Introduction

Navigating student loan payments can be complex, especially for married couples where one or both partners have federal student loans.

This guide aims to simplify the process, providing clear examples and explanations to help you understand how your filing status affects your payments.

Introduction

Navigating student loan payments can be complex, especially for married couples where one or both partners have federal student loans.

This guide aims to simplify the process, providing clear examples and explanations to help you understand how your filing status affects your payments.

When planning for student loans, your goal is to minimize your payments, knowing that any remaining balance will ultimately be forgiven. The first step is enrolling in an Income-Driven Repayment (IDR) plan. In an IDR plan, your monthly payment is calculated based on your income and family size.

In simple terms:

☁️ Higher income = higher payment

☁️ Larger family = lower payment

Understanding this, to lower your student loan payments, you can either decrease your income or increase your family size. We do not encourage rushing into marriage or having children solely to reduce your student loan payment. However, there are creative ways to lower your income and, consequently, decrease your student loan payment.

To learn how saving into a Traditional (Pre-Tax) retirement strategy can lower your student loan payment, click here.

When planning for student loans, your goal is to minimize your payments, knowing that any remaining balance will ultimately be forgiven. The first step is enrolling in an Income-Driven Repayment (IDR) plan. In an IDR plan, your monthly payment is calculated based on your income and family size.

In simple terms:

☁️ Higher income = higher payment

☁️ Larger family = lower payment

Understanding this, to lower your student loan payments, you can either decrease your income or increase your family size. We do not encourage rushing into marriage or having children solely to reduce your student loan payment. However, there are creative ways to lower your income and, consequently, decrease your student loan payment.

To learn how saving into a Traditional (Pre-Tax) retirement strategy can lower your student loan payment, click here.

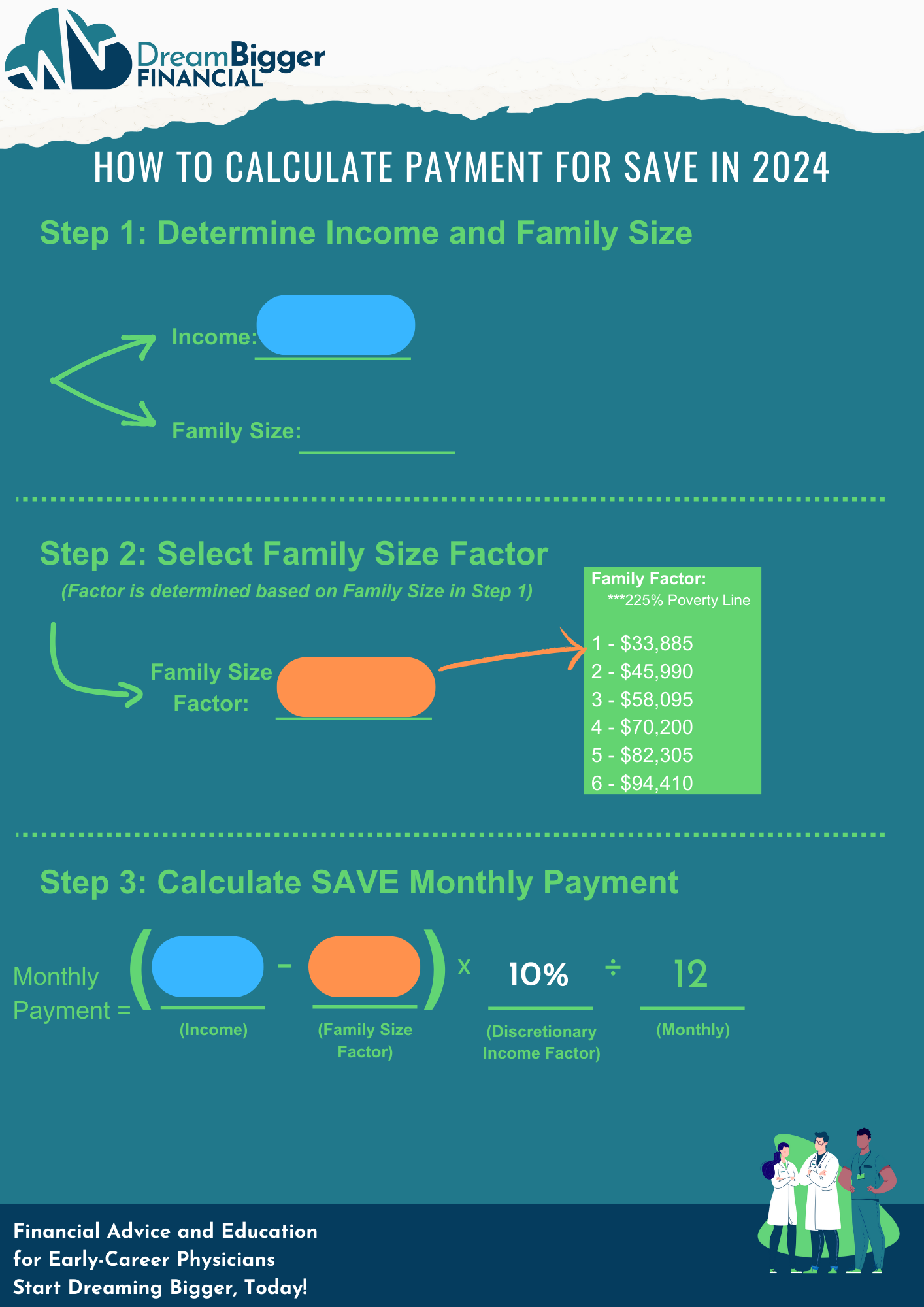

The image below illustrates how to calculate your monthly student loan payment using the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan.

To learn more about SAVE, click here.

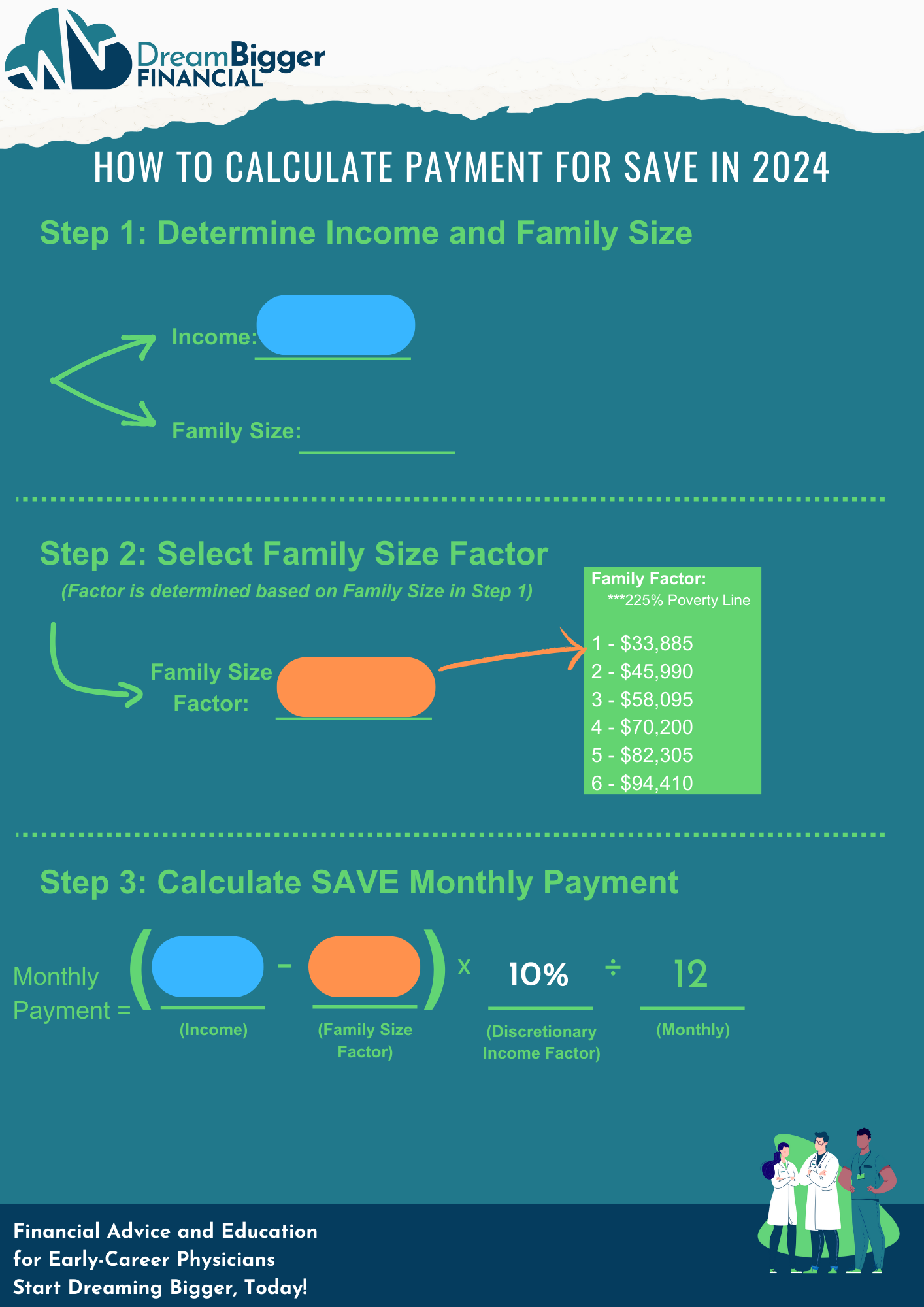

The image below illustrates how to calculate your monthly student loan payment using the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan.

To learn more about SAVE, click here.

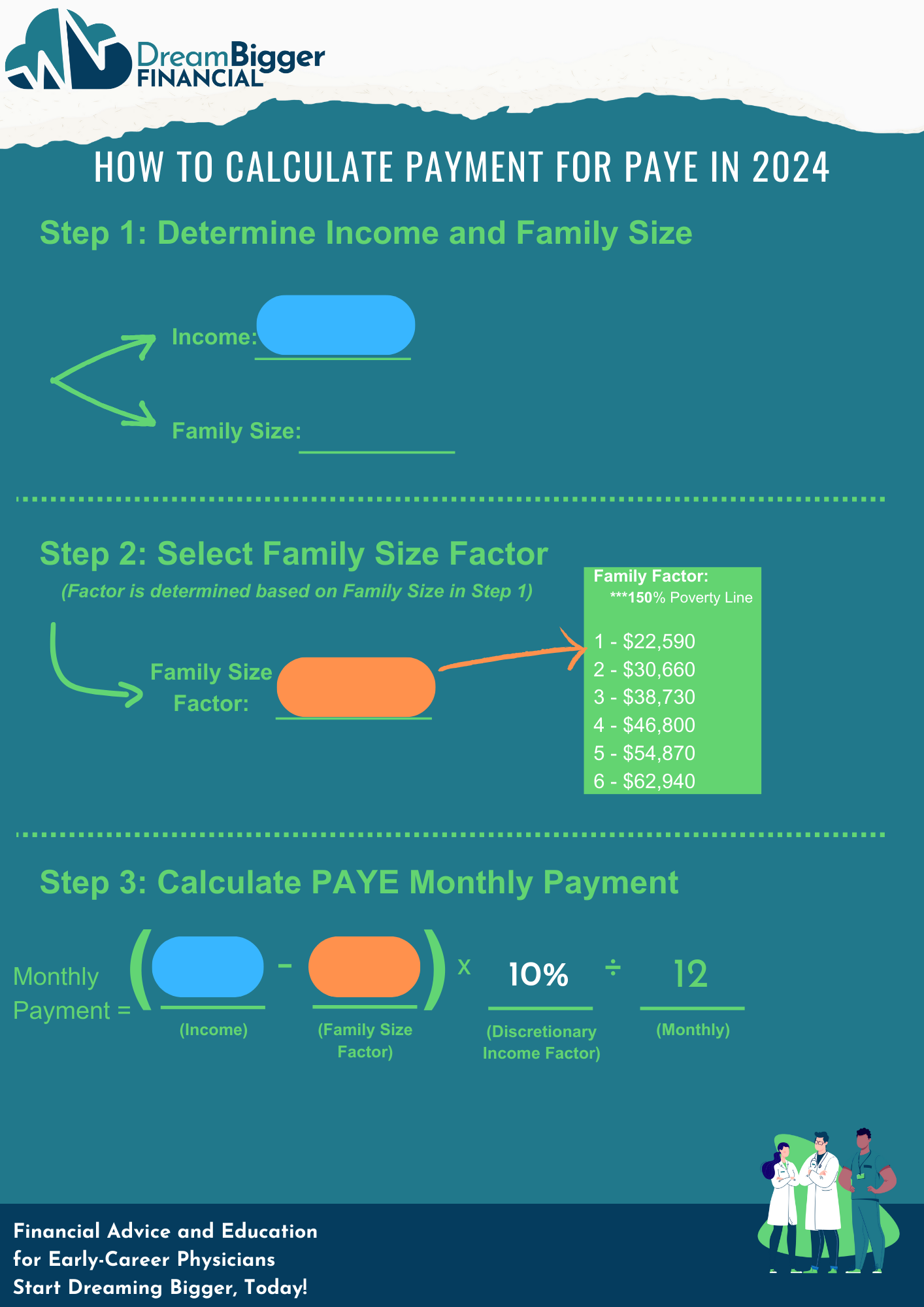

The image below illustrates how to calculate your monthly student loan payment using the Pay As You Earn (PAYE) Income-Driven Repayment (IDR) plan.

To learn more about PAYE, click here.

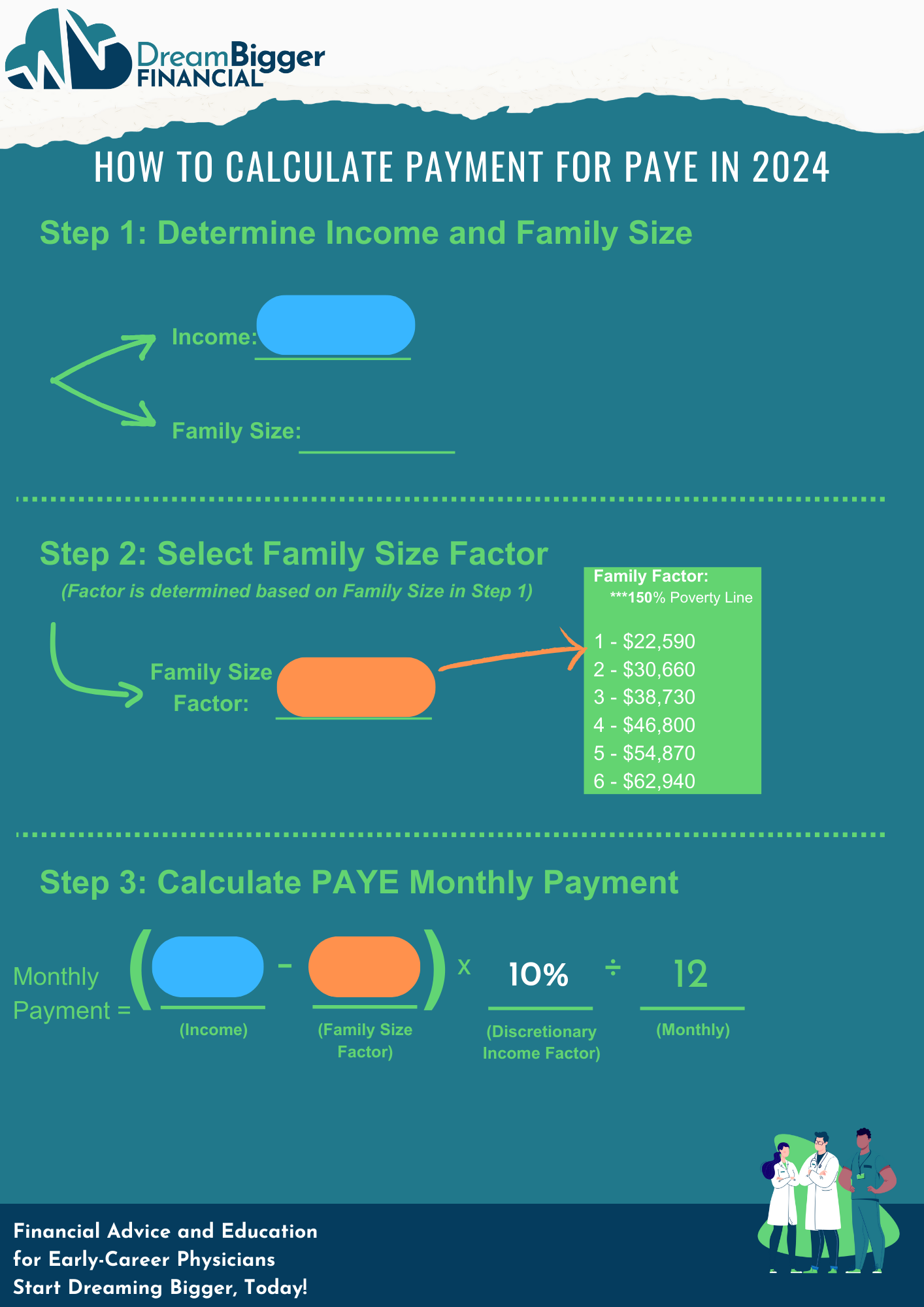

The image below illustrates how to calculate your monthly student loan payment using the Pay As You Earn (PAYE) Income-Driven Repayment (IDR) plan.

To learn more about PAYE, click here.

Married Filing Jointly

When you file your taxes as married filing jointly, your partner’s federal student loan debt is considered in determining your student loan payment. Your payment is prorated based on your share of the combined federal student loan debt.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $60,000 (60% of total debt)

-

Partner 2: $40,000 (40% of total debt)

-

-

Tax Filing Status: Married Filing Jointly (MFJ)

If Partner 1 chooses SAVE (Combined Income):

-

Income: $100,000

-

225% of Poverty Line: $45,990

-

Discretionary Income: $54,010

-

Monthly Payment: $270 ($450 x 60%)

If Partner 1 chooses PAYE (Combined Income):

-

Income: $100,000

-

150% of Poverty Line: $30,660

-

Discretionary Income: $69,340

-

Monthly Payment: $346.80 ($578 x 60%)

If Partner 2 chooses SAVE (Combined Income):

-

Income: $100,000

-

225% of Poverty Line: $45,990

-

Discretionary Income: $54,010

-

Monthly Payment: $180 ($450 x 40%)

If Partner 2 chooses PAYE (Combined Income):

-

Income: $100,000

-

150% of Poverty Line: $30,660

-

Discretionary Income: $69,340

-

Monthly Payment: $231.20 ($578 x 40%)

Married Filing Jointly

When you file your taxes as married filing jointly, your partner’s federal student loan debt is considered in determining your student loan payment. Your payment is prorated based on your share of the combined federal student loan debt.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $60,000 (60% of total debt)

-

Partner 2: $40,000 (40% of total debt)

-

-

Tax Filing Status: Married Filing Jointly (MFJ)

If Partner 1 chooses SAVE (Combined Income):

-

Income: $100,000

-

225% of Poverty Line: $45,990

-

Discretionary Income: $54,010

-

Monthly Payment: $270 ($450 x 60%)

If Partner 1 chooses PAYE (Combined Income):

-

Income: $100,000

-

150% of Poverty Line: $30,660

-

Discretionary Income: $69,340

-

Monthly Payment: $346.80 ($578 x 60%)

If Partner 2 chooses SAVE (Combined Income):

-

Income: $100,000

-

225% of Poverty Line: $45,990

-

Discretionary Income: $54,010

-

Monthly Payment: $180 ($450 x 40%)

If Partner 2 chooses PAYE (Combined Income):

-

Income: $100,000

-

150% of Poverty Line: $30,660

-

Discretionary Income: $69,340

-

Monthly Payment: $231.20 ($578 x 40%)

What if Your Spouse Doesn’t Have Federal Student Loans?

If your partner does not have student loan debt, you will be responsible for 100% of the payment. Your payment will not be prorated because you own all the debt.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $100,000 (100% of total debt)

-

Partner 2: $0 (0% of total debt)

-

-

Tax Filing Status: Married Filing Jointly (MFJ)

If Partner 1 chooses SAVE (Combined Income):

-

Income: $100,000

-

225% of Poverty Line: $45,990

-

Discretionary Income: $54,010

-

Monthly Payment: $450 ($450 x 100%)

If Partner 1 chooses PAYE (Combined Income):

-

Income: $100,000

-

150% of Poverty Line: $30,660

-

Discretionary Income: $69,340

-

Monthly Payment: $578 ($578 x 100%)

What if Your Spouse Doesn’t Have Federal Student Loans?

If your partner does not have student loan debt, you will be responsible for 100% of the payment. Your payment will not be prorated because you own all the debt.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $100,000 (100% of total debt)

-

Partner 2: $0 (0% of total debt)

-

-

Tax Filing Status: Married Filing Jointly (MFJ)

If Partner 1 chooses SAVE (Combined Income):

-

Income: $100,000

-

225% of Poverty Line: $45,990

-

Discretionary Income: $54,010

-

Monthly Payment: $450 ($450 x 100%)

If Partner 1 chooses PAYE (Combined Income):

-

Income: $100,000

-

150% of Poverty Line: $30,660

-

Discretionary Income: $69,340

-

Monthly Payment: $578 ($578 x 100%)

Married Filing Separately (Non-Community Property State)

If you file separately in a non-community property state, your payment only considers your income. You can only use a family size of 1, assuming no dependents.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $60,000 (60% of total debt)

-

Partner 2: $40,000 (40% of total debt)

-

-

Tax Filing Status: Married Filing Separately (MFS)

If Partner 1 chooses SAVE (Separate Income):

-

Income: $60,000

-

225% of Poverty Line: $33,885

-

Discretionary Income: $26,115

-

Monthly Payment: $218

If Partner 1 chooses PAYE (Separate Income):

-

Income: $60,000

-

150% of Poverty Line: $22,590

-

Discretionary Income: $37,410

-

Monthly Payment: $312

If Partner 2 chooses SAVE (Separate Income):

-

Income: $40,000

-

225% of Poverty Line: $33,885

-

Discretionary Income: $6,115

-

Monthly Payment: $51

If Partner 2 chooses PAYE (Separate Income):

-

Income: $40,000

-

150% of Poverty Line: $22,590

-

Discretionary Income: $17,410

-

Monthly Payment: $145

Married Filing Separately (Non-Community Property State)

If you file separately in a non-community property state, your payment only considers your income. You can only use a family size of 1, assuming no dependents.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $60,000 (60% of total debt)

-

Partner 2: $40,000 (40% of total debt)

-

-

Tax Filing Status: Married Filing Separately (MFS)

If Partner 1 chooses SAVE (Separate Income):

-

Income: $60,000

-

225% of Poverty Line: $33,885

-

Discretionary Income: $26,115

-

Monthly Payment: $218

If Partner 1 chooses PAYE (Separate Income):

-

Income: $60,000

-

150% of Poverty Line: $22,590

-

Discretionary Income: $37,410

-

Monthly Payment: $312

If Partner 2 chooses SAVE (Separate Income):

-

Income: $40,000

-

225% of Poverty Line: $33,885

-

Discretionary Income: $6,115

-

Monthly Payment: $51

If Partner 2 chooses PAYE (Separate Income):

-

Income: $40,000

-

150% of Poverty Line: $22,590

-

Discretionary Income: $17,410

-

Monthly Payment: $145

Married Filing Separately (Community Property State)

In a community property state, your payment is based on 50% of the household income, regardless of each partner’s income. You can only use a family size of 1, assuming no dependents.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $60,000 (60% of total debt)

-

Partner 2: $40,000 (40% of total debt)

-

-

Tax Filing Status: Married Filing Separately (MFS)

If Partner 1 or Partner 2 chooses SAVE (Separate Income):

-

Income: $50,000

-

225% of Poverty Line: $33,885

-

Discretionary Income: $16,115

-

Monthly Payment: $134/each

If Partner 1 or Partner 2 chooses PAYE (Separate Income):

-

Income: $50,000

-

150% of Poverty Line: $22,590

-

Discretionary Income: $27,410

-

Monthly Payment: $228/each

Married Filing Separately (Community Property State)

In a community property state, your payment is based on 50% of the household income, regardless of each partner’s income. You can only use a family size of 1, assuming no dependents.

Example:

-

Household Income: $100,000

-

Partner 1: $60,000

-

Partner 2: $40,000

-

-

Total Student Loans: $100,000

-

Partner 1: $60,000 (60% of total debt)

-

Partner 2: $40,000 (40% of total debt)

-

-

Tax Filing Status: Married Filing Separately (MFS)

If Partner 1 or Partner 2 chooses SAVE (Separate Income):

-

Income: $50,000

-

225% of Poverty Line: $33,885

-

Discretionary Income: $16,115

-

Monthly Payment: $134/each

If Partner 1 or Partner 2 chooses PAYE (Separate Income):

-

Income: $50,000

-

150% of Poverty Line: $22,590

-

Discretionary Income: $27,410

-

Monthly Payment: $228/each

Important Considerations

1. Form 8958: If you live in a community property state and file separately, ensure you fill out Form 8958 correctly to inform the IRS you are splitting your income.

-

-

Community Property States:

-

Arizona

-

California

-

Idaho

-

Louisiana

-

Nevada

-

New Mexico

-

Texas

-

Washington

-

Wisconsin

-

-

2. Tax Implications: Do not base your decision to file jointly or separately solely on the monthly payment. Consider additional tax implications, such as potential tax benefits or liabilities.

3. Repayment Plan Options: Understand the differences between repayment plans like SAVE and PAYE. Each plan has its own criteria and benefits, so choose the one that best fits your financial situation.

4. Consult a Professional: Always consult with a financial advisor or tax professional to ensure you are making the best choice for your circumstances.

Important Considerations

1. Form 8958: If you live in a community property state and file separately, ensure you fill out Form 8958 correctly to inform the IRS you are splitting your income.

-

-

Community Property States:

-

Arizona

-

California

-

Idaho

-

Louisiana

-

Nevada

-

New Mexico

-

Texas

-

Washington

-

Wisconsin

-

-

2. Tax Implications: Do not base your decision to file jointly or separately solely on the monthly payment. Consider additional tax implications, such as potential tax benefits or liabilities.

3. Repayment Plan Options: Understand the differences between repayment plans like SAVE and PAYE. Each plan has its own criteria and benefits, so choose the one that best fits your financial situation.

4. Consult a Professional: Always consult with a financial advisor or tax professional to ensure you are making the best choice for your circumstances.

Conclusion

Understanding how your filing status affects your student loan payments is crucial for effective financial planning.

By considering the examples and guidelines provided, you can make informed decisions that best suit your financial situation.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Conclusion

Understanding how your filing status affects your student loan payments is crucial for effective financial planning.

By considering the examples and guidelines provided, you can make informed decisions that best suit your financial situation.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.