Overview

Starting mid-December 2024, Income-Contingent Repayment (ICR) may be the only Income-Driven Repayment (IDR) plan that is eligible for Public Service Loan Forgiveness (PSLF) for high-earning professionals with student loans.

If you’re a high-earning physician, this could put you in a tough spot. With your income too high compared to your student loan balance, you might no longer qualify for IDR plans like PAYE or IBR, which typically offer lower monthly payments.

This means the ICR Income-Driven Repayment plan could become your only path to PSLF. For physicians who no longer qualify for Partial Financial Hardship, it’s more important than ever to understand how ICR works, so you can manage your payments and maximize the benefits.

In this guide, I’ll explain how to calculate your ICR payment and help you navigate this new repayment system step by step. Let’s get started!

Note: This information is current as of November 2024 and may change with future updates.

Overview

Starting mid-December 2024, Income-Contingent Repayment (ICR) may be the only Income-Driven Repayment (IDR) plan that is eligible for Public Service Loan Forgiveness (PSLF) for high-earning professionals with student loans.

If you’re a high-earning physician, this could put you in a tough spot. With your income too high compared to your student loan balance, you might no longer qualify for IDR plans like PAYE or IBR, which typically offer lower monthly payments.

This means the ICR Income-Driven Repayment plan could become your only path to PSLF. For physicians who no longer qualify for Partial Financial Hardship, it’s more important than ever to understand how ICR works, so you can manage your payments and maximize the benefits.

In this guide, I’ll explain how to calculate your ICR payment and help you navigate this new repayment system step by step. Let’s get started!

Note: This information is current as of November 2024 and may change with future updates.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Income-Contingent Repayment (ICR)

Income-Contingent Repayment (ICR) is an Income-Driven Repayment (IDR) plan that determines your monthly student loan payment based on your income and family size, unlike the 10-Year Standard Repayment plan, which calculates payments based on your loan balance and interest rate.

***It’s important to note that ICR calculates payments differently than other IDR plans, often resulting in the highest monthly student loan payment.

Why ICR May Be the Only Option for High-Earning Professionals

Recent changes in student loan policies have positioned ICR as potentially the only IDR plan available for high-earning professionals pursuing Public Service Loan Forgiveness (PSLF).

Here’s why:

-

-

If your income is too high relative to your student loan balance, you may no longer qualify for popular IDR plans like Income-Based Repayment (IBR) or Pay As You Earn (PAYE).

-

Both IBR and PAYE require you to demonstrate a Partial Financial Hardship to enroll.

-

For high-income borrowers who no longer meet this requirement, ICR is the fallback option that remains PSLF-eligible.

Why Choose ICR?

ICR stands apart because it does not require a Partial Financial Hardship. This means that anyone can enroll, regardless of income level, making it accessible to borrowers with higher earnings.

Important Update

The Department of Education issued an interim ruling on November 15, 2024, extending the deadline for most borrowers to enroll in ICR (or PAYE) from July 1, 2024, to July 1, 2027.

Enrollment in ICR is expected to open in mid-December 2024. For the latest information and updates, refer to the Department of Education’s official guidelines.

Income-Contingent Repayment (ICR)

Income-Contingent Repayment (ICR) is an Income-Driven Repayment (IDR) plan that determines your monthly student loan payment based on your income and family size, unlike the 10-Year Standard Repayment plan, which calculates payments based on your loan balance and interest rate.

***It’s important to note that ICR calculates payments differently than other IDR plans, often resulting in the highest monthly student loan payment.

Why ICR May Be the Only Option for High-Earning Professionals

Recent changes in student loan policies have positioned ICR as potentially the only IDR plan available for high-earning professionals pursuing Public Service Loan Forgiveness (PSLF).

Here’s why:

-

-

If your income is too high relative to your student loan balance, you may no longer qualify for popular IDR plans like Income-Based Repayment (IBR) or Pay As You Earn (PAYE).

-

Both IBR and PAYE require you to demonstrate a Partial Financial Hardship to enroll.

-

For high-income borrowers who no longer meet this requirement, ICR is the fallback option that remains PSLF-eligible.

Why Choose ICR?

ICR stands apart because it does not require a Partial Financial Hardship. This means that anyone can enroll, regardless of income level, making it accessible to borrowers with higher earnings.

Important Update

The Department of Education issued an interim ruling on November 15, 2024, extending the deadline for most borrowers to enroll in ICR (or PAYE) from July 1, 2024, to July 1, 2027.

Enrollment in ICR is expected to open in mid-December 2024. For the latest information and updates, refer to the Department of Education’s official guidelines.

☁️ Poverty Line Deduction: 100%

☁️ Payment & Timeline:

-

-

Timeline: 25 Years

-

-

-

Calculated payments under ICR are the lesser of

-

-

-

-

20% of your discretionary income; or

-

The amount you would pay under a fixed 12-year repayment plan, adjusted by a factor based on your adjusted gross income (AGI).

-

-

☁️ Payment Cap: None

☁️ Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

Note: If you and your spouse choose to repay your Direct Loans jointly under the ICR Plan, your servicer will use your joint income to calculate the monthly payment, regardless of whether you file a joint or separate federal tax return.

☁️ Interest Subsidy: No

Note: ICR payments may not cover all the interest accruing each month (negative amortization). Any unpaid interest is capitalized (added to your loan balance) annually when you submit new income documentation. Capitalized interest is capped at 10% of your original repayment balance. Once this cap is reached, unpaid interest will continue to accrue but will not be capitalized further.

☁️ Poverty Line Deduction: 100%

☁️ Payment & Timeline:

-

-

Timeline: 25 Years

-

-

-

Calculated payments under ICR are the lesser of

-

-

-

-

20% of your discretionary income; or

-

The amount you would pay under a fixed 12-year repayment plan, adjusted by a factor based on your adjusted gross income (AGI).

-

-

☁️ Payment Cap: None

☁️ Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

Note: If you and your spouse choose to repay your Direct Loans jointly under the ICR Plan, your servicer will use your joint income to calculate the monthly payment, regardless of whether you file a joint or separate federal tax return.

☁️ Interest Subsidy: No

Note: ICR payments may not cover all the interest accruing each month (negative amortization). Any unpaid interest is capitalized (added to your loan balance) annually when you submit new income documentation. Capitalized interest is capped at 10% of your original repayment balance. Once this cap is reached, unpaid interest will continue to accrue but will not be capitalized further.

☁️ The following Direct Federal Loans qualify for ICR:

-

-

Subsidized Direct Loans

-

Unsubsidized Direct Loans

-

Direct Grad PLUS Loans

-

Direct Consolidation Loans

-

☁️ However, the following types of loans do not qualify for ICR, unless consolidated:

-

-

Parent PLUS Loans

-

FFEL (Federal Family Education Loan) Loans

-

Direct Loans in Default

-

☁️ Private Student Loans cannot be consolidated with federal student loans, and are not eligible for ICR.

It’s worth noting that Parent PLUS Loans can also qualify through the Double-Consolidation Loophole, involving two separate consolidations. If you are a Parent PLUS loan borrower, it is highly recommended to consult with someone who specializes in student loan planning.

☁️ The following Direct Federal Loans qualify for ICR:

-

-

Subsidized Direct Loans

-

Unsubsidized Direct Loans

-

Direct Grad PLUS Loans

-

Direct Consolidation Loans

-

☁️ However, the following types of loans do not qualify for ICR, unless consolidated:

-

-

Parent PLUS Loans

-

FFEL (Federal Family Education Loan) Loans

-

Direct Loans in Default

-

☁️ Private Student Loans cannot be consolidated with federal student loans, and are not eligible for ICR.

It’s worth noting that Parent PLUS Loans can also qualify through the Double-Consolidation Loophole, involving two separate consolidations. If you are a Parent PLUS loan borrower, it is highly recommended to consult with someone who specializes in student loan planning.

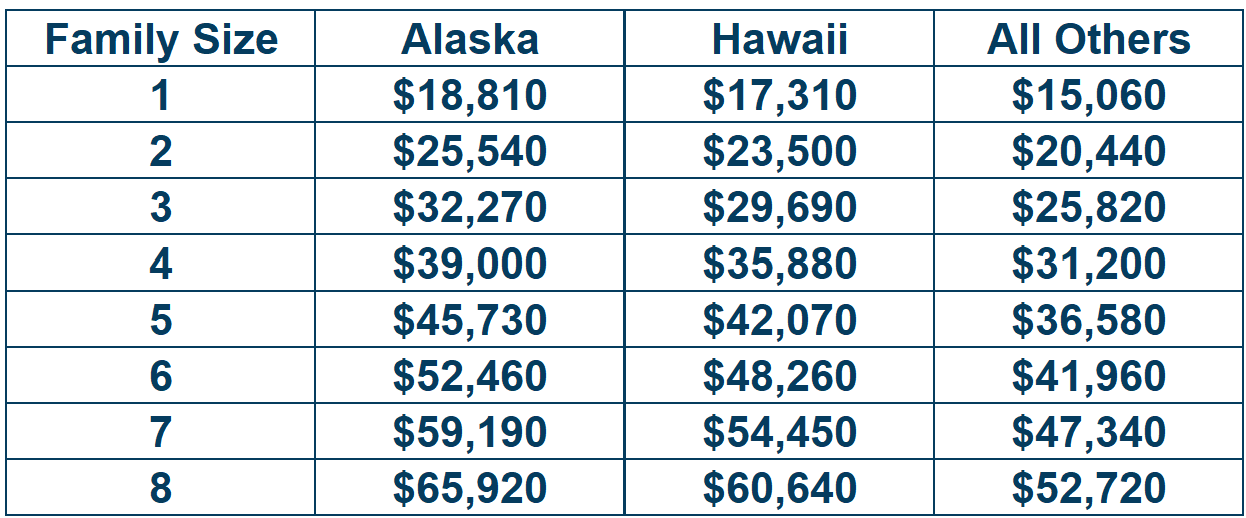

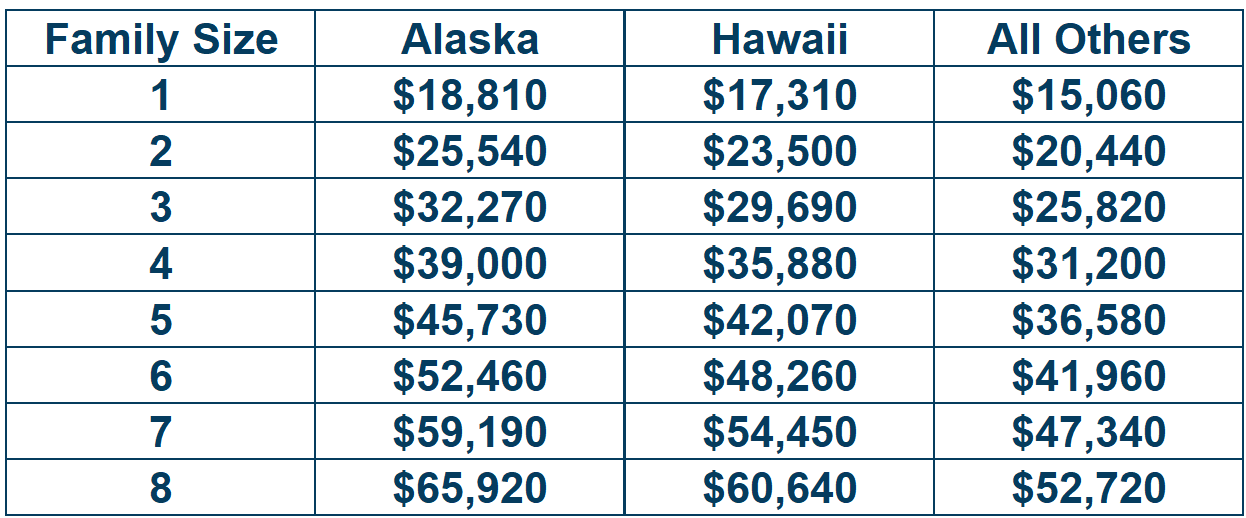

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

Instead of a calculation, the Family Size Factor is 100% of the current Poverty Guideline. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

Instead of a calculation, the Family Size Factor is 100% of the current Poverty Guideline. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

ICR – Payment & Timeline

Income-Contingent Repayment (ICR) plan:

-

-

Timeline: 25 Years

-

-

-

Calculated payments under ICR are the lesser of

-

-

-

-

20% of your discretionary income; or

-

The amount you would pay under a fixed 12-year repayment plan, adjusted by a factor based on your adjusted gross income (AGI).

-

-

While the ICR plan offers forgiveness after 25 years, those working for a non-profit or a 501(c)(3) hospital can qualify for Public Service Loan Forgiveness (PSLF). This program allows for loan forgiveness after just 10 years of payments — tax-free.

Since many physicians will pay off their loans before reaching the 25-year mark, PSLF is an attractive option for eligible borrowers.

ICR – Payment & Timeline

Income-Contingent Repayment (ICR) plan:

-

-

Timeline: 25 Years

-

-

-

Calculated payments under ICR are the lesser of

-

-

-

-

20% of your discretionary income; or

-

The amount you would pay under a fixed 12-year repayment plan, adjusted by a factor based on your adjusted gross income (AGI).

-

-

While the ICR plan offers forgiveness after 25 years, those working for a non-profit or a 501(c)(3) hospital can qualify for Public Service Loan Forgiveness (PSLF). This program allows for loan forgiveness after just 10 years of payments — tax-free.

Since many physicians will pay off their loans before reaching the 25-year mark, PSLF is an attractive option for eligible borrowers.

ICR – Payment Cap

The Payment Cap is the maximum monthly payment under Income-Driven Repayment plans, specifically for PAYE and IBR. This cap is especially beneficial for higher-earning physicians.

For example, if you have a $230,000 student loan balance at a 6% interest rate, your monthly payment under the 10-Year Standard Repayment Plan would be $2,553. By enrolling in PAYE and IBR, you ensure that your monthly payment never exceeds this amount.

In contrast, the Income-Contingent Repayment (ICR) IDR plan does not have a payment cap, meaning your monthly payments could be significantly higher, particularly if you’re a high-earning physician.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, PAYE and IBR are likely your best option due to this payment cap.

ICR – Payment Cap

The Payment Cap is the maximum monthly payment under Income-Driven Repayment plans, specifically for PAYE and IBR. This cap is especially beneficial for higher-earning physicians.

For example, if you have a $230,000 student loan balance at a 6% interest rate, your monthly payment under the 10-Year Standard Repayment Plan would be $2,553. By enrolling in PAYE and IBR, you ensure that your monthly payment never exceeds this amount.

In contrast, the Income-Contingent Repayment (ICR) IDR plan does not have a payment cap, meaning your monthly payments could be significantly higher, particularly if you’re a high-earning physician.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, PAYE and IBR are likely your best option due to this payment cap.

If you’re enrolled in ICR, you can choose to file your taxes separately from your partner, which is a strategy many physicians use to reduce their monthly payments.

When filing Married Filing Separately (MFS), you cannot claim any dependents that someone else has already claimed. This opens up various planning opportunities.

Filing as Married Filing Jointly (MFJ) provides a straightforward calculation for family size. However, if you opt for MFS to lower your student loan payments, it’s crucial that the spouse with the student loans claims the dependents. Otherwise, you might end up paying more on your loans.

For example, consider a family of four where Spouse 1 has $260,000 in student loans, and Spouse 2 has none. If they file MFS, it’s beneficial for Spouse 1 to claim the children. Under the Income-Driven Repayment plan, a larger family size leads to a lower monthly payment.

If Spouse 2 claims the kids, Spouse 1’s family size is 1, resulting in a deduction of $15,060 for their student loan payment under ICR. However, if Spouse 1 claims the kids, their family size increases to 3 (excluding Spouse 1), yielding a deduction of $25,820.

Note: If you and your spouse choose to repay your Direct Loans jointly under the ICR Plan, your servicer will use your joint income to calculate the monthly payment, regardless of whether you file a joint or separate federal tax return.

If you find yourself in this situation, it’s wise to consult a financial professional specializing in student loans, as this strategy is often misunderstood by many tax professionals.

If you’re enrolled in ICR, you can choose to file your taxes separately from your partner, which is a strategy many physicians use to reduce their monthly payments.

When filing Married Filing Separately (MFS), you cannot claim any dependents that someone else has already claimed. This opens up various planning opportunities.

Filing as Married Filing Jointly (MFJ) provides a straightforward calculation for family size. However, if you opt for MFS to lower your student loan payments, it’s crucial that the spouse with the student loans claims the dependents. Otherwise, you might end up paying more on your loans.

For example, consider a family of four where Spouse 1 has $260,000 in student loans, and Spouse 2 has none. If they file MFS, it’s beneficial for Spouse 1 to claim the children. Under the Income-Driven Repayment plan, a larger family size leads to a lower monthly payment.

If Spouse 2 claims the kids, Spouse 1’s family size is 1, resulting in a deduction of $15,060 for their student loan payment under ICR. However, if Spouse 1 claims the kids, their family size increases to 3 (excluding Spouse 1), yielding a deduction of $25,820.

Note: If you and your spouse choose to repay your Direct Loans jointly under the ICR Plan, your servicer will use your joint income to calculate the monthly payment, regardless of whether you file a joint or separate federal tax return.

If you find yourself in this situation, it’s wise to consult a financial professional specializing in student loans, as this strategy is often misunderstood by many tax professionals.

ICR – Interest Rate Subsidy

Interest Rate Subsidies: No

Similar to PAYE and IBR, ICR does not offer an interest rate subsidy.

However, ICR payments may not fully cover the monthly accruing interest (negative amortization). Any unpaid interest is capitalized (added to your loan balance) annually when you provide new income documentation.

Capitalized interest is limited to 10% of your original repayment balance. Once this cap is reached, unpaid interest will continue to accrue but will no longer be capitalized.

ICR – Interest Rate Subsidy

Interest Rate Subsidies: No

Similar to PAYE and IBR, ICR does not offer an interest rate subsidy.

However, ICR payments may not fully cover the monthly accruing interest (negative amortization). Any unpaid interest is capitalized (added to your loan balance) annually when you provide new income documentation.

Capitalized interest is limited to 10% of your original repayment balance. Once this cap is reached, unpaid interest will continue to accrue but will no longer be capitalized.

ICR – How to Calculate Income

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

You have two ways to calculate your income for an IDR Plan: Adjusted Gross Income (AGI) or an Alternative Documentation of Income, usually your paystub.

Way 1: Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

For married individuals, the household income is taken into account when calculating payments. You might consider filing taxes as Married Filing Separately (MFS) to potentially lower your student loan payments. However, it’s essential to carefully weigh the pros and cons of this strategy before proceeding.

Click here to learn more about this strategy.

Way 2: Alternative Documentation of Income

If you didn’t file a tax return, you’ll need to use Alternative Documentation of Income, usually a paystub, to certify your income. Your paystub serves as the basis for extrapolating your income for a full year, determining the income used in calculating your monthly student loan payment. As a 1st Year Attending, if your salary is $300,000, this amount becomes the cornerstone for your student loan payment calculation in an IDR plan.

ICR – How to Calculate Income

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

You have two ways to calculate your income for an IDR Plan: Adjusted Gross Income (AGI) or an Alternative Documentation of Income, usually your paystub.

Way 1: Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

For married individuals, the household income is taken into account when calculating payments. You might consider filing taxes as Married Filing Separately (MFS) to potentially lower your student loan payments. However, it’s essential to carefully weigh the pros and cons of this strategy before proceeding.

Click here to learn more about this strategy.

Way 2: Alternative Documentation of Income

If you didn’t file a tax return, you’ll need to use Alternative Documentation of Income, usually a paystub, to certify your income. Your paystub serves as the basis for extrapolating your income for a full year, determining the income used in calculating your monthly student loan payment. As a 1st Year Attending, if your salary is $300,000, this amount becomes the cornerstone for your student loan payment calculation in an IDR plan.

ICR – How to Determine Your Family Size

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is calculated based on your income and family size.

In simple terms: the bigger your family, the smaller your monthly student loan payment; the smaller your family, the bigger your monthly student loan payment.

Your family size for the purposes of Income-Driven Repayment plans includes: You, your spouse, any dependents/family that receives more than half of their support from you. Additionally, any unborn children also count when calculating your family size.

ICR – How to Determine Your Family Size

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is calculated based on your income and family size.

In simple terms: the bigger your family, the smaller your monthly student loan payment; the smaller your family, the bigger your monthly student loan payment.

Your family size for the purposes of Income-Driven Repayment plans includes: You, your spouse, any dependents/family that receives more than half of their support from you. Additionally, any unborn children also count when calculating your family size.

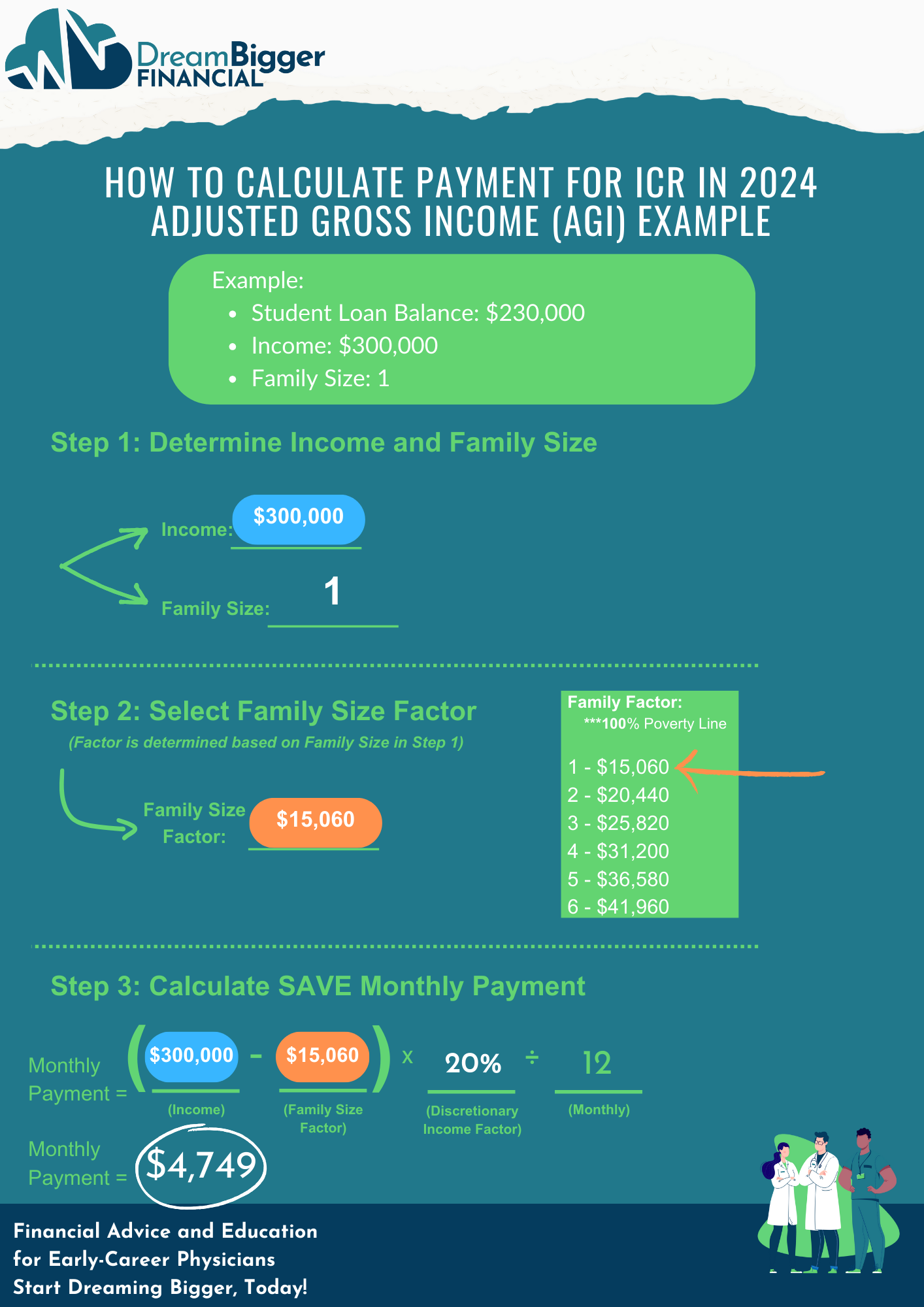

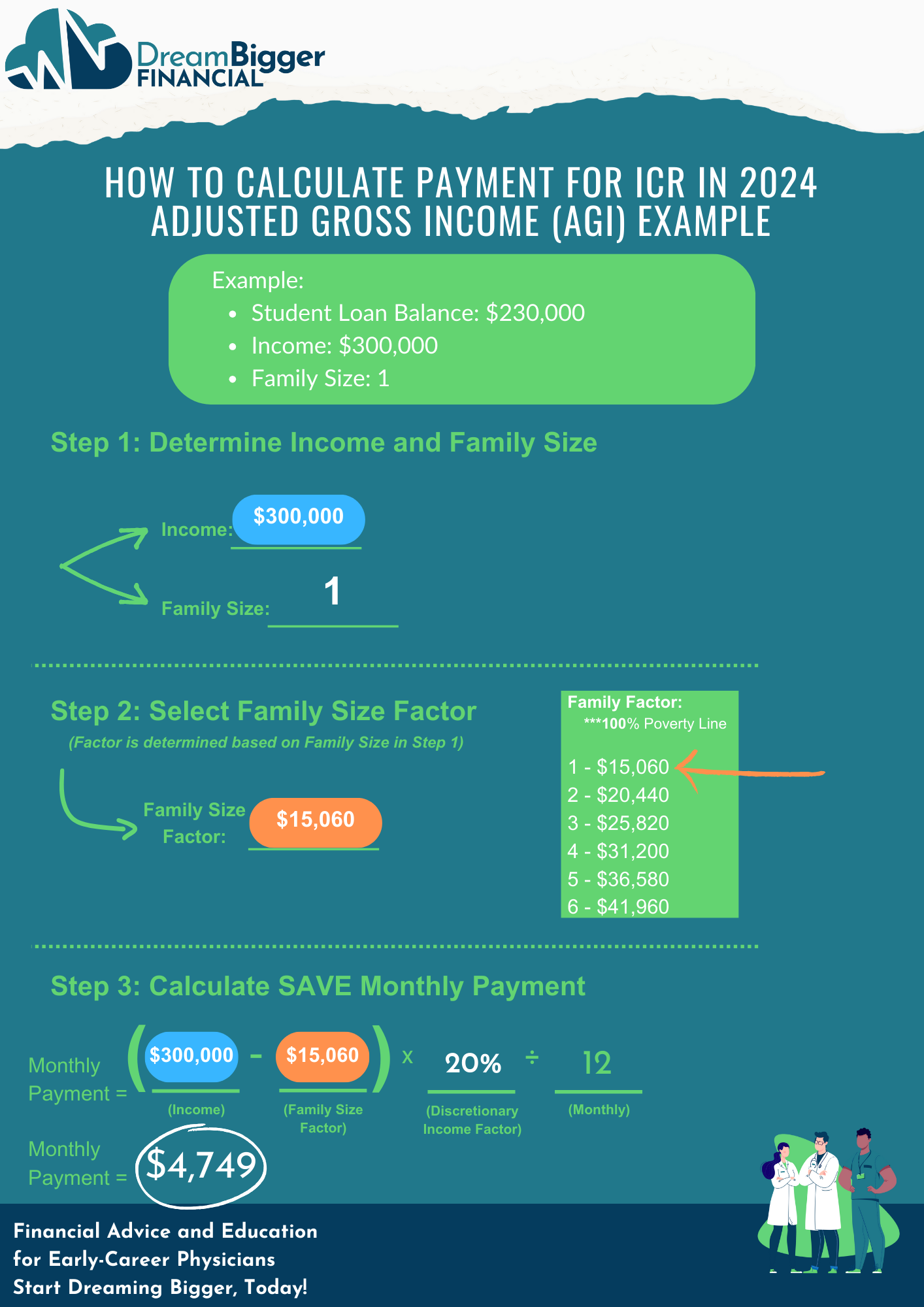

ICR Example

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $230,000

-

Average Interest Rate: 6%

-

Income: $300,000

-

Family Size: 1

-

Dr. Don recently graduated from training and has a student loan balance of $230,000. His Adjusted Gross Income (AGI) from his prior year’s tax return is $300,000.

He is currently on the Saving on a Valuable Education (SAVE) plan and pursuing Public Service Loan Forgiveness (PSLF).

However, since SAVE is likely to be repealed and likely will no longer be available as an income-driven repayment (IDR) plan, Dr. Don is exploring other options to remain on an eligible IDR plan that qualifies for PSLF.

Due to his high income relative to his student loan balance, Dr. Don is not eligible for Income-Based Repayment (IBR) or Pay As You Earn (PAYE), as both plans require a Partial Financial Hardship.

Without a Partial Financial Hardship, the only PSLF-eligible IDR plan available to Dr. Don is Income-Contingent Repayment (ICR).

Let’s calculate what Dr. Don’s monthly payment under ICR might look like.

Note: In this example, we are assuming Dr. Don does not live in Alaska or Hawaii. If he does, a different family size factor will apply, which would affect the payment calculation.

ICR Example

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $230,000

-

Average Interest Rate: 6%

-

Income: $300,000

-

Family Size: 1

-

Dr. Don recently graduated from training and has a student loan balance of $230,000. His Adjusted Gross Income (AGI) from his prior year’s tax return is $300,000.

He is currently on the Saving on a Valuable Education (SAVE) plan and pursuing Public Service Loan Forgiveness (PSLF).

However, since SAVE is likely to be repealed and likely will no longer be available as an income-driven repayment (IDR) plan, Dr. Don is exploring other options to remain on an eligible IDR plan that qualifies for PSLF.

Due to his high income relative to his student loan balance, Dr. Don is not eligible for Income-Based Repayment (IBR) or Pay As You Earn (PAYE), as both plans require a Partial Financial Hardship.

Without a Partial Financial Hardship, the only PSLF-eligible IDR plan available to Dr. Don is Income-Contingent Repayment (ICR).

Let’s calculate what Dr. Don’s monthly payment under ICR might look like.

Note: In this example, we are assuming Dr. Don does not live in Alaska or Hawaii. If he does, a different family size factor will apply, which would affect the payment calculation.

How to Calculate Your ICR Payment

When calculating your ICR payment, there are two methods. Your monthly payment will be the lower of these two calculations:

1. 20% of Discretionary Income

2. Adjusted 12-Year Fixed Payment

Let’s break it down step by step:

How to Calculate Your ICR Payment

When calculating your ICR payment, there are two methods. Your monthly payment will be the lower of these two calculations:

1. 20% of Discretionary Income

2. Adjusted 12-Year Fixed Payment

Let’s break it down step by step:

Step 1: Calculate 20% of Your Discretionary Income

1. Find Your AGI and Family Size:

-

-

Use your Adjusted Gross Income (AGI) from your most recent tax return.

-

2. Determine Your Discretionary Income:

-

-

Unlike other plans, ICR uses 100% of the federal poverty line for your family size to calculate discretionary income.

-

Example:

-

-

Poverty Line (Family Size 1): $15,060

-

Discretionary Income: $300,000 – $15,060 = $284,940

-

3. Calculate 20% of Discretionary Income:

-

-

(20% × $284,940) ÷ 12 months = $4,749/month

-

Step 1: Calculate 20% of Your Discretionary Income

1. Find Your AGI and Family Size:

-

-

Use your Adjusted Gross Income (AGI) from your most recent tax return.

-

2. Determine Your Discretionary Income:

-

-

Unlike other plans, ICR uses 100% of the federal poverty line for your family size to calculate discretionary income.

-

Example:

-

-

Poverty Line (Family Size 1): $15,060

-

Discretionary Income: $300,000 – $15,060 = $284,940

-

3. Calculate 20% of Discretionary Income:

-

-

(20% × $284,940) ÷ 12 months = $4,749/month

-

Step 2: Calculate the Adjusted 12-Year Fixed Payment

ICR also calculates your payment using your loan balance, interest rate, and an adjusted factor based on your AGI and family size.

Step 2: Calculate the Adjusted 12-Year Fixed Payment

ICR also calculates your payment using your loan balance, interest rate, and an adjusted factor based on your AGI and family size.

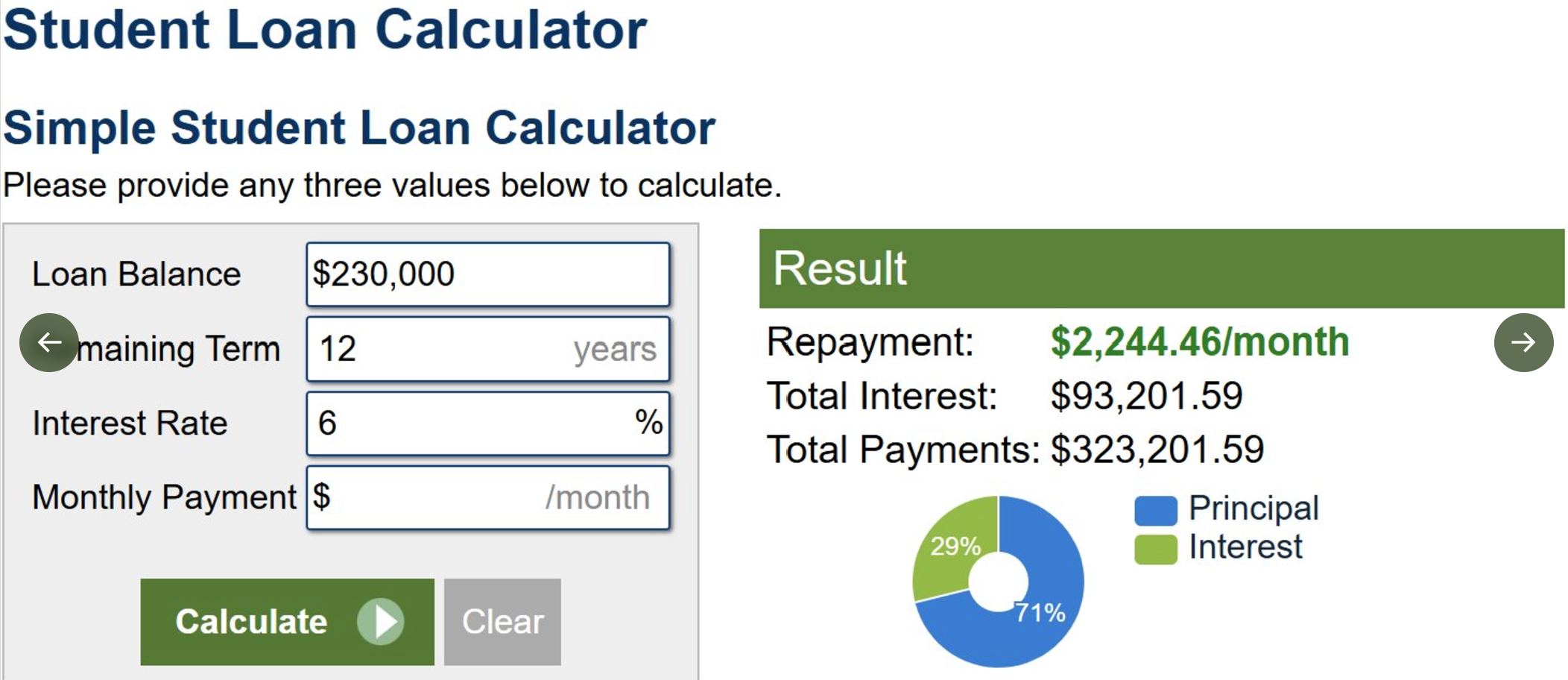

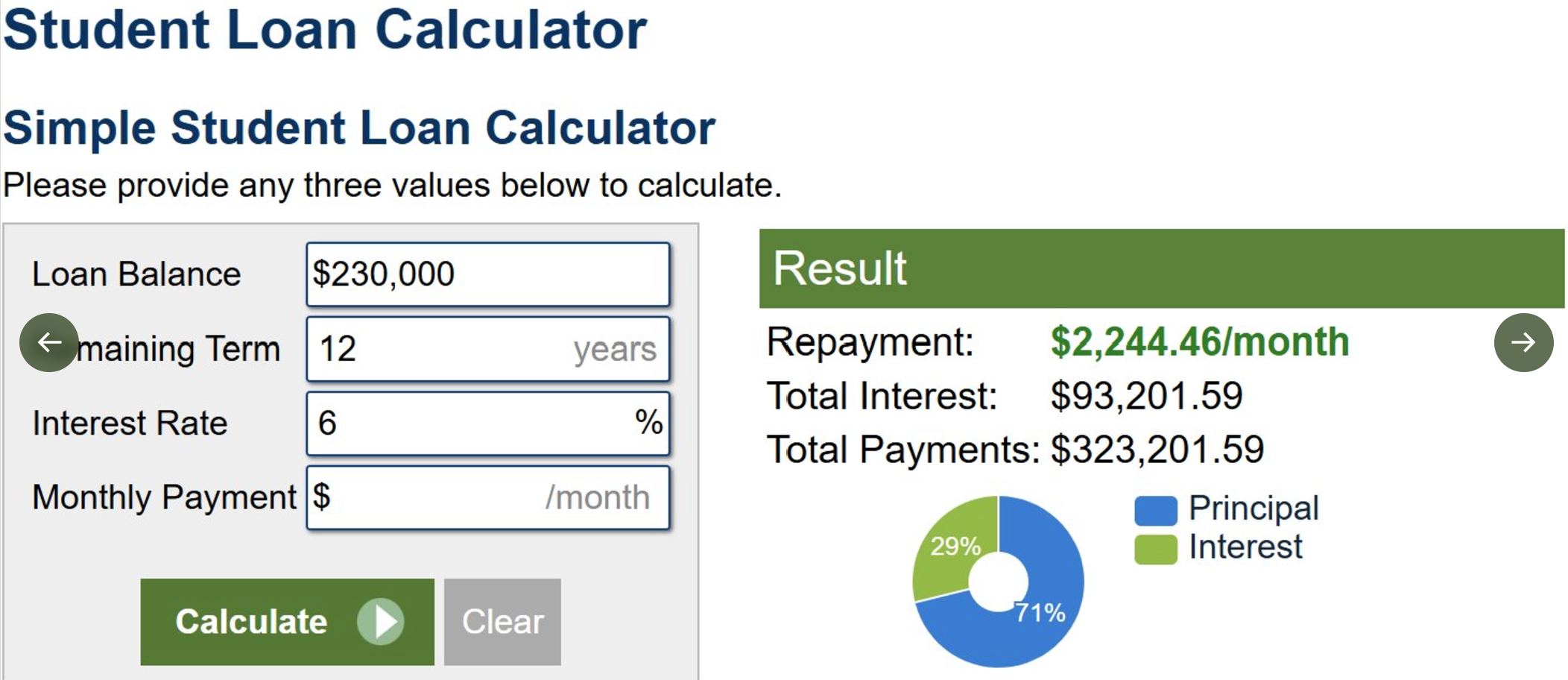

Step 2A: Find Your Fixed 12-Year Payment

The simplest way to calculate your Fixed 12-Year Payment is by using an online loan calculator, such as Calculator.net.

Input your loan balance, interest rate, and a 12-year term to find the monthly payment needed to fully repay your loan in that time frame.

Example:

-

Loan Balance: $230,000

-

Interest Rate: 6%

-

Fixed 12-Year Payment: $2,245/month

Step 2A: Find Your Fixed 12-Year Payment

The simplest way to calculate your Fixed 12-Year Payment is by using an online loan calculator, such as Calculator.net.

Input your loan balance, interest rate, and a 12-year term to find the monthly payment needed to fully repay your loan in that time frame.

Example:

-

Loan Balance: $230,000

-

Interest Rate: 6%

-

Fixed 12-Year Payment: $2,245/month

Step 2B: Adjust the Fixed Payment with a Factor

This step fine-tunes your Fixed 12-Year Payment by applying an adjustment factor based on your AGI and family size.

There are five parts to calculate the adjusted number:

Step 2B: Adjust the Fixed Payment with a Factor

This step fine-tunes your Fixed 12-Year Payment by applying an adjustment factor based on your AGI and family size.

There are five parts to calculate the adjusted number:

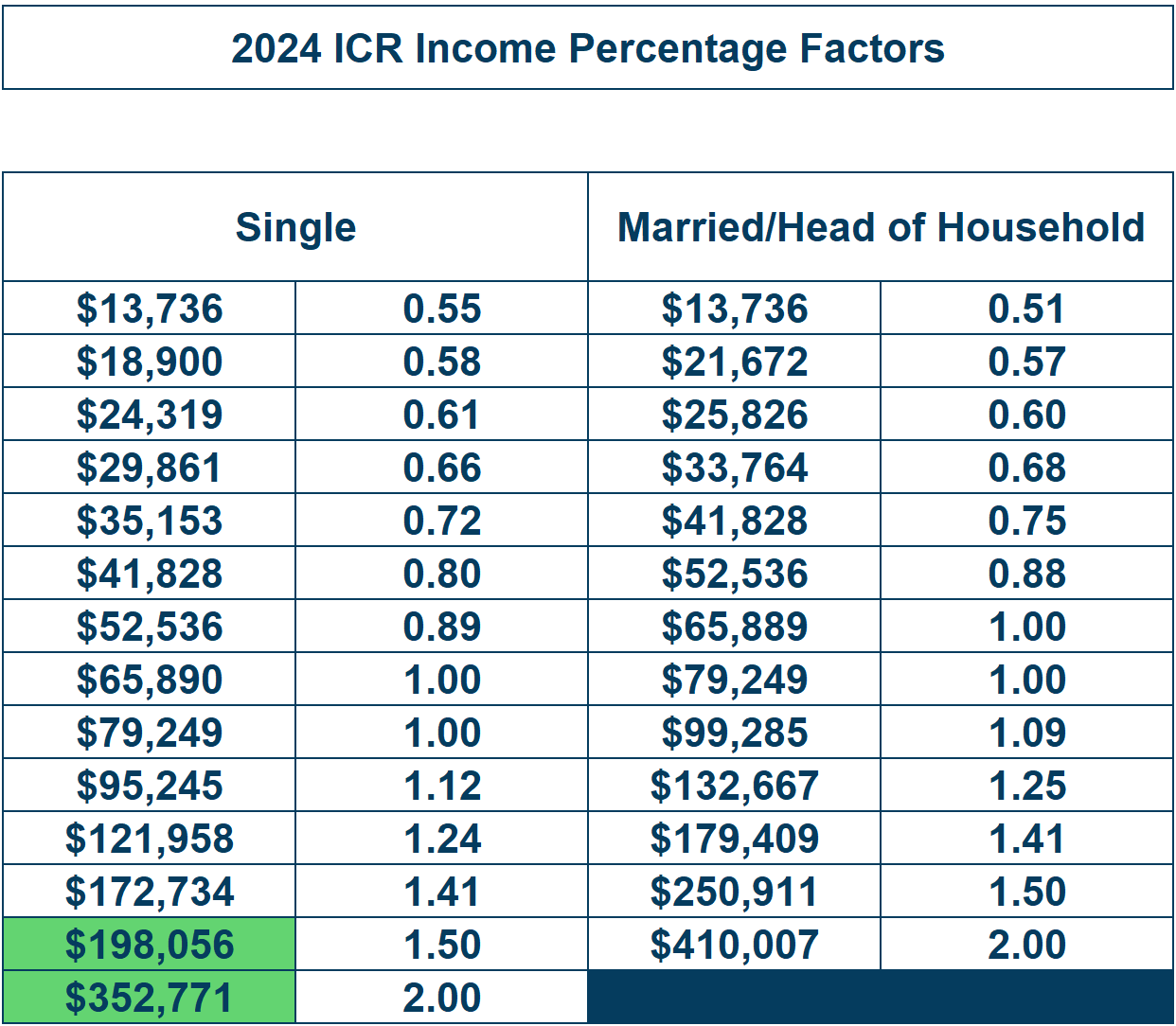

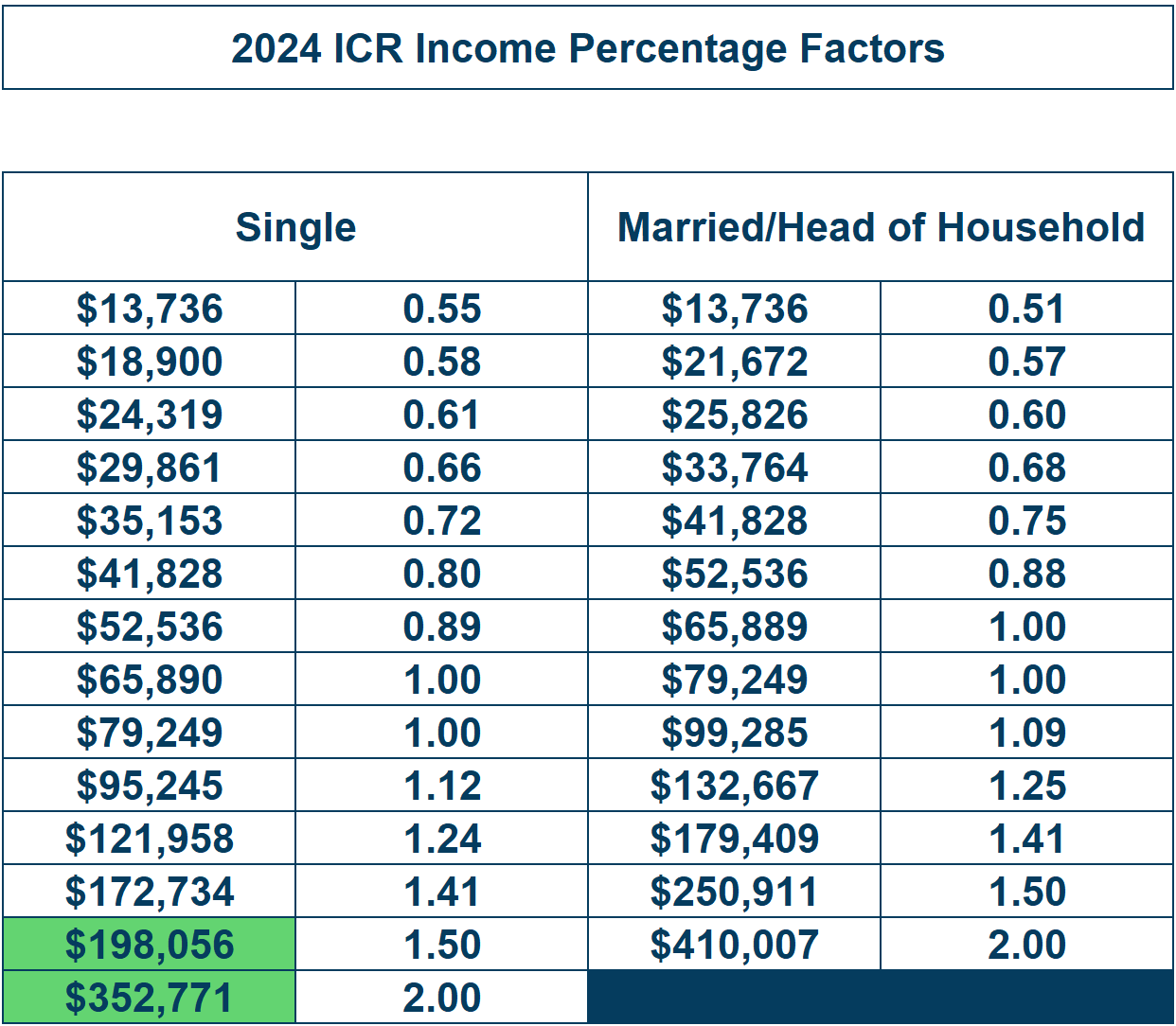

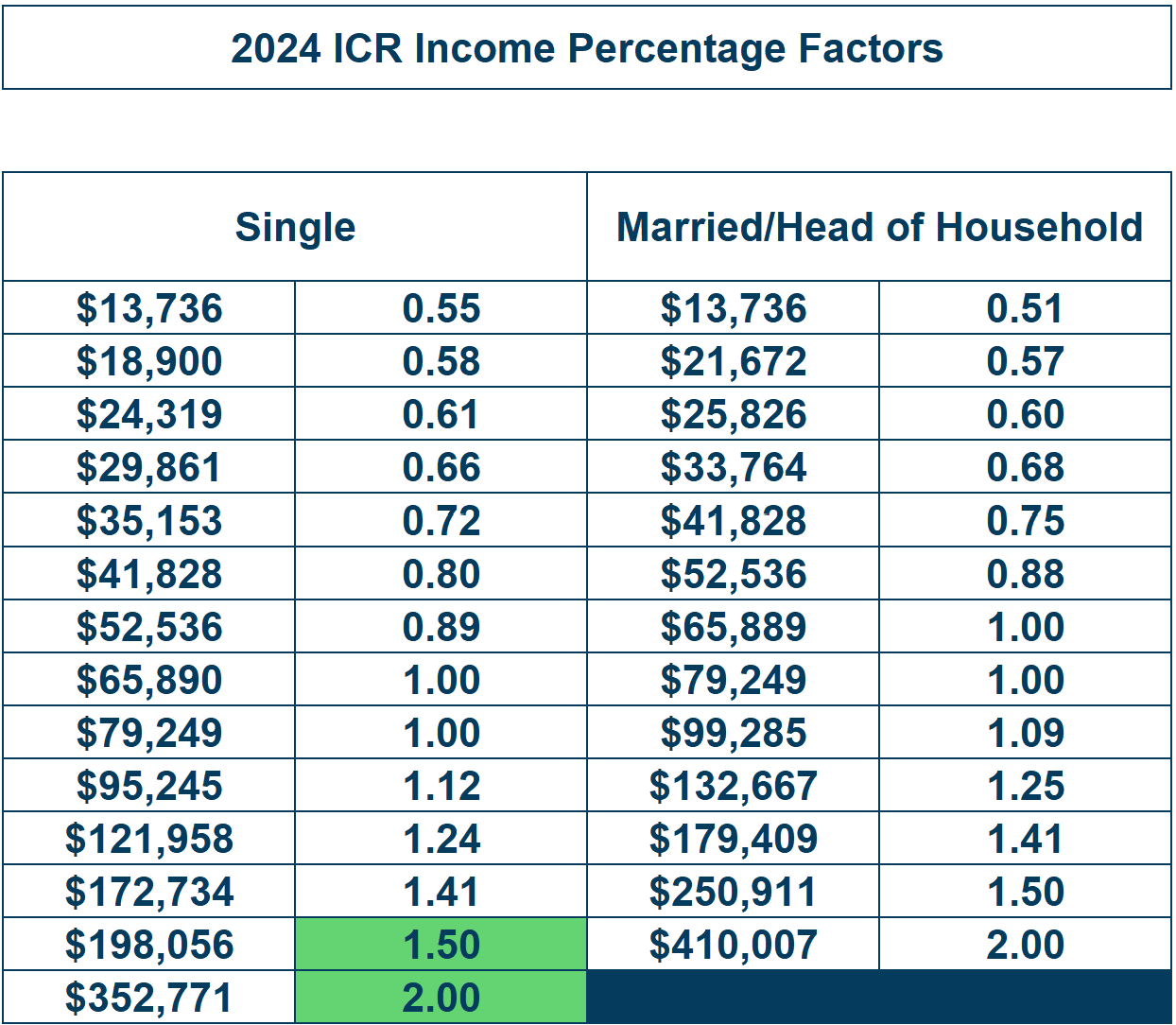

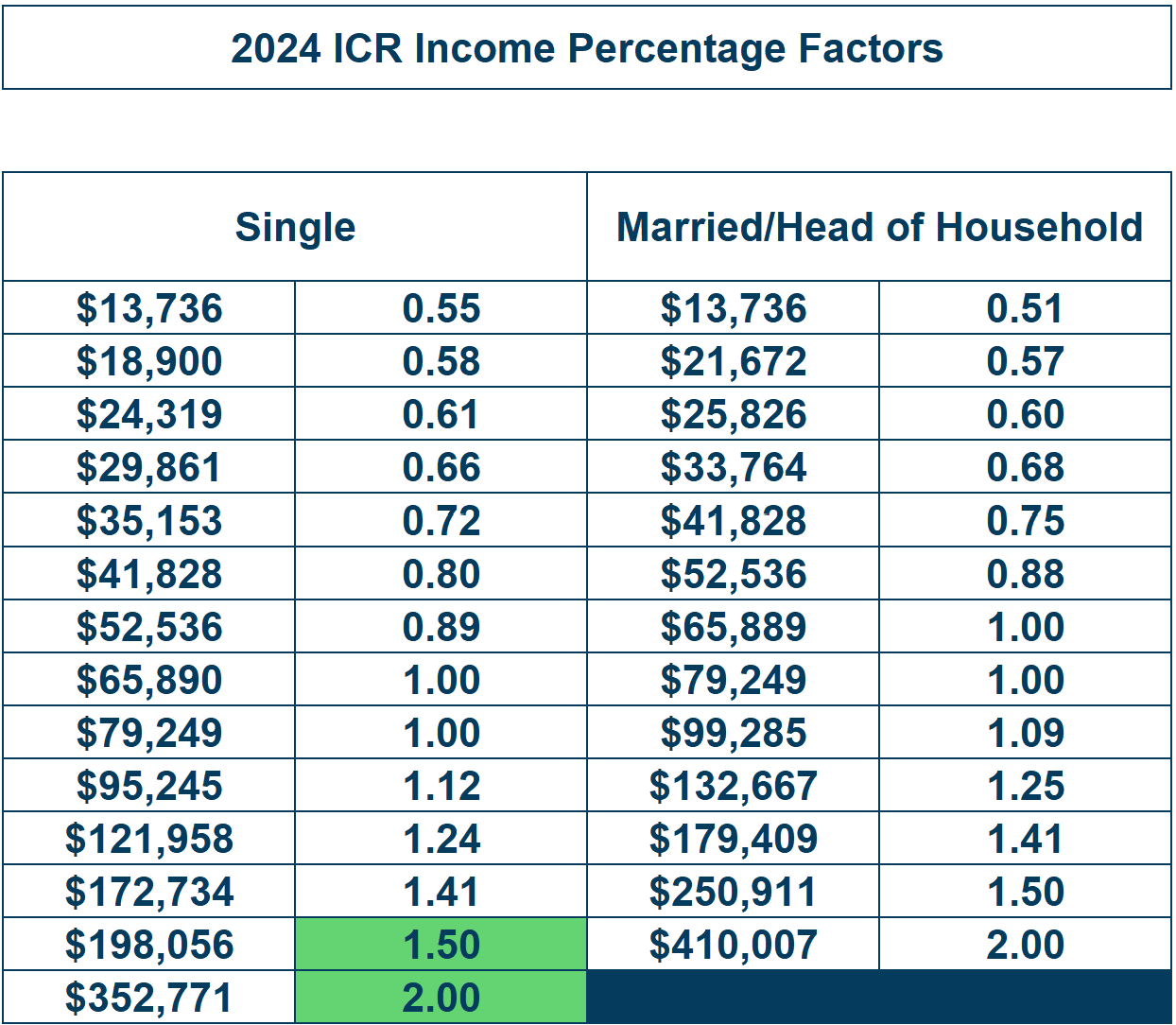

Part 1: Determine Your AGI Range

Locate your AGI in the ICR table for your filing status to find the appropriate range.

Example:

-

-

AGI: $300,000 (Single, Family Size 1)

-

AGI Range: $198,056 to $352,771

-

Range Difference: $352,771 – $198,056 = $154,715

-

Part 1: Determine Your AGI Range

Locate your AGI in the ICR table for your filing status to find the appropriate range.

Example:

-

-

AGI: $300,000 (Single, Family Size 1)

-

AGI Range: $198,056 to $352,771

-

Range Difference: $352,771 – $198,056 = $154,715

-

Part 2: Find the Factor Range

Identify the percentage range corresponding to your AGI.

Example:

-

-

Factor Range: 150% to 200%

-

Factor Difference: 200% – 150% = 50% (0.5)

-

Part 2: Find the Factor Range

Identify the percentage range corresponding to your AGI.

Example:

-

-

Factor Range: 150% to 200%

-

Factor Difference: 200% – 150% = 50% (0.5)

-

Part 3. Calculate Your Proportion Within the AGI Range

Determine where your AGI falls within the range:

1. Subtract the lower limit of the range from your AGI.

2. Divide this value by the range difference, found in Part 1.

Example:

-

-

$300,000 – $198,056 = $101,944

-

$101,944 ÷ $154,715 = 65.89% (0.6589)

-

Part 3. Calculate Your Proportion Within the AGI Range

Determine where your AGI falls within the range:

1. Subtract the lower limit of the range from your AGI.

2. Divide this value by the range difference, found in Part 1.

Example:

-

-

$300,000 – $198,056 = $101,944

-

$101,944 ÷ $154,715 = 65.89% (0.6589)

-

Part 4. Adjust the Factor

Apply the proportion to the factor difference and add it to the lower end of the factor range.

Example:

-

-

50% × 65.89% = 32.95% (0.3295)

-

150% + 32.95% = 183% (1.83)

-

Part 4. Adjust the Factor

Apply the proportion to the factor difference and add it to the lower end of the factor range.

Example:

-

-

50% × 65.89% = 32.95% (0.3295)

-

150% + 32.95% = 183% (1.83)

-

Part 5. Adjust the Fixed 12-Year Payment

Multiply the Fixed 12-Year Payment by the adjusted factor to find your final payment.

Example:

-

-

Fixed 12-Year Payment: $2,245

-

Adjusted Payment: $2,245 × 1.83 = $4,108/month

-

Part 5. Adjust the Fixed 12-Year Payment

Multiply the Fixed 12-Year Payment by the adjusted factor to find your final payment.

Example:

-

-

Fixed 12-Year Payment: $2,245

-

Adjusted Payment: $2,245 × 1.83 = $4,108/month

-

Step 3: Compare the Two Calculations

The lower of the two calculations becomes your ICR payment:

1. 20% of Discretionary Income: $4,749/month

2. Adjusted 12-Year Fixed Payment: $4,108/month

Final ICR Payment: $4,108/month

Step 3: Compare the Two Calculations

The lower of the two calculations becomes your ICR payment:

1. 20% of Discretionary Income: $4,749/month

2. Adjusted 12-Year Fixed Payment: $4,108/month

Final ICR Payment: $4,108/month

Conclusion

This guide is tailored for high-earning professionals who no longer qualify for a Partial Financial Hardship. Here’s what you need to know:

-

ICR for PSLF: Starting mid-December 2024, Income-Contingent Repayment (ICR) will likely be the only Income-Driven Repayment (IDR) plan eligible for Public Service Loan Forgiveness (PSLF) for those currently on SAVE who no longer have a Partial Financial Hardship.

-

For PAYE or IBR Borrowers: If you’re already enrolled in Pay As You Earn (PAYE) or Income-Based Repayment (IBR), these plans will remain PSLF-eligible, and you are not required to switch to ICR.

-

For Those with a Partial Financial Hardship: If you qualify for a Partial Financial Hardship, PAYE or IBR may be better options, as they typically result in lower monthly payments. If you are eligible for both PAYE and New IBR, choose New IBR, as it offers stronger legal protections.

-

For SAVE Borrowers: If you’re on SAVE, it’s best to wait for further updates before making any changes. While you cannot currently enroll in ICR, it is expected to open up mid-December 2024.

-

Hold Off on New Applications: With loan servicers currently pausing the processing of new IDR applications, it’s a good idea to remain patient and hold off until further guidance becomes available.

I’ll continue to provide updates as new details emerge, ensuring you have the latest information to make informed decisions. The best way to stay informed is by enrolling in my newsletter or following me on Twitter for up-to-date information and insights.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance. This information was created based on the details available as of November 2024, and guidance may change if/when new updates become available.

Conclusion

This guide is tailored for high-earning professionals who no longer qualify for a Partial Financial Hardship. Here’s what you need to know:

-

ICR for PSLF: Starting mid-December 2024, Income-Contingent Repayment (ICR) will likely be the only Income-Driven Repayment (IDR) plan eligible for Public Service Loan Forgiveness (PSLF) for those currently on SAVE who no longer have a Partial Financial Hardship.

-

For PAYE or IBR Borrowers: If you’re already enrolled in Pay As You Earn (PAYE) or Income-Based Repayment (IBR), these plans will remain PSLF-eligible, and you are not required to switch to ICR.

-

For Those with a Partial Financial Hardship: If you qualify for a Partial Financial Hardship, PAYE or IBR may be better options, as they typically result in lower monthly payments. If you are eligible for both PAYE and New IBR, choose New IBR, as it offers stronger legal protections.

-

For SAVE Borrowers: If you’re on SAVE, it’s best to wait for further updates before making any changes. While you cannot currently enroll in ICR, it is expected to open up mid-December 2024.

-

Hold Off on New Applications: With loan servicers currently pausing the processing of new IDR applications, it’s a good idea to remain patient and hold off until further guidance becomes available.

I’ll continue to provide updates as new details emerge, ensuring you have the latest information to make informed decisions. The best way to stay informed is by enrolling in my newsletter or following me on Twitter for up-to-date information and insights.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance. This information was created based on the details available as of November 2024, and guidance may change if/when new updates become available.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.