Introduction

Ever feel like your student loans are a confusing mess? Maybe you’ve got multiple servicers, a mix of undergrad and med school debt, or you’re not even sure which loans qualify for forgiveness.

That’s where Direct Loan Consolidation comes in.

It’s not required for everyone, but for many early-career physicians, it’s the key to:

-

-

Getting on the right repayment plan

-

Starting PSLF credit

-

Avoiding costly delays

-

Let’s walk through what Direct Loan Consolidation is, how it works, and whether it’s the right move for you.

Introduction

Ever feel like your student loans are a confusing mess? Maybe you’ve got multiple servicers, a mix of undergrad and med school debt, or you’re not even sure which loans qualify for forgiveness.

That’s where Direct Loan Consolidation comes in.

It’s not required for everyone, but for many early-career physicians, it’s the key to:

- Getting on the right repayment plan

- Starting PSLF credit

- Avoiding costly delays

Let’s walk through what Direct Loan Consolidation is, how it works, and whether it’s the right move for you.

What Is Direct Loan Consolidation?

Direct Loan Consolidation is when you combine multiple federal student loans into a single new loan, a Direct Consolidation Loan, with a weighted average interest rate.

Here’s what changes after consolidation:

-

-

You’ll have one servicer

-

One monthly payment

-

A new loan, still backed by the federal government

-

⚠️ Important: This is not the same as refinancing.

Refinancing moves your loans to a private lender, which can disqualify you from federal protections, PSLF, or IDR plans.

What Is Direct Loan Consolidation?

Direct Loan Consolidation is when you combine multiple federal student loans into a single new loan, a Direct Consolidation Loan, with a weighted average interest rate.

Here’s what changes after consolidation:

-

You’ll have one servicer

-

One monthly payment

-

A new loan, still backed by the federal government

⚠️ Important: This is not the same as refinancing.

Refinancing moves your loans to a private lender, which can disqualify you from federal protections, PSLF, or IDR plans.

Why Physicians Consider Consolidating

For early-career doctors, consolidation is often necessary to:

1. Simplify Loan Management

Combining loans into one makes tracking and managing payments easier, especially during residency chaos.

2. Access Forgiveness Programs

Some loans, like FFEL or Perkins loans, don’t qualify for PSLF or most Income-Driven Repayment (IDR) plans unless consolidated.

3. Start the PSLF Clock Early

This is huge: consolidation can end your grace period early and let you start making PSLF-eligible payments right away during residency, when your income (and thus your payment) is still low.

Why Physicians Consider Consolidating

For early-career doctors, consolidation is often necessary to:

1. Simplify Loan Management

Combining loans into one makes tracking and managing payments easier, especially during residency chaos.

2. Access Forgiveness Programs

Some loans, like FFEL or Perkins loans, don’t qualify for PSLF or most Income-Driven Repayment (IDR) plans unless consolidated.

3. Start the PSLF Clock Early

This is huge: consolidation can end your grace period early and let you start making PSLF-eligible payments right away during residency, when your income (and thus your payment) is still low.

Special Note for MS4s & New Interns 🎓

Think of Direct Loan Consolidation as the third critical deadline post-graduation, after:

1. Filing your previous year’s tax return

2. Completing your student loan exit interview

3. ✅ Then consolidating your loans

👉 Ideally, you’ll complete consolidation within a few days of graduating.

If that’s not possible, aim to get it done within the six-month grace period, the sooner the better, especially if PSLF is part of your long-term plan.

Done correctly, this can help you:

-

-

Set up $0/month payments during residency

-

Save $300–$600/month right away

-

Rack up tens of thousands in potential PSLF savings

-

This step alone can jumpstart your path to forgiveness, and help you avoid common (and costly) delays.

For a more complete walkthrough on how this fits into your broader student loan plan, download my free e-book: The Debt-Free Prescription: Everything MS4s Need to Know About Student Loan Repayment.

Special Note for MS4s & New Interns 🎓

Think of Direct Loan Consolidation as the third critical deadline post-graduation, after:

1. Filing your previous year’s tax return

2. Completing your student loan exit interview

3. ✅ Then consolidating your loans

👉 Ideally, you’ll complete consolidation within a few days of graduating.

If that’s not possible, aim to get it done within the six-month grace period, the sooner the better, especially if PSLF is part of your long-term plan.

Done correctly, this can help you:

-

Set up $0/month payments during residency

-

Save $300–$600/month right away

-

Rack up tens of thousands in potential PSLF savings

This step alone can jumpstart your path to forgiveness, and help you avoid common (and costly) delays.

For a more complete walkthrough on how this fits into your broader student loan plan, download my free e-book: The Debt-Free Prescription: Everything MS4s Need to Know About Student Loan Repayment.

MS4? Get Your Free Student Loan Guide

(The One You’ll Want to Share!)

The step-by-step playbook you (and your classmates) need to avoid costly student loan mistakes, lock in the lowest payments in residency, and maximize forgiveness.

MS4? Get Your Free Student Loan Guide

(The One You’ll Want to Share!)

The step-by-step playbook you (and your classmates) need to avoid costly student loan mistakes, lock in the lowest payments in residency, and maximize forgiveness.

Do You Have to Consolidate to Lower Payments?

No. You can enroll in an Income-Driven Repayment (IDR) plan without consolidating, if you have only Direct Loans.

But if you have:

-

-

FFEL loans → only eligible for IBR without consolidation

-

Perkins loans → not eligible for IDR unless consolidated

-

So while consolidation isn’t always required, it’s often the gateway to the best repayment and forgiveness options.

Do You Have to Consolidate to Lower Payments?

No. You can enroll in an Income-Driven Repayment (IDR) plan without consolidating, if you have only Direct Loans.

But if you have:

-

FFEL loans → only eligible for IBR without consolidation

-

Perkins loans → not eligible for IDR unless consolidated

So while consolidation isn’t always required, it’s often the gateway to the best repayment and forgiveness options.

Pros and Cons of Consolidation

✅ Pros:

-

-

Simpler loan management

-

Access to IDR & PSLF

-

Earlier PSLF start = lower payments, more savings

-

⚠️ Cons:

-

-

Capitalized interest: unpaid interest gets added to your balance

-

Payment count resets (in some cases — read on)

-

Pros and Cons of Consolidation

✅ Pros:

-

Simpler loan management

-

Access to IDR & PSLF

-

Earlier PSLF start = lower payments, more savings

⚠️ Cons:

-

Capitalized interest: unpaid interest gets added to your balance

-

Payment count resets (in some cases — read on)

What Happens to My PSLF Payment Count?

This part’s tricky… but important to pay attention to.

Under current rules:

If any of your loans already had PSLF-eligible payments, your new consolidated loan should receive a weighted average PSLF count.

This mostly applies if:

-

-

You worked at a PSLF-eligible employer before med school

-

You had qualifying payments on undergrad loans

-

✅ Good news: consolidation can preserve your PSLF progress

🧨 BUT — a lawsuit may change this. If rules revert, consolidation could reset your payment count.

If this sounds like you, you will want to confirm the current before consolidating.

What Happens to My PSLF Payment Count?

This part’s tricky… but important to pay attention to.

Under current rules:

If any of your loans already had PSLF-eligible payments, your new consolidated loan should receive a weighted average PSLF count.

This mostly applies if:

-

You worked at a PSLF-eligible employer before med school

-

You had qualifying payments on undergrad loans

✅ Good news: consolidation can preserve your PSLF progress

🧨 BUT — a lawsuit may change this. If rules revert, consolidation could reset your payment count.

If this sounds like you, you will want to confirm the current before consolidating.

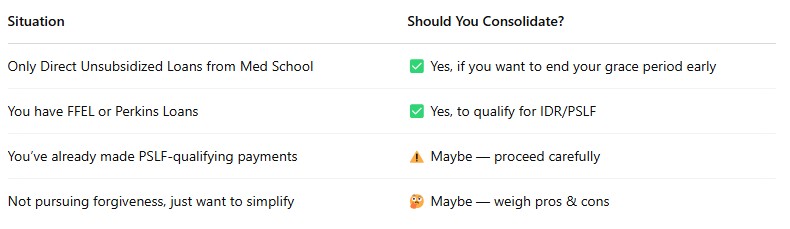

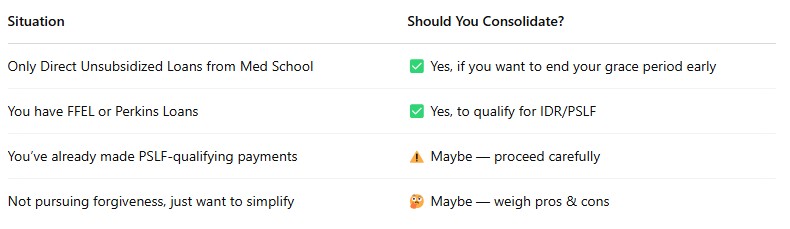

Should You Consolidate? Quick Guide:

Should You Consolidate? Quick Guide:

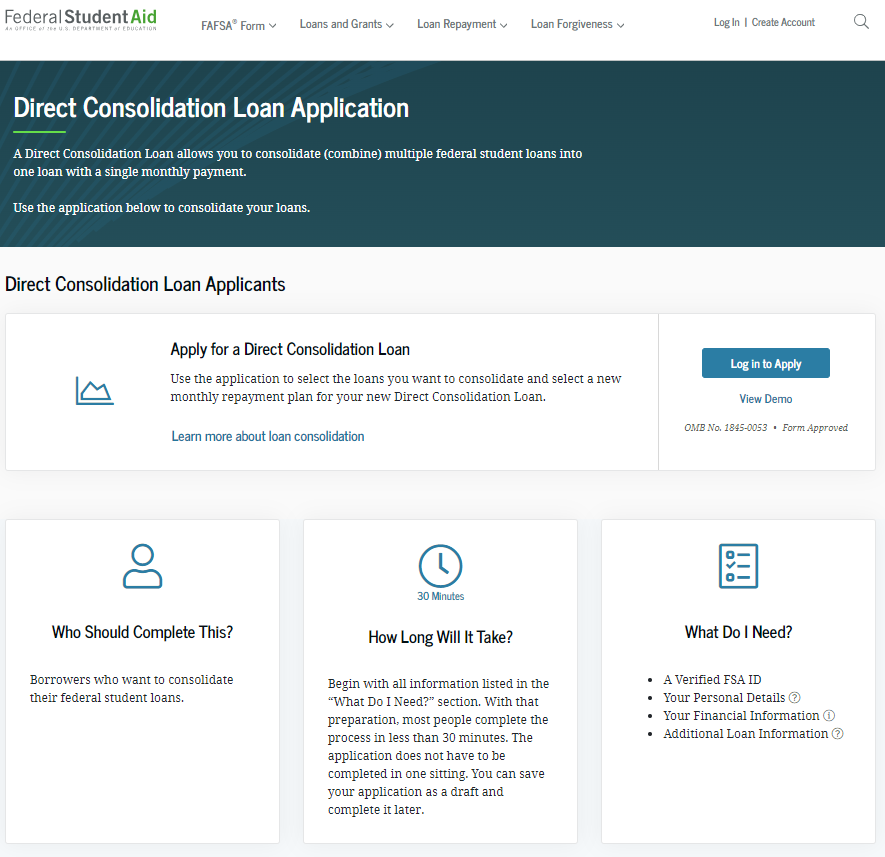

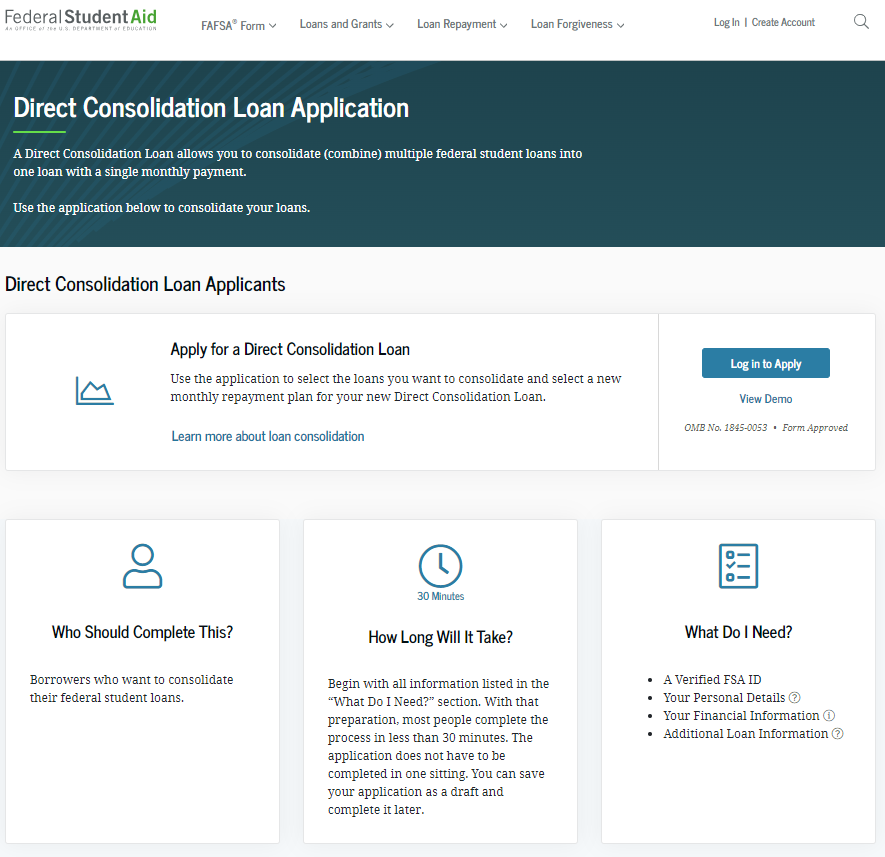

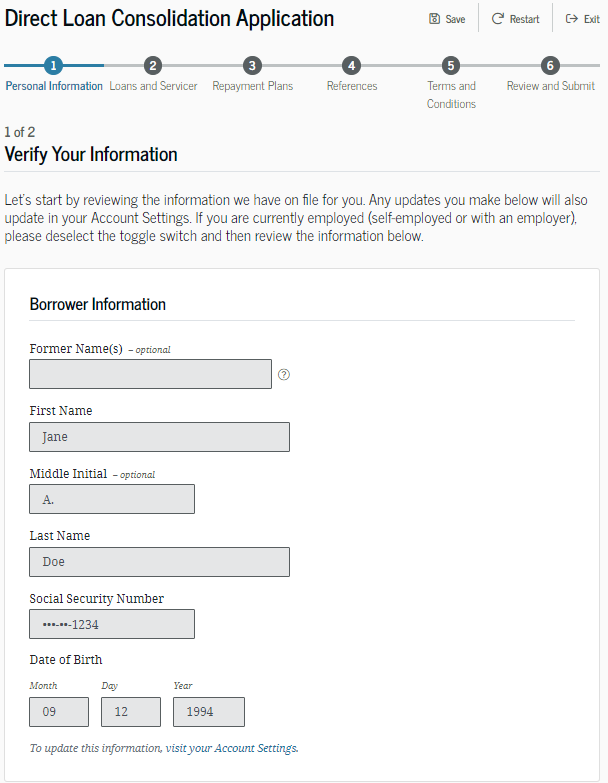

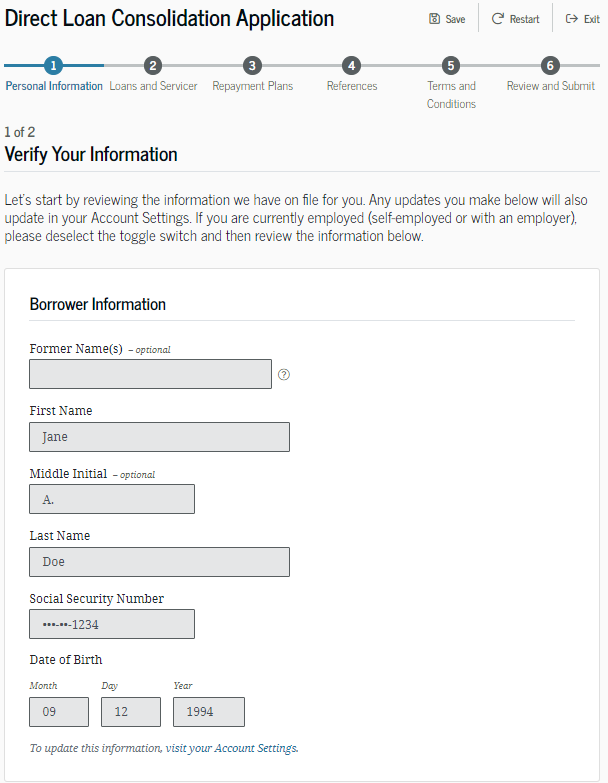

To initiate the consolidation application, go to the Direct Loan Consolidation Application.

Log in using your FSA ID. If you don’t have an FSA ID, follow the prompt to “Create an Account.”

To initiate the consolidation application, go to the Direct Loan Consolidation Application.

Log in using your FSA ID. If you don’t have an FSA ID, follow the prompt to “Create an Account.”

Verify your personal information for accuracy. If any updates are needed, click the hyperlink at the bottom labeled “visit your Account Settings” to make the necessary changes.

Verify your personal information for accuracy. If any updates are needed, click the hyperlink at the bottom labeled “visit your Account Settings” to make the necessary changes.

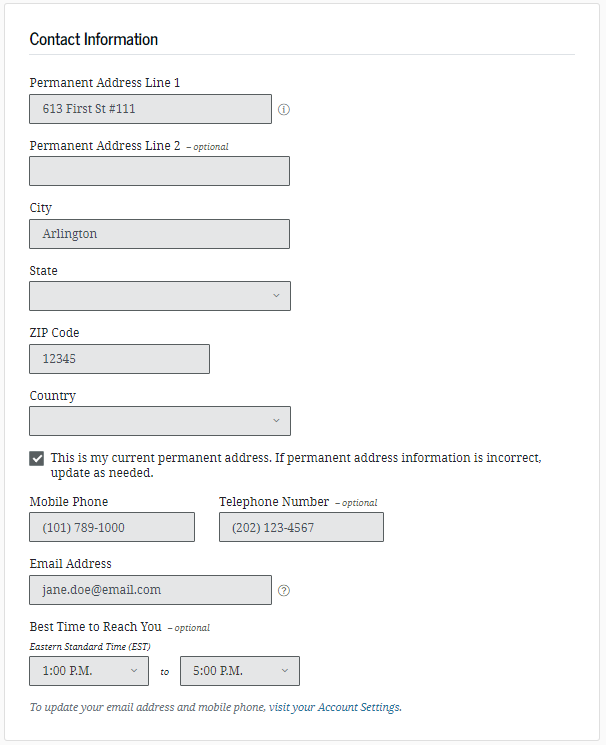

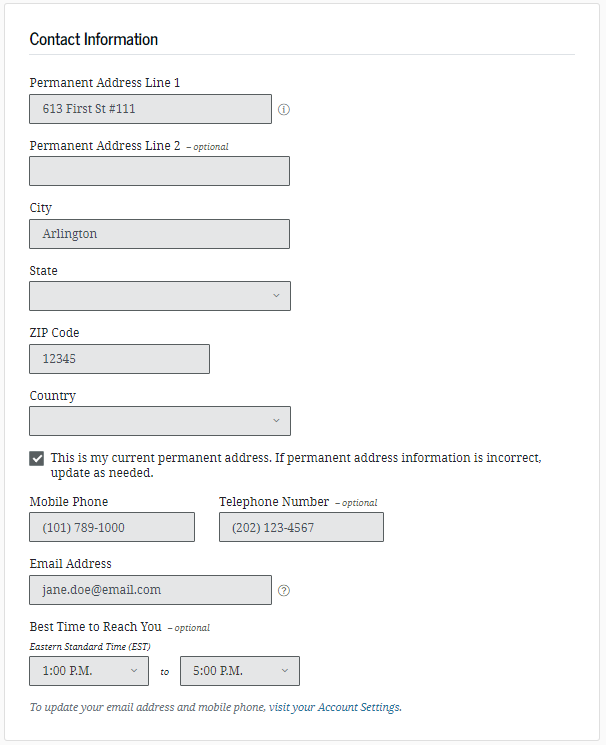

Verify your contact information for accuracy.

If updates are needed, click the hyperlink at the bottom labeled “visit your Account Settings” to make necessary changes.

Keeping your contact information, including address and email, up to date is crucial.

Update your details during transitions from medical school to training and training to fellowship.

Staying informed about your student loans is essential for effective planning.

Any updates regarding your student loans will be communicated through email and, if necessary, mail.

Ensure this information is current to stay well-informed.

Verify your contact information for accuracy.

If updates are needed, click the hyperlink at the bottom labeled “visit your Account Settings” to make necessary changes.

Keeping your contact information, including address and email, up to date is crucial.

Update your details during transitions from medical school to training and training to fellowship.

Staying informed about your student loans is essential for effective planning.

Any updates regarding your student loans will be communicated through email and, if necessary, mail.

Ensure this information is current to stay well-informed.

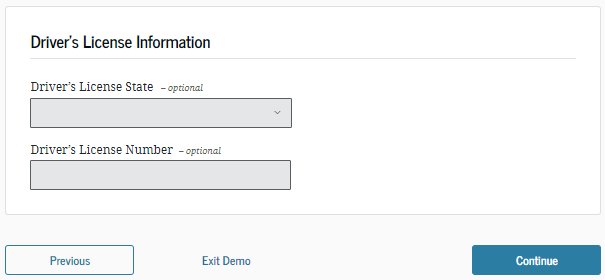

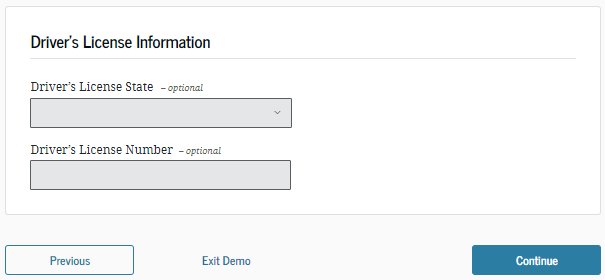

This section is optional, and you may enter your Driver’s License Information as you see fit.

This section is optional, and you may enter your Driver’s License Information as you see fit.

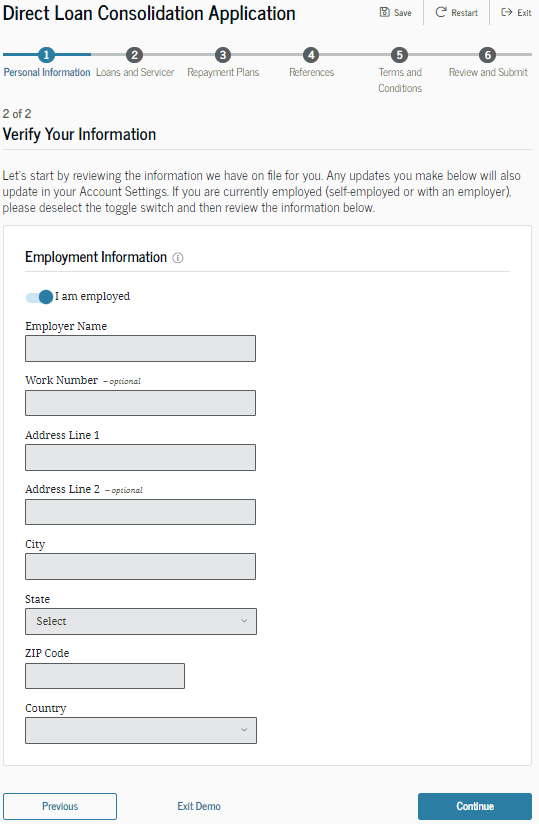

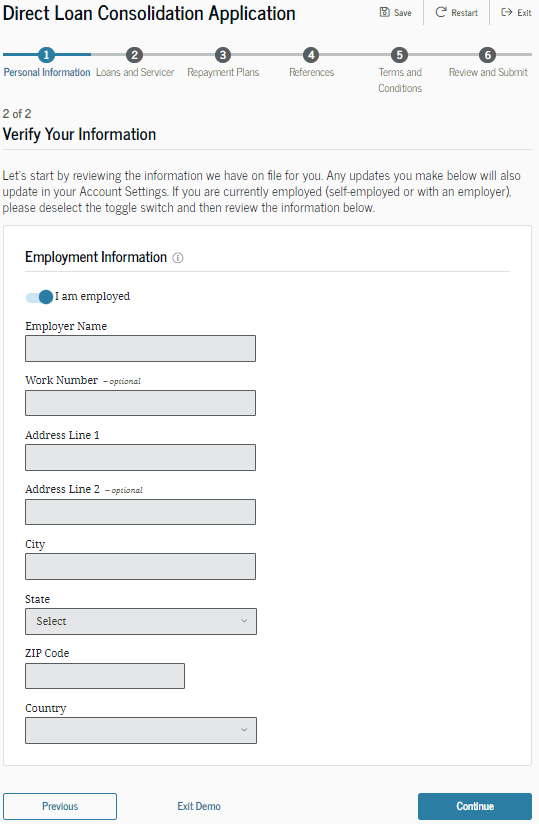

Complete this section by entering your employer information.

If you’ve recently graduated from medical school, your employer will be your residency program.

Complete this section by entering your employer information.

If you’ve recently graduated from medical school, your employer will be your residency program.

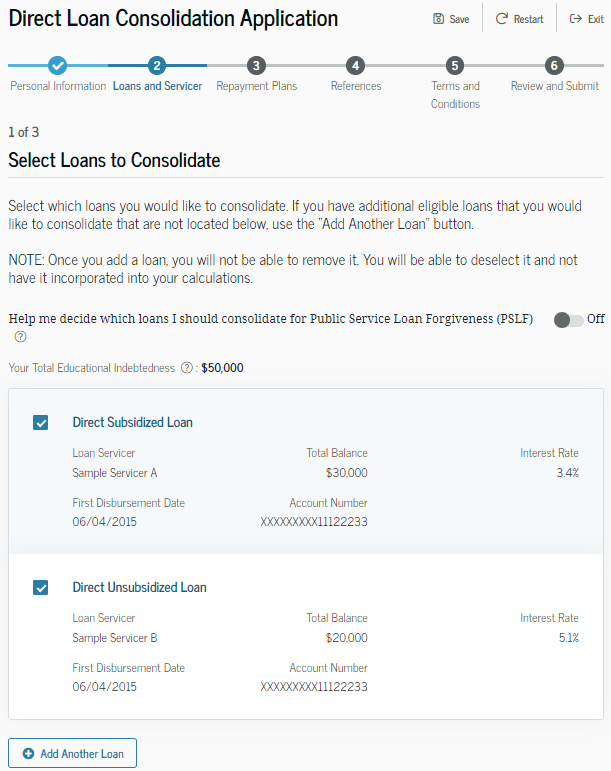

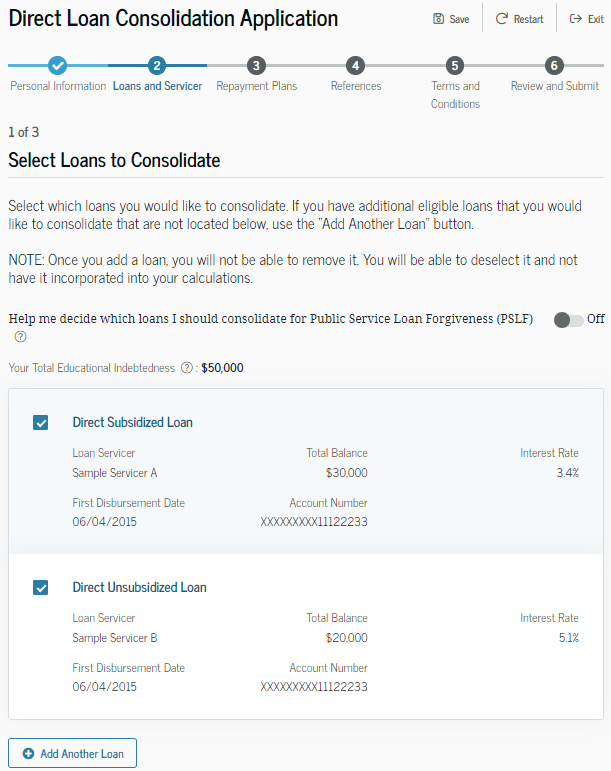

This is an important section that requires attention.

Here, you will select the loans you want to consolidate.

Remember, consolidation combines loans with different interest rates into one loan with a single average interest rate.

For most physicians, including all your student loans in the consolidation is recommended.

If there are specific loans you wish to exclude, leave them unchecked.

Ensure that all your student loans intended for consolidation are selected.

Double-check to avoid unintentionally excluding any loans.

This is an important section that requires attention.

Here, you will select the loans you want to consolidate.

Remember, consolidation combines loans with different interest rates into one loan with a single average interest rate.

For most physicians, including all your student loans in the consolidation is recommended.

If there are specific loans you wish to exclude, leave them unchecked.

Ensure that all your student loans intended for consolidation are selected.

Double-check to avoid unintentionally excluding any loans.

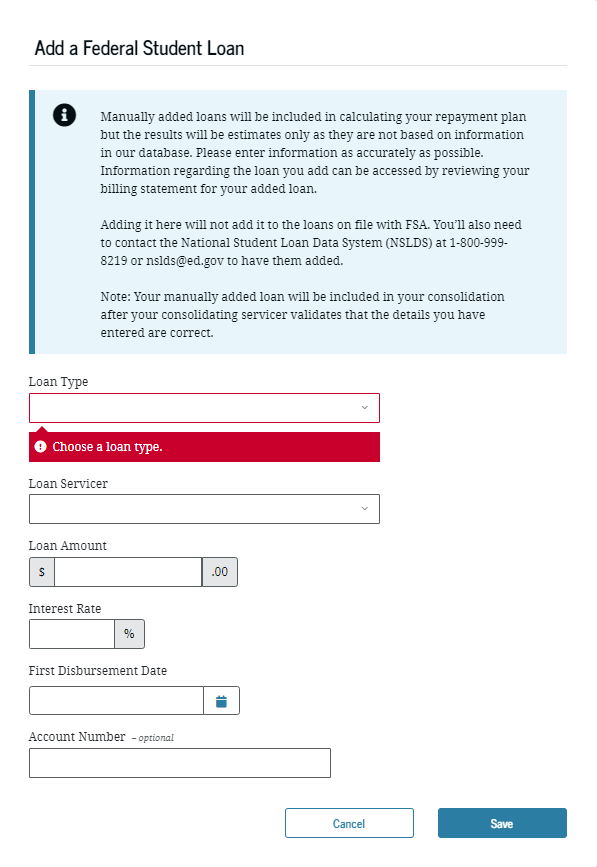

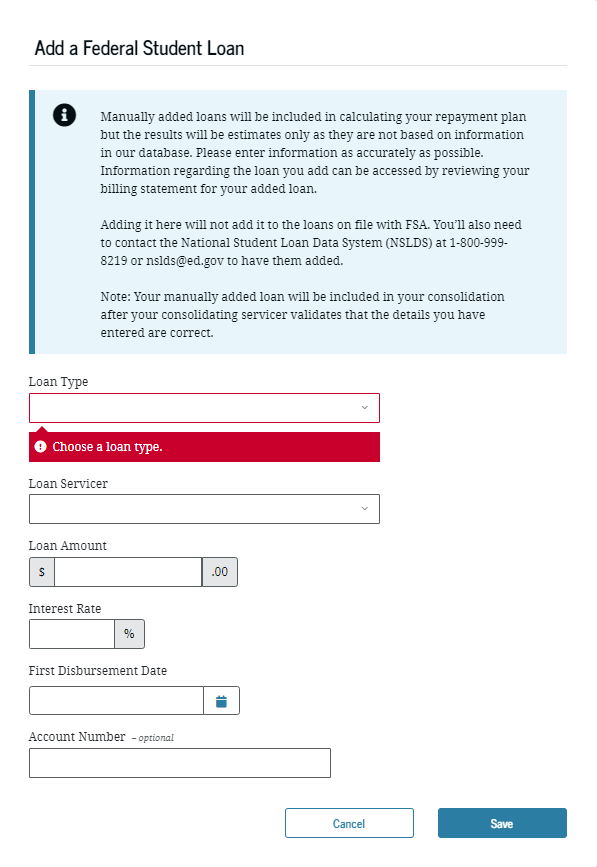

In case a loan was inadvertently excluded from the consolidation selection, you can manually add it in this section.

Provide the necessary details as accurately as possible.

Remember, private student loans cannot be consolidated with federal student loans in this process.

Only federal student loans are eligible for consolidation.

If you have private student loans, you might want to explore refinancing options for a potentially lower interest rate and student loan payment, but that is not part of this consolidation process.

In case a loan was inadvertently excluded from the consolidation selection, you can manually add it in this section.

Provide the necessary details as accurately as possible.

Remember, private student loans cannot be consolidated with federal student loans in this process.

Only federal student loans are eligible for consolidation.

If you have private student loans, you might want to explore refinancing options for a potentially lower interest rate and student loan payment, but that is not part of this consolidation process.

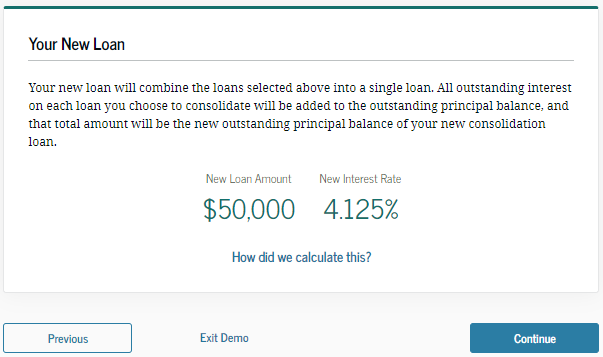

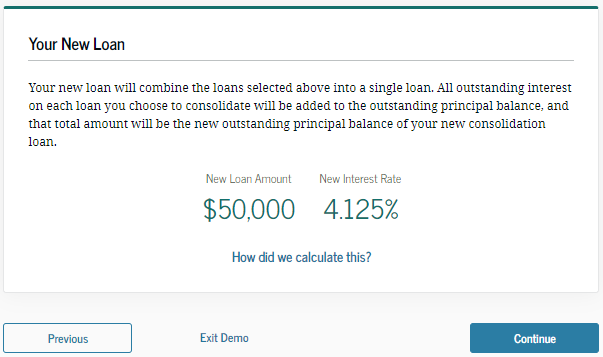

In this screen, you will see your new loan amount and interest rate.

Note, when you consolidate, your interest rate will be slightly higher than keeping each loan unconsolidated.

This is because your average interest rate is rounded up to the nearest one-eighth of one percent.

In this screen, you will see your new loan amount and interest rate.

Note, when you consolidate, your interest rate will be slightly higher than keeping each loan unconsolidated.

This is because your average interest rate is rounded up to the nearest one-eighth of one percent.

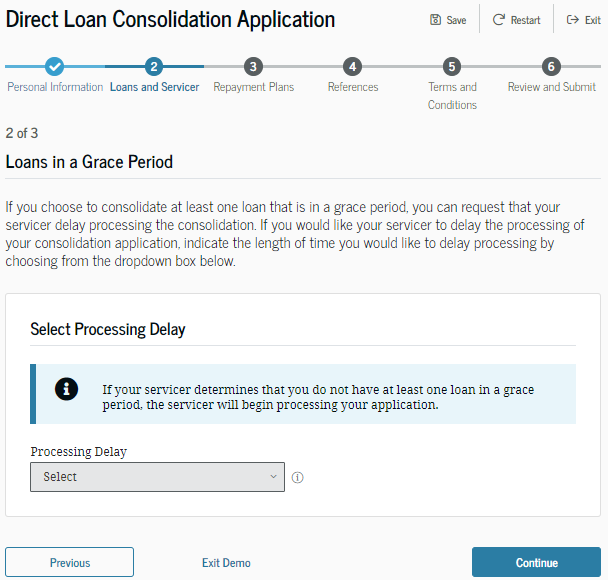

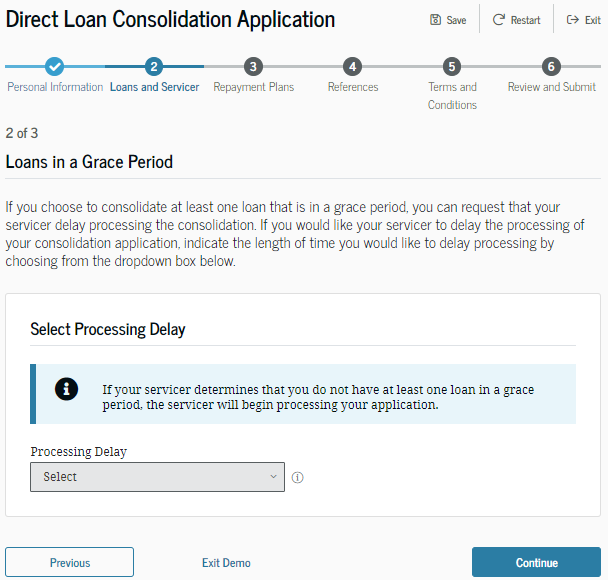

If you are a recent medical school grad, during medical school, your student loans were in a status called “In School” status.

Very shortly after graduation, your loans will flip into an “In Grace Period” status.

This is a 6-month period where you still are not required to make any payments on your student loans.

In this step, you get the opportunity to delay processing until closer to the end of your 6-month grace period.

However, for almost every physician consolidating their student loans, it is advised to select “Do Not Delay” processing.

If you are a recent medical school grad, during medical school, your student loans were in a status called “In School” status.

Very shortly after graduation, your loans will flip into an “In Grace Period” status.

This is a 6-month period where you still are not required to make any payments on your student loans.

In this step, you get the opportunity to delay processing until closer to the end of your 6-month grace period.

However, for almost every physician consolidating their student loans, it is advised to select “Do Not Delay” processing.

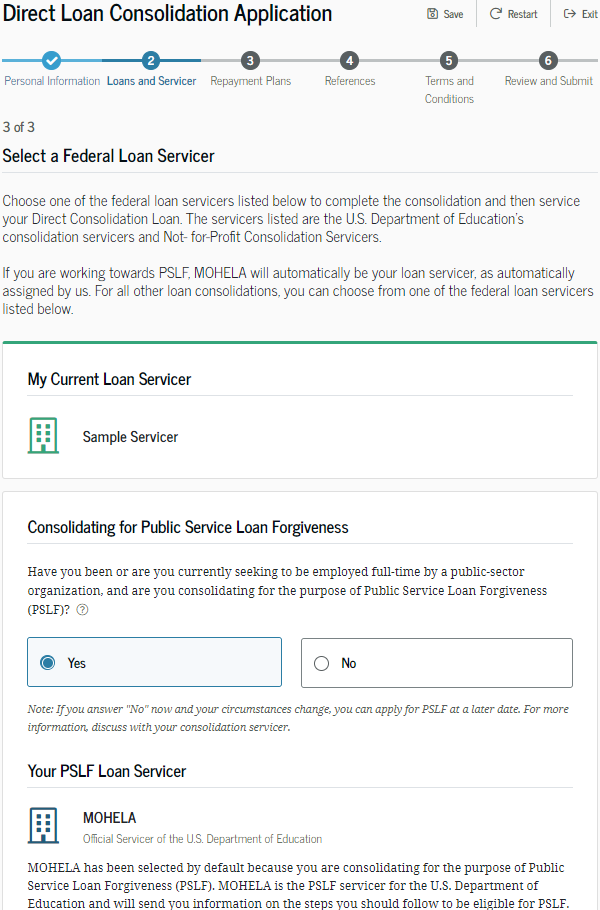

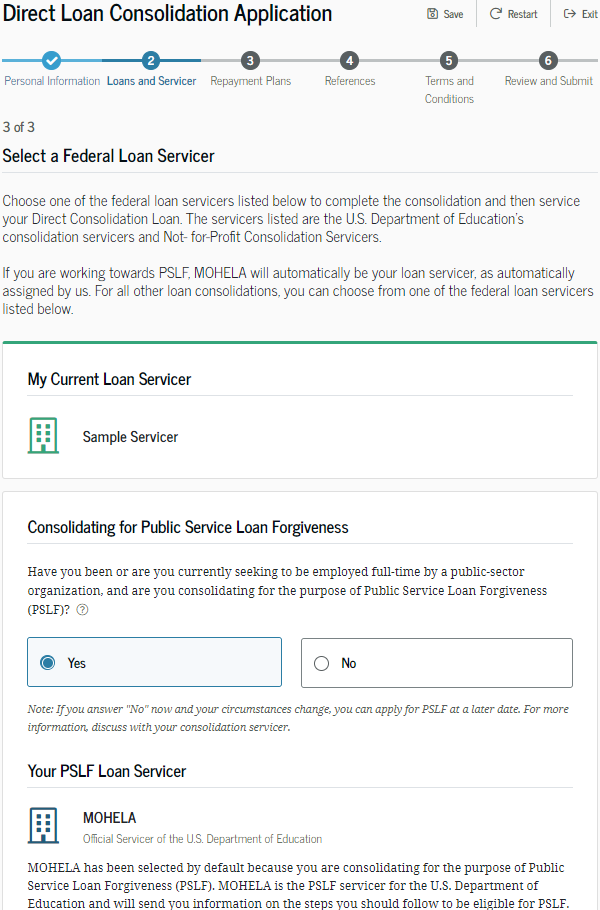

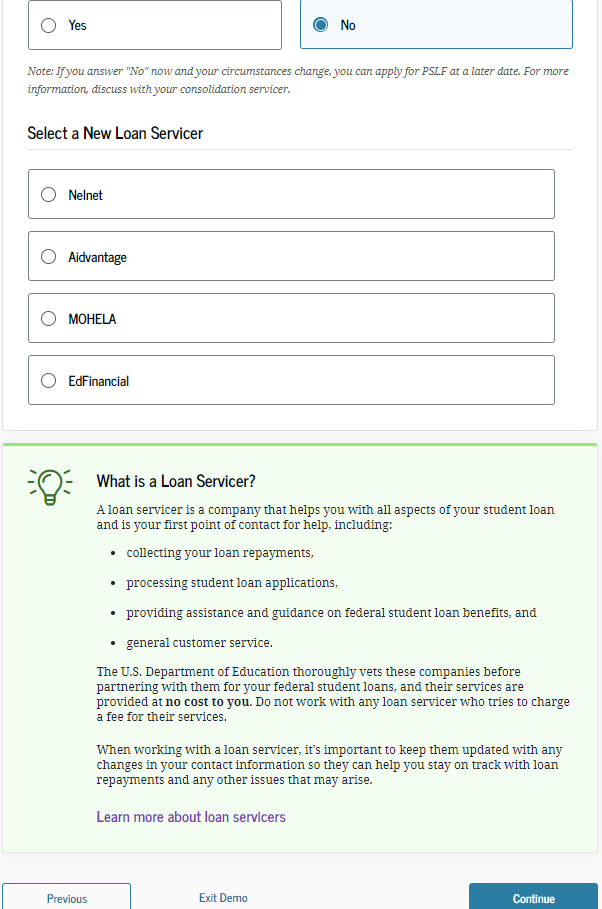

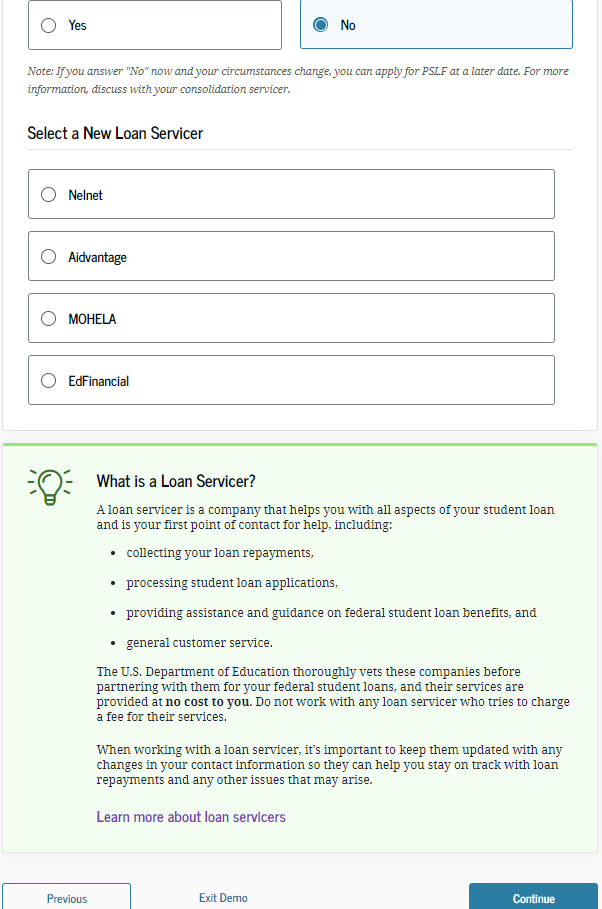

For many of you, it is early in your medical journey, and you may not have a sense of what type of hospital you will work at post-training.

Depending on the track you end up on, you may be working for a non-profit, 501(c)(3), or a for-profit hospital.

Regardless of which route you choose, almost everyone in residency is part of a non-profit 501(c)(3).

This means you are eligible for Public Service Loan Forgiveness (PSLF).

You can always apply for PSLF at any point in the future.

However, if you are 100% positive or there is any chance you may work for a non-profit, 501(c)(3), select “Yes” for the consolidation’s purposes of PSLF. You are not required to end up pursuing PSLF.

When you do so, your loan servicer will automatically default to Mohela. They are the student loan servicer that handles all PSLF student loans.

For many of you, it is early in your medical journey, and you may not have a sense of what type of hospital you will work at post-training.

Depending on the track you end up on, you may be working for a non-profit, 501(c)(3), or a for-profit hospital.

Regardless of which route you choose, almost everyone in residency is part of a non-profit 501(c)(3).

This means you are eligible for Public Service Loan Forgiveness (PSLF).

You can always apply for PSLF at any point in the future.

However, if you are 100% positive or there is any chance you may work for a non-profit, 501(c)(3), select “Yes” for the consolidation’s purposes of PSLF. You are not required to end up pursuing PSLF.

When you do so, your loan servicer will automatically default to Mohela. They are the student loan servicer that handles all PSLF student loans.

If you are certain that you will not be working for a non-profit 501(c)(3), it doesn’t really matter which student loan servicer you choose.

They are all quite comparable.

With all the changes in student loans over the last couple of years, each servicer has its strengths and weaknesses, but they are all more or less the same.

While each servicer functions similarly, if this decision is important to you, it is recommended that you conduct your own research.

If you are certain that you will not be working for a non-profit 501(c)(3), it doesn’t really matter which student loan servicer you choose.

They are all quite comparable.

With all the changes in student loans over the last couple of years, each servicer has its strengths and weaknesses, but they are all more or less the same.

While each servicer functions similarly, if this decision is important to you, it is recommended that you conduct your own research.

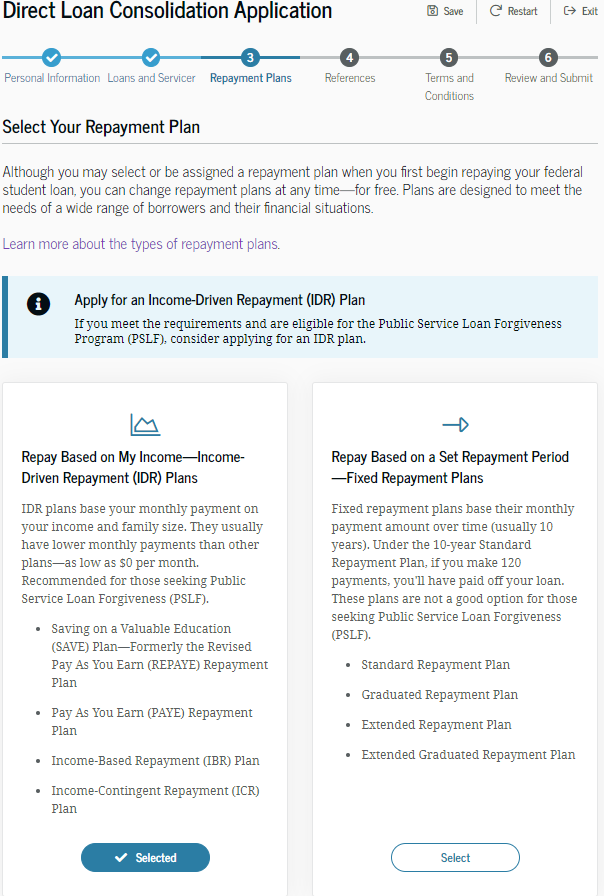

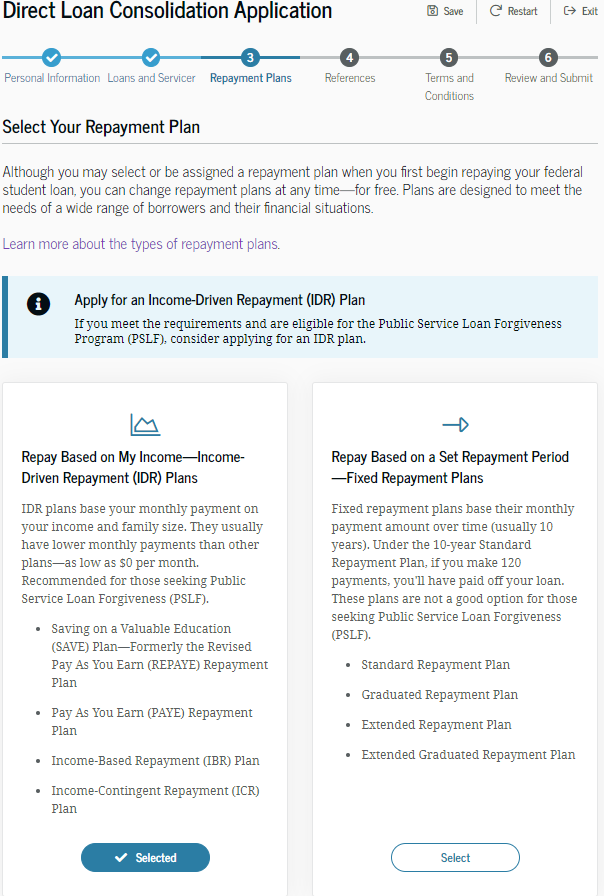

This step in student loans often causes significant stress for physicians.

Here, you will select your repayment plan.

Nearly every physician will find value in opting for an income-driven repayment plan during their training, as it offers the lowest possible payment.

The specific income-driven repayment plan will be chosen in a subsequent step.

This step in student loans often causes significant stress for physicians.

Here, you will select your repayment plan.

Nearly every physician will find value in opting for an income-driven repayment plan during their training, as it offers the lowest possible payment.

The specific income-driven repayment plan will be chosen in a subsequent step.

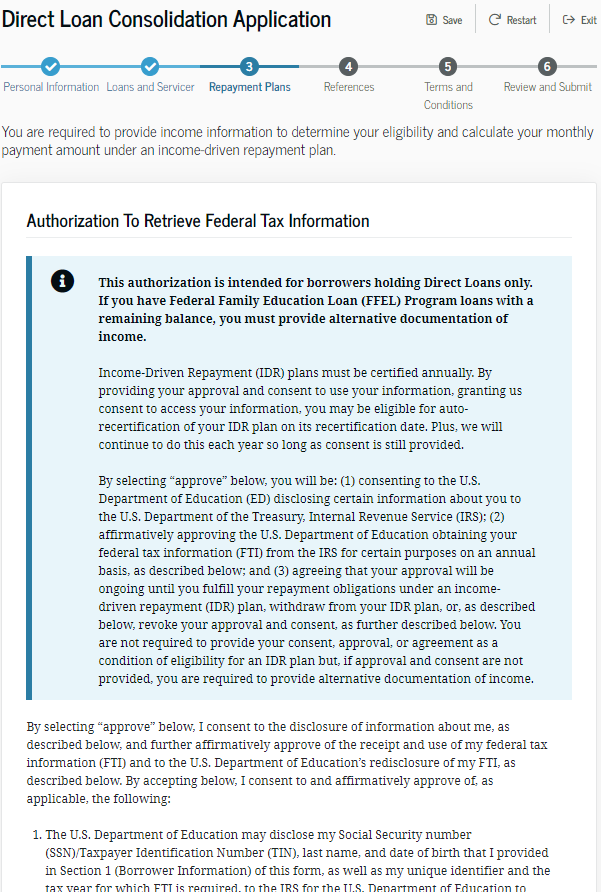

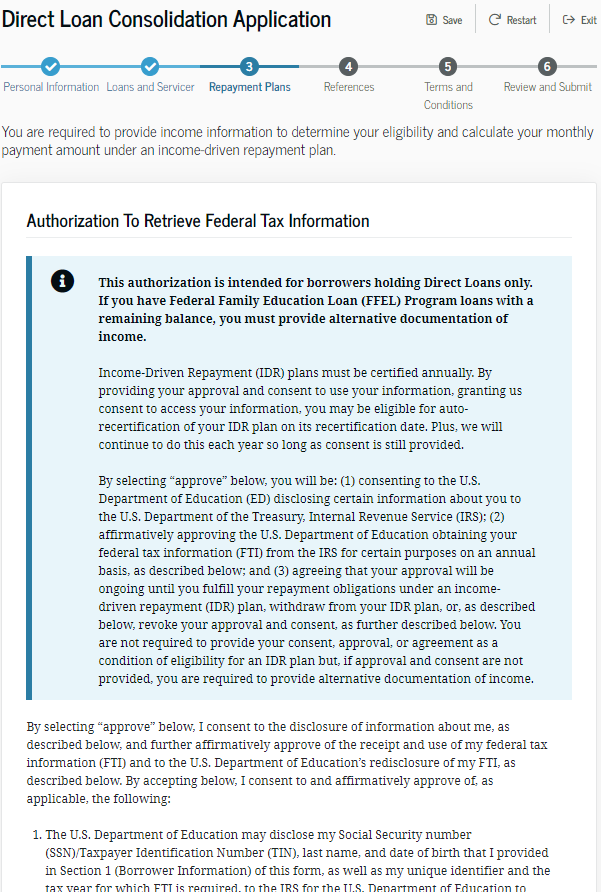

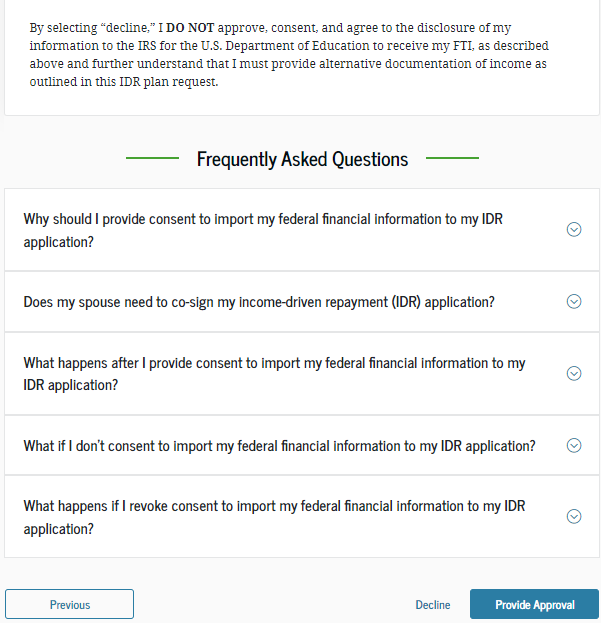

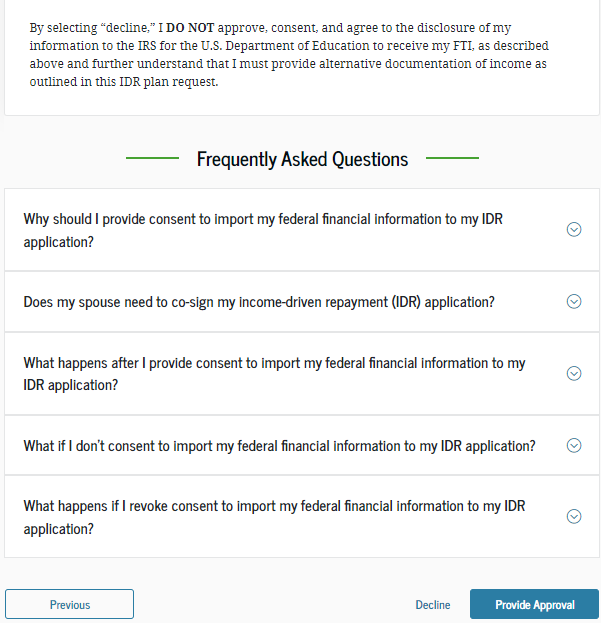

When enrolling in an Income-Driven Repayment plan, you must annually recertify your income, family size, and employment information on your IDR Anniversary date.

This step provides the option to link your Internal Revenue Service (IRS) data with the Department of Education.

Instead of manually submitting your income, family size, and employment information each year, this process calculates your monthly payment using your most recent tax return, offering a quick and easy recertification method.

Linking your information using the IRS Data Retrieval Tool is the easiest way for DIY student loan planning.

However, it might pose challenges if you are employing more advanced student loan planning techniques.

The IRS Data Retrieval Tool is a new process for recertifying your student loans, meaning there could be a chance for errors in calculating your payment.

Additionally, it may mislead you into recertifying your income, family size, and employment info earlier than your IDR Anniversary date.

This could result in you having to make drastically higher student loan payments.

If you do choose to link your IRS data, make sure you regularly log in to studentaid.gov to ensure your payments and loan values look correct.

When enrolling in an Income-Driven Repayment plan, you must annually recertify your income, family size, and employment information on your IDR Anniversary date.

This step provides the option to link your Internal Revenue Service (IRS) data with the Department of Education.

Instead of manually submitting your income, family size, and employment information each year, this process calculates your monthly payment using your most recent tax return, offering a quick and easy recertification method.

Linking your information using the IRS Data Retrieval Tool is the easiest way for DIY student loan planning.

However, it might pose challenges if you are employing more advanced student loan planning techniques.

The IRS Data Retrieval Tool is a new process for recertifying your student loans, meaning there could be a chance for errors in calculating your payment.

Additionally, it may mislead you into recertifying your income, family size, and employment info earlier than your IDR Anniversary date.

This could result in you having to make drastically higher student loan payments.

If you do choose to link your IRS data, make sure you regularly log in to studentaid.gov to ensure your payments and loan values look correct.

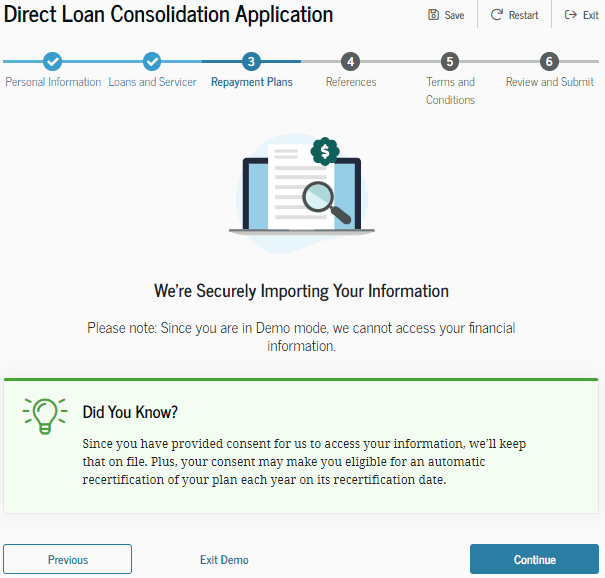

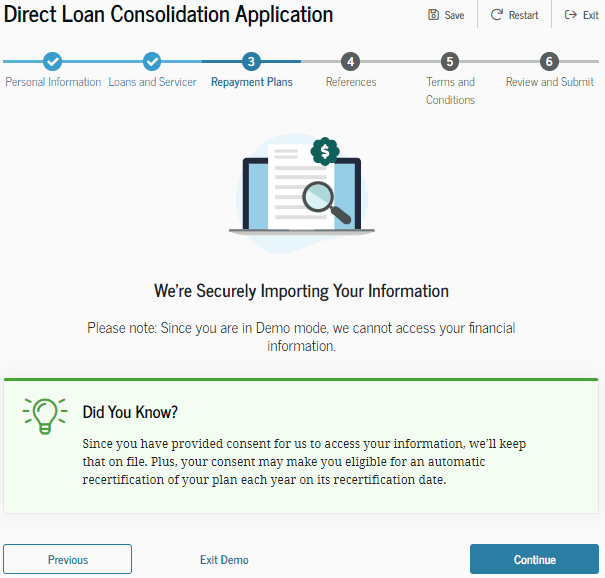

This is the step where you grant approval to link your IRS data with your Department of Education student loan information.

This is the step where you grant approval to link your IRS data with your Department of Education student loan information.

This is the step where you grant approval to link your IRS data with your Department of Education student loan information.

This is the step where you grant approval to link your IRS data with your Department of Education student loan information.

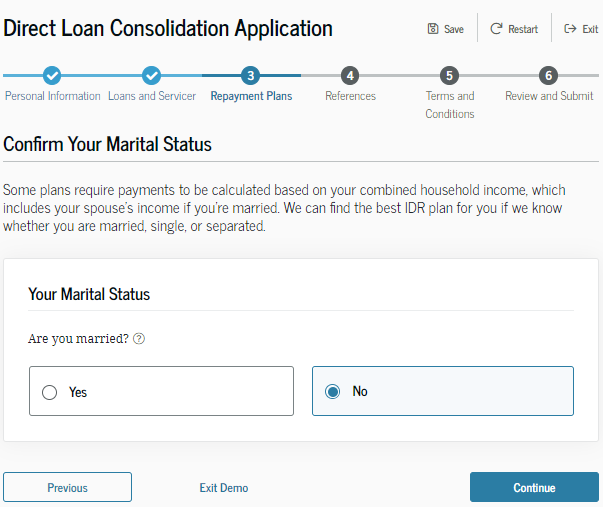

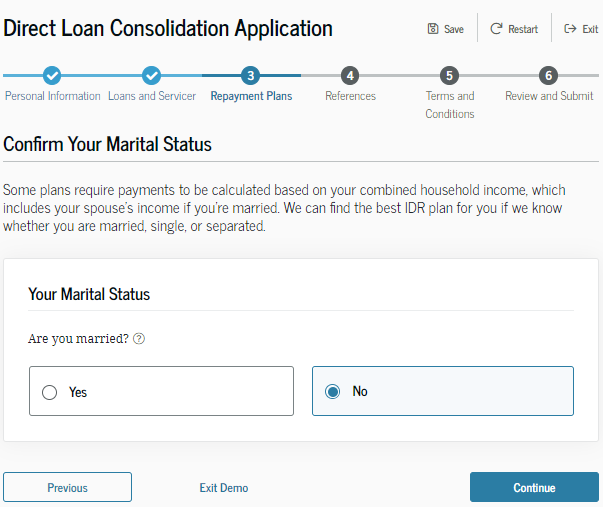

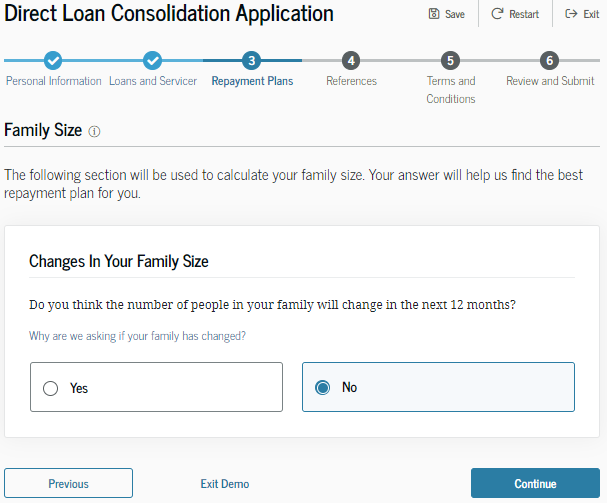

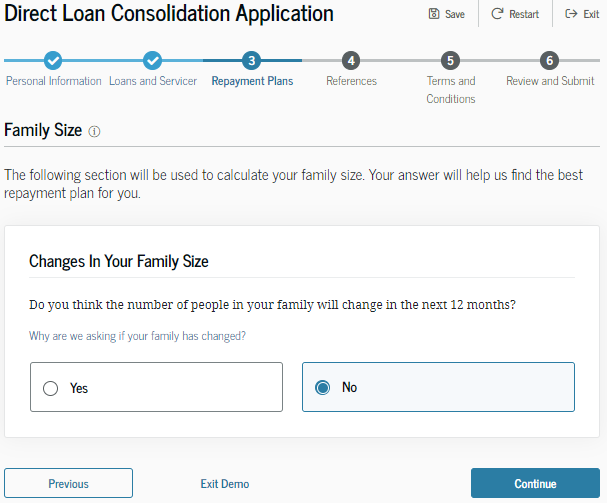

If you don’t believe your family size will change in the next 12 months, select “no.”

If you don’t believe your family size will change in the next 12 months, select “no.”

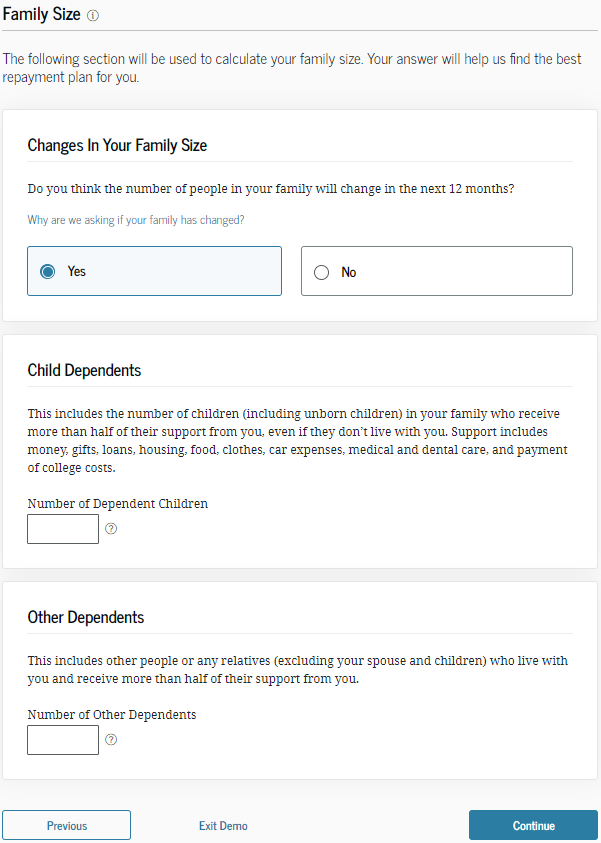

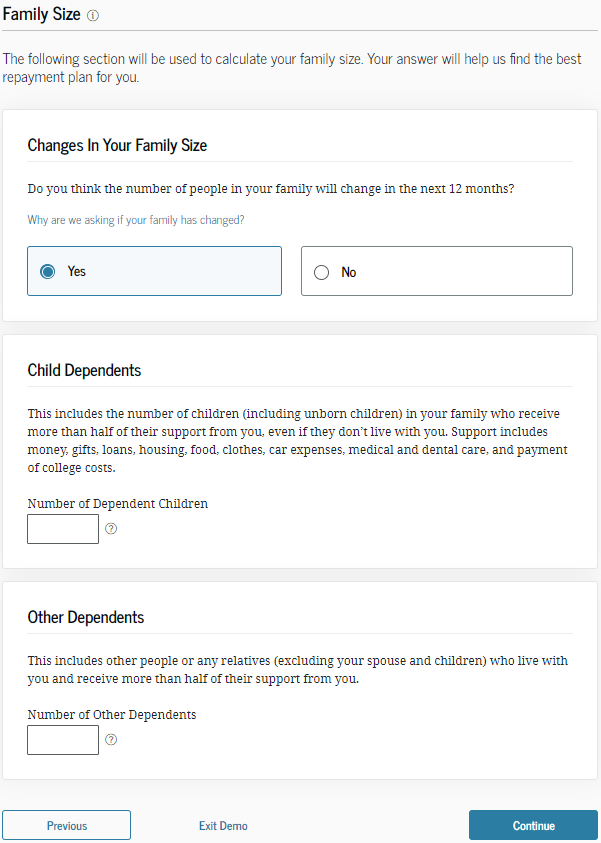

Remember, your Income-Driven Repayment plan payment is calculated based on your income and family size.

If your family size increases, it will lower your student loan payment.

If you believe your family size will change in the next 12 months, select “yes.”

Note, if you have an unborn child, they can be included in your student loan calculation.

Remember, your Income-Driven Repayment plan payment is calculated based on your income and family size.

If your family size increases, it will lower your student loan payment.

If you believe your family size will change in the next 12 months, select “yes.”

Note, if you have an unborn child, they can be included in your student loan calculation.

In this step, your information will be securely connected.

Be advised that you can revoke access to your IRS data at any point in the future.

Log in to your account, go to “Settings,” and under “Financial Information,” select the “Revoke Consent” button.

Type your name into the dialogue box to complete the process.

In this step, your information will be securely connected.

Be advised that you can revoke access to your IRS data at any point in the future.

Log in to your account, go to “Settings,” and under “Financial Information,” select the “Revoke Consent” button.

Type your name into the dialogue box to complete the process.

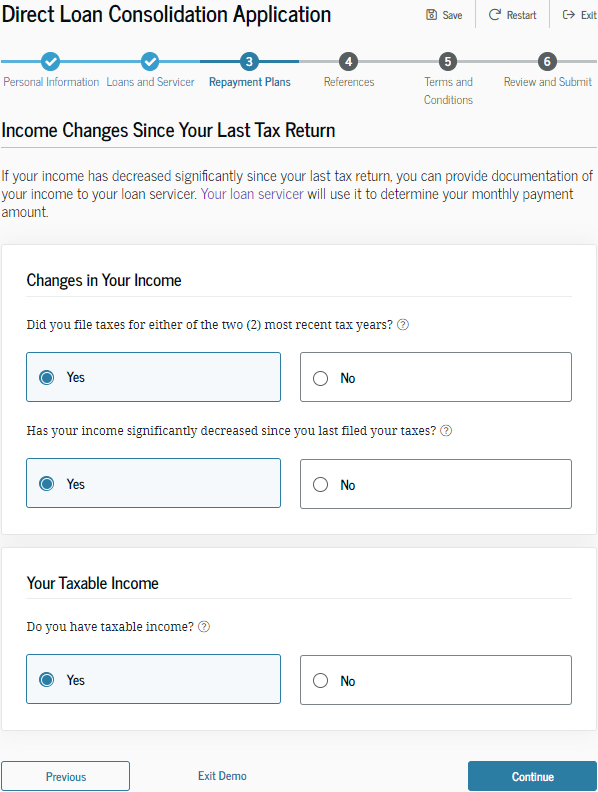

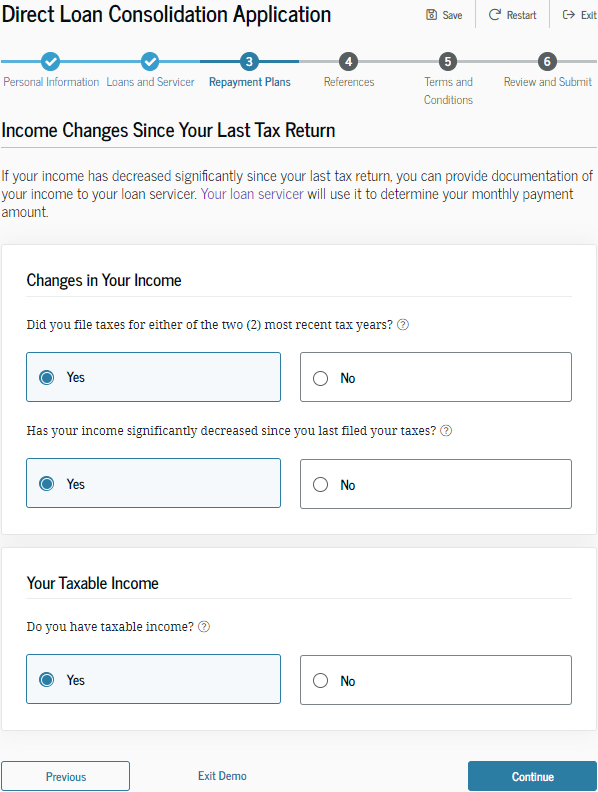

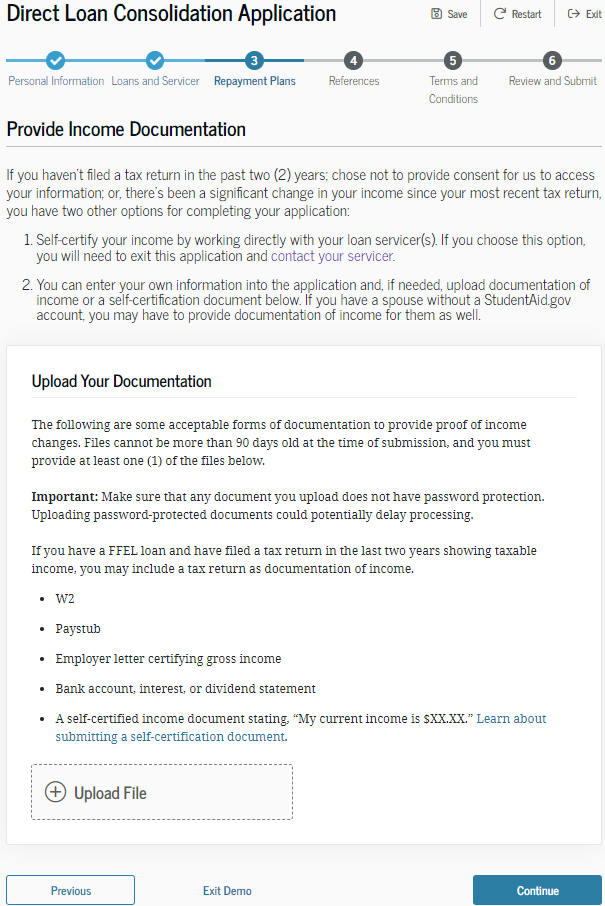

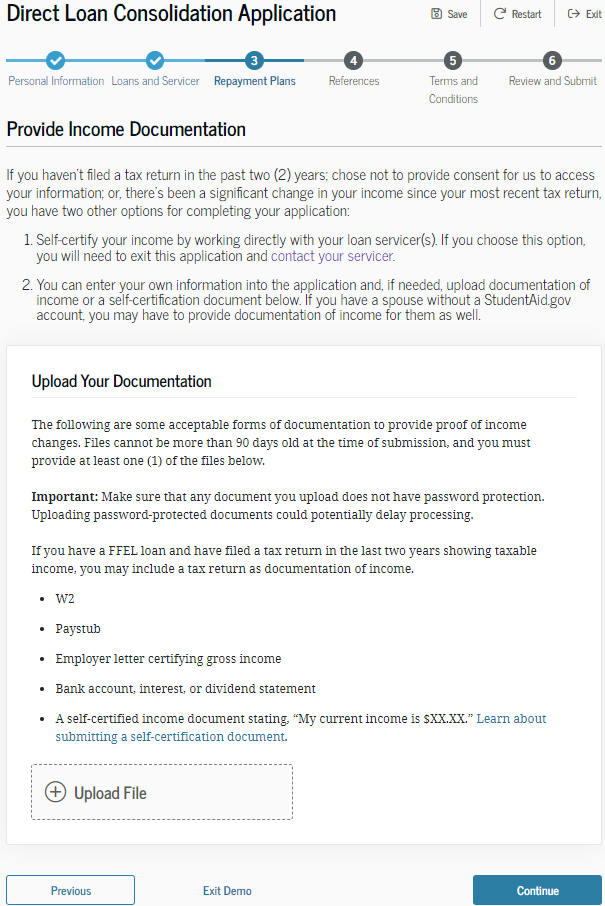

If your income has significantly decreased since your last tax return, you can provide documentation of your lower income to reduce your monthly student loan payment on an Income-Driven Repayment plan.

If your income has significantly decreased since your last tax return, you can provide documentation of your lower income to reduce your monthly student loan payment on an Income-Driven Repayment plan.

If you haven’t filed a tax return in the past two years or do not wish to provide consent for the Department of Education to link to your IRS data, you will need to manually submit documentation of your income.

If you have a tax return, you can submit it here.

Otherwise, the most common alternative documentation of income is your paystub.

If you haven’t filed a tax return in the past two years or do not wish to provide consent for the Department of Education to link to your IRS data, you will need to manually submit documentation of your income.

If you have a tax return, you can submit it here.

Otherwise, the most common alternative documentation of income is your paystub.

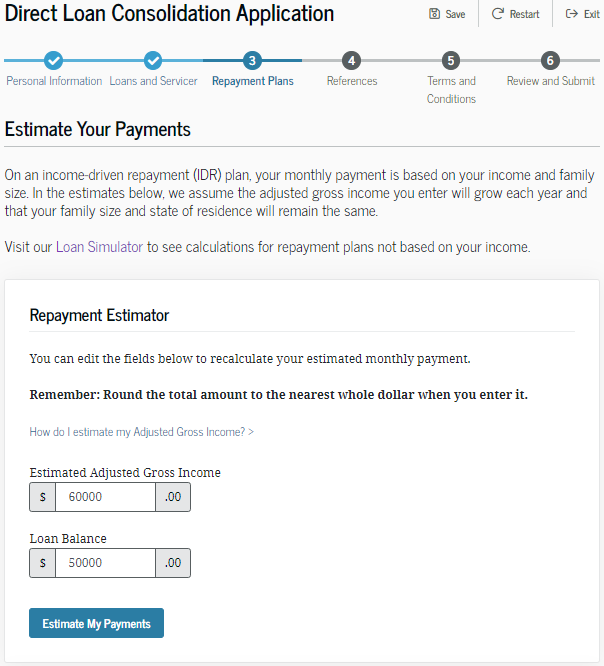

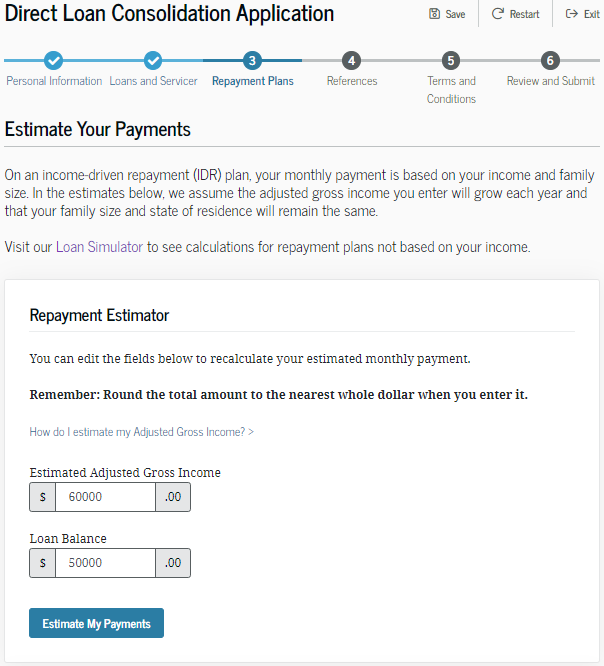

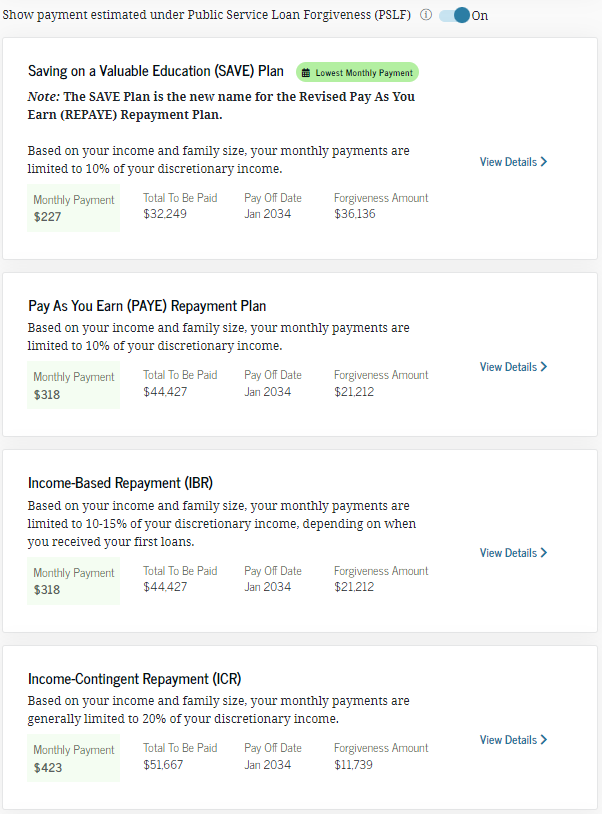

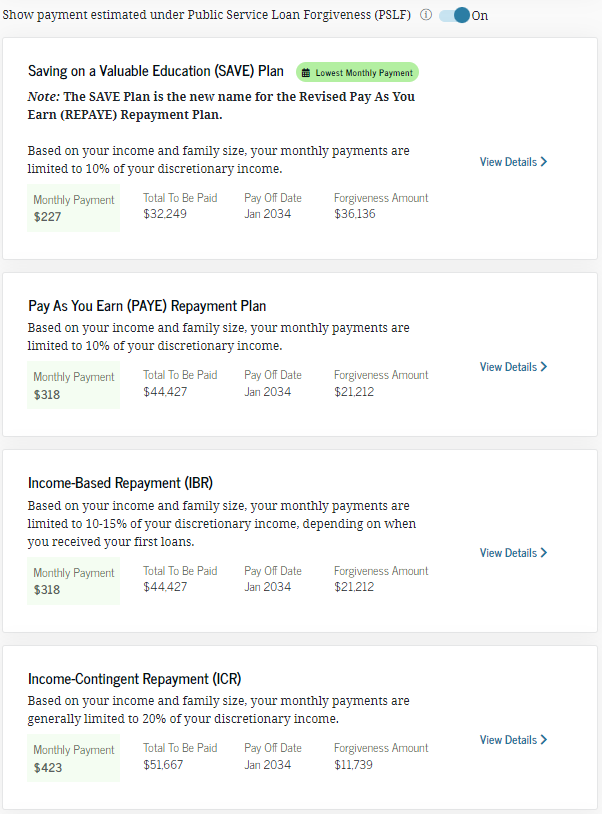

By default, you are enrolled in the Standard 10-Year Repayment plan.

This plan calculates your monthly student loan payment using your loan balance and interest rate, resulting in a substantial monthly payment.

In contrast, an Income-Driven Repayment plan calculates your monthly payment based on your income and family size.

There are three main repayment plans that early-career physicians consider:

Please note that if the information you entered is accurate, the next sections can be used to precisely calculate your next student loan payment.

However, as life changes and you graduate from training, and your income increases or decreases, this tool will not accurately determine which strategy is best for you.

For simplicity, SAVE will almost always allow you to have the lowest monthly payment during training.

By default, you are enrolled in the Standard 10-Year Repayment plan.

This plan calculates your monthly student loan payment using your loan balance and interest rate, resulting in a substantial monthly payment.

In contrast, an Income-Driven Repayment plan calculates your monthly payment based on your income and family size.

There are three main repayment plans that early-career physicians consider:

Please note that if the information you entered is accurate, the next sections can be used to precisely calculate your next student loan payment.

However, as life changes and you graduate from training, and your income increases or decreases, this tool will not accurately determine which strategy is best for you.

For simplicity, SAVE will almost always allow you to have the lowest monthly payment during training.

Here’s a general rule of thumb:

If you’re single or married filing separately, and your future income is expected to exceed $100,000 of your student loan balance, PAYE/IBR might be your best options due to their payment cap.

However, during training, everyone is likely to benefit from SAVE as it offers the lowest monthly payment.

Here’s a general rule of thumb:

If you’re single or married filing separately, and your future income is expected to exceed $100,000 of your student loan balance, PAYE/IBR might be your best options due to their payment cap.

However, during training, everyone is likely to benefit from SAVE as it offers the lowest monthly payment.

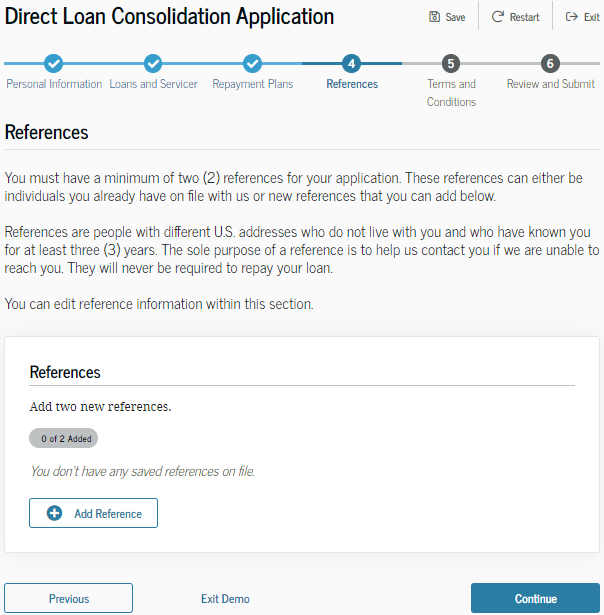

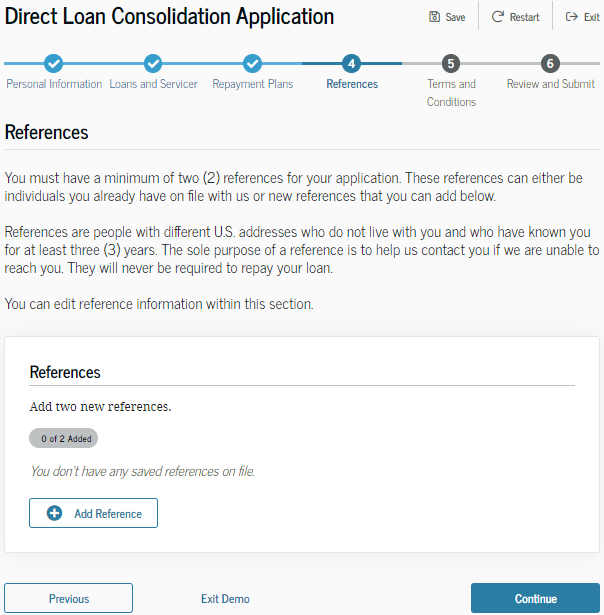

You are required to provide two references.

It’s important to note that these references will never be asked to repay your loans, and they are not cosigners.

The purpose of providing references is to assist the Department of Education in contacting you if they are unable to reach you directly.

You are required to provide two references.

It’s important to note that these references will never be asked to repay your loans, and they are not cosigners.

The purpose of providing references is to assist the Department of Education in contacting you if they are unable to reach you directly.

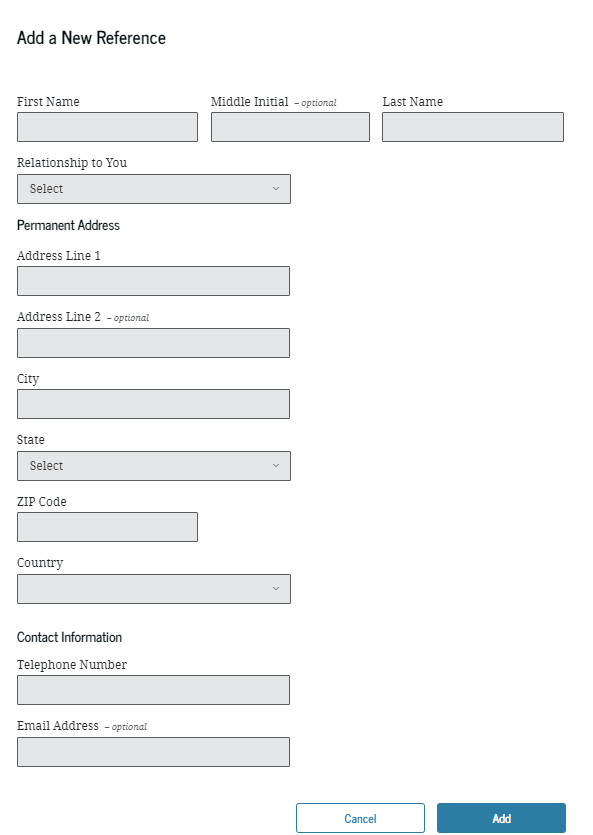

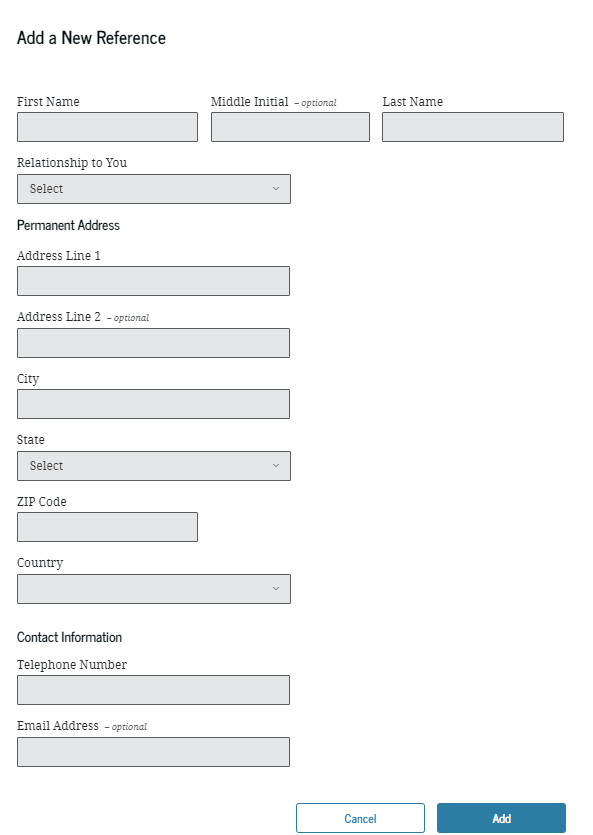

This is where you will add the contact information for a new reference.

This is where you will add the contact information for a new reference.

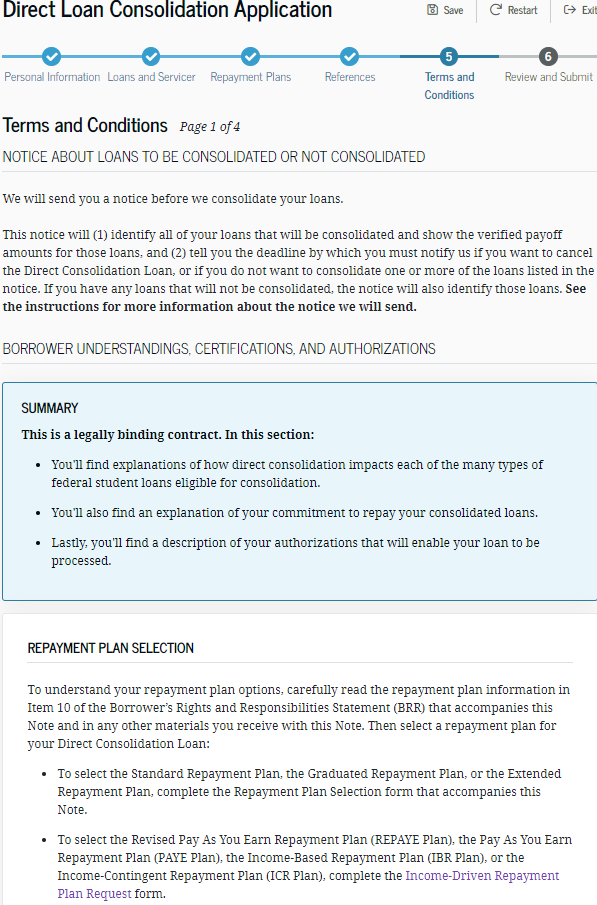

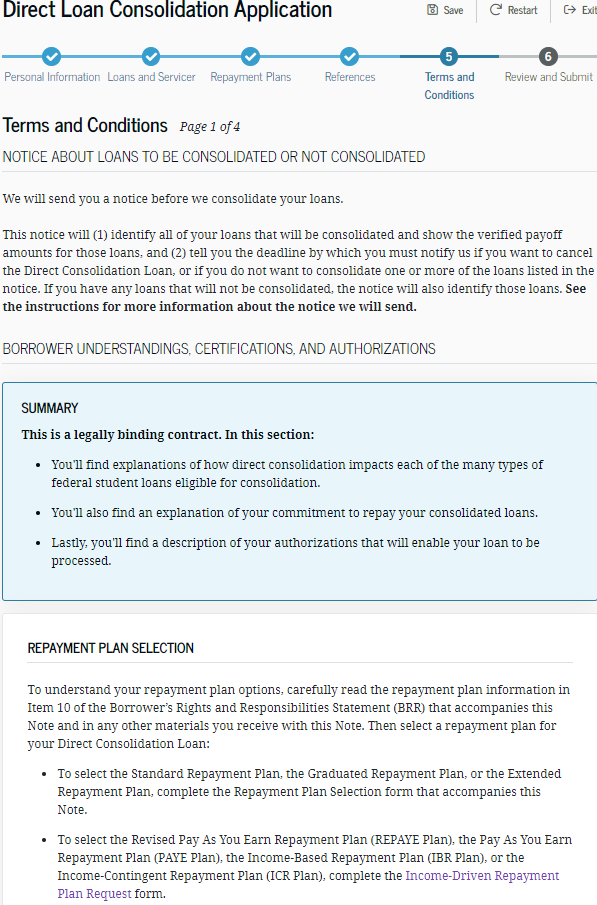

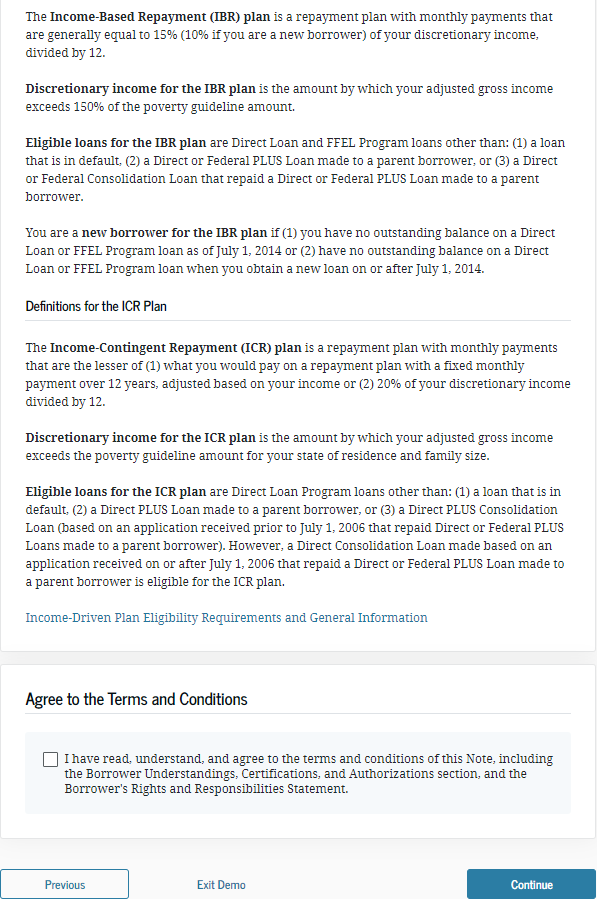

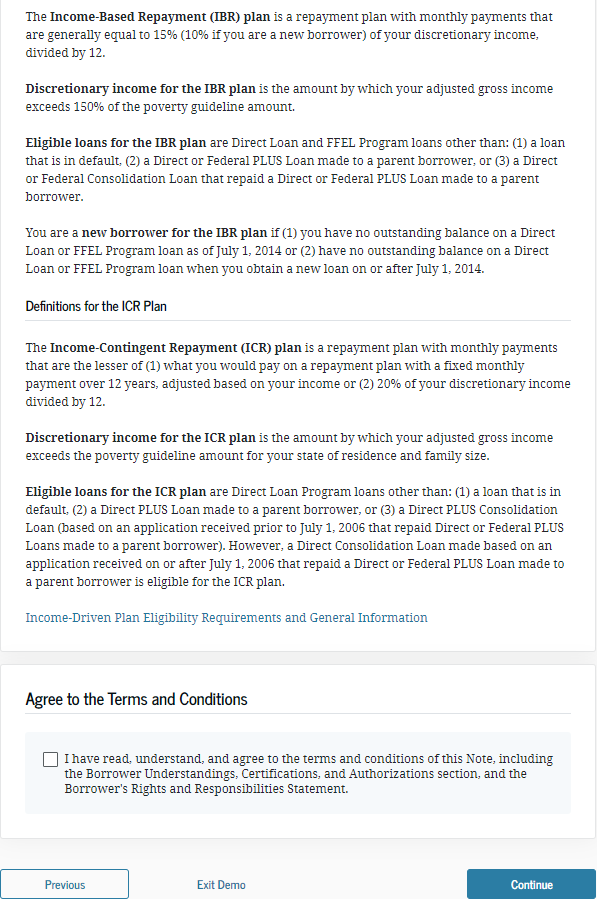

The challenging part is complete. Next, you will be prompted to review the terms and conditions.

The challenging part is complete. Next, you will be prompted to review the terms and conditions.

If you agree to the terms and conditions, go ahead and accept them.

If you agree to the terms and conditions, go ahead and accept them.

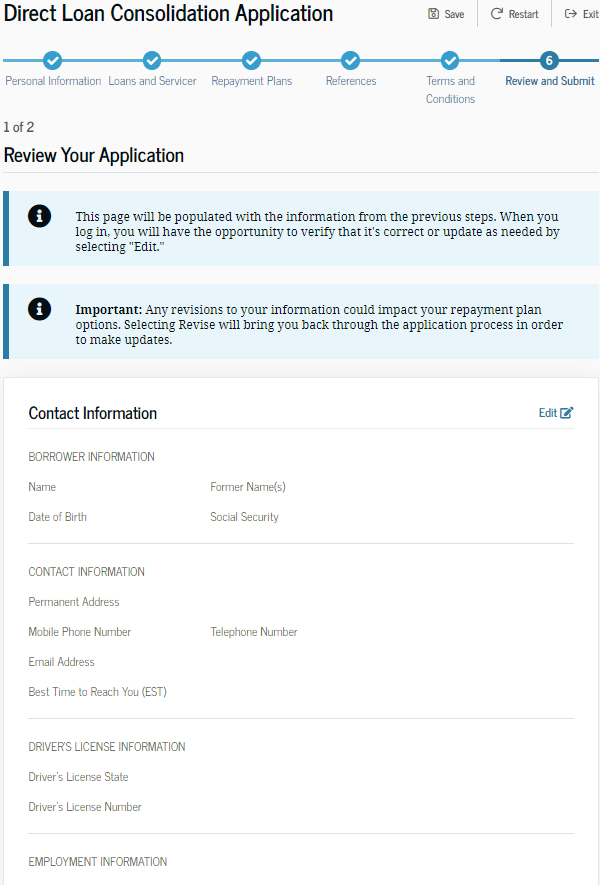

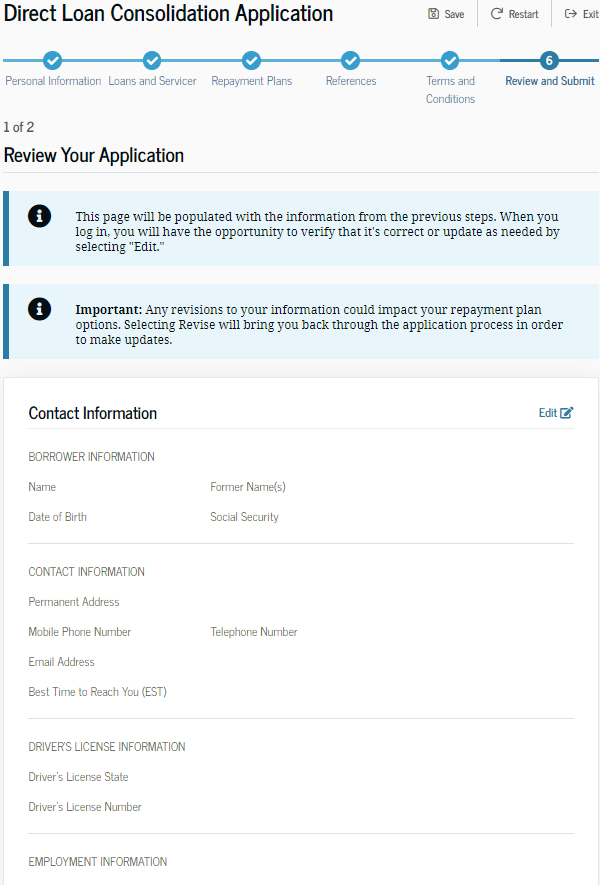

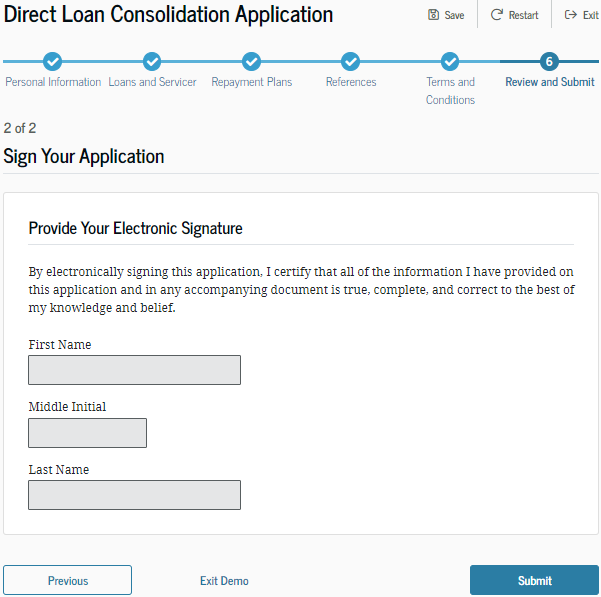

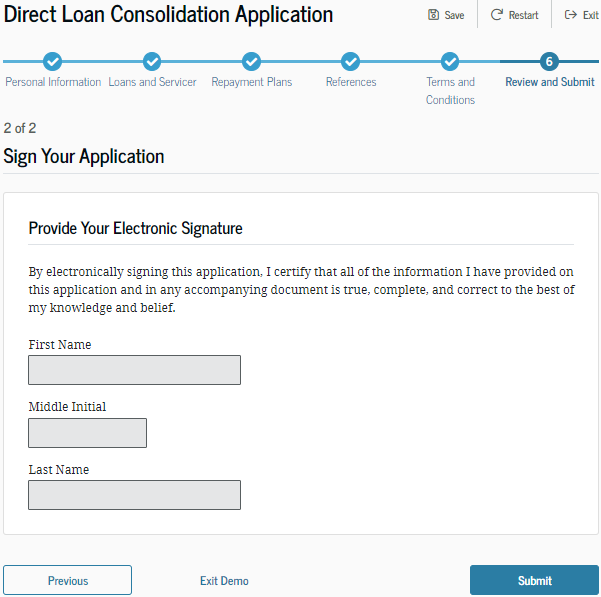

Review your application carefully and check for any inaccuracies.

If you find any, use the “Edit” function to correct the information.

Review your application carefully and check for any inaccuracies.

If you find any, use the “Edit” function to correct the information.

Complete the process by signing and submitting your application.

Keep in mind that the consolidation process can take 60-90 days, occasionally longer. Be patient but ensure you regularly check for updates.

It is highly encouraged to create a folder or system to track everything related to your student loans.

Include any PDFs, documentation, or communications with studentaid.gov or your servicer, noting the time, date, and what was addressed.

The Department of Education has been notoriously inefficient, so diligently tracking every part of the process empowers you.

Complete the process by signing and submitting your application.

Keep in mind that the consolidation process can take 60-90 days, occasionally longer. Be patient but ensure you regularly check for updates.

It is highly encouraged to create a folder or system to track everything related to your student loans.

Include any PDFs, documentation, or communications with studentaid.gov or your servicer, noting the time, date, and what was addressed.

The Department of Education has been notoriously inefficient, so diligently tracking every part of the process empowers you.

Final Thoughts

Loan consolidation can be a powerful step, or a costly misstep, depending on your situation.

For most MS4s and new residents, it’s a key part of setting yourself up for forgiveness and minimizing early-career payments. But if you’ve made PSLF-eligible payments in the past, it’s worth a second look.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Final Thoughts

Loan consolidation can be a powerful step, or a costly misstep, depending on your situation.

For most MS4s and new residents, it’s a key part of setting yourself up for forgiveness and minimizing early-career payments. But if you’ve made PSLF-eligible payments in the past, it’s worth a second look.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.