Introduction

Are the election results not quite what you were hoping for?

Sitting there staring at a mountain of federal student loans and wondering if maybe…just maybe…leaving the country is the answer?

Hey, I say, go for it!

(Alright, alright, mostly joking here.) But in all seriousness, if you’ve been toying with the idea of moving abroad for a while, your student loans don’t have to be the anchor keeping you stateside.

Believe it or not, a move overseas could actually open the door to dramatically lower loan payments, or even get those hefty loans completely forgiven down the line.

Let’s dive into how this works, and maybe, just maybe, you’ll find yourself packing your bags.

Introduction

Are the election results not quite what you were hoping for?

Sitting there staring at a mountain of federal student loans and wondering if maybe…just maybe…leaving the country is the answer?

Hey, I say, go for it!

(Alright, alright, mostly joking here.) But in all seriousness, if you’ve been toying with the idea of moving abroad for a while, your student loans don’t have to be the anchor keeping you stateside.

Believe it or not, a move overseas could actually open the door to dramatically lower loan payments, or even get those hefty loans completely forgiven down the line.

Let’s dive into how this works, and maybe, just maybe, you’ll find yourself packing your bags.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

What is the Foreign Earned Income Exclusion?

The Foreign Earned Income Exclusion (FEIE) is a tax benefit for U.S. citizens and resident aliens who earn income while living and working abroad.

In 2024, the FEIE allows individuals to exclude up to $126,500 of foreign-earned income from their U.S. taxable income.

If you’re married and both of you meet the requirements, that exclusion doubles to $253,000, providing substantial tax relief.

Who Qualifies for the Foreign Earned Income Exclusion?

To qualify, you must:

-

-

Have a foreign tax home,

-

Earn income abroad, and

-

Meet either the Bona Fide Residence Test or the Physical Presence Test.

-

Let’s break those down further:

-

-

Bona Fide Residence Test: You must live in a foreign country for an uninterrupted period that includes a full tax year.

-

Physical Presence Test: You must be physically present in a foreign country for at least 330 full days during any consecutive 12-month period.

-

What is the Foreign Earned Income Exclusion?

The Foreign Earned Income Exclusion (FEIE) is a tax benefit for U.S. citizens and resident aliens who earn income while living and working abroad.

In 2024, the FEIE allows individuals to exclude up to $126,500 of foreign-earned income from their U.S. taxable income.

If you’re married and both of you meet the requirements, that exclusion doubles to $253,000, providing substantial tax relief.

Who Qualifies for the Foreign Earned Income Exclusion?

To qualify, you must:

-

Have a foreign tax home,

-

Earn income abroad, and

-

Meet either the Bona Fide Residence Test or the Physical Presence Test.

Let’s break those down further:

-

Bona Fide Residence Test: You must live in a foreign country for an uninterrupted period that includes a full tax year.

-

Physical Presence Test: You must be physically present in a foreign country for at least 330 full days during any consecutive 12-month period.

How the Foreign Earned Income Exclusion (FEIE) Can Lower Your Taxable Income

The Foreign Earned Income Exclusion (FEIE) is a tax rule designed to ease the burden on U.S. citizens working abroad.

In 2024, it allows you to exclude up to $126,500 of foreign-earned income from your U.S. taxable income.

If you’re married and both of you meet the requirements, you can exclude as much as $253,000 together.

How This May Look on Your Tax Return

Let’s break down a high-level example to show how the FEIE might work for a couple. Imagine you and your spouse earn a combined income of $300,000 while working overseas.

For tax year 2024:

-

-

Household Income: $300,000

-

Foreign Earned Income Exclusion: $253,000 (for two qualifying individuals)

-

Taxable Income: $47,000 ($300,000 – $253,000)

-

In this scenario, the FEIE reduces your taxable income dramatically.

With just $47,000 left to report on your U.S. tax return, your Adjusted Gross Income (AGI) is significantly lower than it would be if you earned a similar amount in the U.S.

Now, if you’re on an Income-Driven Repayment (IDR) plan for your federal student loans, this lower AGI could mean you’re eligible for a much smaller payment, or potentially even a $0 payment.

Not bad, right?

How the Foreign Earned Income Exclusion (FEIE) Can Lower Your Taxable Income

The Foreign Earned Income Exclusion (FEIE) is a tax rule designed to ease the burden on U.S. citizens working abroad.

In 2024, it allows you to exclude up to $126,500 of foreign-earned income from your U.S. taxable income.

If you’re married and both of you meet the requirements, you can exclude as much as $253,000 together.

How This May Look on Your Tax Return

Let’s break down a high-level example to show how the FEIE might work for a couple. Imagine you and your spouse earn a combined income of $300,000 while working overseas.

For tax year 2024:

-

-

Household Income: $300,000

-

Foreign Earned Income Exclusion: $253,000 (for two qualifying individuals)

-

Taxable Income: $47,000 ($300,000 – $253,000)

-

In this scenario, the FEIE reduces your taxable income dramatically.

With just $47,000 left to report on your U.S. tax return, your Adjusted Gross Income (AGI) is significantly lower than it would be if you earned a similar amount in the U.S.

Now, if you’re on an Income-Driven Repayment (IDR) plan for your federal student loans, this lower AGI could mean you’re eligible for a much smaller payment, or potentially even a $0 payment.

Not bad, right?

So, What Does This Mean for Your Student Loans?

Here’s where it gets interesting.

With an Income-Driven Repayment (IDR) plan, your monthly student loan payments are based on your Adjusted Gross Income (AGI).

With the FEIE, your income reported on your tax return could be much lower, possibly leading to a $0 monthly payment if your taxable income falls low enough.

And even better?

After making those $0 payments consistently on an IDR plan, your loans can be forgiven after 20 or 25 years, depending on your plan.

You might owe taxes on the forgiven amount at the end, but there’s also a chance the tax code could change by then, making it tax-free.

Stranger things have happened!

So, What Does This Mean for Your Student Loans?

Here’s where it gets interesting.

With an Income-Driven Repayment (IDR) plan, your monthly student loan payments are based on your Adjusted Gross Income (AGI).

With the FEIE, your income reported on your tax return could be much lower, possibly leading to a $0 monthly payment if your taxable income falls low enough.

And even better?

After making those $0 payments consistently on an IDR plan, your loans can be forgiven after 20 or 25 years, depending on your plan.

You might owe taxes on the forgiven amount at the end, but there’s also a chance the tax code could change by then, making it tax-free.

Stranger things have happened!

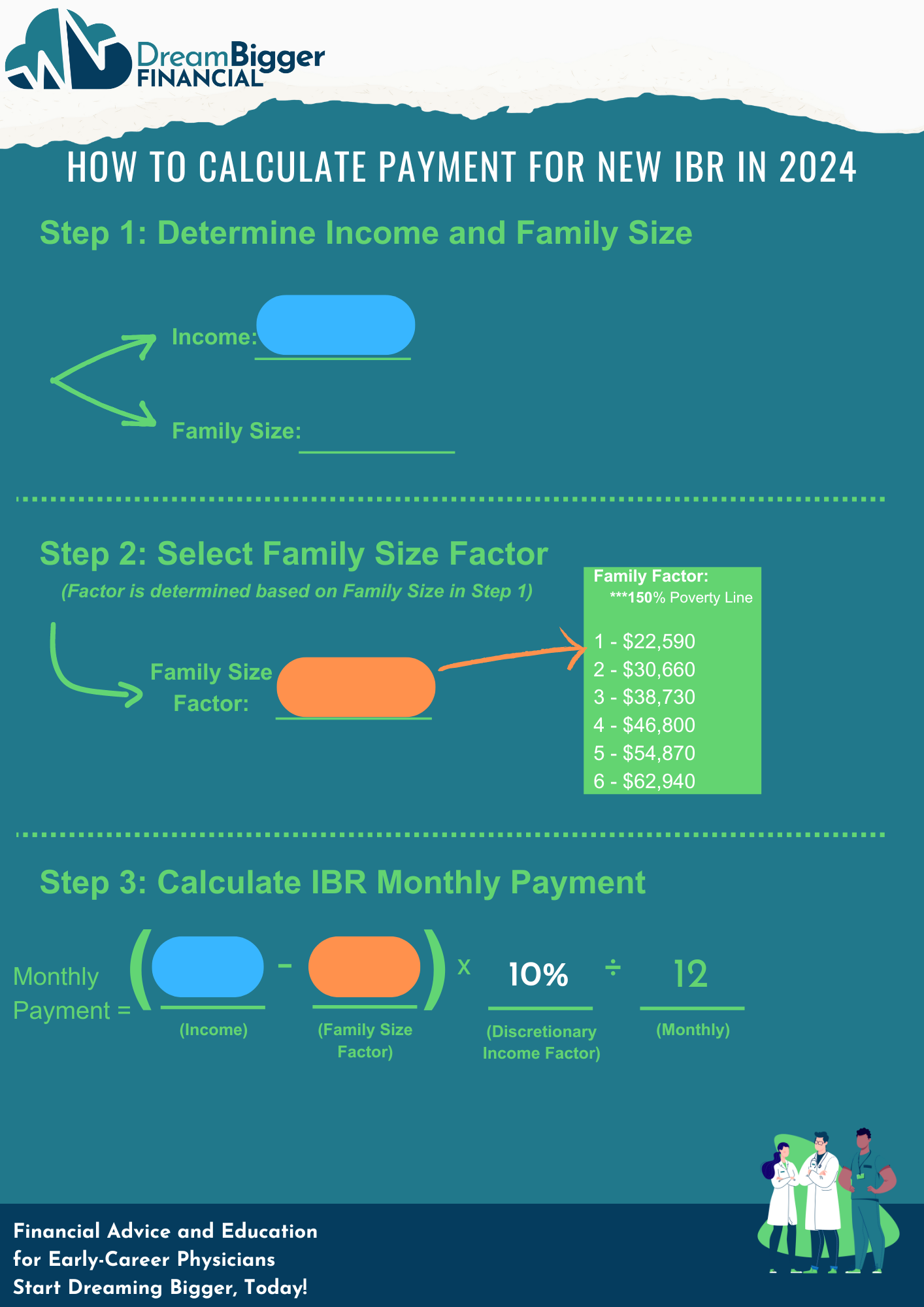

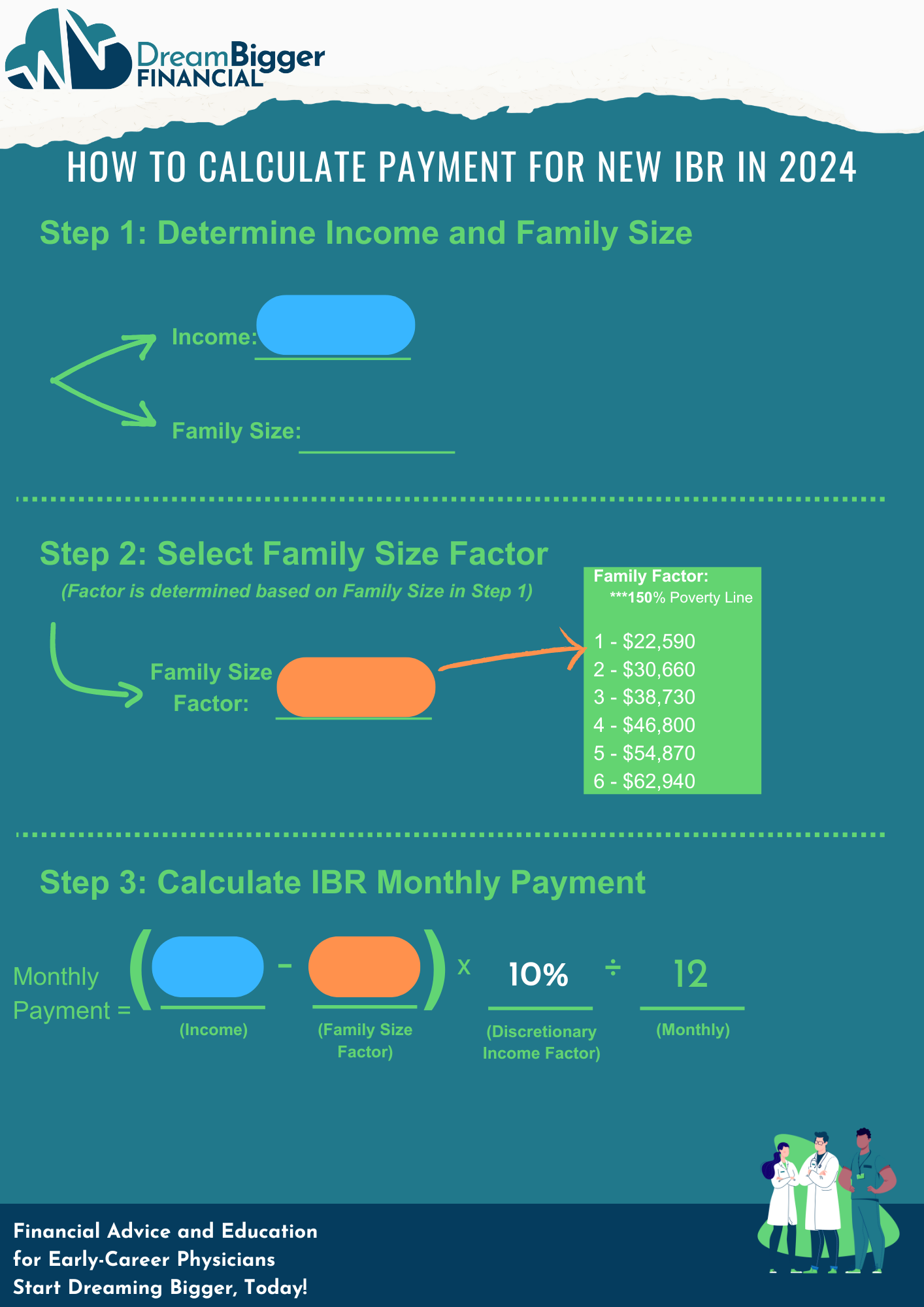

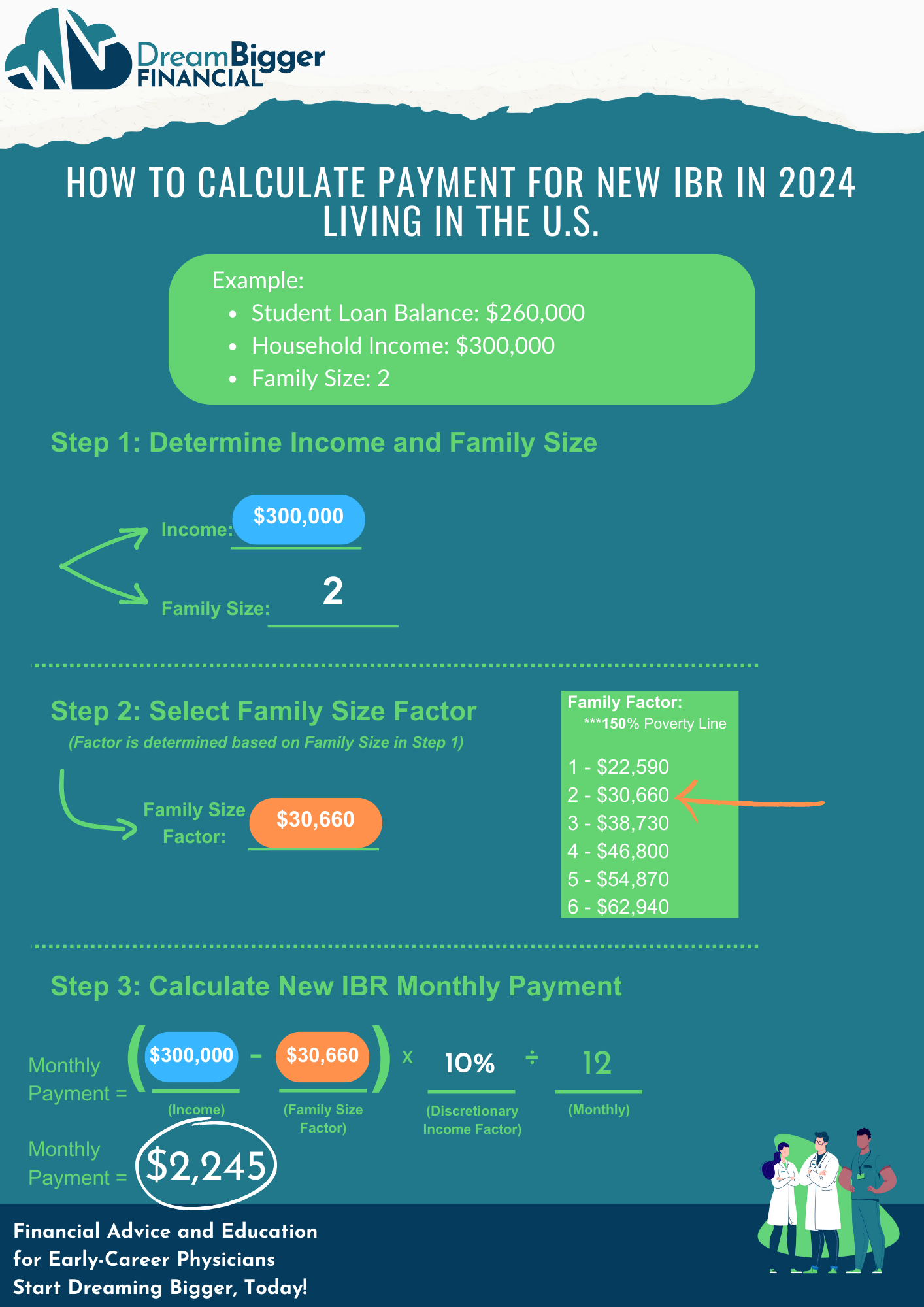

Understanding Income-Driven Repayment (IDR) Plans

When you start your residency (or leave school), you are automatically enrolled in the Standard 10-Year Repayment Plan.

This plan works similarly to a mortgage, calculating your monthly student loan payment based on your loan balance and interest rate.

For example, if your student loan balance is $260,000 with an interest rate of 6%, your monthly payment would be a hefty $2,887!

Enrolling in an Income-Driven Repayment (IDR) plan can dramatically reduce your monthly student loan payments.

Unlike the Standard 10-Year Repayment Plan, which calculates payments based on your loan balance and interest rate, IDR plans base your payment on your income and family size.

-

-

Lower Income = Lower Payments: The lower your income, the smaller your monthly payment will be.

-

Larger Family Size = Lower Payments: A larger family size also reduces your payment.

-

Note: This is a high-level example of how to calculate New Income-Based Repayment (IBR). You can learn more about IBR here.

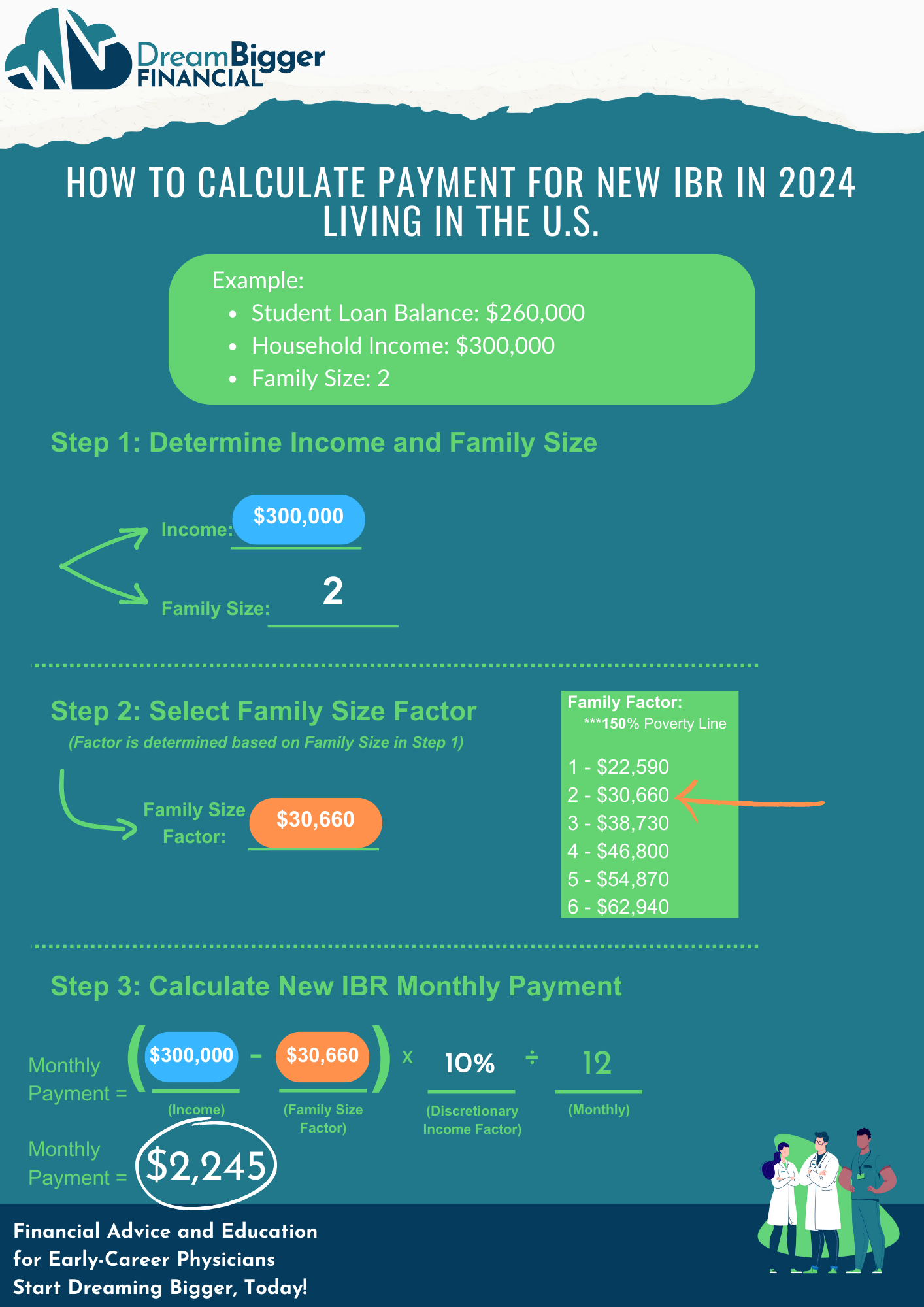

Example: IDR Payment Calculation Living in the U.S. (Without FEIE)

-

-

Loan Balance: $260,000

-

Family Size: 2

-

Household Income: $300,000

-

Taxable Income: $300,000 (no FEIE applied)

-

With a household income of $300,000 and a family size of 2, your monthly payment under the New Income-Based Repayment (IBR) plan in this example would be $2,245/month.

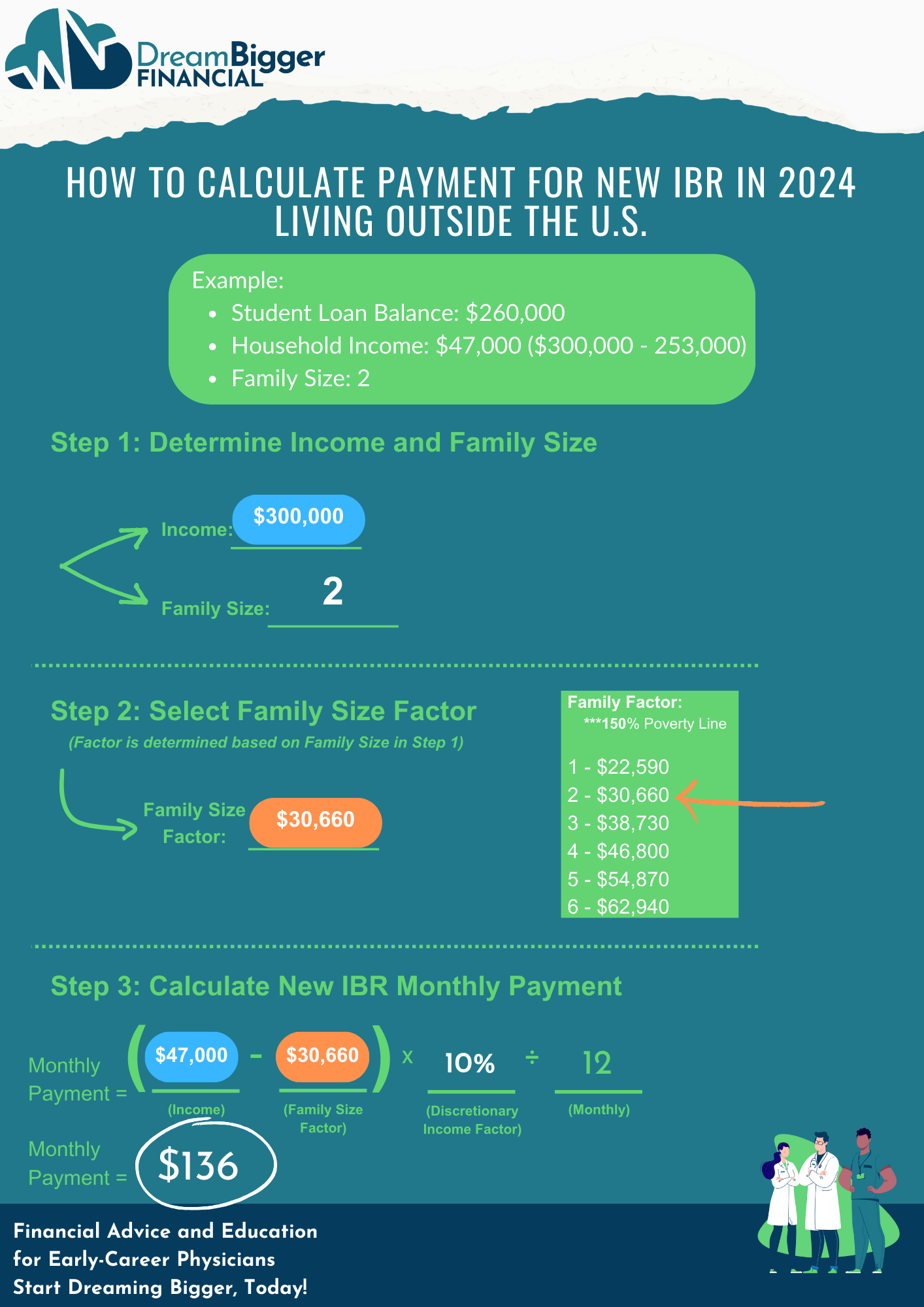

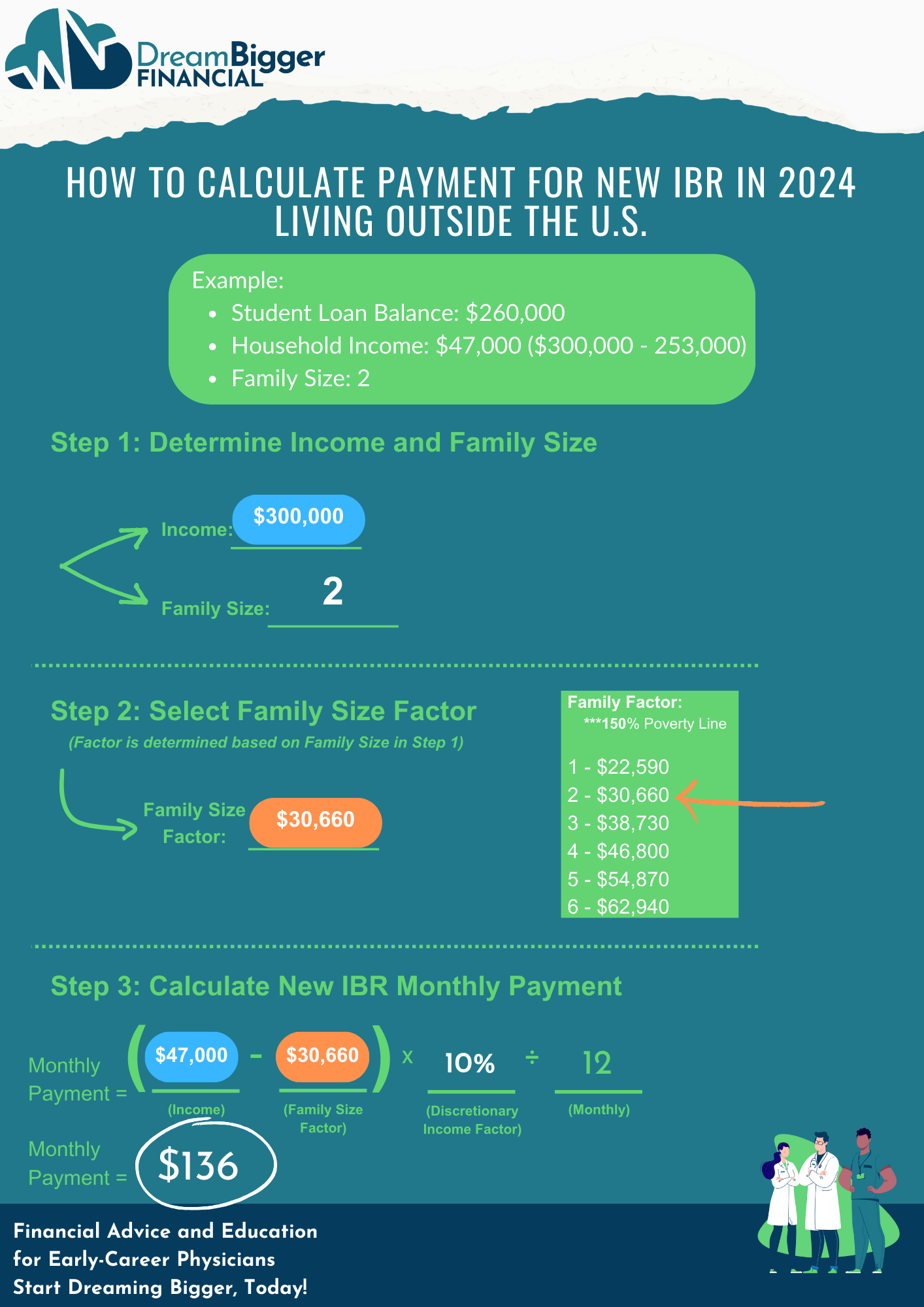

Example: IDR Payment Calculation Using the Foreign Earned Income Exclusion (FEIE)

Note: This example applies to the New Income-Based Repayment (IBR) plan. The calculation may vary slightly for other IDR plans.

-

-

Loan Balance: $260,000

-

Family Size: 2

-

Household Income: $300,000

-

Foreign Earned Income Exclusion (FEIE): $253,000 (for two qualifying individuals)

-

Taxable Income: $47,000 ($300,000 – $253,000)

-

With a taxable income of $47,000 (due to the FEIE) and a family size of 2, your monthly payment under the New IBR plan in this scenario would be $136/month if living outside the U.S.

While this isn’t $0/month, it’s still an incredibly manageable payment, especially considering the potential for future loan forgiveness.

Understanding Income-Driven Repayment (IDR) Plans

When you start your residency (or leave school), you are automatically enrolled in the Standard 10-Year Repayment Plan.

This plan works similarly to a mortgage, calculating your monthly student loan payment based on your loan balance and interest rate.

For example, if your student loan balance is $260,000 with an interest rate of 6%, your monthly payment would be a hefty $2,887!

Enrolling in an Income-Driven Repayment (IDR) plan can dramatically reduce your monthly student loan payments.

Unlike the Standard 10-Year Repayment Plan, which calculates payments based on your loan balance and interest rate, IDR plans base your payment on your income and family size.

-

-

Lower Income = Lower Payments: The lower your income, the smaller your monthly payment will be.

-

Larger Family Size = Lower Payments: A larger family size also reduces your payment.

-

Note: This is a high-level example of how to calculate New Income-Based Repayment (IBR). You can learn more about IBR here.

Example: IDR Payment Calculation Living in the U.S. (Without FEIE)

-

-

Loan Balance: $260,000

-

Family Size: 2

-

Household Income: $300,000

-

Taxable Income: $300,000 (no FEIE applied)

-

With a household income of $300,000 and a family size of 2, your monthly payment under the New Income-Based Repayment (IBR) plan in this example would be $2,245/month.

Example: IDR Payment Calculation Using the Foreign Earned Income Exclusion (FEIE)

Note: This example applies to the New Income-Based Repayment (IBR) plan. The calculation may vary slightly for other IDR plans.

-

-

Loan Balance: $260,000

-

Family Size: 2

-

Household Income: $300,000

-

Foreign Earned Income Exclusion (FEIE): $253,000 (for two qualifying individuals)

-

Taxable Income: $47,000 ($300,000 – $253,000)

-

With a taxable income of $47,000 (due to the FEIE) and a family size of 2, your monthly payment under the New IBR plan in this scenario would be $136/month if living outside the U.S.

While this isn’t $0/month, it’s still an incredibly manageable payment, especially considering the potential for future loan forgiveness.

What Happens If You Come Back to the U.S.?

Let’s say your overseas adventure has run its course, and you’re ready to return to U.S. soil. You’ll simply pick up where you left off:

-

-

Payment Calculation: Your IDR plan will base your payments on your most recent U.S. income when you recertify.

-

No FEIE, Regular Payments Resume: Your full U.S. income will now factor into your payments, but you’ll still be working toward loan forgiveness.

-

What Happens If You Come Back to the U.S.?

Let’s say your overseas adventure has run its course, and you’re ready to return to U.S. soil. You’ll simply pick up where you left off:

-

Payment Calculation: Your IDR plan will base your payments on your most recent U.S. income when you recertify.

-

No FEIE, Regular Payments Resume: Your full U.S. income will now factor into your payments, but you’ll still be working toward loan forgiveness.

And Yes, You Can Still Visit the U.S.

Planning to visit friends and family in the U.S. during your time abroad?

No problem! As long as you meet the FEIE criteria, especially the 330-day requirement of the Physical Presence Test, you’re good to go.

Keep up with your annual tax return and IDR recertification based on your foreign income, and you’ll stay fully compliant.

And Yes, You Can Still Visit the U.S.

Planning to visit friends and family in the U.S. during your time abroad?

No problem! As long as you meet the FEIE criteria, especially the 330-day requirement of the Physical Presence Test, you’re good to go.

Keep up with your annual tax return and IDR recertification based on your foreign income, and you’ll stay fully compliant.

A Few Considerations

This approach has some nice perks, but keep these in mind:

-

-

Tax Code Changes: Things can shift in Washington, so stay on top of any updates that could affect your repayment plan.

-

Possible Tax Bill at Forgiveness: If your loans are forgiven after 20-25 years, there might be a tax bill. But hey, who knows? By then, loan forgiveness might be completely tax-free.

-

A Few Considerations

This approach has some nice perks, but keep these in mind:

-

Tax Code Changes: Things can shift in Washington, so stay on top of any updates that could affect your repayment plan.

-

Possible Tax Bill at Forgiveness: If your loans are forgiven after 20-25 years, there might be a tax bill. But hey, who knows? By then, loan forgiveness might be completely tax-free.

Final Thoughts: Should You Really Leave the Country Over Student Loans?

Look, I’m not suggesting anyone jump ship just because of a loan balance (or election results).

But if you’ve got an itch to experience life abroad, your student loans don’t have to hold you back.

With the Foreign Earned Income Exclusion (FEIE) and an IDR plan, you can potentially enjoy $0 monthly payments, work toward loan forgiveness, and still keep your dream of financial freedom alive.

So, go ahead, dream big, travel far, and maybe even leave that student debt on standby for a while.

Who knew handling student loans could be so…freeing?

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Final Thoughts: Should You Really Leave the Country Over Student Loans?

Look, I’m not suggesting anyone jump ship just because of a loan balance (or election results).

But if you’ve got an itch to experience life abroad, your student loans don’t have to hold you back.

With the Foreign Earned Income Exclusion (FEIE) and an IDR plan, you can potentially enjoy $0 monthly payments, work toward loan forgiveness, and still keep your dream of financial freedom alive.

So, go ahead, dream big, travel far, and maybe even leave that student debt on standby for a while.

Who knew handling student loans could be so…freeing?

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.