Overview

If your objective in repaying your student loans is maximum student loan forgiveness, your mission should be to minimize the amount you pay towards your loans. This is because, at the end of your forgiveness period, any remaining balance will be forgiven.

For example, let’s say you have a $260,000 loan and are aiming for Public Service Loan Forgiveness (PSLF). Upon making 120 qualifying payments, the entire loan balance would be forgiven tax-free.

In an extreme comparison, would you prefer to pay $10,000 into your loans and have the balance forgiven, or pay $100,000 and still have the balance forgiven? The sensible choice would be the first example, paying $10,000.

There’s no need to pay more into your loans if, in the end, the balance will be completely forgiven.

Now, let’s explore how different retirement strategies impact your student loans, with one strategy reducing both monthly student loan payments and your tax obligation significantly.

Overview

If your objective in repaying your student loans is maximum student loan forgiveness, your mission should be to minimize the amount you pay towards your loans. This is because, at the end of your forgiveness period, any remaining balance will be forgiven.

For example, let’s say you have a $260,000 loan and are aiming for Public Service Loan Forgiveness (PSLF). Upon making 120 qualifying payments, the entire loan balance would be forgiven tax-free.

In an extreme comparison, would you prefer to pay $10,000 into your loans and have the balance forgiven, or pay $100,000 and still have the balance forgiven? The sensible choice would be the first example, paying $10,000.

There’s no need to pay more into your loans if, in the end, the balance will be completely forgiven.

Now, let’s explore how different retirement strategies impact your student loans, with one strategy reducing both monthly student loan payments and your tax obligation significantly.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

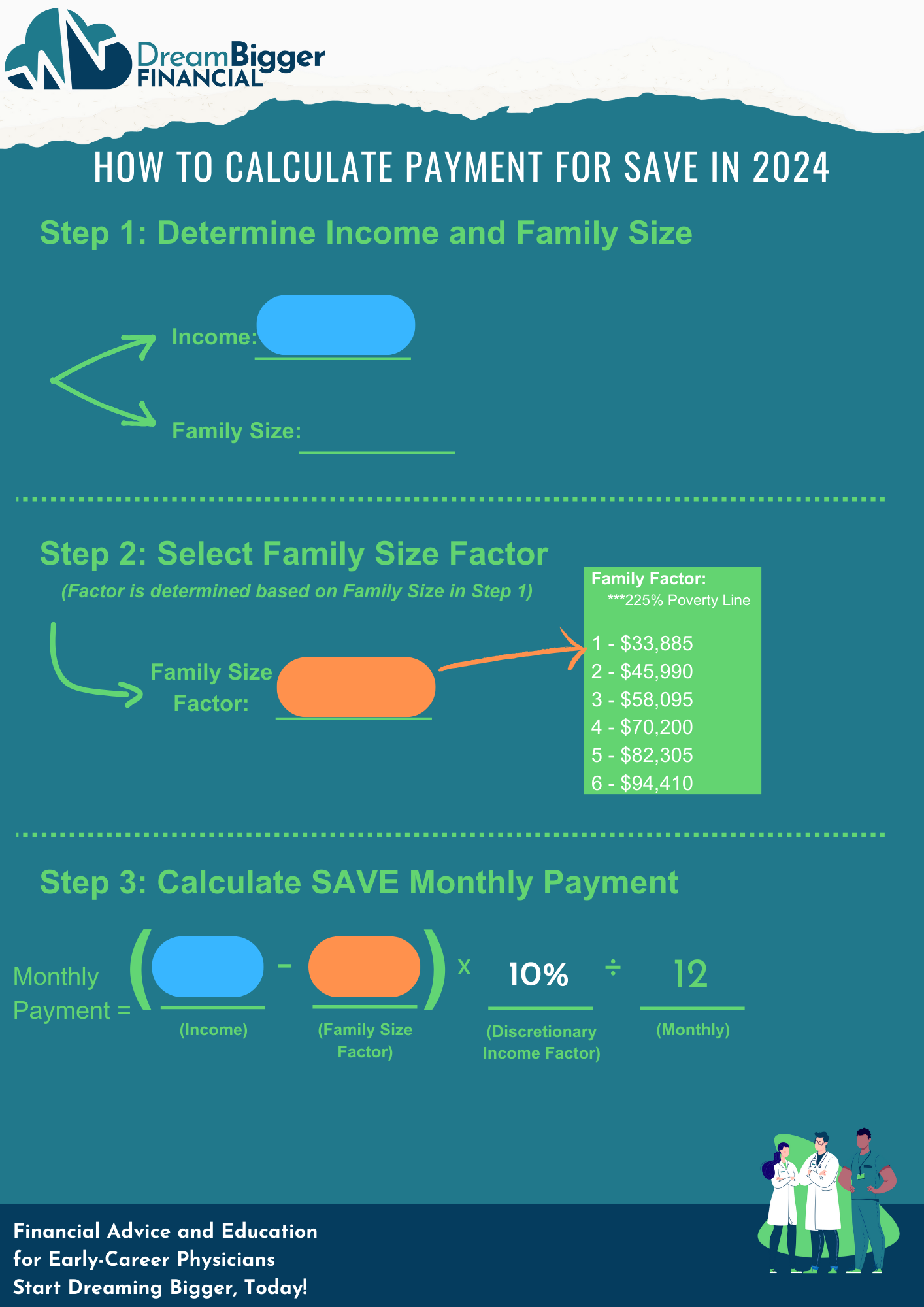

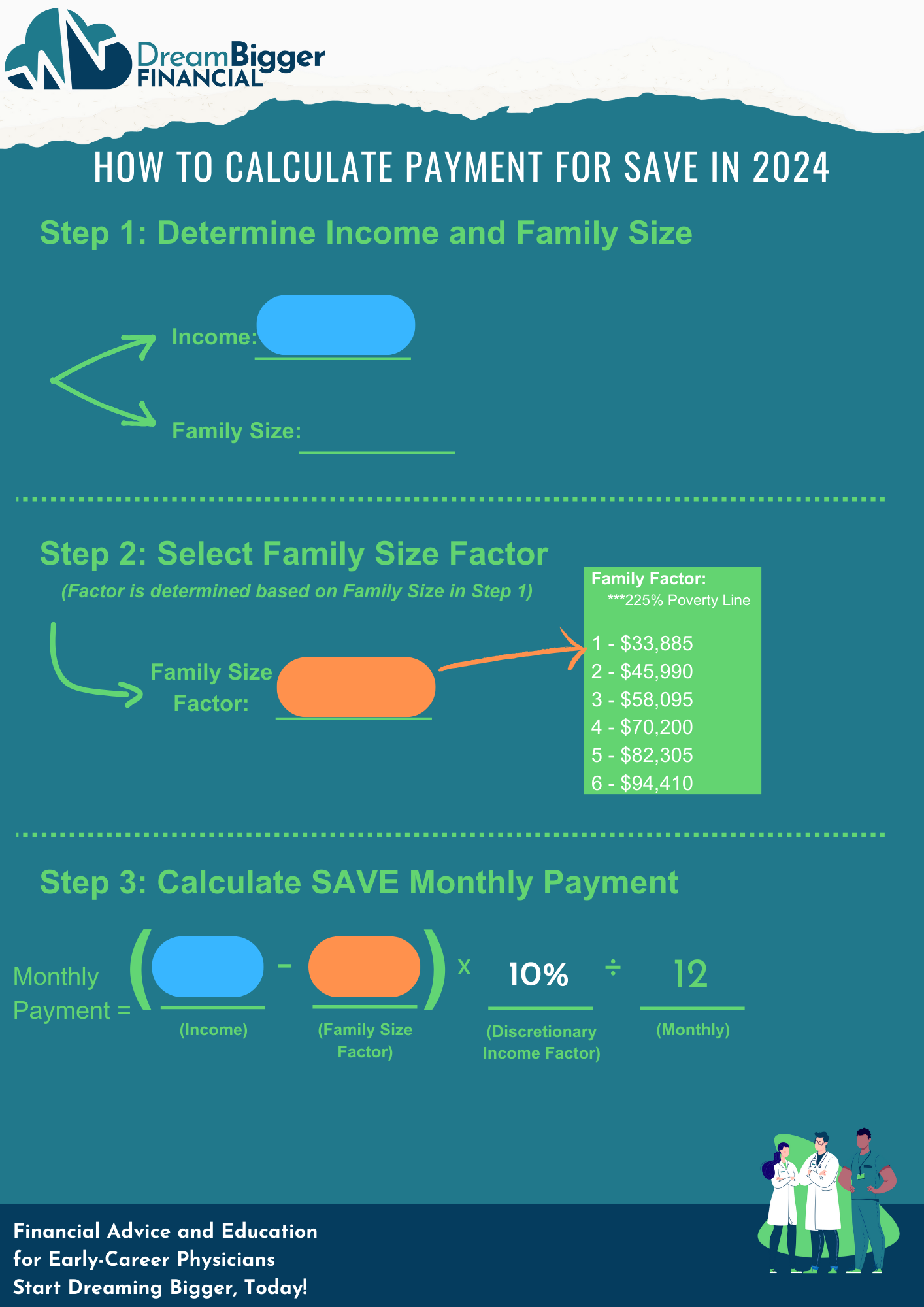

When planning for student loans, your goal is to minimize your payments, knowing that any remaining balance will ultimately be forgiven. The first step is enrolling in an Income-Driven Repayment (IDR) plan. In an IDR plan, your monthly payment is calculated based on your income and family size.

In simple terms:

☁️ Higher income = higher payment

☁️ Larger family = lower payment

Understanding this, to lower your student loan payments, you can either decrease your income or increase your family size. We do not encourage rushing into marriage or having children solely to reduce your student loan payment. However, there are creative ways to lower your income and, consequently, decrease your student loan payment.

The image below illustrates how to calculate your monthly student loan payment using the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan.

When planning for student loans, your goal is to minimize your payments, knowing that any remaining balance will ultimately be forgiven. The first step is enrolling in an Income-Driven Repayment (IDR) plan. In an IDR plan, your monthly payment is calculated based on your income and family size.

In simple terms:

☁️ Higher income = higher payment

☁️ Larger family = lower payment

Understanding this, to lower your student loan payments, you can either decrease your income or increase your family size. We do not encourage rushing into marriage or having children solely to reduce your student loan payment. However, there are creative ways to lower your income and, consequently, decrease your student loan payment.

The image below illustrates how to calculate your monthly student loan payment using the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan.

Calculating Income for Income-Driven Repayment Plans

There are two methods for calculating income: adjusted gross income (AGI) from your tax return and alternative documentation of income, usually your paystub.

When enrolled in an IDR plan, you must recertify your income annually on your IDR Anniversary Date. In most cases, AGI is used as the income factor. Let’s review what AGI is and how we can lower it to reduce your student loan payments.

Adjusted Gross Income (AGI) is located on line 11 of IRS Form 1040 in your prior year’s tax return.

This figure is computed by summing all the income you earn in a given year — such as job earnings, self-employment income, dividends, and interest — and deducting specific eligible deductions. Noteworthy deductions frequently employed in student loan planning encompass contributions to retirement accounts and Health Savings Accounts.

Calculating Income for Income-Driven Repayment Plans

There are two methods for calculating income: adjusted gross income (AGI) from your tax return and alternative documentation of income, usually your paystub.

When enrolled in an IDR plan, you must recertify your income annually on your IDR Anniversary Date. In most cases, AGI is used as the income factor. Let’s review what AGI is and how we can lower it to reduce your student loan payments.

Adjusted Gross Income (AGI) is located on line 11 of IRS Form 1040 in your prior year’s tax return.

This figure is computed by summing all the income you earn in a given year—such as job earnings, self-employment income, dividends, and interest—and deducting specific eligible deductions. Noteworthy deductions frequently employed in student loan planning encompass contributions to retirement accounts and Health Savings Accounts.

When making decisions about saving for retirement, one of the most significant choices you face is whether to contribute to a Roth or a Traditional (Pre-Tax) retirement account.

Opting for a Roth retirement account means choosing to pay taxes upfront for the opportunity to withdraw money tax-free in the future. For instance, if you invest $10,000 this year into a Roth retirement account and it grows to $30,000 over the next 30 years, you won’t be required to pay any taxes on the $30,000 when you withdraw it during retirement.

On the other hand, contributing to a Traditional (Pre-Tax) retirement account means deferring taxes until a later date. With a Traditional (Pre-Tax) strategy, you will pay taxes in retirement when you withdraw the funds. For example, investing $10,000 this year into a Traditional (Pre-Tax) retirement account that grows to $30,000 over 30 years would require you to pay taxes at your future tax rate when making withdrawals in retirement.

Instead of focusing solely on the numbers in the examples, it’s important to understand the taxation aspect. With a Roth retirement account, taxes are paid upfront, offering tax-free withdrawals in the future. With a Traditional (Pre-Tax) strategy, taxes are deferred until withdrawal, requiring payment in the future.

When making decisions about saving for retirement, one of the most significant choices you face is whether to contribute to a Roth or a Traditional (Pre-Tax) retirement account.

Opting for a Roth retirement account means choosing to pay taxes upfront for the opportunity to withdraw money tax-free in the future. For instance, if you invest $10,000 this year into a Roth retirement account and it grows to $30,000 over the next 30 years, you won’t be required to pay any taxes on the $30,000 when you withdraw it during retirement.

On the other hand, contributing to a Traditional (Pre-Tax) retirement account means deferring taxes until a later date. With a Traditional (Pre-Tax) strategy, you will pay taxes in retirement when you withdraw the funds. For example, investing $10,000 this year into a Traditional (Pre-Tax) retirement account that grows to $30,000 over 30 years would require you to pay taxes at your future tax rate when making withdrawals in retirement.

Instead of focusing solely on the numbers in the examples, it’s important to understand the taxation aspect. With a Roth retirement account, taxes are paid upfront, offering tax-free withdrawals in the future. With a Traditional (Pre-Tax) strategy, taxes are deferred until withdrawal, requiring payment in the future.

Calculating your taxes starts with your annual earnings, known as your gross income. Next, you subtract certain deductions, like the standard or itemized deduction, to lower your gross income. Once these deductions are taken away, you get your net or taxable income. Finally, you multiply this taxable income by your tax rate to find out how much you owe in taxes.

For example, if you’re a physician earning $100,000 with a flat 20% tax rate, your gross tax liability would be $17,080:

-

-

Income = $100,000

-

Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $85,400 ($100,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $17,080 ($85,400 x 20%)

-

Now, let’s explore the disparity between Roth and Traditional (Pre-Tax) strategies and their impact on Adjusted Gross Income (AGI) and the taxes you are required to pay:

Let’s say you’re a physician earning $100,000 and planning to save $20,000 into your retirement account.

Calculating your taxes starts with your annual earnings, known as your gross income. Next, you subtract certain deductions, like the standard or itemized deduction, to lower your gross income. Once these deductions are taken away, you get your net or taxable income. Finally, you multiply this taxable income by your tax rate to find out how much you owe in taxes.

For example, if you’re a physician earning $100,000 with a flat 20% tax rate, your gross tax liability would be $17,080:

-

Income = $100,000

-

Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $85,400 ($100,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $17,080 ($85,400 x 20%)

Now, let’s explore the disparity between Roth and Traditional (Pre-Tax) strategies and their impact on Adjusted Gross Income (AGI) and the taxes you are required to pay:

Let’s say you’re a physician earning $100,000 and planning to save $20,000 into your retirement account.

-

-

Income = $100,000

-

Less: Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $85,400 ($100,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $17,080 ($85,400 x 20%)

-

By saving into a Roth retirement account, you will be required to pay taxes on the money, which means your $20,000 contribution is included in your Taxable Income.

-

Income = $100,000

-

Less: Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $85,400 ($100,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $17,080 ($85,400 x 20%)

By saving into a Roth retirement account, you will be required to pay taxes on the money, which means your $20,000 contribution is included in your Taxable Income.

In contrast, by saving into a Traditional (Pre-Tax) retirement account you will not be required to pay taxes on the money, this year. Meaning your Traditional (Pre-Tax) retirement contribution needs to be removed before the money gets taxed.

-

-

Income = $100,000

-

Less: Traditional (Pre-Tax) Retirement = $20,000

-

Adjusted Gross Income = $80,000 ($100,000 – $20,000)

-

Less: Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $65,400 ($80,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $13,080 ($65,400 x 20%)

-

In contrast, by saving into a Traditional (Pre-Tax) retirement account you will not be required to pay taxes on the money, this year. Meaning your Traditional (Pre-Tax) retirement contribution needs to be removed before the money gets taxed.

-

Income = $100,000

-

Less: Traditional (Pre-Tax) Retirement = $20,000

-

Adjusted Gross Income = $80,000 ($100,000 – $20,000)

-

Less: Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $65,400 ($80,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $13,080 ($65,400 x 20%)

Point 1: When saving into a Traditional (Pre-Tax) retirement account, you pay $4,000 less in taxes ($13,080 vs. $17,0800), in this example, because it decreases your taxable income.

Point 2: Adjusted Gross Income (AGI) appears as a new line above the Standard Deduction, calculated by subtracting Traditional (Pre-Tax) retirement contributions from your income.

Note: AGI plays an important role in calculating your monthly student loan payment for Income-Driven Repayment. Additionally, if you save into a Roth retirement account, you still have an AGI (as illustrated below), however, Roth retirement contributions do not lower your AGI.

-

-

Income = $100,000

-

Less: Traditional (Pre-Tax) Retirement = $0

-

Adjusted Gross Income = $100,000 ($100,000 – $0)

-

Less: Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $85,400 ($100,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $17,080 ($85,400 x 20%)

-

In summary, contributing to a Traditional (Pre-Tax) retirement account is linked to lower student loan payments, as it reduces your AGI. A lower AGI translates to smaller monthly student loan payments and, consequently, potentially results in a larger forgiven balance during the forgiveness period.

Point 1: When saving into a Traditional (Pre-Tax) retirement account, you pay $4,000 less in taxes ($13,080 vs. $17,0800), in this example, because it decreases your taxable income.

Point 2: Adjusted Gross Income (AGI) appears as a new line above the Standard Deduction, calculated by subtracting Traditional (Pre-Tax) retirement contributions from your income.

Note: AGI plays an important role in calculating your monthly student loan payment for Income-Driven Repayment. Additionally, if you save into a Roth retirement account, you still have an AGI (as illustrated below), however, Roth retirement contributions do not lower your AGI.

-

Income = $100,000

-

Less: Traditional (Pre-Tax) Retirement = $0

-

Adjusted Gross Income = $100,000 ($100,000 – $0)

-

Less: Standard Deduction (2024, Single) = $14,600

-

Taxable Income = $85,400 ($100,000 – $14,600)

-

Tax Rate = 20%

-

Gross Tax Liability = $17,080 ($85,400 x 20%)

In summary, contributing to a Traditional (Pre-Tax) retirement account is linked to lower student loan payments, as it reduces your AGI. A lower AGI translates to smaller monthly student loan payments and, consequently, potentially results in a larger forgiven balance during the forgiveness period.

Saving Traditional (Pre-Tax) contributions in the following retirement accounts can lower your AGI, leading to decreased student loan payments:

☁️ 401(k)

☁️ 403(b)

☁️ 457

☁️ Government Pension Funds

☁️ Traditional Individual Retirement Account (IRA)

Saving Traditional (Pre-Tax) contributions in the following retirement accounts can lower your AGI, leading to decreased student loan payments:

☁️ 401(k)

☁️ 403(b)

☁️ 457

☁️ Government Pension Funds

☁️ Traditional Individual Retirement Account (IRA)

Now, let’s apply this knowledge to a practical example. We’ll guide you through the process of calculating your monthly student loan payment using the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan.

Consider an adjusted gross income of $300,000 and a family size of 1, which leads to a $2,218 monthly student loan payment.

For a more in-depth understanding of the SAVE IDR plan, click here.

Now, let’s apply this knowledge to a practical example. We’ll guide you through the process of calculating your monthly student loan payment using the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan.

Consider an adjusted gross income of $300,000 and a family size of 1, which leads to a $2,218 monthly student loan payment.

For a more in-depth understanding of the SAVE IDR plan, click here.

Next, we’ll explore how your decision to contribute to a Roth retirement account can impact both your student loan payments and tax liability. Using a hypothetical scenario with a 40% flat tax rate, we’ll break down the calculations to illustrate the potential financial impact.

-

-

Household Income: $300,000

-

Family Size: 1

-

Retirement Contribution: $23,000

-

Tax Rate: 40% Flat

-

Income = $300,000

Less: Traditional (Pre-Tax) Retirement = $0

Adjusted Gross Income = $300,000 ($300,000 – $0)

With a Roth retirement account, your monthly student loan payments remain at $2,218. Additionally, assuming a 40% flat tax rate, you’ll incur a tax of $114,460.

Adjusted Gross Income = $300,000

Less: Standard Deduction (2024, Single) = $14,600

Taxable Income = $285,400 ($300,000 – $14,600)

Tax Rate = 40%

Gross Tax Liability = $114,160 ($285,400 x 40%)

Next, we’ll explore how your decision to contribute to a Roth retirement account can impact both your student loan payments and tax liability. Using a hypothetical scenario with a 40% flat tax rate, we’ll break down the calculations to illustrate the potential financial impact.

-

Household Income: $300,000

-

Family Size: 1

-

Retirement Contribution: $23,000

-

Tax Rate: 40% Flat

Income = $300,000

Less: Traditional (Pre-Tax) Retirement = $0

Adjusted Gross Income = $300,000 ($300,000 – $0)

With a Roth retirement account, your monthly student loan payments remain at $2,218. Additionally, assuming a 40% flat tax rate, you’ll incur a tax of $114,460.

Adjusted Gross Income = $300,000

Less: Standard Deduction (2024, Single) = $14,600

Taxable Income = $285,400 ($300,000 – $14,600)

Tax Rate = 40%

Gross Tax Liability = $114,160 ($285,400 x 40%)

Now, consider contributing to a Traditional (Pre-Tax) retirement account.

-

-

Household Income: $300,000

-

Family Size: 1

-

Retirement Contribution: $23,000

-

Tax Rate: 40%

-

Income = $300,000

Less: Traditional (Pre-Tax) Retirement = $23,000

Adjusted Gross Income = $277,000 ($300,000 – $23,000)

This shift in strategy results in not only a new monthly student loan payment of $2,026 but also a savings of $192 per month or $2,304 per year. Furthermore, due to the adjusted gross income of $277,000, you’ll pay $9,200 less in taxes.

Adjusted Gross Income = $277,000

Less: Standard Deduction (2024, Single) = $14,600

Taxable Income = $262,400 ($277,000 – $14,600)

Tax Rate = 40%

Gross Tax Liability = $104,960 ($262,400 x 40%)

Now, consider contributing to a Traditional (Pre-Tax) retirement account.

-

Household Income: $300,000

-

Family Size: 1

-

Retirement Contribution: $23,000

-

Tax Rate: 40%

Income = $300,000

Less: Traditional (Pre-Tax) Retirement = $23,000

Adjusted Gross Income = $277,000 ($300,000 – $23,000)

This shift in strategy results in not only a new monthly student loan payment of $2,026 but also a savings of $192 per month or $2,304 per year. Furthermore, due to the adjusted gross income of $277,000, you’ll pay $9,200 less in taxes.

Adjusted Gross Income = $277,000

Less: Standard Deduction (2024, Single) = $14,600

Taxable Income = $262,400 ($277,000 – $14,600)

Tax Rate = 40%

Gross Tax Liability = $104,960 ($262,400 x 40%)

To sum everything up, when choosing where to put your retirement savings, like in a 401(k) or IRA, picking between Traditional (Pre-Tax) and Roth accounts matters more than you might think.

Look at it this way: if you go for Traditional savings, it can lower your monthly student loan payments and even save you money on taxes.

In a simple example with a $300,000 income and a family size of 1, picking Traditional contributions instead of Roth not only trims down your monthly student loan payment but also puts extra money back in your pocket, thanks to lower taxes.

To sum everything up, when choosing where to put your retirement savings, like in a 401(k) or IRA, picking between Traditional (Pre-Tax) and Roth accounts matters more than you might think.

Look at it this way: if you go for Traditional savings, it can lower your monthly student loan payments and even save you money on taxes.

In a simple example with a $300,000 income and a family size of 1, picking Traditional contributions instead of Roth not only trims down your monthly student loan payment but also puts extra money back in your pocket, thanks to lower taxes.

Conclusion

If your goal is maximum student loan forgiveness, the key is to minimize your payments while staying on track for forgiveness.

There’s no benefit to paying more than necessary if the remaining balance will eventually be wiped away.

By incorporating smart retirement strategies, you can reduce your monthly payments and tax liability, positioning yourself for greater financial success while working towards loan forgiveness.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Conclusion

If your goal is maximum student loan forgiveness, the key is to minimize your payments while staying on track for forgiveness.

There’s no benefit to paying more than necessary if the remaining balance will eventually be wiped away.

By incorporating smart retirement strategies, you can reduce your monthly payments and tax liability, positioning yourself for greater financial success while working towards loan forgiveness.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.