Introduction

What to do if you’re in school, didn’t earn income last year, and need to file a return for IDR purposes?

If you’re a 4th-year med student or new intern, didn’t earn income last year, and are filing a tax return just to report $0 income for your Income-Driven Repayment (IDR) plan, this is for you.

This situation confuses a lot of people.

And even though it seems simple, a small mismatch between what you file and what your parents file likely won’t prevent you from e-filing, but it’s still best to coordinate and get it right.

Especially if you’re over 26, there’s a good chance they shouldn’t be claiming you at all.

Introduction

What to do if you’re in school, didn’t earn income last year, and need to file a return for IDR purposes?

If you’re a 4th-year med student or new intern, didn’t earn income last year, and are filing a tax return just to report $0 income for your Income-Driven Repayment (IDR) plan, this is for you.

This situation confuses a lot of people.

And even though it seems simple, a small mismatch between what you file and what your parents file likely won’t prevent you from e-filing, but it’s still best to coordinate and get it right.

Especially if you’re over 26, there’s a good chance they shouldn’t be claiming you at all.

MS4? Intern?

🎓 Get Your Free Student Loan Guide!

The one you’ll want to share with your classmates.

Everything you need to avoid costly student loan mistakes, lock in $0 payments during residency, and set yourself up for forgiveness success.

By signing up, you’ll also get the Dream Bigger: Physician Edition Newsletter.

Get quick, actionable tips + timely student loan updates made just for busy residents.

📌 Important: Use your personal email (not your med school address) so you don’t miss time-sensitive updates, especially during graduation and your transition to residency.

MS4? Intern?

🎓 Get Your Free Student Loan Guide!

The one you’ll want to share with your classmates.

Everything you need to avoid costly student loan mistakes, lock in $0 payments during residency, and set yourself up for forgiveness success.

By signing up, you’ll also get the Dream Bigger: Physician Edition Newsletter.

Get quick, actionable tips + timely student loan updates made just for busy residents.

📌 Important: Use your personal email (not your med school address) so you don’t miss time-sensitive updates, especially during graduation and your transition to residency.

Why are you even filing a tax return?

If you didn’t earn any income last year, you’re not filing because the IRS made you. You’re filing because:

-

-

You want to show $0 income for your student loan payment calculation

-

You aren’t expecting a refund

-

You’re getting ahead on paperwork before payments restart or recertification happens

-

That’s totally valid, but even a simple $0 return still has to match what the IRS has on file. And that’s where your dependency status comes in.

Why are you even filing a tax return?

If you didn’t earn any income last year, you’re not filing because the IRS made you. You’re filing because:

-

You want to show $0 income for your student loan payment calculation

-

You aren’t expecting a refund

-

You’re getting ahead on paperwork before payments restart or recertification happens

That’s totally valid, but even a simple $0 return still has to match what the IRS has on file. And that’s where your dependency status comes in.

Want to learn how to file your $0 income return the right way?

Check out this step-by-step post on how to e-file your $0 tax return for student loans, including the exact steps, forms, and common mistakes to avoid.

Want to learn how to file your $0 income return the right way?

Check out this step-by-step post on how to e-file your $0 tax return for student loans, including the exact steps, forms, and common mistakes to avoid.

Can your parents claim you?

If you’re 26 or older, you’re too old to be considered a “qualifying child” under IRS rules.

The cutoff for that is 24 for full-time students.

That leaves “qualifying relative” as the only option, and that requires all of the following to be true:

-

-

You made less than $5,050 in 2024

-

Your parents provided more than half of your total financial support (tuition, housing, food, etc.)

-

You didn’t file a joint return with someone else

-

You’re not already claimed by anyone else

-

Here’s the catch:

Student loans count as your own support, not your parents’.

So, if your tuition, rent, and living expenses are paid by loans, you’re likely financially independent, and your parents cannot claim you.

Can your parents claim you?

If you’re 26 or older, you’re too old to be considered a “qualifying child” under IRS rules.

The cutoff for that is 24 for full-time students.

That leaves “qualifying relative” as the only option, and that requires all of the following to be true:

-

You made less than $5,050 in 2024

-

Your parents provided more than half of your total financial support (tuition, housing, food, etc.)

-

You didn’t file a joint return with someone else

-

You’re not already claimed by anyone else

Here’s the catch:

Student loans count as your own support, not your parents’.

So, if your tuition, rent, and living expenses are paid by loans, you’re likely financially independent, and your parents cannot claim you.

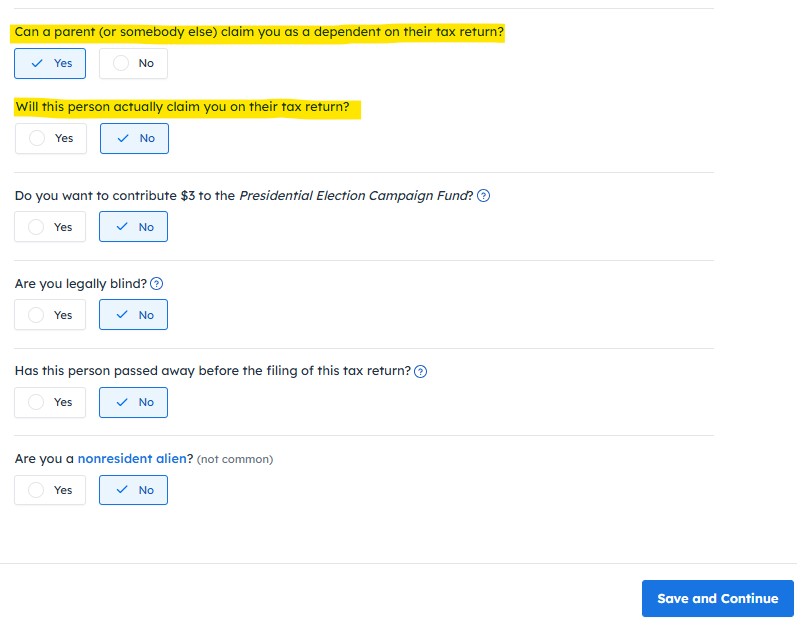

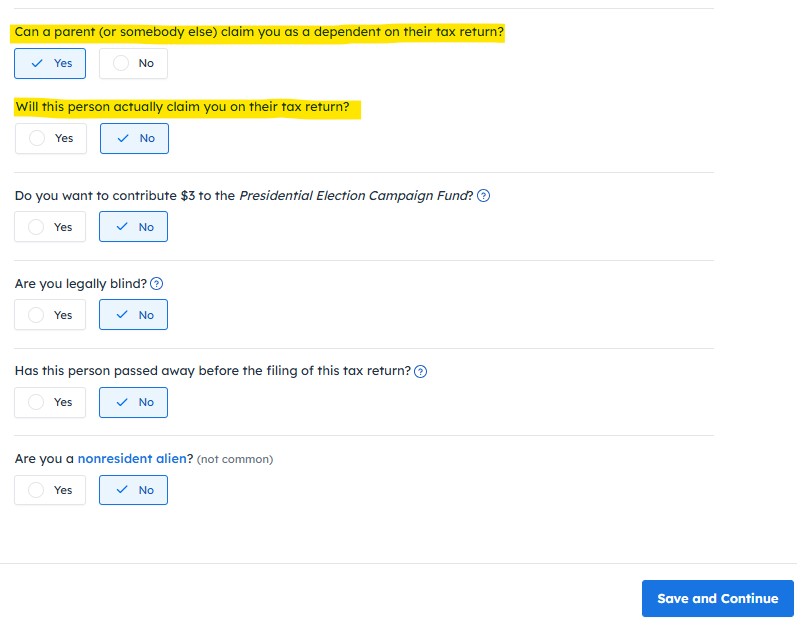

What if your parents claimed you anyway?

This happens more than you might think.

Your parents may have filed quickly, checked the dependent box out of habit, or simply assumed they could still claim you.

Now, you’re filing your $0 return for student loans and wondering:

Do I say they claimed me. even if they shouldn’t have?

Technically, your parents shouldn’t have claimed you.

But practically speaking, if they already filed and marked you as a dependent, and you’re only submitting a $0 return to report income for your student loans…

Yes, you can match their filing. That means saying “yes” to the question about being a dependent, even if the IRS rules don’t fully apply to you.

Why?

-

-

Your return won’t get rejected for a mismatch.

-

It gets processed faster, meaning fewer delays in calculating your student loan payment.

-

You’re not seeking any refund or tax benefits, just making sure the IRS has accurate info for the sake of your loan plan.

-

It’s not perfect compliance... it’s a way to avoid unnecessary hiccups in the student loan process.

What if your parents claimed you anyway?

This happens more than you might think.

Your parents may have filed quickly, checked the dependent box out of habit, or simply assumed they could still claim you.

Now, you’re filing your $0 return for student loans and wondering:

Do I say they claimed me. even if they shouldn’t have?

Technically, your parents shouldn’t have claimed you.

But practically speaking, if they already filed and marked you as a dependent, and you’re only submitting a $0 return to report income for your student loans…

Yes, you can match their filing. That means saying “yes” to the question about being a dependent, even if the IRS rules don’t fully apply to you.

Why?

-

Your return won’t get rejected for a mismatch.

-

It gets processed faster, meaning fewer delays in calculating your student loan payment.

-

You’re not seeking any refund or tax benefits, just making sure the IRS has accurate info for the sake of your loan plan.

It’s not perfect compliance... it’s a way to avoid unnecessary hiccups in the student loan process.

What if you don’t know what your parents did?

If you’re not sure whether your parents claimed you, it’s simple to ask them.

A quick chat or text can save you from a rejected return or delayed loan processing.

Try something like this:

“Hey! Did you claim me on your taxes this year? Just checking before I file mine for student loans.”

If they haven’t filed yet, let them know:

-

-

You’re supporting yourself through loans

-

They probably shouldn’t be claiming you

-

Coordinating now will save everyone time and hassle later

-

What if you don’t know what your parents did?

If you’re not sure whether your parents claimed you, it’s simple to ask them.

A quick chat or text can save you from a rejected return or delayed loan processing.

Try something like this:

“Hey! Did you claim me on your taxes this year? Just checking before I file mine for student loans.”

If they haven’t filed yet, let them know:

-

You’re supporting yourself through loans

-

They probably shouldn’t be claiming you

-

Coordinating now will save everyone time and hassle later

Decision Tree: What Should You Do?

Step 1: Are you financially independent (i.e., using student loans to cover your expenses)?

→ Yes → Go to Step 2

→ No → Your parents may still be able to claim you, confirm with them before filing.

Step 2: Have your parents already filed their taxes?

→ Yes → Go to Step 3

→ No → Coordinate before either of you files.

Step 3: Did they claim you as a dependent?

→ Yes → Go to Step 4

→ No → You’re good to file as independent.

Step 4: Are you filing just to report $0 income for student loan repayment?

→ Yes → It’s okay to match their return and say you can be claimed.

→ No → The system might reject your return due to the dependency mismatch. You may need to clarify your filing with your parents to make sure everything lines up correctly.

Decision Tree: What Should You Do?

Step 1: Are you financially independent (i.e., using student loans to cover your expenses)?

→ Yes → Go to Step 2

→ No → Your parents may still be able to claim you, confirm with them before filing.

Step 2: Have your parents already filed their taxes?

→ Yes → Go to Step 3

→ No → Coordinate before either of you files.

Step 3: Did they claim you as a dependent?

→ Yes → Go to Step 4

→ No → You’re good to file as independent.

Step 4: Are you filing just to report $0 income for student loan repayment?

→ Yes → It’s okay to match their return and say you can be claimed.

→ No → The system might reject your return due to the dependency mismatch. You may need to clarify your filing with your parents to make sure everything lines up correctly.

Need Personalized Help?

Some student loan situations are more complex.

If you’d like custom guidance on your unique setup, you can schedule a 1-hour student loan consultation for $299.

We’ll walk through your income, loans, and repayment options to create a clear, personalized plan.

Need Personalized Help?

Some student loan situations are more complex.

If you’d like custom guidance on your unique setup, you can schedule a 1-hour student loan consultation for $299.

We’ll walk through your income, loans, and repayment options to create a clear, personalized plan.

Final Thoughts

If you’re using loans to cover school and living expenses, you’re likely financially independent.

That means your parents shouldn’t claim you, but if they did, you can match their filing to avoid IRS issues.

The key here is communication.

A quick check-in with your parents can prevent a lot of trouble later.

And next year, start the conversation earlier to stay ahead of the game.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Final Thoughts

If you’re using loans to cover school and living expenses, you’re likely financially independent.

That means your parents shouldn’t claim you, but if they did, you can match their filing to avoid IRS issues.

The key here is communication.

A quick check-in with your parents can prevent a lot of trouble later.

And next year, start the conversation earlier to stay ahead of the game.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.