qualify for $0 monthly payments.

Income During 3rd-Year and 4th-Year Medical School

For many 4th-year medical students, the tax year includes the second half of your MS3 year and the first half of your MS4 year.

This is typically a time when most students did not earn any income — no job, no side hustle, no paid research.

If that’s your situation, that’s totally normal.

Income During 3rd-Year and 4th-Year Medical School

For many 4th-year medical students, the tax year includes the second half of your MS3 year and the first half of your MS4 year.

This is typically a time when most students did not earn any income — no job, no side hustle, no paid research.

If that’s your situation, that’s totally normal.

Why This Matters for Your Student Loans

Your monthly student loan payment under an IDR plan is based on your income and family size, not your loan balance.

If you had no income in 2024, your payment could be $0/month.

But you’ll need to prove that with official documentation.

That’s where e-filing a $0 tax return comes in.

Why This Matters for Your Student Loans

Your monthly student loan payment under an IDR plan is based on your income and family size, not your loan balance.

If you had no income in 2024, your payment could be $0/month.

But you’ll need to prove that with official documentation.

That’s where e-filing a $0 tax return comes in.

Special Considerations for Married Students

Before we jump in…

This strategy is mainly designed for those of you who are single or in a pretty simple situation — like if you didn’t earn much income in medical school.

If you’re married, there are some really powerful strategies you can use to lower your student loan payments… but it gets a bit more nuanced depending on how you file taxes and where you live.

This guide will still be helpful, but if you’re married and want the full picture, I recommend checking out this post instead:

➡️ Student Loans for Married Physicians: What You Need to Know

Special Considerations for Married Students

Before we jump in…

This strategy is mainly designed for those of you who are single or in a pretty simple situation — like if you didn’t earn much income in medical school.

If you’re married, there are some really powerful strategies you can use to lower your student loan payments… but it gets a bit more nuanced depending on how you file taxes and where you live.

This guide will still be helpful, but if you’re married and want the full picture, I recommend checking out this post instead:

➡️ Student Loans for Married Physicians: What You Need to Know

Need Personalized Help?

Some student loan situations are more complex.

If you’d like custom guidance on your unique setup, you can schedule a 1-hour student loan consultation for $299.

We’ll walk through your income, loans, and repayment options to create a clear, personalized plan.

Need Personalized Help?

Some student loan situations are more complex.

If you’d like custom guidance on your unique setup, you can schedule a 1-hour student loan consultation for $299.

We’ll walk through your income, loans, and repayment options to create a clear, personalized plan.

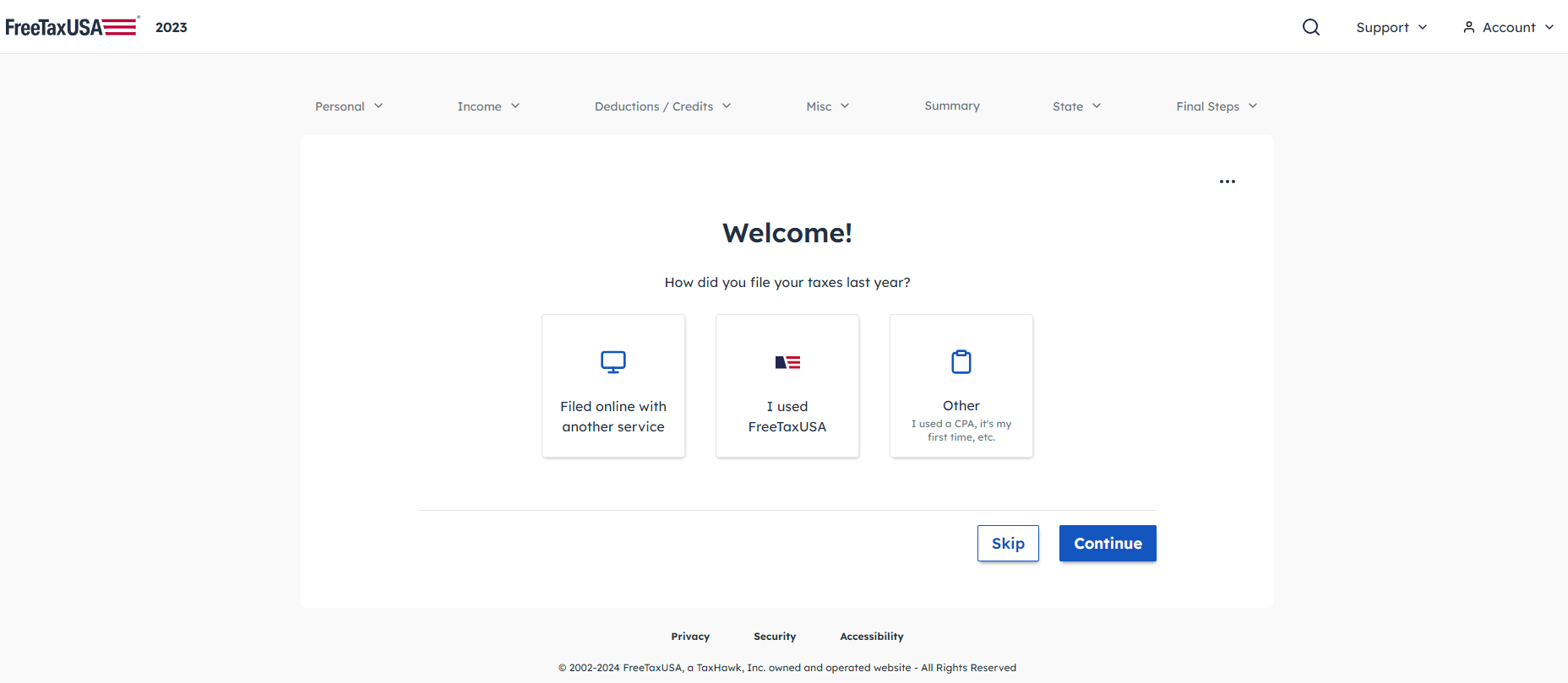

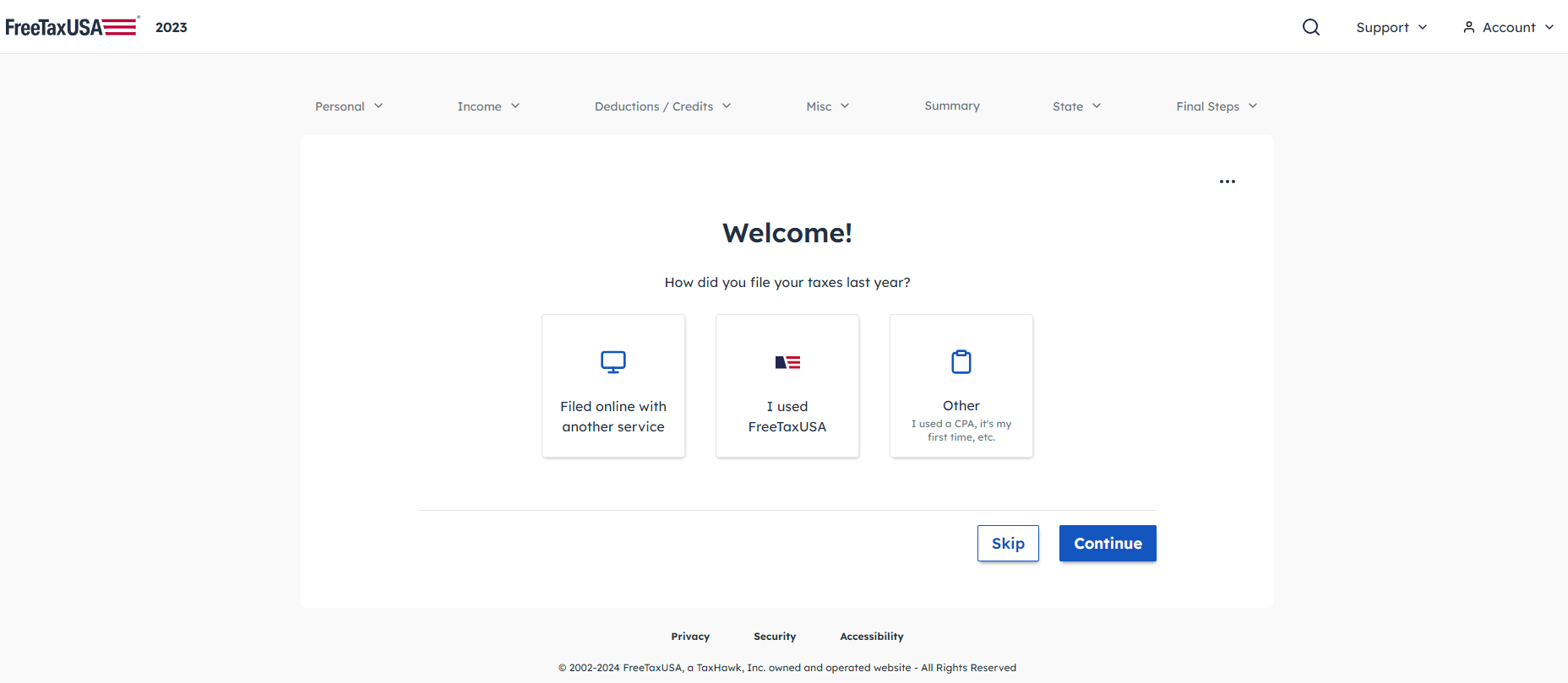

How to E-File a $0 Tax Return

Let’s walk through how to e-file your federal tax return using FreeTaxUSA, a free and straightforward tool.

How to E-File a $0 Tax Return

Let’s walk through how to e-file your federal tax return using FreeTaxUSA, a free and straightforward tool.

Step 1: Log In to Tax Software and Set Up Your Account

Go to FreeTaxUSA.com and create your account.

Step 1: Log In to Tax Software and Set Up Your Account

Go to FreeTaxUSA.com and create your account.

Step 2: Skip the “How Did You File Last Year?” Section

If you didn’t file in 2023, just skip this section.

Step 2: Skip the “How Did You File Last Year?” Section

If you didn’t file in 2023, just skip this section.

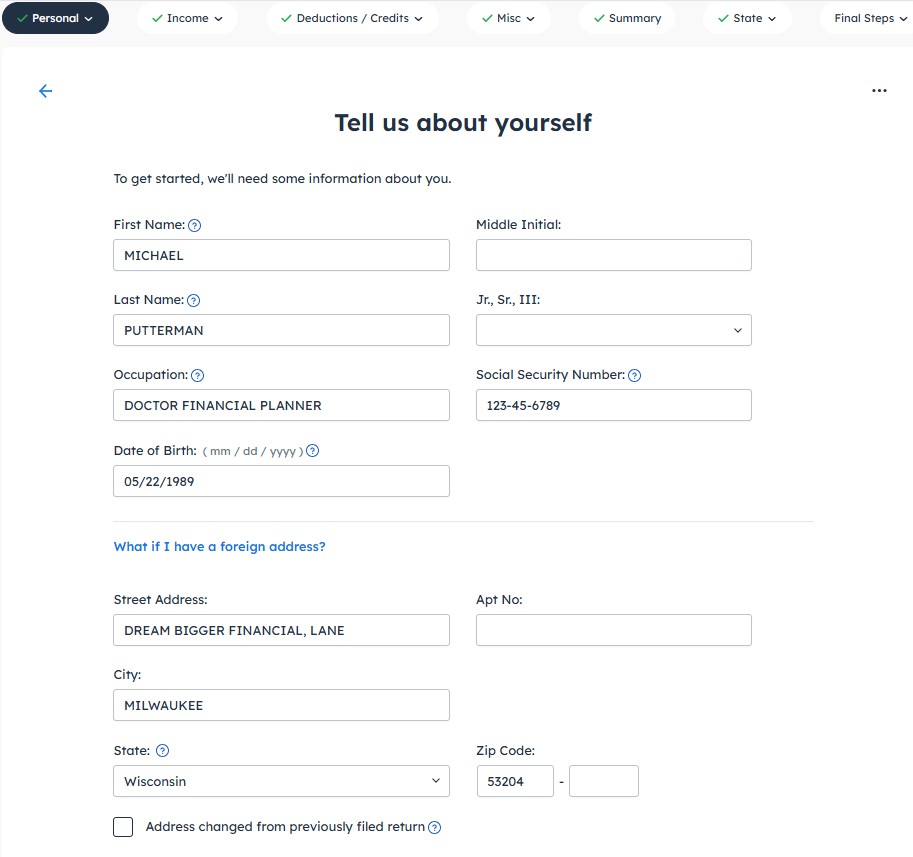

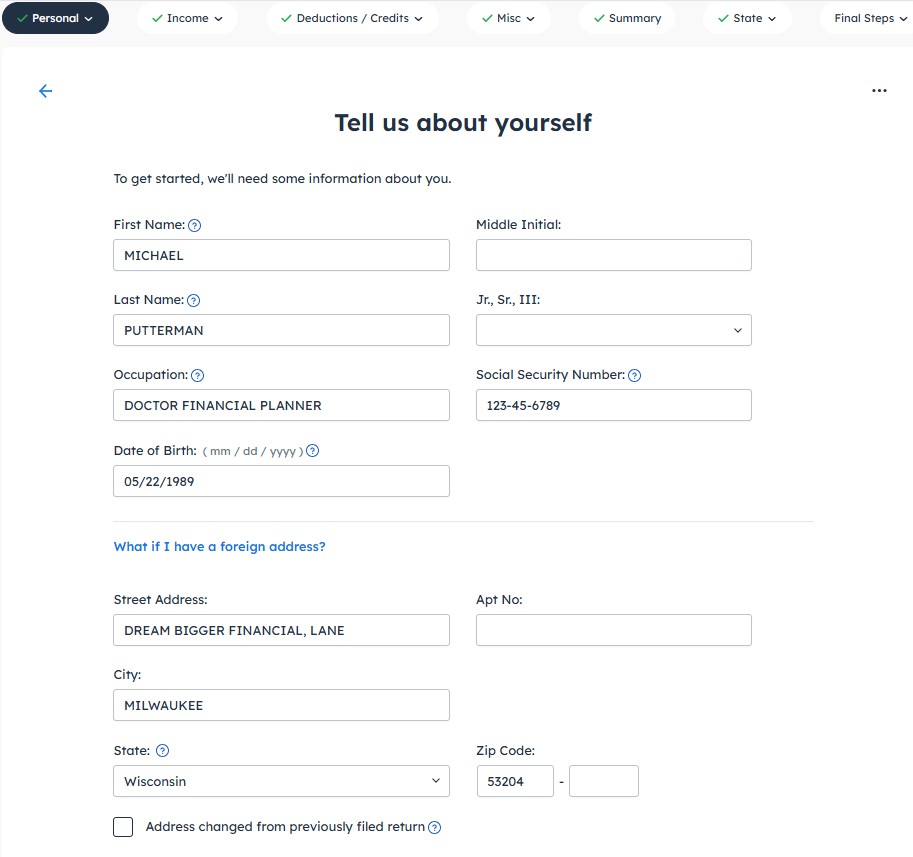

Step 3: Create Your Profile

Complete this section accurately, including your Social Security Number.

Linking this return to you requires the inclusion of your Social Security Number.

Step 3: Create Your Profile

Complete this section accurately, including your Social Security Number.

Linking this return to you requires the inclusion of your Social Security Number.

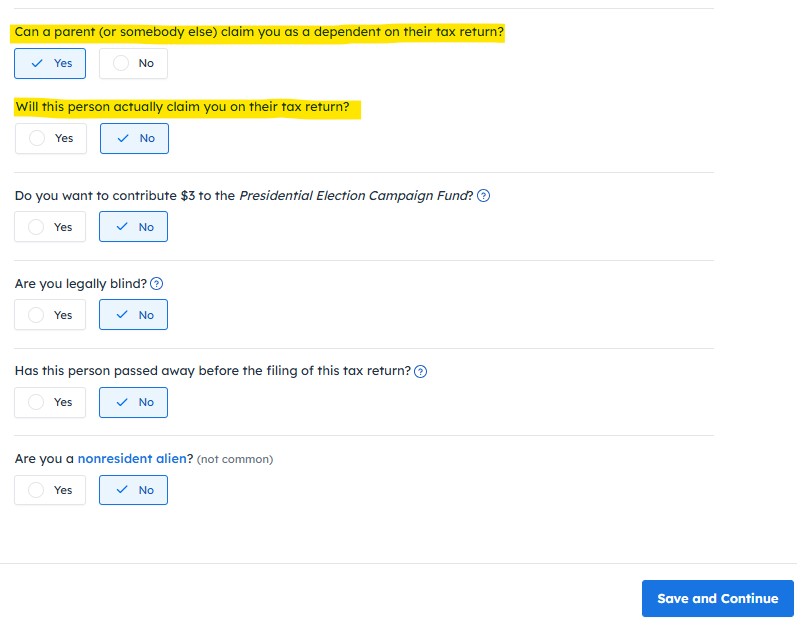

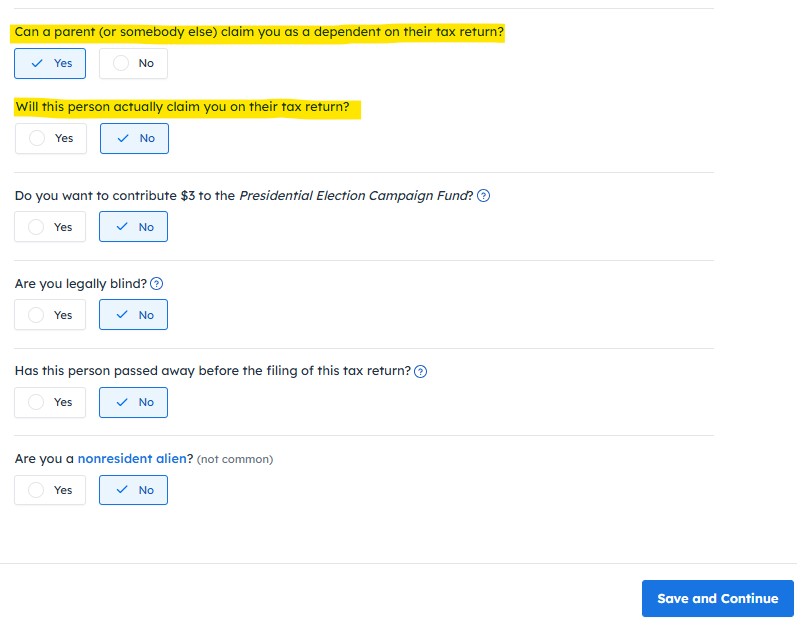

Step 4: Can Someone Claim You as a Dependent?

If you’re not sure whether your parents or guardians claimed you, it’s a good idea to check with them.

If they did claim you, answer truthfully on your tax return.

This shouldn’t prevent you from filing, but matching your return with what’s already in the IRS system can help avoid errors or delays.

If your parents haven’t filed yet, ask them to confirm.

You can explain that claiming you might affect your IDR plan, and it’s best to coordinate to avoid complications.

For more detailed guidance on how to handle this and ensure your taxes are filed correctly, check out my in-depth blog post on how to navigate dependency status and your student loans.

Step 4: Can Someone Claim You as a Dependent?

If you’re not sure whether your parents or guardians claimed you, it’s a good idea to check with them.

If they did claim you, answer truthfully on your tax return.

This shouldn’t prevent you from filing, but matching your return with what’s already in the IRS system can help avoid errors or delays.

If your parents haven’t filed yet, ask them to confirm.

You can explain that claiming you might affect your IDR plan, and it’s best to coordinate to avoid complications.

For more detailed guidance on how to handle this and ensure your taxes are filed correctly, check out my in-depth blog post on how to navigate dependency status and your student loans.

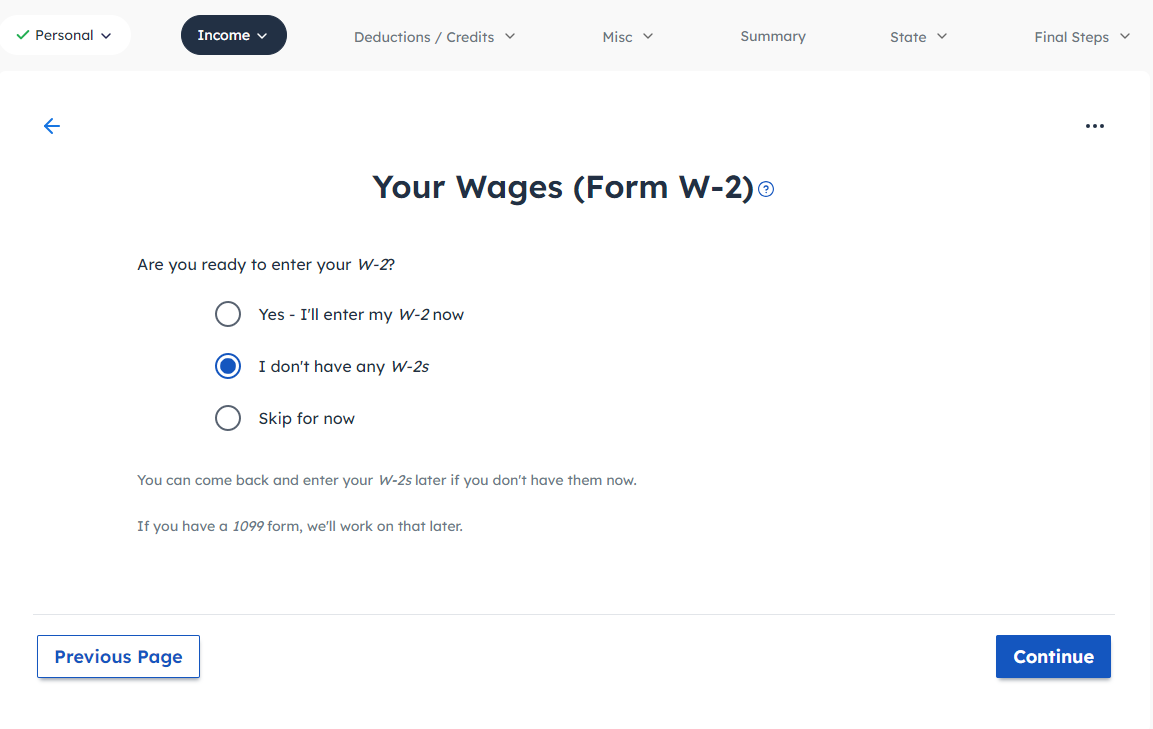

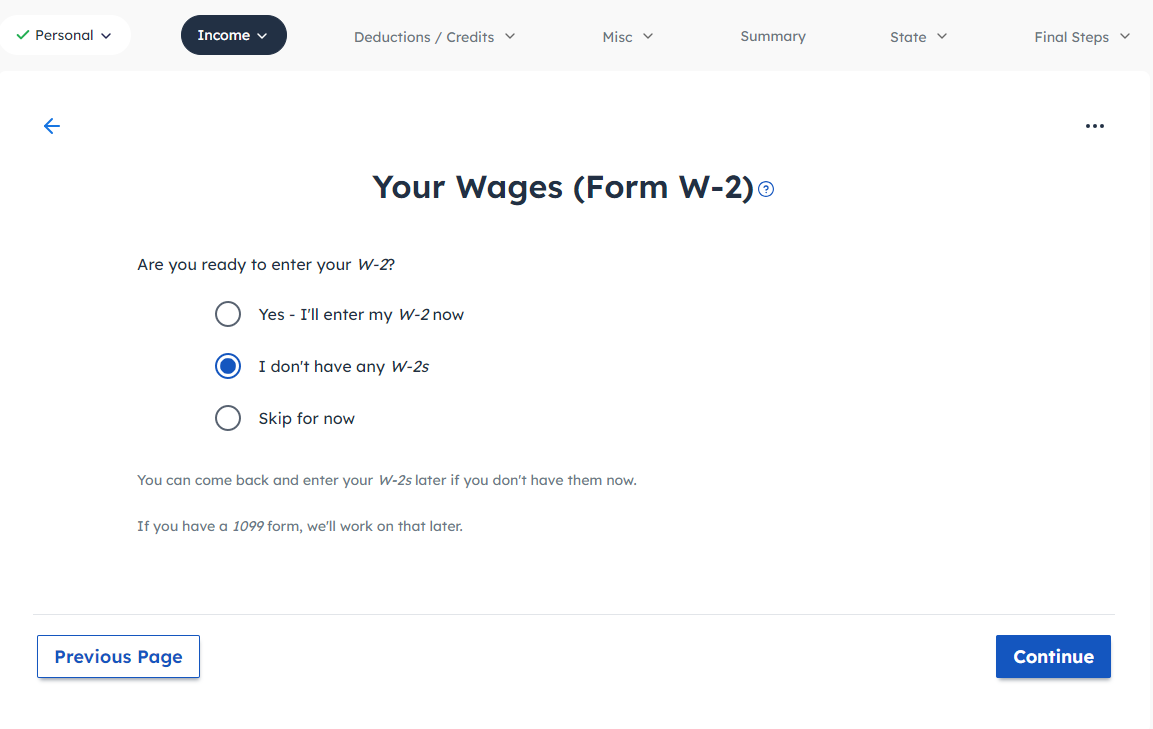

Step 5: Wages (Form W-2)

If you didn’t work, you likely don’t have a W-2. Select “I don’t have any W-2s.”

If you did work, enter your W-2 info here and report your actual income.

Step 5: Wages (Form W-2)

If you didn’t work, you likely don’t have a W-2. Select “I don’t have any W-2s.”

If you did work, enter your W-2 info here and report your actual income.

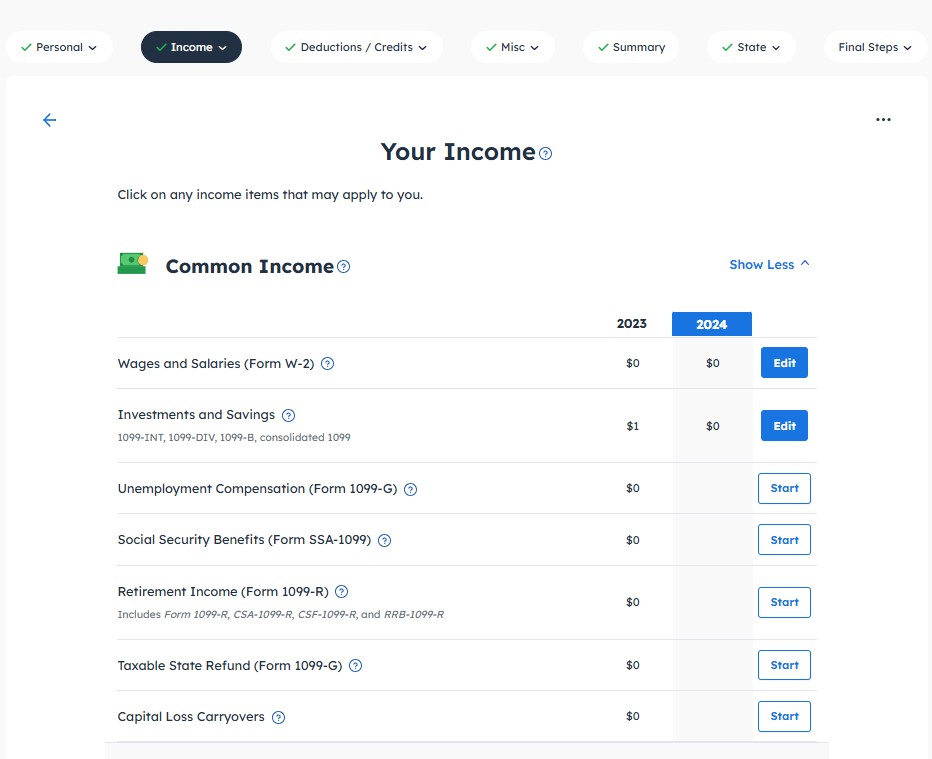

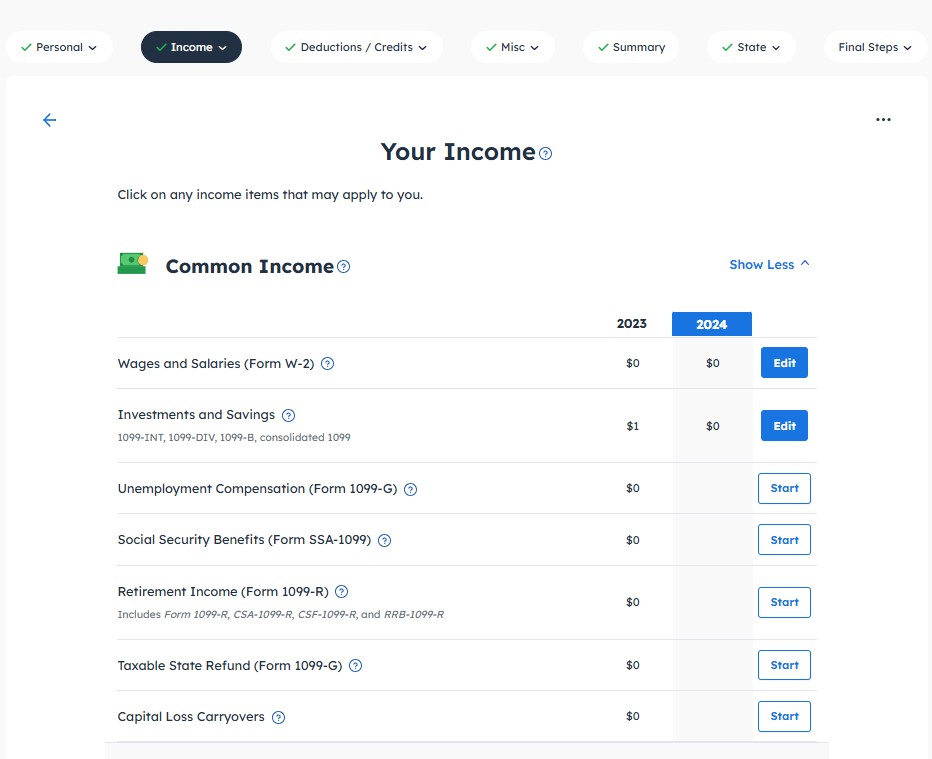

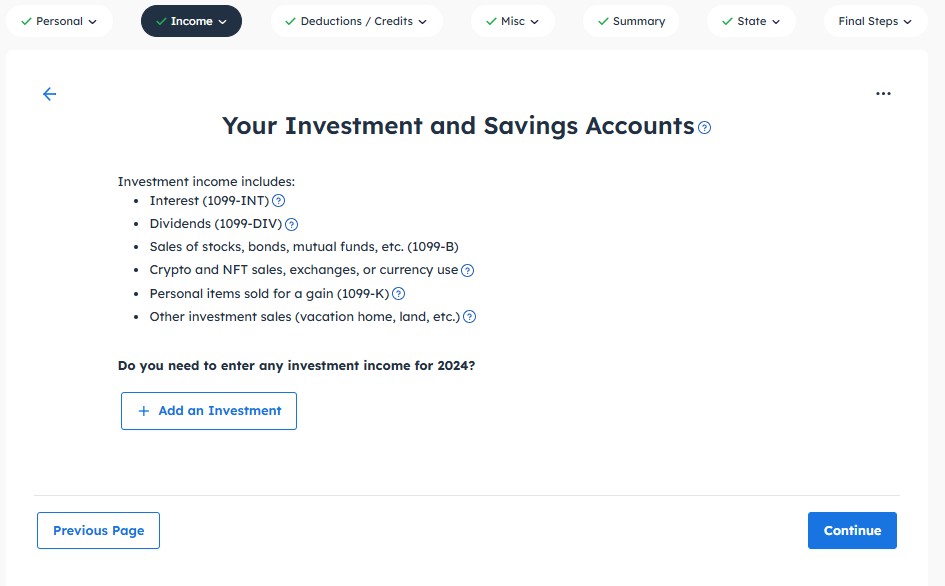

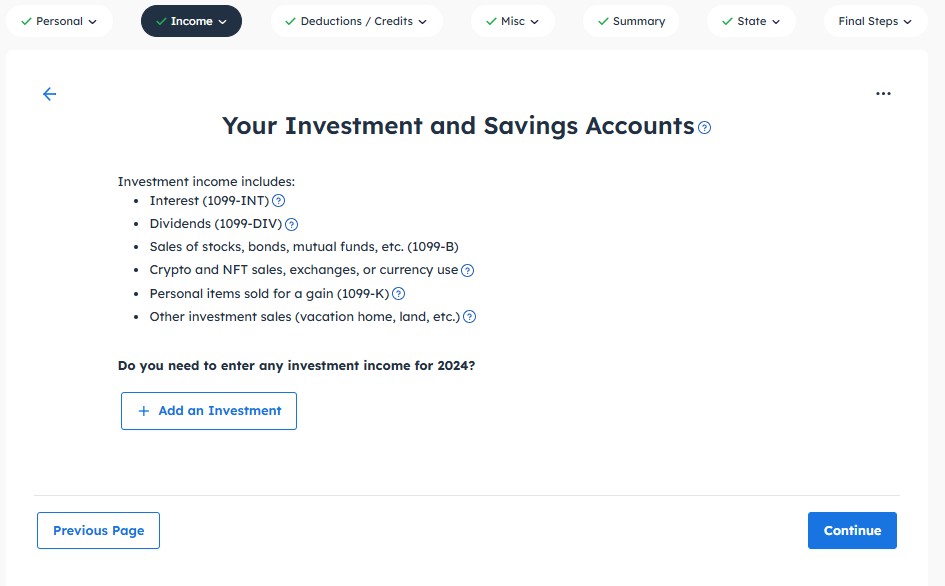

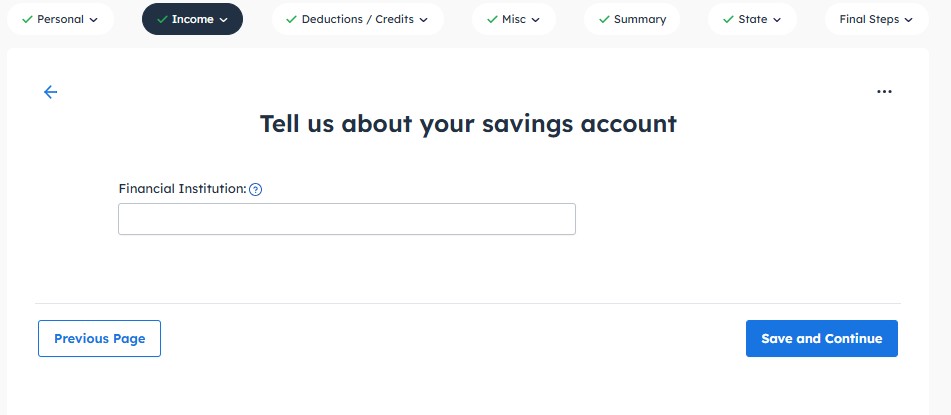

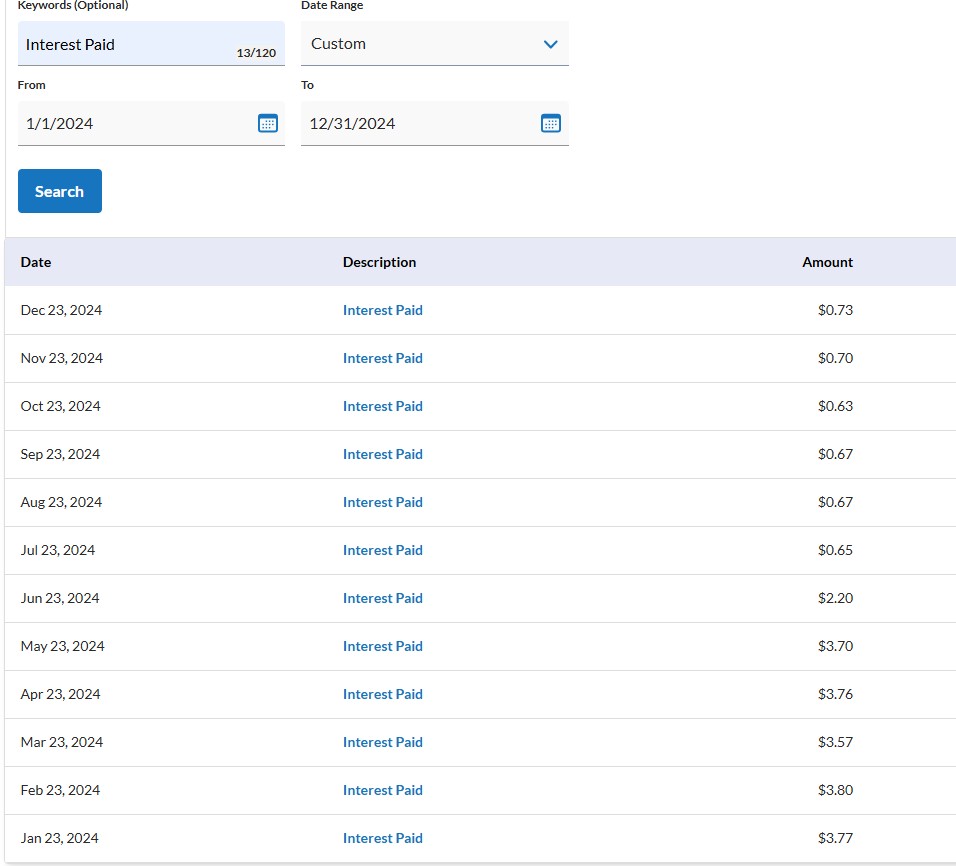

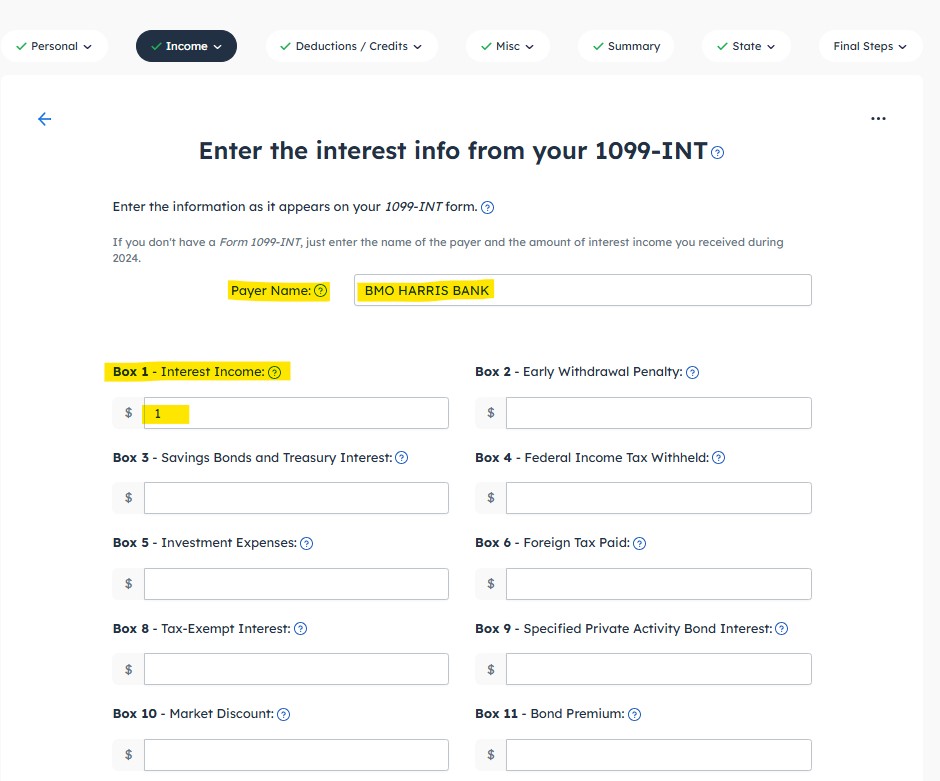

Step 6: Interest Income (Form 1099-INT)

Even with $0 income, most tax software won’t let you submit a truly blank return.

Here’s the workaround: report at least $1 of interest income.

Step 6: Interest Income (Form 1099-INT)

Even with $0 income, most tax software won’t let you submit a truly blank return.

Here’s the workaround: report at least $1 of interest income.

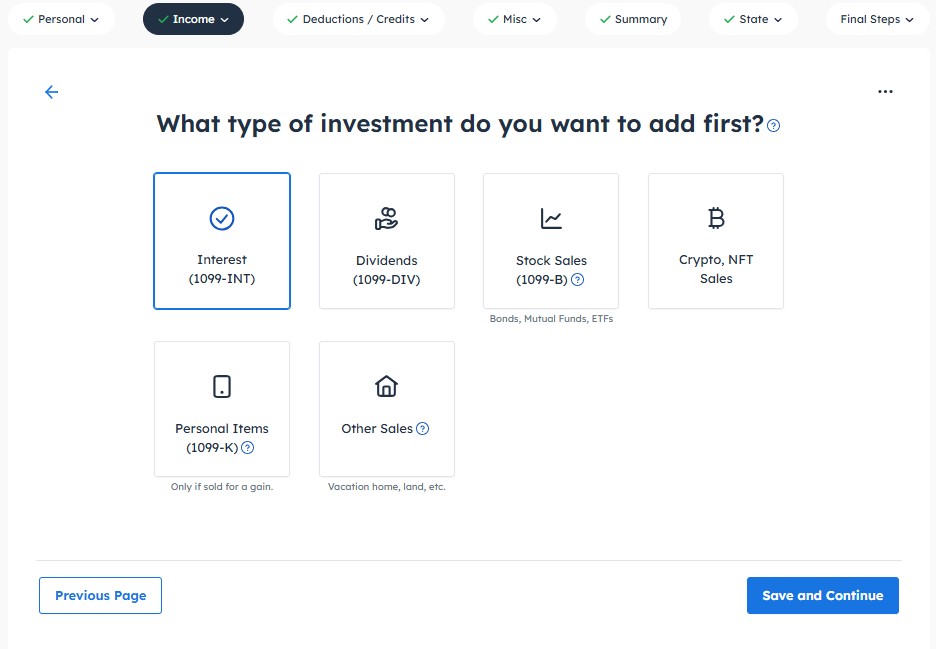

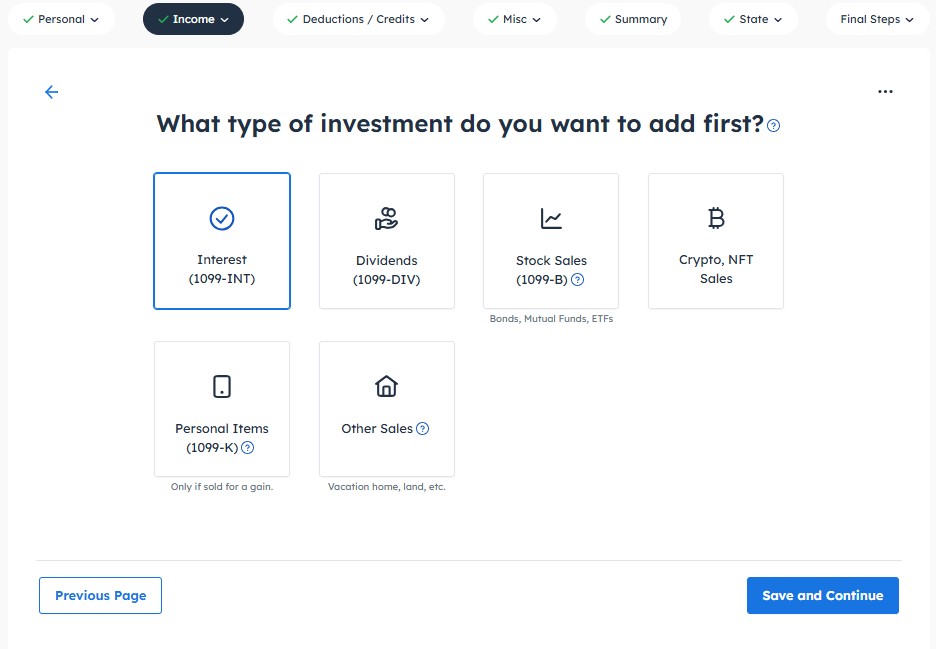

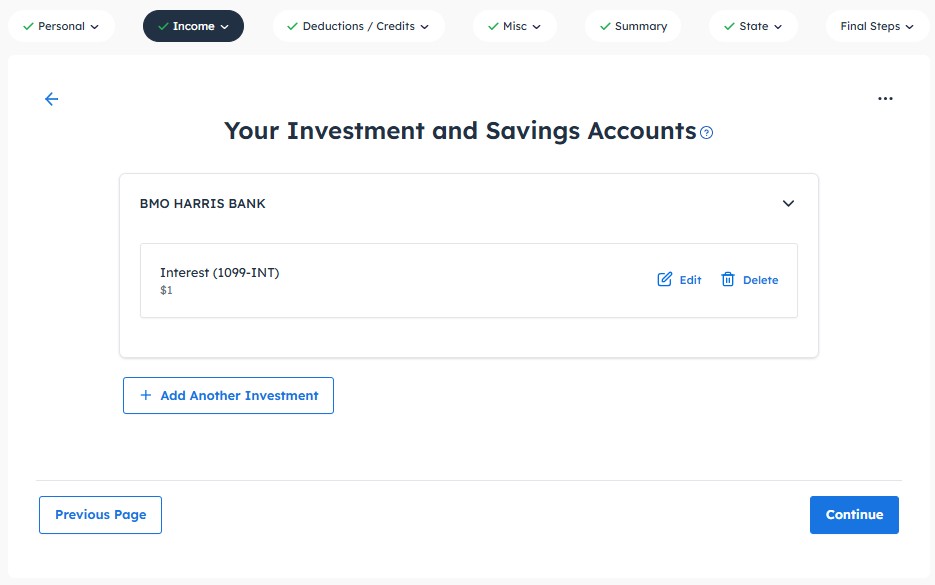

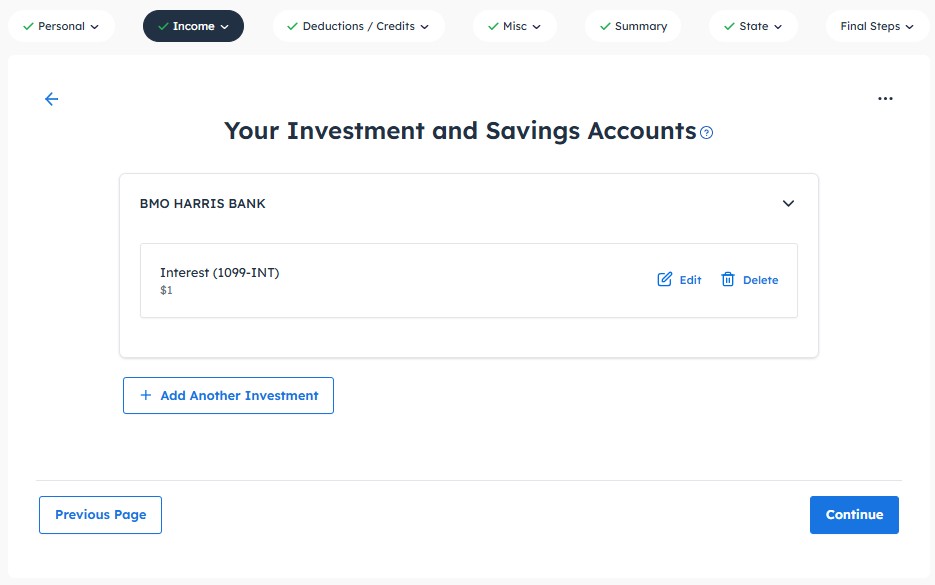

Choose the option “+ Add Interest Income” to input your interest earnings.

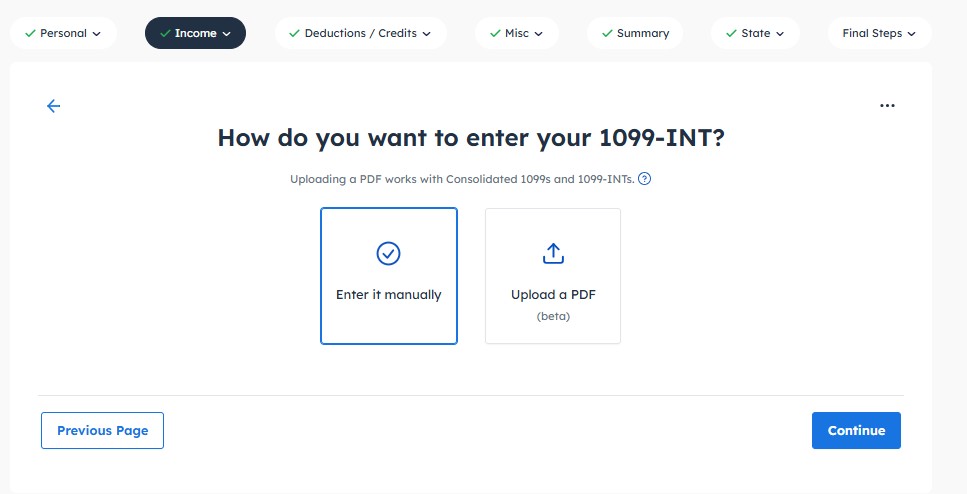

Select “Interest (1099-INT)

Choose the option “+ Add Interest Income” to input your interest earnings.

Select “Interest (1099-INT)

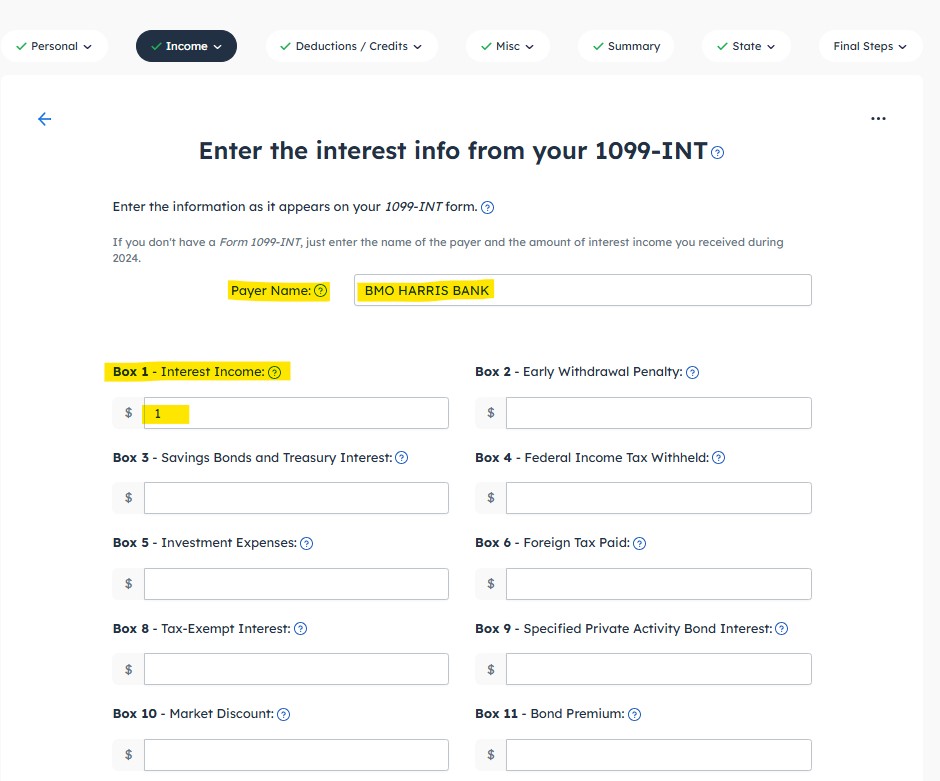

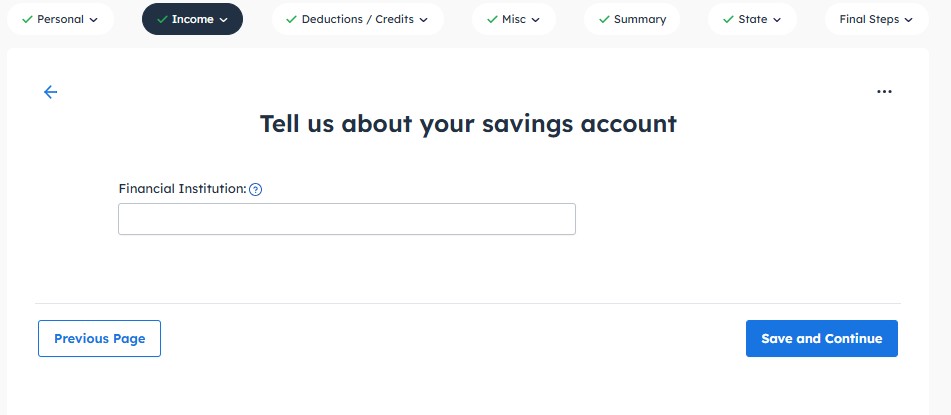

Add the payer’s name (your bank or financial institution).

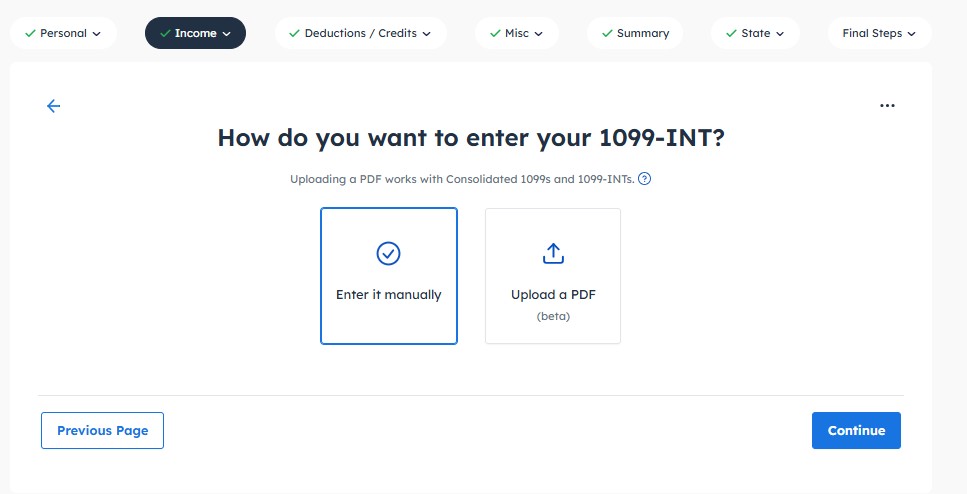

If you do not have an official 1099-INT from your bank, click “Enter it manually”

Fill in Box 1: Interest Income with the relevant information.

If you own a savings account, you likely earned at least some interest. Use that information when completing this section.

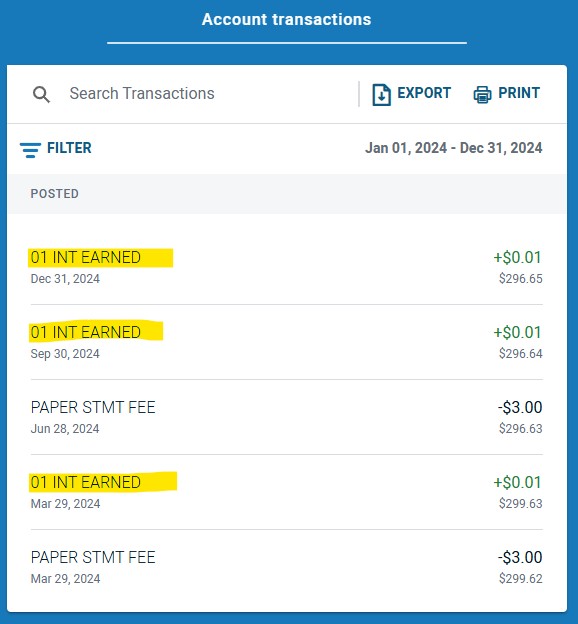

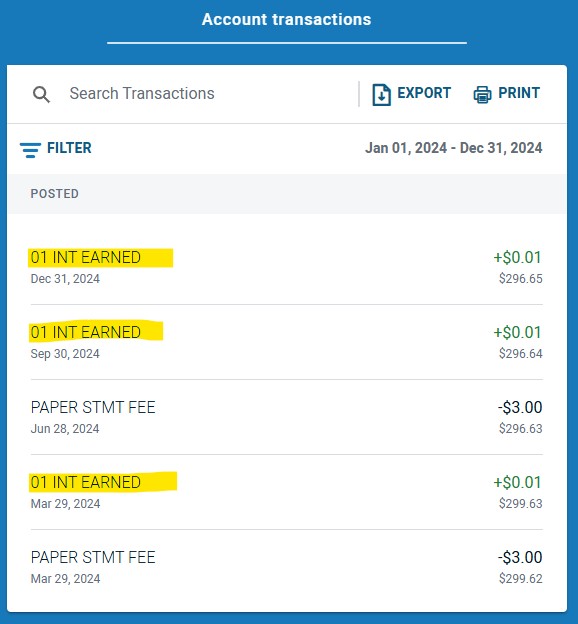

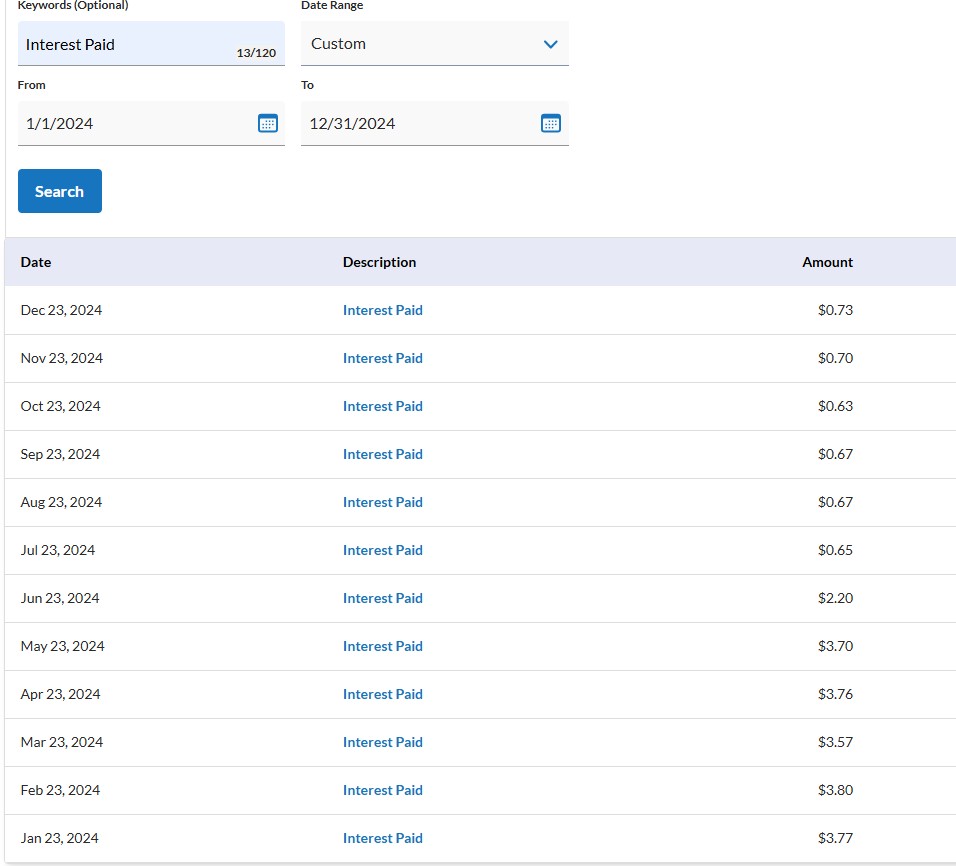

If you didn’t receive a 1099-INT form from your bank, log into your account and look for a statement showing your annual interest earned or check your prior year’s transactions.

Even without an official 1099-INT, you probably still earned interest, and it should still be reported.

Here are a couple of real-world examples:

Scenario 1: My BMO savings account didn’t earn much — just $0.03 in interest for the year. Since tax software usually won’t accept decimals that small, I rounded it up and reported $1 of interest income.

Scenario 2: My Ally High-Yield Savings Account earned $24.85 in interest in 2024. In this case, I simply entered the actual amount I earned.

Either way, reporting this small amount should help your return be processed and accepted without issues.

For this example, I’m just going to illustrate my BMO interest of $1.

Once that’s entered, continue to the next step.

Add the payer’s name (your bank or financial institution).

If you do not have an official 1099-INT from your bank, click “Enter it manually”

Fill in Box 1: Interest Income with the relevant information.

If you own a savings account, you likely earned at least some interest. Use that information when completing this section.

If you didn’t receive a 1099-INT form from your bank, log into your account and look for a statement showing your annual interest earned or check your prior year’s transactions.

Even without an official 1099-INT, you probably still earned interest, and it should still be reported.

Here are a couple of real-world examples:

Scenario 1: My BMO savings account didn’t earn much — just $0.03 in interest for the year. Since tax software usually won’t accept decimals that small, I rounded it up and reported $1 of interest income.

Scenario 2: My Ally High-Yield Savings Account earned $24.85 in interest in 2024. In this case, I simply entered the actual amount I earned.

Either way, reporting this small amount should help your return be processed and accepted without issues.

For this example, I’m just going to illustrate my BMO interest of $1.

Once that’s entered, continue to the next step.

Work your way through the remaining sections of the return.

Since this filing is just to report $0 income, you’ll likely answer “No” to most of the questions that follow.

A few key reminders before submitting:

-

-

This strategy is designed only to generate documentation of income for student loan purposes, not to claim a refund or avoid taxes.

-

If you earned income, report it accurately.

-

If you’re married and file jointly, your partner’s income and tax situation must be included, this guide is not intended for those scenarios.

-

If you owe taxes, you are still responsible for paying them.

-

This method is best suited for simple cases, typically single individuals with no significant income in the prior year.

Once everything looks good, submit your return electronically.

After it’s accepted by the IRS, download a copy of the return as a PDF, you will be required to submit this when enrolling in an Income-Driven Repayment (IDR) plan.

Work your way through the remaining sections of the return.

Since this filing is just to report $0 income, you’ll likely answer “No” to most of the questions that follow.

A few key reminders before submitting:

-

This strategy is designed only to generate documentation of income for student loan purposes, not to claim a refund or avoid taxes.

-

If you earned income, report it accurately.

-

If you’re married and file jointly, your partner’s income and tax situation must be included, this guide is not intended for those scenarios.

-

If you owe taxes, you are still responsible for paying them.

This method is best suited for simple cases, typically single individuals with no significant income in the prior year.

Once everything looks good, submit your return electronically.

After it’s accepted by the IRS, download a copy of the return as a PDF, you will be required to submit this when enrolling in an Income-Driven Repayment (IDR) plan.

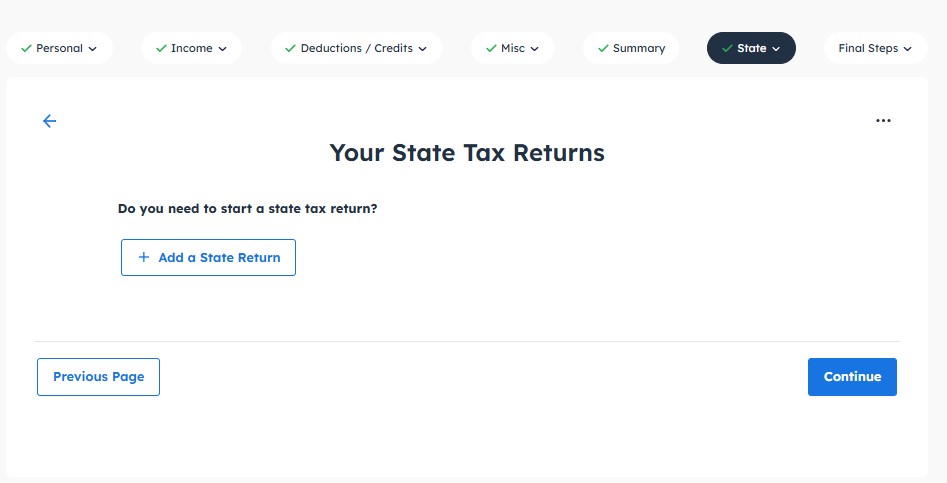

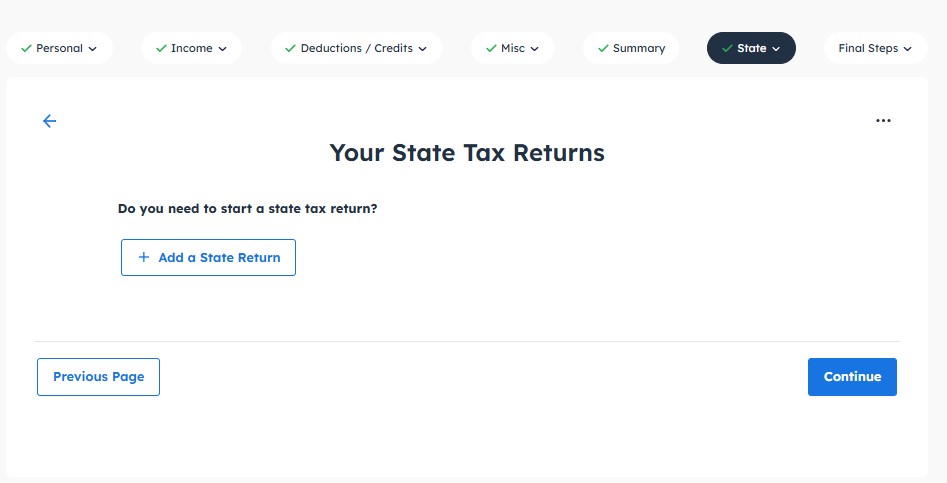

Optional: State Tax Return

As you approach the end of the process, you may be prompted to add a State Tax Return.

This step is not required if you’re filing solely to document $0 income for student loan purposes.

To receive the benefits of e-filing a $0 federal tax return, you only need the federal return when enrolling in an Income-Driven Repayment (IDR) plan.

Heads up: FreeTaxUSA charges $15 to file a state return. If you get to the end and are being asked to make a payment, it’s likely because you included a state tax return by default.

To avoid the fee:

-

-

Go back to the State tab.

-

Remove the state tax return.

-

Continue to file the federal return only for free.

-

This helps you avoid unnecessary charges and keeps the process simple.

Optional: State Tax Return

As you approach the end of the process, you may be prompted to add a State Tax Return.

This step is not required if you’re filing solely to document $0 income for student loan purposes.

To receive the benefits of e-filing a $0 federal tax return, you only need the federal return when enrolling in an Income-Driven Repayment (IDR) plan.

Heads up: FreeTaxUSA charges $15 to file a state return. If you get to the end and are being asked to make a payment, it’s likely because you included a state tax return by default.

To avoid the fee:

-

Go back to the State tab.

-

Remove the state tax return.

-

Continue to file the federal return only for free.

This helps you avoid unnecessary charges and keeps the process simple.

Conclusion

Filing a tax return, even when you’re not technically required to, is a smart move for MS4s.

By e-filing a return that reports $0 income, you position yourself to qualify for $0 payments during residency under an Income-Driven Repayment (IDR) plan.

This small step can reduce stress and help you stay financially flexible as you begin your career.

Start early, follow the steps above, and set yourself up for success.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Conclusion

Filing a tax return, even when you’re not technically required to, is a smart move for MS4s.

By e-filing a return that reports $0 income, you position yourself to qualify for $0 payments during residency under an Income-Driven Repayment (IDR) plan.

This small step can reduce stress and help you stay financially flexible as you begin your career.

Start early, follow the steps above, and set yourself up for success.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.