Introduction

Taxes can feel complicated, especially when you realize that your effective tax rate is lower than your marginal tax rate.

Many people believe they’re taxed at a single rate, like 24%, but in reality, the tax system is more complex.

This guide walks you through a real-world example, explaining why this happens and how to calculate your actual tax liability using the 2025 tax brackets.

Introduction

Taxes can feel complicated, especially when you realize that your effective tax rate is lower than your marginal tax rate.

Many people believe they’re taxed at a single rate, like 24%, but in reality, the tax system is more complex.

This guide walks you through a real-world example, explaining why this happens and how to calculate your actual tax liability using the 2025 tax brackets.

What Are Marginal and Effective Tax Rates?

Before diving into the calculations, let’s first understand two important terms used in tax planning: marginal tax rate and effective tax rate.

☁️ Marginal Tax Rate: This is the tax rate that applies to the last dollar of your taxable income. Essentially, it reflects the highest tax bracket you fall into based on your total income. For instance, if your taxable income places you in the 24% tax bracket, that 24% is your marginal rate, but only a portion of your income is actually taxed at this rate.

☁️ Effective Tax Rate: This represents your average tax rate across all income brackets. It accounts for the fact that your income is taxed at multiple rates as it progresses through the lower brackets (e.g., 10%, 12%, etc.) before reaching the marginal rate. The effective tax rate gives you a clearer picture of what percentage of your total income you actually pay in taxes.

For example, even if you’re in the 24% marginal tax bracket, your effective tax rate will be lower because much of your income is taxed at lower rates (like 10%, 12%, and 22%).

What Are Marginal and Effective Tax Rates?

Before diving into the calculations, let’s first understand two important terms used in tax planning: marginal tax rate and effective tax rate.

☁️ Marginal Tax Rate: This is the tax rate that applies to the last dollar of your taxable income. Essentially, it reflects the highest tax bracket you fall into based on your total income. For instance, if your taxable income places you in the 24% tax bracket, that 24% is your marginal rate, but only a portion of your income is actually taxed at this rate.

☁️ Effective Tax Rate: This represents your average tax rate across all income brackets. It accounts for the fact that your income is taxed at multiple rates as it progresses through the lower brackets (e.g., 10%, 12%, etc.) before reaching the marginal rate. The effective tax rate gives you a clearer picture of what percentage of your total income you actually pay in taxes.

For example, even if you’re in the 24% marginal tax bracket, your effective tax rate will be lower because much of your income is taxed at lower rates (like 10%, 12%, and 22%).

Example: Calculating Tax for a Married Couple Filing Jointly in 2025

In this example, we will calculate taxes for a married couple with the following details:

-

-

Household Income: $250,000

-

Filing Status: Married Filing Jointly

-

Standard Deduction (2025): $30,000

-

Example: Calculating Tax for a Married Couple Filing Jointly in 2025

In this example, we will calculate taxes for a married couple with the following details:

-

-

Household Income: $250,000

-

Filing Status: Married Filing Jointly

-

Standard Deduction (2025): $30,000

-

Step 1: Calculate Taxable Income

The first step is to subtract the standard deduction from the total household income:

Taxable Income Formula:

Taxable Income = Total Income – Standard Deduction

$220,000 = $250,000 – $30,000

So, the couple has a taxable income of $220,000.

Step 1: Calculate Taxable Income

The first step is to subtract the standard deduction from the total household income:

Taxable Income Formula:

Taxable Income = Total Income – Standard Deduction

$220,000 = $250,000 – $30,000

So, the couple has a taxable income of $220,000.

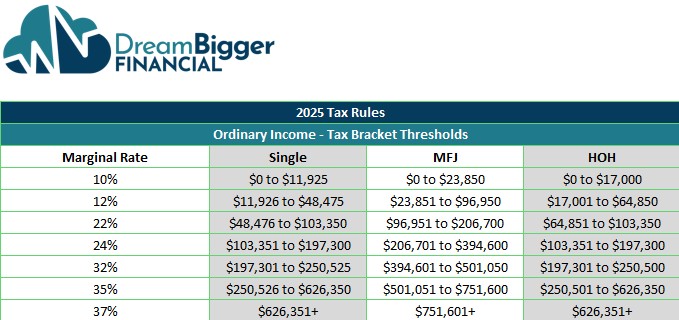

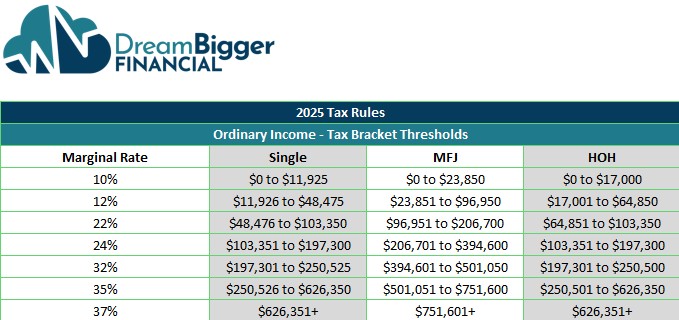

Step 2: Determine Taxable Income by Bracket

After calculating your taxable income (which is your total income minus the standard deduction), the next step is to break it down across the applicable tax brackets.

In the U.S. tax system, different portions of your income are taxed at progressively higher rates.

This is why your effective tax rate is lower than your marginal tax rate, only the portion of your income in the highest bracket is taxed at the marginal rate.

Using the 2025 tax brackets, let’s walk through how much of your income falls into each tax bracket:

10% Bracket

The first $23,850 of income is taxed at 10%.

$23,850 x 10% = $2,385

12% Bracket

The portion from $23,851 to $96,950 is taxed at 12%.

$96,950 – $23,850 = $73,100

$73,100 x 12% = $8,772

22% Bracket

The portion from $96,951 to $206,700 is taxed at 22%.

$206,700 – $96,951 = $109,750

$109,750 x 22% = $24,145

24% Bracket

The remaining portion, from $206,701 to $220,000, is taxed at 24%.

$220,000 – $206,700 = $13,300

$13,300 x 24% = $3,192

Step 2: Determine Taxable Income by Bracket

After calculating your taxable income (which is your total income minus the standard deduction), the next step is to break it down across the applicable tax brackets.

In the U.S. tax system, different portions of your income are taxed at progressively higher rates.

This is why your effective tax rate is lower than your marginal tax rate, only the portion of your income in the highest bracket is taxed at the marginal rate.

Using the 2025 tax brackets, let’s walk through how much of your income falls into each tax bracket:

10% Bracket

The first $23,850 of income is taxed at 10%.

$23,850 x 10% = $2,385

12% Bracket

The portion from $23,851 to $96,950 is taxed at 12%.

$96,950 – $23,850 = $73,100

$73,100 x 12% = $8,772

22% Bracket

The portion from $96,951 to $206,700 is taxed at 22%.

$206,700 – $96,951 = $109,750

$109,750 x 22% = $24,145

24% Bracket

The remaining portion, from $206,701 to $220,000, is taxed at 24%.

$220,000 – $206,700 = $13,300

$13,300 x 24% = $3,192

Step 3: Calculate the Total Tax Liability

Now, let’s sum up the tax from each bracket to get the total tax liability.

Total Tax:

$2,385 + $8,772 + $24,145 + $3,192 = $38,494

The total tax liability for this couple is $38,494.

Step 3: Calculate the Total Tax Liability

Now, let’s sum up the tax from each bracket to get the total tax liability.

Total Tax:

$2,385 + $8,772 + $24,145 + $3,192 = $38,494

The total tax liability for this couple is $38,494.

Step 4: Calculate the Effective Tax Rate

To calculate the effective tax rate, divide the total tax liability by the total income and multiply by 100 to get the percentage.

Effective Tax Rate Formula:

Effective Tax Rate = (Total Tax / Total Income) x 100

($38,494 / $250,000) x 100 = 17.5%

So, the couple’s effective tax rate is 17.5%.

Step 4: Calculate the Effective Tax Rate

To calculate the effective tax rate, divide the total tax liability by the total income and multiply by 100 to get the percentage.

Effective Tax Rate Formula:

Effective Tax Rate = (Total Tax / Total Income) x 100

($38,494 / $250,000) x 100 = 17.5%

So, the couple’s effective tax rate is 17.5%.

Why Is the Effective Tax Rate Lower Than the Marginal Rate?

One common source of confusion in tax planning is why your effective tax rate is always lower than your marginal tax rate. To understand this, we need to look at how income is taxed across different brackets.

The marginal tax rate is the highest rate you pay on the last portion of your income. In this case, if you’re in the 24% marginal tax bracket, that means only the income above a certain threshold is taxed at 24%.

However, the tax system is progressive, which means income is divided and taxed at multiple levels. As your income increases, it passes through several brackets, each taxed at a different rate:

-

-

The first portion of your income (up to $23,850 for married couples filing jointly in 2025) is taxed at the lowest rate, 10%.

-

The next portion (from $23,851 to $96,950) is taxed at 12%.

-

After that, your income between $96,951 and $206,700 is taxed at 22%.

-

Only the income above $206,701 is taxed at the marginal rate of 24%.

Putting It All Together

Because much of your income is taxed at the lower rates of 10%, 12%, and 22%, the average rate (or effective tax rate) is much lower than the marginal rate. This is why, despite being in the 24% tax bracket, your overall effective tax rate could be just 17.5%.

In short, your effective tax rate reflects the blend of rates applied to different parts of your income, which helps reduce your overall tax burden.

Why Is the Effective Tax Rate Lower Than the Marginal Rate?

One common source of confusion in tax planning is why your effective tax rate is always lower than your marginal tax rate. To understand this, we need to look at how income is taxed across different brackets.

The marginal tax rate is the highest rate you pay on the last portion of your income. In this case, if you’re in the 24% marginal tax bracket, that means only the income above a certain threshold is taxed at 24%.

However, the tax system is progressive, which means income is divided and taxed at multiple levels. As your income increases, it passes through several brackets, each taxed at a different rate:

-

The first portion of your income (up to $23,850 for married couples filing jointly in 2025) is taxed at the lowest rate, 10%.

-

The next portion (from $23,851 to $96,950) is taxed at 12%.

-

After that, your income between $96,951 and $206,700 is taxed at 22%.

Only the income above $206,701 is taxed at the marginal rate of 24%.

Putting It All Together

Because much of your income is taxed at the lower rates of 10%, 12%, and 22%, the average rate (or effective tax rate) is much lower than the marginal rate. This is why, despite being in the 24% tax bracket, your overall effective tax rate could be just 17.5%.

In short, your effective tax rate reflects the blend of rates applied to different parts of your income, which helps reduce your overall tax burden.

Conclusion

Understanding the difference between your marginal and effective tax rates is essential for effective tax planning.

While your marginal rate shows what you’ll pay on your last dollar of income, your effective tax rate reflects the average amount of tax you pay on every dollar earned.

This distinction explains why even though you may fall into a higher tax bracket, much of your income is taxed at lower rates, ultimately reducing your overall tax burden.

By recognizing which portion of your income is taxed at each rate and how deductions, such as the standard deduction, impact your final tax liability, you can make more informed financial decisions.

This insight can help you plan for future tax savings, decide how much to contribute to retirement accounts, and even explore tax-efficient investments.

In the long run, understanding your tax structure enables you to take full advantage of strategies to lower your tax bill and keep more of your hard-earned money.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Conclusion

Understanding the difference between your marginal and effective tax rates is essential for effective tax planning.

While your marginal rate shows what you’ll pay on your last dollar of income, your effective tax rate reflects the average amount of tax you pay on every dollar earned.

This distinction explains why even though you may fall into a higher tax bracket, much of your income is taxed at lower rates, ultimately reducing your overall tax burden.

By recognizing which portion of your income is taxed at each rate and how deductions, such as the standard deduction, impact your final tax liability, you can make more informed financial decisions.

This insight can help you plan for future tax savings, decide how much to contribute to retirement accounts, and even explore tax-efficient investments.

In the long run, understanding your tax structure enables you to take full advantage of strategies to lower your tax bill and keep more of your hard-earned money.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.