Your One Shot to Get This Right

As a graduating med student, you have a unique, one-time opportunity to set up your student loans the right way.

Get it right, and you could pay $0 per month during intern year while making progress toward Public Service Loan Forgiveness (PSLF).

Get it wrong, and you might waste thousands of dollars in unnecessary payments.

Most med students miss this. But you won’t.

To make this process simple, I created a free step-by-step guide that walks you through everything you need to do, and exactly when to do it.

No fluff, no sales pitch, just the clear action steps to lock in the lowest possible student loan payments.

Here’s the 3-step game plan every MS4 needs to follow before residency starts.

Your One Shot to Get This Right

As a graduating med student, you have a unique, one-time opportunity to set up your student loans the right way.

Get it right, and you could pay $0 per month during intern year while making progress toward Public Service Loan Forgiveness (PSLF).

Get it wrong, and you might waste thousands of dollars in unnecessary payments.

Most med students miss this. But you won’t.

To make this process simple, I created a free step-by-step guide that walks you through everything you need to do, and exactly when to do it.

No fluff, no sales pitch, just the clear action steps to lock in the lowest possible student loan payments.

Here’s the 3-step game plan every MS4 needs to follow before residency starts.

MS4? Get Your Free Student Loan Guide

(The One You’ll Want to Share!)

The step-by-step playbook you (and your classmates) need to avoid costly student loan mistakes, lock in the lowest payments in residency, and maximize forgiveness.

MS4? Get Your Free Student Loan Guide

(The One You’ll Want to Share!)

The step-by-step playbook you (and your classmates) need to avoid costly student loan mistakes, lock in the lowest payments in residency, and maximize forgiveness.

3 Deadlines That Will Save You Thousands

Step 1: E-File Your 2024 Tax Return (Even If You Made $0)

Deadline: April 15, 2025 (or ASAP before graduation)

Why? Your income-driven repayment (IDR) plan bases your payments on last year’s income. If you earned nothing in 2024 and file taxes showing $0 income, you can lock in a $0/month student loan payment for your intern year. No tax return? Your loan servicer will estimate your income based on your residency salary, meaning higher payments.

✅ Action: File your 2024 tax return electronically before graduation.

Click Here to Learn More About E-Filing a Tax Return

Step 2: Complete Student Loan Exit Counseling

Deadline: Right after graduation

Why? You can’t move forward with repayment or consolidation without it. This step is mandatory, but it’s also quick and easy.

✅ Action: Click Here to Complete Your Exit Counseling immediately after graduation.

Step 3: Consolidate & Enroll in an IDR Plan

Deadline: Before the end of May (ASAP after graduation)

Why? This starts your PSLF clock. Every month in an IDR plan counts toward PSLF, even if your payment is $0. Most residents delay this step, costing them months of PSLF credit and thousands of dollars in extra payments later.

✅ Action: Click Here to Consolidate Your Loans and Enroll in an IDR Plan ASAP. When asked about processing delays, select “Do Not Delay.”

3 Deadlines That Will Save You Thousands

Step 1: E-File Your 2024 Tax Return (Even If You Made $0)

Deadline: April 15, 2025 (or ASAP before graduation)

Why? Your income-driven repayment (IDR) plan bases your payments on last year’s income. If you earned nothing in 2024 and file taxes showing $0 income, you can lock in a $0/month student loan payment for your intern year. No tax return? Your loan servicer will estimate your income based on your residency salary, meaning higher payments.

✅ Action: File your 2024 tax return electronically before graduation.

Click Here to Learn More About E-Filing a Tax Return

Step 2: Complete Student Loan Exit Counseling

Deadline: Right after graduation

Why? You can’t move forward with repayment or consolidation without it. This step is mandatory, but it’s also quick and easy.

✅ Action: Click Here to Complete Your Exit Counseling immediately after graduation.

Step 3: Consolidate & Enroll in an IDR Plan

Deadline: Before the end of May (ASAP after graduation)

Why? This starts your PSLF clock. Every month in an IDR plan counts toward PSLF, even if your payment is $0. Most residents delay this step, costing them months of PSLF credit and thousands of dollars in extra payments later.

✅ Action: Click Here to Consolidate Your Loans and Enroll in an IDR Plan ASAP. When asked about processing delays, select “Do Not Delay.”

Why This Matters

Every year, thousands of new doctors overpay on their loans simply because they didn’t know the rules. You don’t have to be one of them.

Follow these three steps, and you’ll:

-

-

Lock in the lowest possible student loan payment (likely $0/month).

-

Start your PSLF clock immediately, saving thousands in future payments.

-

Avoid common mistakes that cost residents tens of thousands of dollars.

-

Why This Matters

Every year, thousands of new doctors overpay on their loans simply because they didn’t know the rules. You don’t have to be one of them.

Follow these three steps, and you’ll:

-

Lock in the lowest possible student loan payment (likely $0/month).

-

Start your PSLF clock immediately, saving thousands in future payments.

-

Avoid common mistakes that cost residents tens of thousands of dollars.

The Big Picture: How It All Works

Your Loans Right Now: What You’re Working With

Right now, your loans are in in-school deferment, meaning no payments are required while you’re enrolled at least half-time.

Once you graduate, you enter a six-month grace period, where no payments are due, but interest continues to grow.

This is where most med students make their first major mistake, doing nothing and letting the grace period pass without taking action.

During this time, you could be securing a $0 student loan payment and starting the clock toward PSLF, but if you wait until your first bill arrives, you’re already months behind.

The 10-Year Standard Repayment Plan: The Nightmare Scenario

If you do absolutely nothing, your loans will default to the 10-Year Standard Repayment Plan.

This means your loan balance is divided into 120 equal monthly payments over ten years.

That might sound fine, until you see the actual bill.

For most residents, this means a $2,500+ monthly payment, starting just six months after graduation.

Imagine paying half (or more) of your residency paycheck toward loans before you’ve even settled into your new job.

That’s why defaulting into this plan is a disaster for new doctors.

Income-Driven Repayment (IDR): The Game-Changer

IDR plans calculate your student loan payment based on your income, not your loan balance.

Since you’re just starting residency, your income is low, which means your payment can be as low as $0 per month if you take the right steps before your grace period ends, like e-filing a 2024 tax return…

Every $0 payment still counts toward PSLF, meaning you’re making real progress toward loan forgiveness without spending a dime.

This is why getting into an IDR plan as soon as possible is critical.

The Big Picture: How It All Works

Your Loans Right Now: What You’re Working With

Right now, your loans are in in-school deferment, meaning no payments are required while you’re enrolled at least half-time.

Once you graduate, you enter a six-month grace period, where no payments are due, but interest continues to grow.

This is where most med students make their first major mistake, doing nothing and letting the grace period pass without taking action.

During this time, you could be securing a $0 student loan payment and starting the clock toward PSLF, but if you wait until your first bill arrives, you’re already months behind.

The 10-Year Standard Repayment Plan: The Nightmare Scenario

If you do absolutely nothing, your loans will default to the 10-Year Standard Repayment Plan.

This means your loan balance is divided into 120 equal monthly payments over ten years.

That might sound fine, until you see the actual bill.

For most residents, this means a $2,500+ monthly payment, starting just six months after graduation.

Imagine paying half (or more) of your residency paycheck toward loans before you’ve even settled into your new job.

That’s why defaulting into this plan is a disaster for new doctors.

Income-Driven Repayment (IDR): The Game-Changer

IDR plans calculate your student loan payment based on your income, not your loan balance.

Since you’re just starting residency, your income is low, which means your payment can be as low as $0 per month if you take the right steps before your grace period ends, like e-filing a 2024 tax return…

Every $0 payment still counts toward PSLF, meaning you’re making real progress toward loan forgiveness without spending a dime.

This is why getting into an IDR plan as soon as possible is critical.

Final Recap & Next Steps

You don’t need to be a financial expert to win with student loans, you just need the right plan.

✅ File your 2024 tax return before graduation to lock in a $0 payment.

✅ Complete student loan exit counseling so you’re ready to consolidate.

✅ Consolidate and enroll in an IDR plan ASAP to start the PSLF clock immediately.

By taking these steps, you’ll avoid thousands of dollars in unnecessary payments and set yourself up for loan forgiveness.

Future You will thank you.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Final Recap & Next Steps

You don’t need to be a financial expert to win with student loans, you just need the right plan.

✅ File your 2024 tax return before graduation to lock in a $0 payment.

✅ Complete student loan exit counseling so you’re ready to consolidate.

✅ Consolidate and enroll in an IDR plan ASAP to start the PSLF clock immediately.

By taking these steps, you’ll avoid thousands of dollars in unnecessary payments and set yourself up for loan forgiveness.

Future You will thank you.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Frequently Asked Questions

Who is this guide for?

This guide is written for 4th-year medical students (MS4s) who are about to graduate and have student loans.

But it’s also helpful for other people graduating with student loans, like healthcare professionals, graduate students, and anyone entering a public service career.

What happens if I don’t file my tax return before residency?

If you don’t file your tax return before starting residency, your first loan payment will be based on your salary as a resident (which is typically higher than $0).

This could result in monthly payments ranging from $300-600, which is much higher than if you file your taxes before graduation.

Filing your taxes before residency ensures you pay the lowest amount possible for your loans.

Do I have to consolidate my loans?

No, consolidation isn’t required, but if you’re planning to work in public service (like in healthcare or government jobs), consolidation is a good idea.

Consolidating your loans after graduation starts a process that can lead to loan forgiveness after 10 years of qualifying payments, which can save you thousands of dollars.

What’s the best IDR plan for residents?

For most residents, SAVE is likely the best plan if available, but be aware that legal challenges could cause it to go away in the future.

If SAVE isn’t an option, the best IDR plans to prioritize are:

-

-

New IBR – This plan is protected by law and offers the most stability.

-

PAYE – Often better than Old IBR, PAYE offers lower payments.

-

Old IBR – This plan results in the highest payments, but it is also protected by law like New IBR.

-

Choosing between the plans depends on when you took out your loans, so check out the guide to learn more!

Note: These plans may change in the future.

Should I refinance my loans instead?

Refinancing turns your federal loans into private loans, which means you lose access to PSLF and IDR plans.

For residents, refinancing is almost always a bad idea unless you’re not planning on pursuing PSLF and are in a solid financial position to pay off the loans quickly.

Want more details?

Each of these strategies can save you a lot of money and make loan repayment easier.

For more detailed guidance and to figure out what’s best for your situation, check out the full guide!

Frequently Asked Questions

Who is this guide for?

This guide is written for 4th-year medical students (MS4s) who are about to graduate and have student loans.

But it’s also helpful for other people graduating with student loans, like healthcare professionals, graduate students, and anyone entering a public service career.

What happens if I don’t file my tax return before residency?

If you don’t file your tax return before starting residency, your first loan payment will be based on your salary as a resident (which is typically higher than $0).

This could result in monthly payments ranging from $300-600, which is much higher than if you file your taxes before graduation.

Filing your taxes before residency ensures you pay the lowest amount possible for your loans.

Do I have to consolidate my loans?

No, consolidation isn’t required, but if you’re planning to work in public service (like in healthcare or government jobs), consolidation is a good idea.

Consolidating your loans after graduation starts a process that can lead to loan forgiveness after 10 years of qualifying payments, which can save you thousands of dollars.

What’s the best IDR plan for residents?

For most residents, SAVE is likely the best plan if available, but be aware that legal challenges could cause it to go away in the future.

If SAVE isn’t an option, the best IDR plans to prioritize are:

-

New IBR – This plan is protected by law and offers the most stability.

-

PAYE – Often better than Old IBR, PAYE offers lower payments.

-

Old IBR – This plan results in the highest payments, but it is also protected by law like New IBR.

Choosing between the plans depends on when you took out your loans, so check out the guide to learn more!

Note: These plans may change in the future.

Should I refinance my loans instead?

Refinancing turns your federal loans into private loans, which means you lose access to PSLF and IDR plans.

For residents, refinancing is almost always a bad idea unless you’re not planning on pursuing PSLF and are in a solid financial position to pay off the loans quickly.

Want more details?

Each of these strategies can save you a lot of money and make loan repayment easier.

For more detailed guidance and to figure out what’s best for your situation, check out the full guide!

Want the step-by-step guide to mastering your student loans before residency?

Download the Debt-Free Prescription: Everything MS4s Need to Know About Student Loan Repayment!

This is the exact plan I walk my clients through. Now, you can use it too.

Want the step-by-step guide to mastering your student loans before residency?

Download the Debt-Free Prescription: Everything MS4s Need to Know About Student Loan Repayment!

This is the exact plan I walk my clients through. Now, you can use it too.

Subscribe to The Dream Bigger – Physician Edition Newsletter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsletter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Concept 1: Student Loan Statuses

Understanding the different statuses of student loans is an important part of your financial journey. It helps you determine when payments are required and when you have opportunities to take a break, allowing for strategic planning.

Let’s break down the key phases:

☁️ “In School” Status: While attending medical school, your student loans are in the “In School” status. During this time, you are not required to make any payments on your loans.

☁️ “In Grace Period” Status: After graduation, your loans transition to the “In Grace Period” status. This is a 6-month window where payments are still not required, giving you a buffer before repayment begins.

☁️ “In Repayment” Status: Once the grace period ends, your loans enter the “In Repayment” status, marking the time when you’re required to begin making payments on your student loans.

Understanding these phases is key to managing your loans effectively and can lead to smart financial decisions during residency.

Concept 1: Student Loan Statuses

Understanding the different statuses of student loans is an important part of your financial journey. It helps you determine when payments are required and when you have opportunities to take a break, allowing for strategic planning.

Let’s break down the key phases:

☁️ “In School” Status: While attending medical school, your student loans are in the “In School” status. During this time, you are not required to make any payments on your loans.

☁️ “In Grace Period” Status: After graduation, your loans transition to the “In Grace Period” status. This is a 6-month window where payments are still not required, giving you a buffer before repayment begins.

☁️ “In Repayment” Status: Once the grace period ends, your loans enter the “In Repayment” status, marking the time when you’re required to begin making payments on your student loans.

Understanding these phases is key to managing your loans effectively and can lead to smart financial decisions during residency.

Concept 2: Student Loan Timeline (Average Borrower)

For many medical graduates transitioning into residency, managing student loans can feel overwhelming. Here’s a typical timeline that demonstrates how a borrower might navigate this phase with a balance of $260,000 at a 6.8% interest rate, and a starting PGY1 salary of $60,000.

Here’s a snapshot of the average borrower’s timeline:

-

-

Relationship Status: Single

-

2023 Income: $0

-

PGY1 Salary: $60,000

-

Student Loan Balance: $260,000

-

Interest Rate: 6.8%

-

Timeline:

Pre-May 2024:

-

-

Status: Loans are in “In School” status (no payments required).

-

May 2024:

-

-

Event: Graduate from medical school.

-

Status: Loans transition to “In Grace Period,” giving you six months before payments are due.

-

November 2024:

-

-

Event: Grace period ends, and your loans enter “In Repayment” status.

-

Action: The default repayment plan is the Standard 10-Year Repayment, which results in monthly payments of around $3,000.

-

Panic Mode: Realization sets in that these $3,000/month payments are unaffordable.

-

November 2024:

-

-

Action: Enroll in the SAVE Income-Driven Repayment (IDR) plan without consolidating your loans. Payments are based on your PGY1 salary of $60,000 using Alternative Documentation Income (ADI).

-

December 2024:

-

-

New Payment: Under the SAVE plan, your monthly payment is reduced to $220/month, based on your income.

-

Bonus: This is your first payment that counts toward Public Service Loan Forgiveness (PSLF) if you qualify.

-

Concept 2: Student Loan Timeline (Average Borrower)

For many medical graduates transitioning into residency, managing student loans can feel overwhelming. Here’s a typical timeline that demonstrates how a borrower might navigate this phase with a balance of $260,000 at a 6.8% interest rate, and a starting PGY1 salary of $60,000.

Here’s a snapshot of the average borrower’s timeline:

-

Relationship Status: Single

-

2023 Income: $0

-

PGY1 Salary: $60,000

-

Student Loan Balance: $260,000

-

Interest Rate: 6.8%

Timeline:

Pre-May 2024:

-

Status: Loans are in “In School” status (no payments required).

May 2024:

-

Event: Graduate from medical school.

-

Status: Loans transition to “In Grace Period,” giving you six months before payments are due.

November 2024:

-

Event: Grace period ends, and your loans enter “In Repayment” status.

-

Action: The default repayment plan is the Standard 10-Year Repayment, which results in monthly payments of around $3,000.

-

Panic Mode: Realization sets in that these $3,000/month payments are unaffordable.

November 2024:

-

Action: Enroll in the SAVE Income-Driven Repayment (IDR) plan without consolidating your loans. Payments are based on your PGY1 salary of $60,000 using Alternative Documentation Income (ADI).

December 2024:

-

New Payment: Under the SAVE plan, your monthly payment is reduced to $220/month, based on your income.

-

Bonus: This is your first payment that counts toward Public Service Loan Forgiveness (PSLF) if you qualify.

Concept 3: Standard 10-Year Repayment Plan

When you graduate from medical school in May 2024, your student loans enter the “In Grace Period” status — a 6-month window after graduation during which no payments are required.

Once this grace period ends, your loans transition to “In Repayment” status, marking the beginning of your student loan payments. This is often a shock for interns, and here’s why:

When your loans enter “In Repayment” status, your monthly payment is automatically calculated using the Standard 10-Year Repayment Plan. Similar to a mortgage, this plan considers your loan balance and interest rate, setting a monthly payment designed to pay off your debt over ten years.

For example, a $260,000 loan at a 6.8% interest rate would result in a hefty $3,000 monthly payment. For most interns earning around $60,000, this payment would eat up about three-quarters of their take-home pay.

The good news? You can drastically reduce your student loan payments by enrolling in an Income-Driven Repayment (IDR) plan, potentially bringing your monthly payment down to $0.

Concept 3: Standard 10-Year Repayment Plan

When you graduate from medical school in May 2024, your student loans enter the “In Grace Period” status — a 6-month window after graduation during which no payments are required.

Once this grace period ends, your loans transition to “In Repayment” status, marking the beginning of your student loan payments. This is often a shock for interns, and here’s why:

When your loans enter “In Repayment” status, your monthly payment is automatically calculated using the Standard 10-Year Repayment Plan. Similar to a mortgage, this plan considers your loan balance and interest rate, setting a monthly payment designed to pay off your debt over ten years.

For example, a $260,000 loan at a 6.8% interest rate would result in a hefty $3,000 monthly payment. For most interns earning around $60,000, this payment would eat up about three-quarters of their take-home pay.

The good news? You can drastically reduce your student loan payments by enrolling in an Income-Driven Repayment (IDR) plan, potentially bringing your monthly payment down to $0.

Concept 4: Income-Driven Repayment Plans

Concept 4: Income-Driven Repayment Plans

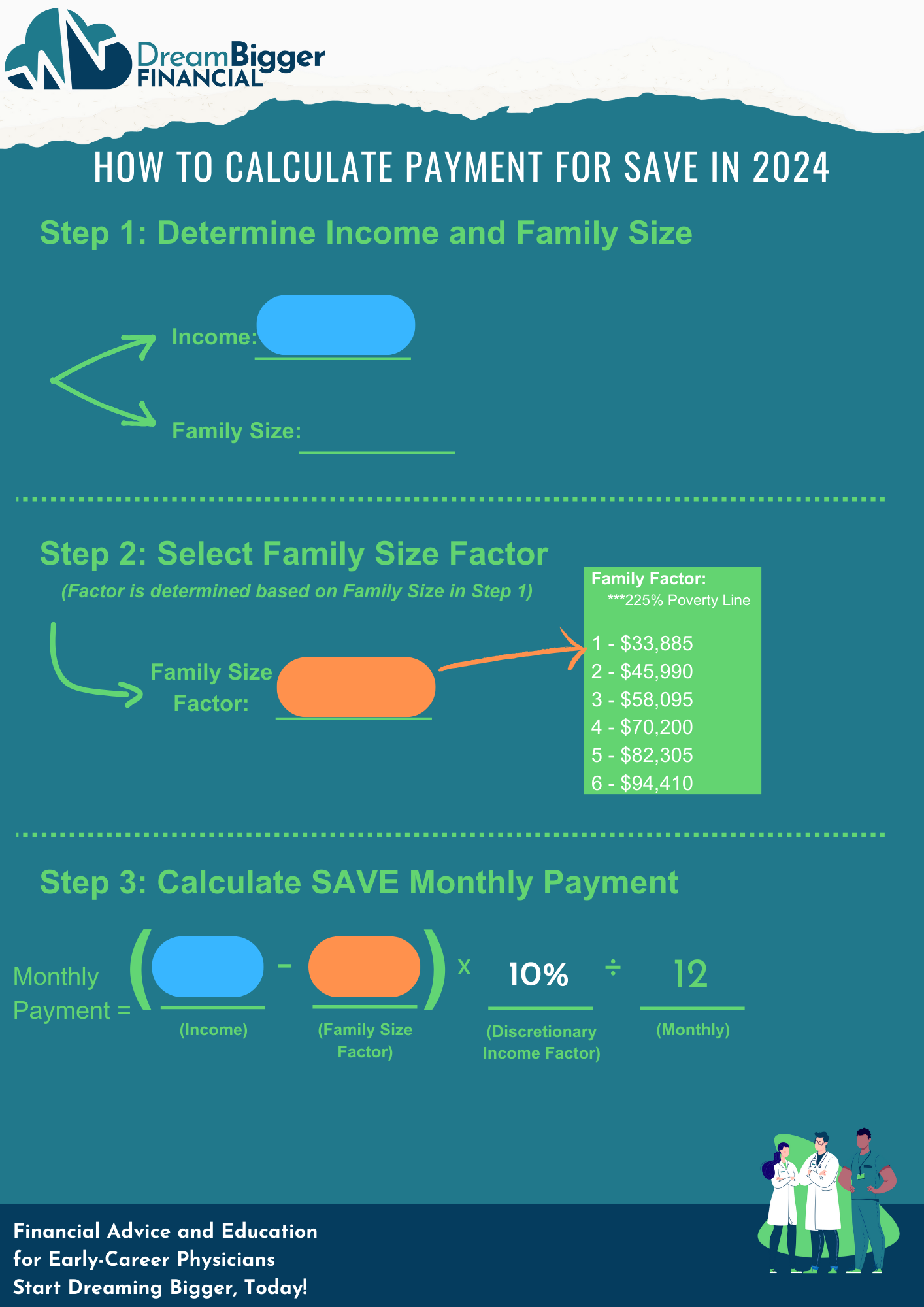

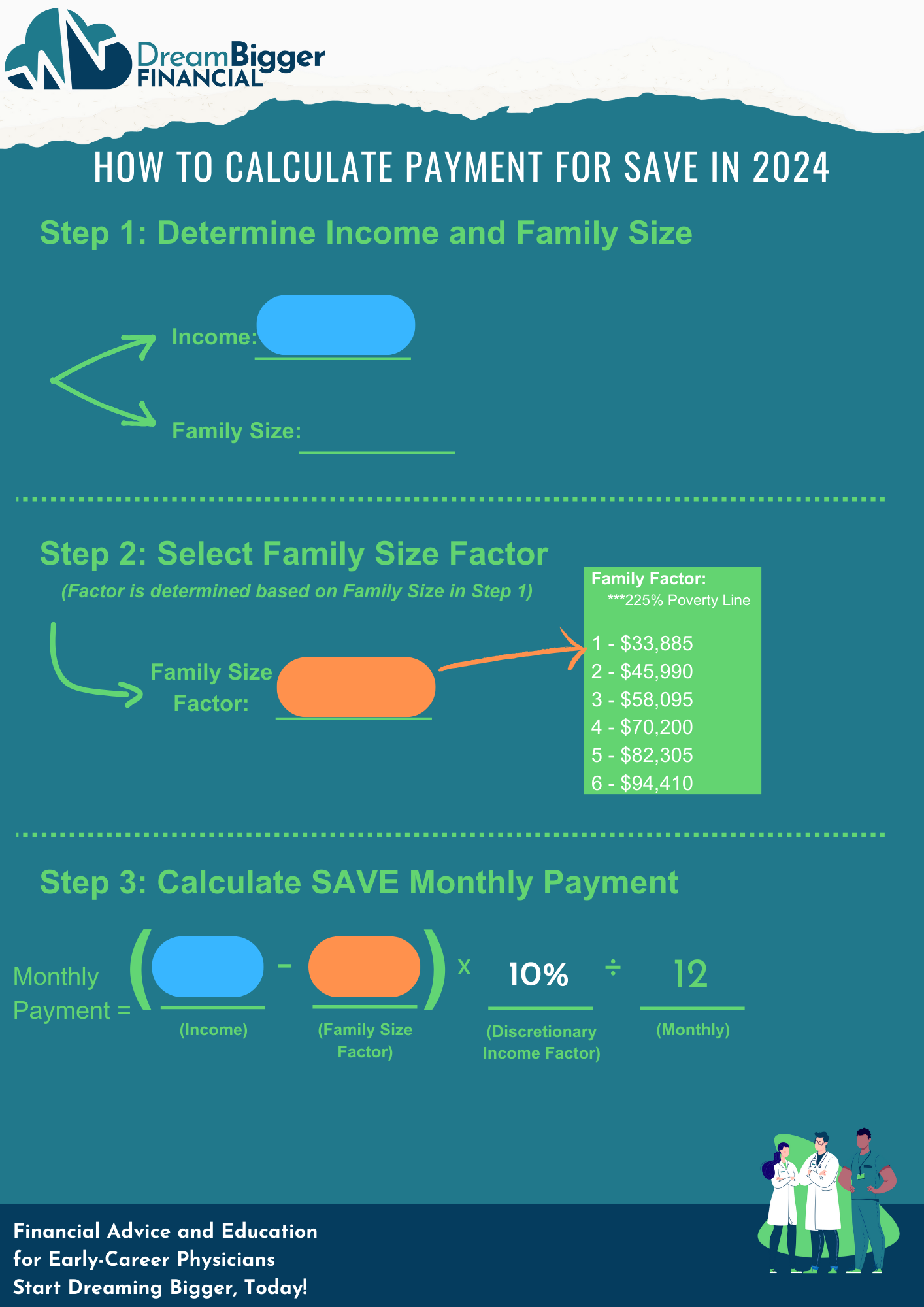

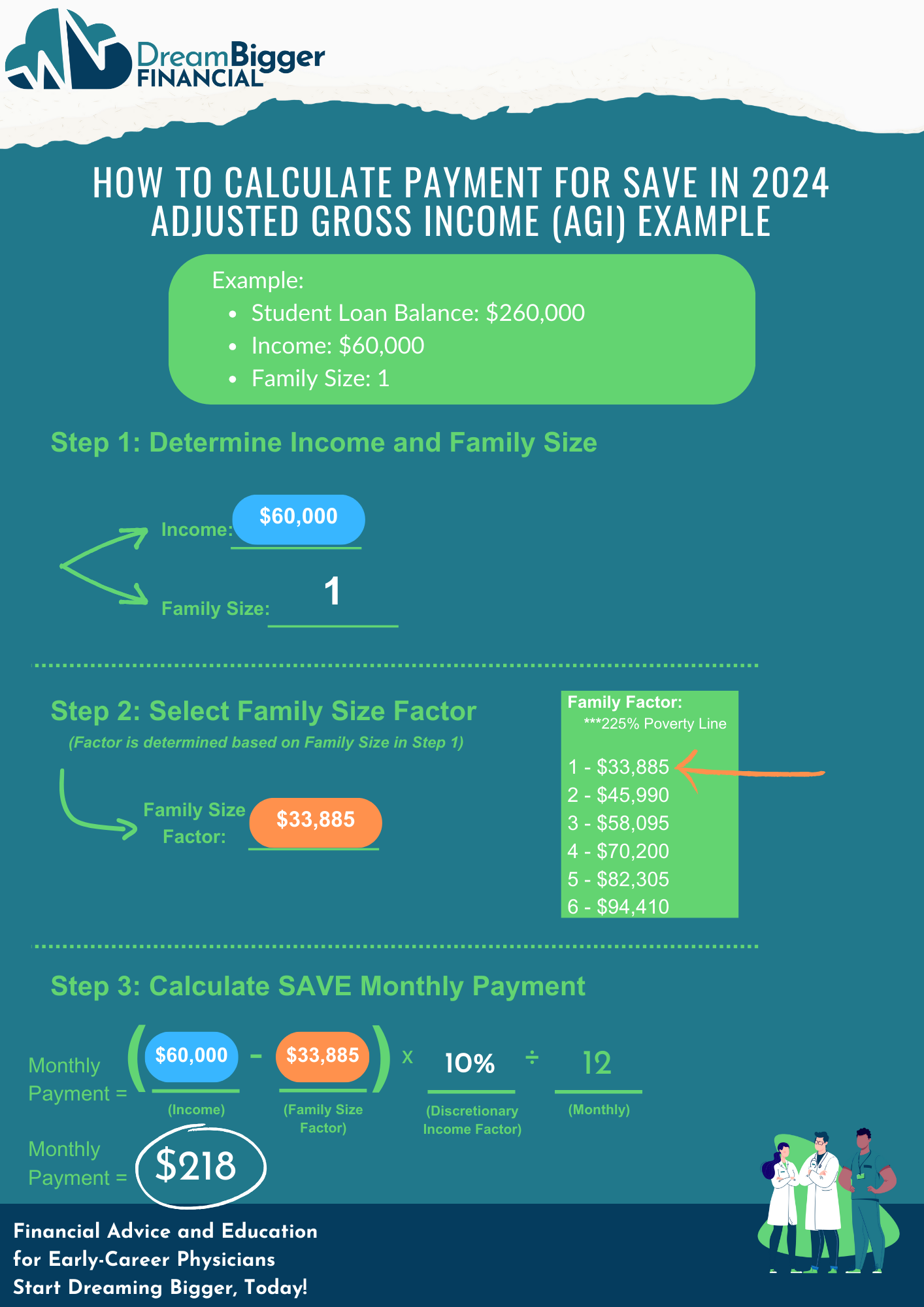

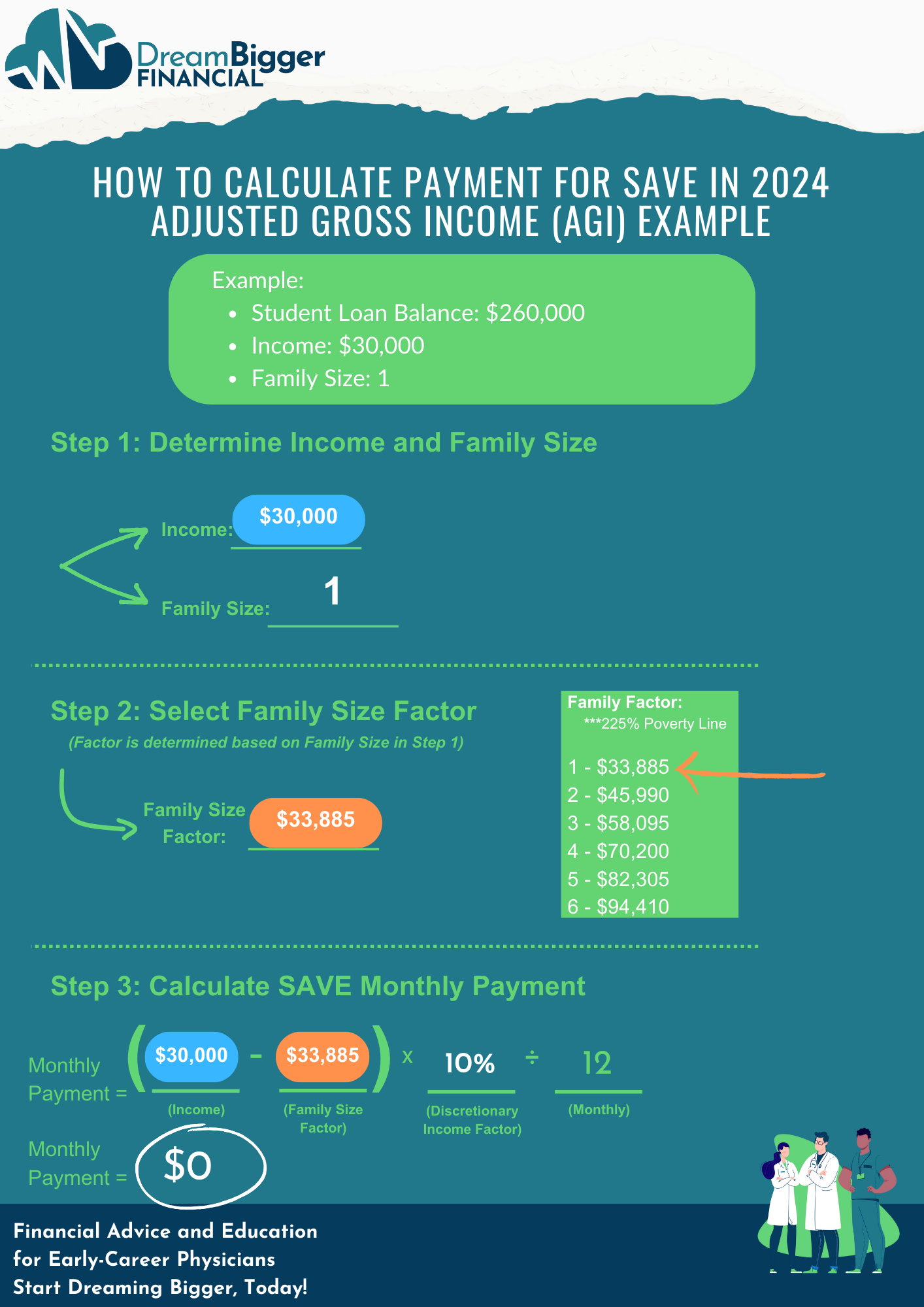

Concept 5: Saving on a Valuable Education (SAVE)

For recent medical school graduates, the Saving on A Valuable Education (SAVE) plan is likely the best option when consolidating student loans and enrolling in an Income-Driven Repayment (IDR) plan.

SAVE offers the lowest monthly payments and includes a 100% interest subsidy if your payment doesn’t cover the interest owed.

Here’s a breakdown of the SAVE Plan:

-

-

Poverty Line Deduction: 225%

-

-

For a family size of 1, this calculates to $33,885.

-

-

-

-

-

Payment & Timeline:

-

-

Undergraduate Loans: 5% of your discretionary income for 20 years

-

Graduate Loans: 10% of your discretionary income for 25 years

-

-

-

-

-

Payment Cap: None

-

-

-

Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

-

-

Filing taxes as Married Filing Separately lets you exclude your spouse’s income, potentially lowering your payment. However, this choice comes with tax implications, especially in community property states, so professional advice is recommended if you’re married.

-

-

-

-

-

Interest Subsidy: Yes, 100% of any unpaid interest

-

-

If your monthly payment doesn’t cover the full interest, any unpaid interest is forgiven. For example, if your SAVE payment is $300/month but you owe $1,000/month in interest without IDR, the $700 difference is forgiven. This means your student loan balance won’t grow, even if your payments fall short.

-

-

-

Concept 5: Saving on a Valuable Education (SAVE)

For recent medical school graduates, the Saving on A Valuable Education (SAVE) plan is likely the best option when consolidating student loans and enrolling in an Income-Driven Repayment (IDR) plan.

SAVE offers the lowest monthly payments and includes a 100% interest subsidy if your payment doesn’t cover the interest owed.

Here’s a breakdown of the SAVE Plan:

-

Poverty Line Deduction: 225%

-

For a family size of 1, this calculates to $33,885.

-

-

Payment & Timeline:

-

Undergraduate Loans: 5% of your discretionary income for 20 years

-

Graduate Loans: 10% of your discretionary income for 25 years

-

-

Payment Cap: None

-

Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

-

Filing taxes as Married Filing Separately lets you exclude your spouse’s income, potentially lowering your payment. However, this choice comes with tax implications, especially in community property states, so professional advice is recommended if you’re married.

-

-

Interest Subsidy: Yes, 100% of any unpaid interest

-

If your monthly payment doesn’t cover the full interest, any unpaid interest is forgiven. For example, if your SAVE payment is $300/month but you owe $1,000/month in interest without IDR, the $700 difference is forgiven. This means your student loan balance won’t grow, even if your payments fall short.

-

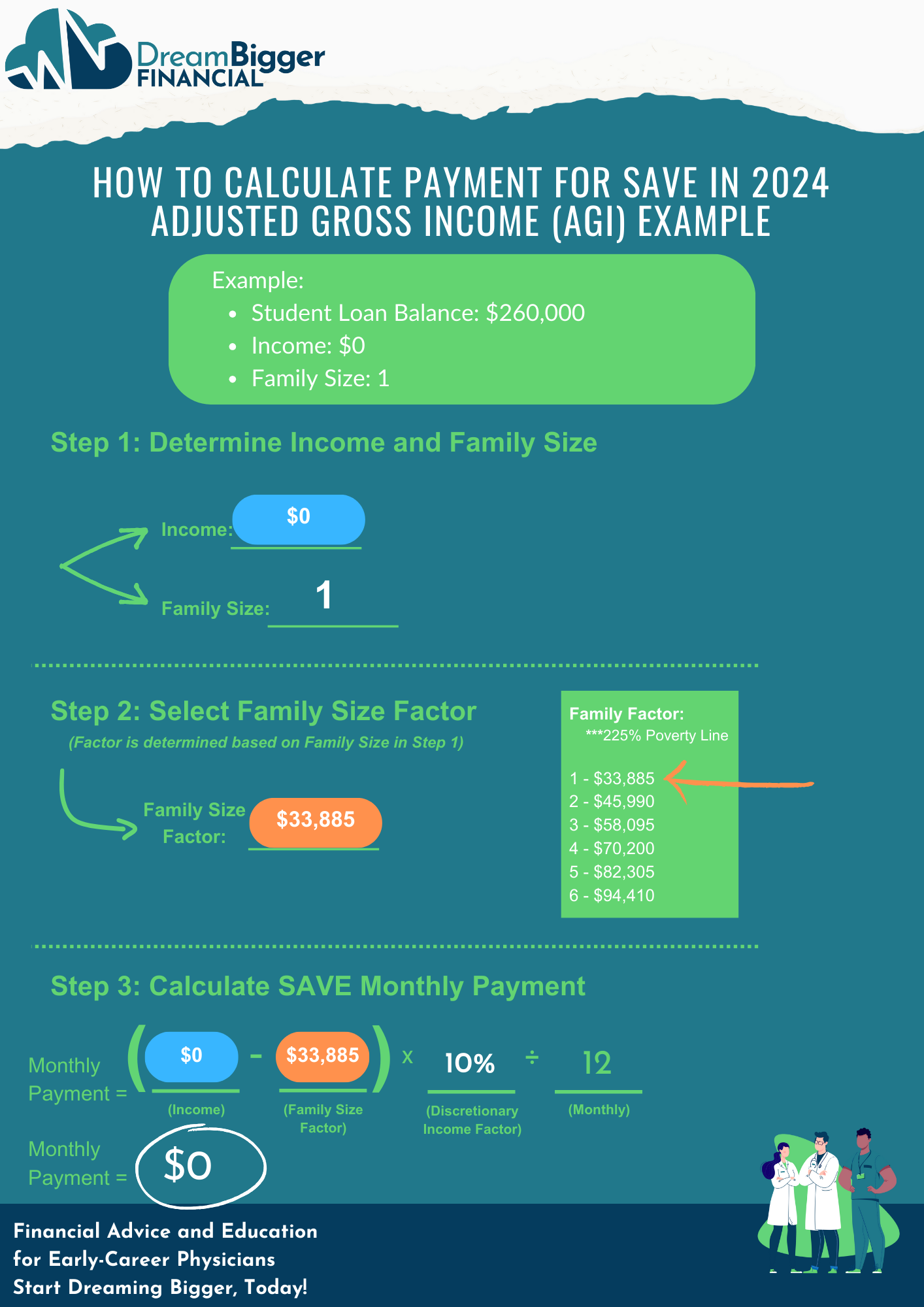

Concept 6: Calculating Income for Income-Driven Repayment Plans

When enrolled in an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by two key factors: income and family size.

In simple terms:

-

-

Higher income = larger monthly payment

-

Lower income = smaller monthly payment

-

There are two methods to calculate your income for IDR plans: Adjusted Gross Income (AGI) and Alternative Documentation of Income, typically your paystub.

Annual Recertification

Each year, participants in an IDR plan must recertify their income and family size on their IDR Anniversary Date. This provides an annual opportunity to choose the method that results in the lowest student loan payment. If your income decreases or family size increases, you can recertify early, potentially reducing your payment before the anniversary.

Example Scenario:

-

-

A family of 4 with a household income of $300,000 may have a monthly student loan payment of around $1,900 under the SAVE plan.

-

If one partner takes time off, lowering household income to $200,000, the monthly payment would drop to approximately $1,100.

-

Recertifying before the IDR Anniversary Date could save this borrower $800/month.

-

Method 1: Adjusted Gross Income (AGI)

Your AGI, found on Line 11 of your IRS Form 1040 from the prior year’s tax return, includes your total income minus specific eligible deductions. Income sources can include job earnings, self-employment income, dividends, and interest.

Using AGI requires that a tax return be on file. Even if you had no income during medical school, filing a tax return showing $0 income is essential, as it often results in $0/month payments during PGY1 for recent graduates.

Married Individuals: Household income is considered, so filing Married Filing Separately (MFS) could reduce your payment. However, weigh the tax implications carefully before choosing this strategy.

Method 2: Alternative Documentation of Income

If you haven’t filed a tax return, you’ll use Alternative Documentation of Income, typically your paystub, to certify your income. This method projects your annual income based on your paystub earnings. For example, if your salary as a PGY1 is $60,000, this amount will be used to calculate your student loan payment under an IDR plan.

Both methods offer ways to manage your monthly payment based on your circumstances, allowing you to adapt your repayment strategy as your financial situation changes.

Concept 6: Calculating Income for Income-Driven Repayment Plans

When enrolled in an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by two key factors: income and family size.

In simple terms:

-

Higher income = larger monthly payment

-

Lower income = smaller monthly payment

There are two methods to calculate your income for IDR plans: Adjusted Gross Income (AGI) and Alternative Documentation of Income, typically your paystub.

Annual Recertification

Each year, participants in an IDR plan must recertify their income and family size on their IDR Anniversary Date. This provides an annual opportunity to choose the method that results in the lowest student loan payment. If your income decreases or family size increases, you can recertify early, potentially reducing your payment before the anniversary.

Example Scenario:

-

A family of 4 with a household income of $300,000 may have a monthly student loan payment of around $1,900 under the SAVE plan.

-

If one partner takes time off, lowering household income to $200,000, the monthly payment would drop to approximately $1,100.

-

Recertifying before the IDR Anniversary Date could save this borrower $800/month.

Method 1: Adjusted Gross Income (AGI)

Your AGI, found on Line 11 of your IRS Form 1040 from the prior year’s tax return, includes your total income minus specific eligible deductions. Income sources can include job earnings, self-employment income, dividends, and interest.

Using AGI requires that a tax return be on file. Even if you had no income during medical school, filing a tax return showing $0 income is essential, as it often results in $0/month payments during PGY1 for recent graduates.

Married Individuals: Household income is considered, so filing Married Filing Separately (MFS) could reduce your payment. However, weigh the tax implications carefully before choosing this strategy.

Method 2: Alternative Documentation of Income

If you haven’t filed a tax return, you’ll use Alternative Documentation of Income, typically your paystub, to certify your income. This method projects your annual income based on your paystub earnings. For example, if your salary as a PGY1 is $60,000, this amount will be used to calculate your student loan payment under an IDR plan.

Both methods offer ways to manage your monthly payment based on your circumstances, allowing you to adapt your repayment strategy as your financial situation changes.

Concept 7: Calculating Family Size for Income-Driven Repayment Plans

Concept 8: Direct Consolidation

Direct Consolidation can simplify your student loan management and maximize opportunities for student loan forgiveness. By consolidating, you combine multiple federal loans into one, with a weighted-average interest rate. If you have both subsidized and unsubsidized loans, you’ll receive one consolidated loan for each type (resulting in two total).

Key Benefits of Direct Consolidation:

1. Simplifies repayment by reducing multiple loans to a single payment.

2. Grants eligibility for Income-Driven Repayment (IDR) plans for loans that normally wouldn’t qualify.

3. Transitions loans from “In Grace Period” to “In Repayment” status, allowing for early payments that count toward forgiveness.

Eligible Loans for Direct Consolidation:

-

-

Direct Subsidized/Unsubsidized Loans

-

Subsidized/Unsubsidized Federal Stafford Loans

-

Direct PLUS Loans

-

FFEL PLUS Loans

-

Supplemental Loans for Students (SLS)

-

Federal Perkins Loans

-

Federal Nursing Loans

-

Health Education Assistance Loans

-

Some existing consolidation loans

-

Important Note:

-

Private loans cannot be consolidated with federal loans.

-

Do not refinance federal loans into private loans (most likely), as this would eliminate federal protections and benefits like IDR plans and loan forgiveness.

Consolidation Strategy:

After medical school, you should prioritize consolidating your federal loans and enrolling in an IDR plan such as SAVE. This moves your loans from the 6-month grace period into “In Repayment,” triggering the start of your payments earlier, when your income is lower.

This strategy is especially beneficial if your goal is loan forgiveness, such as under the Public Service Loan Forgiveness (PSLF) program. Making early, lower payments when your income is minimal (e.g., during residency) reduces the number of high payments you’ll make later at your attending salary.

Example Scenario:

-

-

Residency Relationship Status: Single

-

Medical School Income: $0

-

PGY1 Salary: $60,000

-

Attending Relationship Status: Married w/ 1 child

-

Attending Household Income: $350,000

-

Without consolidation, your loans would remain in “In Grace Period” for six months after medical school, during which no payments are required. However, by consolidating right after graduation, you could start making IDR payments based on your low residency salary. If you file your tax return with $0 income, your payment could be as low as $0/month under the SAVE plan.

This allows you to start accumulating payments toward forgiveness without actually making payments, if your calculated payment is $0/month. Without consolidation, you’d potentially make higher payments based on your attending salary once your grace period ends.

Consolidation Example:

-

-

With Consolidation:

You consolidate your loans and enroll in SAVE right after graduation. Your initial payments start in August based on your PGY1 salary, possibly at $0/month. These low (or no) payments count toward loan forgiveness.

-

-

-

Without Consolidation:

Your loans stay in the 6-month grace period and payments start in December. This delay means you’ll need to make four payments at the end of your forgivness period, but now based on your attending salary of $350,000. These payments could be around $2,500 per month for four months, totaling $10,000—a cost that could have been avoided by consolidating your loans early.

-

By consolidating your loans, you can start making lower payments while your income is still low during residency, maximizing forgiveness and minimizing your total loan payments over time.

Concept 9: e-File Your Tax Return (April 15th “Loose” Deadline)

Filing your tax return is important when managing student loans under Income-Driven Repayment (IDR) plans like SAVE. Even if you earned no income, filing a tax return is necessary to prove that income and potentially secure $0 monthly student loan payments.

For medical students transitioning into residency, this strategy can help you save thousands on your loan repayments. Here’s how it works:

Why File a Tax Return with $0 Income?

As a medical student, you likely didn’t earn any income during most of 2023. While you may not be required to file a tax return since you earned $0, you should file a return if you plan to consolidate your student loans and enroll in the SAVE plan.

SAVE calculates payments based on your income and family size. Since you earned $0 in 2023, you can calculate your payment using that income, resulting in $0 monthly payments. However, you’ll need to prove your $0 income when applying for SAVE, and the best way to do that is by e-Filing a tax return.

Steps to Follow:

1. By April 15, 2024:

-

-

-

-

-

e-File your 2023 tax return and report $0 income.

-

This officially documents your $0 income, allowing you to use it when calculating your monthly payments under SAVE.

-

-

-

-

2. By May 2024:

-

-

-

-

-

Consolidate your loans (if necessary) and enroll in SAVE.

-

Use your e-Filed tax return as proof of $0 income to set your payments at $0/month for the first year of repayment.

-

-

-

-

Example: First-Year Resident (PGY1)

Let’s say you graduate medical school in 2024 and begin residency (PGY1) with an income of about $60,000. By e-Filing your 2023 tax return with $0 income, when you enroll in SAVE after graduation, your first year of payments will be based on your $0 income from the prior year, resulting in $0 monthly payments. This allows you to accumulate payments toward forgiveness without actually making any payments.

Key Considerations:

-

-

If you are single or file taxes as Married Filing Separately (MFS), you can report only your income (e.g., $0) without considering your partner’s income.

-

This strategy ensures that your loan payments remain as low as possible during residency, while still counting toward loan forgiveness under programs like Public Service Loan Forgiveness (PSLF).

-

Even with no income, filing a tax return is a important step to securing low or $0 student loan payments under SAVE, allowing you to save money during residency while still progressing toward forgiveness.

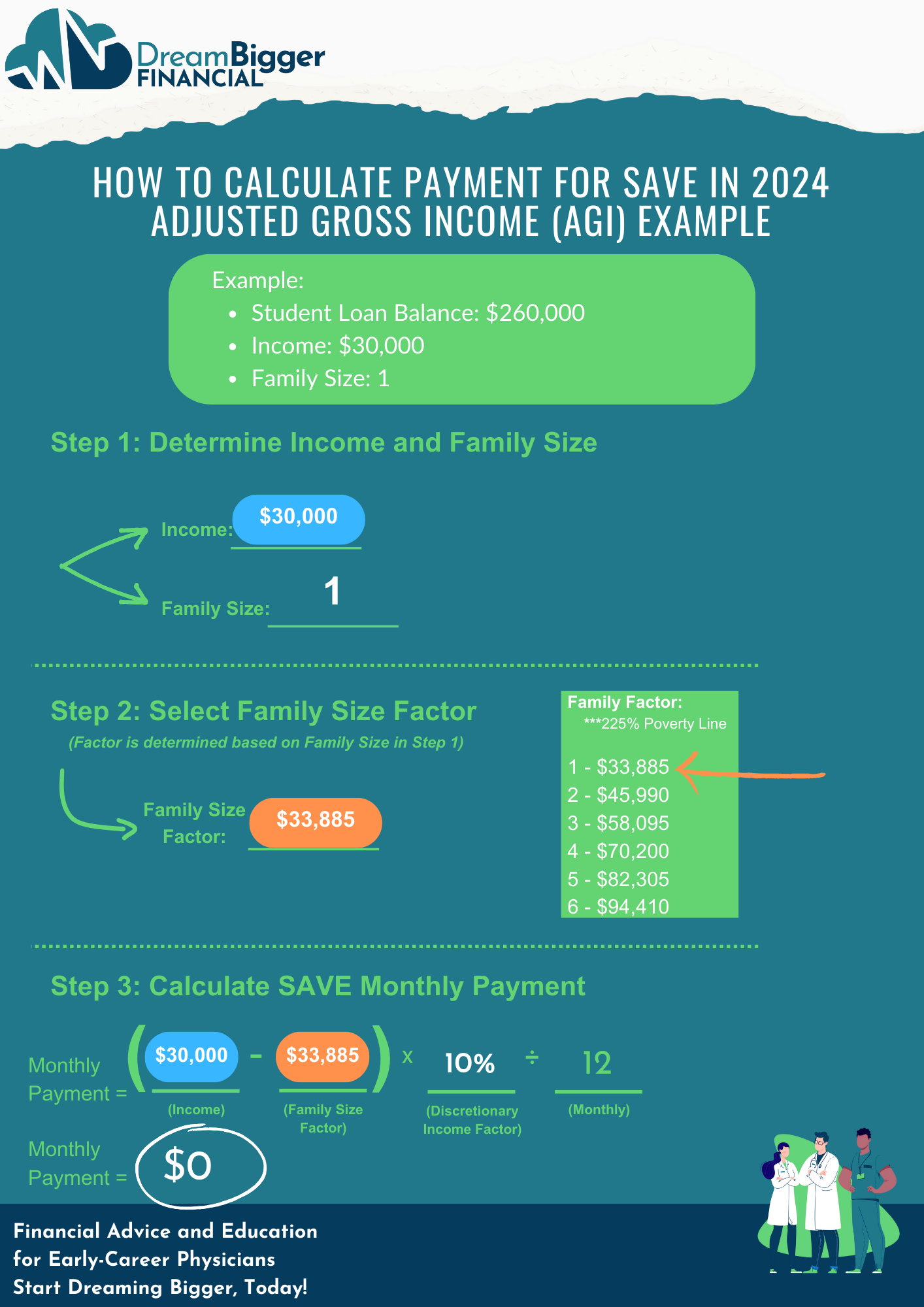

Concept 10: IDR Anniversary Date

When you join an Income-Driven Repayment (IDR) plan, your IDR Anniversary Date becomes a critical date each year. On this date, you must recertify your income and family size, which triggers a recalculation of your monthly student loan payment. If your income increases, your payment will rise accordingly. Conversely, if your family size increases, your payment could decrease.

Let’s assume your SAVE IDR Anniversary Date is June 1st each year.

PGY2 (2025): Student Loan Payment Recalculation

To understand how your payment will be recalculated, consider the timeline for filing taxes:

-

-

April 15, 2025: You will file taxes for the income earned in 2024. Here’s the breakdown of your income:

-

January 1, 2024, to June 30, 2024 (MS4): You earned $0 during this period.

-

July 1, 2024, to December 31, 2024 (PGY1): You earned $30,000 (assuming an annual salary of $60,000).

-

-

This means your total income for 2024 was $30,000.

-

-

June 1, 2025: Your IDR payment will be recalculated using the $30,000 income reported on your 2024 tax return. Based on this income, your SAVE payment for your second year will likely be $0/month.

-

Note: If your 2024 income exceeded $33,885, you could consider filing a tax extension to lower your monthly student loan payment. (Refer to Concept 11 for more on tax extensions.)

PGY3 (2026): Student Loan Payment Recalculation

Now, let’s see how your payments change as you move into PGY3 (2026).

-

-

April 15, 2026: You will file taxes for the income earned in 2025. Here’s the breakdown:

-

January 1, 2025, to June 30, 2025 (PGY1): You earned $30,000.

-

July 1, 2025, to December 31, 2025 (PGY2): You earned $30,000 (assuming an annual salary of $60,000).

-

-

This means your total income for 2025 was $60,000.

-

-

June 1, 2026: Your IDR payment will be recalculated using the $60,000 income from your 2025 tax return. Based on this income, your new monthly payment for the third year will likely be around $218/month.

-

Concept 11: Filing a Tax Extension

Each year, you must file a tax return by April 15 to report the previous year’s income. However, the IRS allows you to request a tax extension, giving you an additional six months to file, moving the deadline to October 15. Remember, you still need to pay any taxes owed by April 15, but you can defer filing your return until October 15.

Impact of Filing a Tax Extension on Your IDR Payments

Let’s explore how filing a tax extension might affect your student loan payments, particularly if you’re in your PGY3 (2026) year.

Scenario Overview:

-

-

Income for 2025:

-

January 1, 2025, to June 30, 2025 (PGY1): Earned $30,000 (assuming an annual income of $60,000).

-

July 1, 2025, to December 31, 2025 (PGY2): Earned $30,000 (assuming continued income at $60,000).

-

-

IDR Anniversary Date: June 1, 2026.

-

Without a Tax Extension:

-

-

April 15, 2026: You are required to file your tax return, showing an income of $60,000 for 2025.

-

June 1, 2026: Your SAVE payment will be recalculated using the $60,000 income from 2025. This would result in a monthly payment of approximately $218.

-

With a Tax Extension:

By filing a tax extension:

-

-

April 15, 2026: File for a tax extension, moving your tax filing deadline to October 15, 2026.

-

June 1, 2026: Your IDR Anniversary Date arrives, but your 2025 tax return has not yet been filed. Therefore, your most recent tax return on file is for 2024.

-

Income for 2024:

-

January 1, 2024, to June 30, 2024 (MS4): Earned $0.

-

July 1, 2024, to December 31, 2024 (PGY1): Earned $30,000.

-

Total Income for 2024: $30,000.

-

-

-

Result: Since you’ve filed a tax extension, your June 1, 2026 IDR Anniversary Date will use the 2024 income of $30,000. This results in a $0/month payment for the third year.

-

Summary:

-

-

By June 1, 2026: Using your 2024 income of $30,000 (due to the tax extension) results in a $0/month payment.

-

By October 15, 2026: You will file your 2025 tax return showing an income of $60,000, but this will not impact your June 1, 2026 IDR payment.

-

This strategic approach helps you manage your student loan payments effectively, potentially avoiding payments during your training years.

Important Note: This is not tax advice but a strategy to illustrate how filing a tax extension can impact your student loan payments. Always consult with a tax professional for personalized advice.

Concept 12: Student Loan Timeline (Elite Borrower)

To effectively manage your student loans as an Elite Borrower, here’s a comprehensive timeline demonstrating how strategic actions can optimize your payments and potentially maximize savings.

Example Overview:

-

-

Relationship Status: Single

-

2023 Income: $0

-

PGY1 Salary: $60,000

-

Student Loan Balance: $260,000

-

Interest Rate: 6.8%

-

Timeline and Actions:

April 15, 2024:

-

-

Action: e-File your tax return reporting 2023 income as $0.

-

Pre-May 2024:

-

-

Status: Loans are in “In School” status.

-

May 2024:

-

-

Action: Graduate from Medical School.

-

Status: Student loans transition from “In School” to “In Grace Period.”

-

Action: Immediately consolidate your student loans.

-

Action: Enroll in the SAVE Income-Driven Repayment plan. Your SAVE payment will be calculated based on your $0 tax return.

-

August 2024:

-

-

Status: Student loans shift from “In Grace Period” to “In Repayment” status (Consolidation may take 1-2 months).

-

Action: New SAVE payment of $0/month.

-

Note: This is your first payment counting towards forgiveness.

-

Action: Annual IDR Anniversary Date set.

-

April 15, 2025:

-

-

Action: e-File your tax return reporting 2024 income as $30,000.

-

Note: If your income exceeds $33,885, consider filing a tax extension to lower your payment.

-

August 2025:

-

-

Action: Recertify Income and Family Size.

-

Status: New SAVE payment of $0/month based on the 2024 income.

-

April 15, 2026:

-

-

Action: File a tax extension to move your tax filing deadline to October 15, 2026.

-

Note: Taxes owed must still be paid by April 15, 2026.

-

August 2026:

-

-

Action: Recertify Income and Family Size.

-

Status: New SAVE payment of $0/month, based on your 2024 tax return ($30,000).

-

October 15, 2026:

-

-

Action: e-File your tax return reporting 2025 income as $60,000.

-

Financial Impact:

-

-

Savings in Payments:

-

First Three Years: Save approximately $220/month, totaling around $7,920.

-

Final Four Payments: Save approximately $10,000 until forgiveness.

-

-

Total Savings: Potentially close to $18,000 over the course of your loan.

-

Summary:

By utilizing strategic actions like consolidating your loans, enrolling in the SAVE IDR plan, and managing your tax filings effectively, you can significantly reduce your monthly payments and maximize savings. This approach helps you maintain manageable payments while working towards loan forgiveness, potentially saving thousands over the life of your loan.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.