Introduction

The PSLF Help Tool makes Public Service Loan Forgiveness (PSLF) easier than ever. PSLF is a program for public service professionals, like government or non-profit hospital doctors. After making 120 qualifying payments (10 years), the remaining student loan amount gets forgiven tax-free.

The PSLF Help Tool tracks your progress and is used to submit your forgiveness application.

Pro Tip: If you’re on an Income-Driven Repayment (IDR) plan, you are required to update your income and family size annually on your IDR Anniversary Date. This is also a great time to log in to the PSLF Help Tool and certify your eligible employment history. The whole process takes less than five minutes each year, making the PSLF forgiveness application straightforward when the time comes!

Here are the simple steps to get your loans forgiven:

Introduction

The PSLF Help Tool makes Public Service Loan Forgiveness (PSLF) easier than ever. PSLF is a program for public service professionals, like government or non-profit hospital doctors. After making 120 qualifying payments (10 years), the remaining student loan amount gets forgiven tax-free.

The PSLF Help Tool tracks your progress and is used to submit your forgiveness application.

Pro Tip: If you’re on an Income-Driven Repayment (IDR) plan, you are required to update your income and family size annually on your IDR Anniversary Date. This is also a great time to log in to the PSLF Help Tool and certify your eligible employment history. The whole process takes less than five minutes each year, making the PSLF forgiveness application straightforward when the time comes!

Here are the simple steps to get your loans forgiven:

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

The PSLF Help Tool should be completed annually and when changing jobs to monitor your progress towards PSLF. After making 120 qualifying payments, use the tool to apply for forgiveness.

Before starting, gather:

-

-

For current employment: Most recent W2 or Federal Employer Identification Number (EIN) and EXACT date of employment.

-

If you don’t have the EIN, you can use the Student Aid Employer Search tool.

-

For first-time users, collect the same details for past PSLF-eligible employers, if applicable.

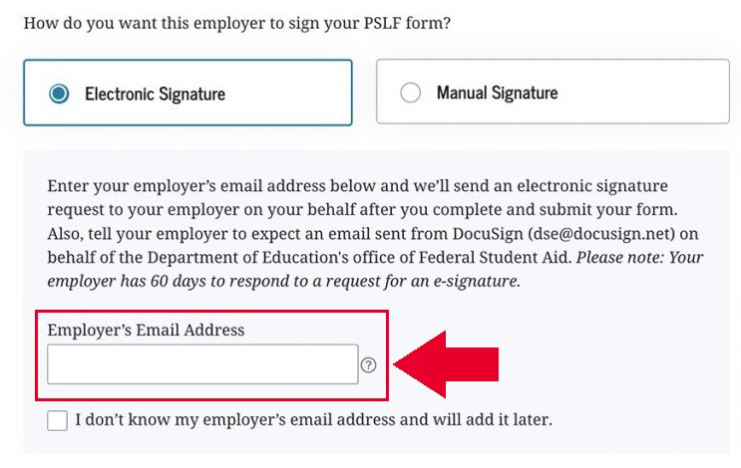

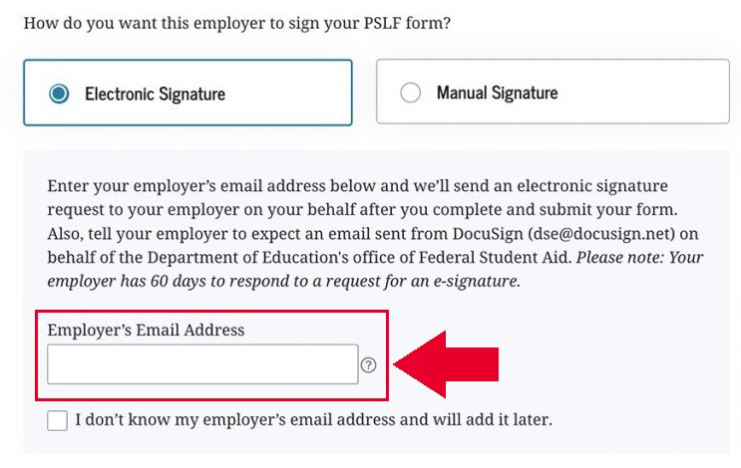

Note: In the final step of the process, you’ll need to enter an email address to digitally send the form to your employer for signing. Since this form contains your social security number, it’s important to avoid sending it to a general email address. Reach out to your GME or HR Department to find an appropriate email address for someone responsible for signing these forms. It is highly encouraged to inform them in advance, letting them know to expect an email from DocuSign, and follow up after sending it for their signature.

The PSLF Help Tool should be completed annually and when changing jobs to monitor your progress towards PSLF. After making 120 qualifying payments, use the tool to apply for forgiveness.

Before starting, gather:

-

For current employment: Most recent W2 or Federal Employer Identification Number (EIN) and EXACT date of employment.

-

If you don’t have the EIN, you can use the Student Aid Employer Search tool.

For first-time users, collect the same details for past PSLF-eligible employers, if applicable.

Note: In the final step of the process, you’ll need to enter an email address to digitally send the form to your employer for signing. Since this form contains your social security number, it’s important to avoid sending it to a general email address. Reach out to your GME or HR Department to find an appropriate email address for someone responsible for signing these forms. It is highly encouraged to inform them in advance, letting them know to expect an email from DocuSign, and follow up after sending it for their signature.

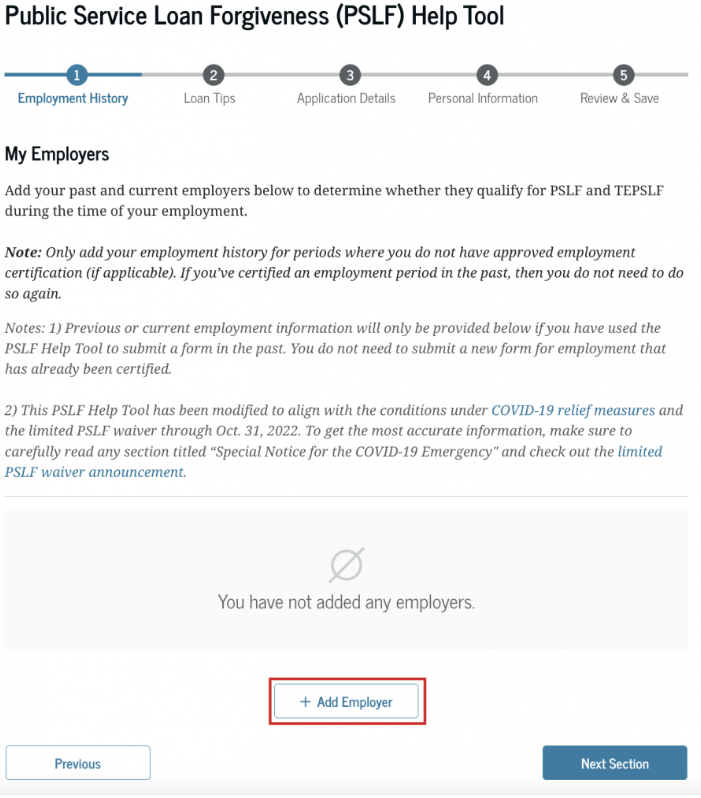

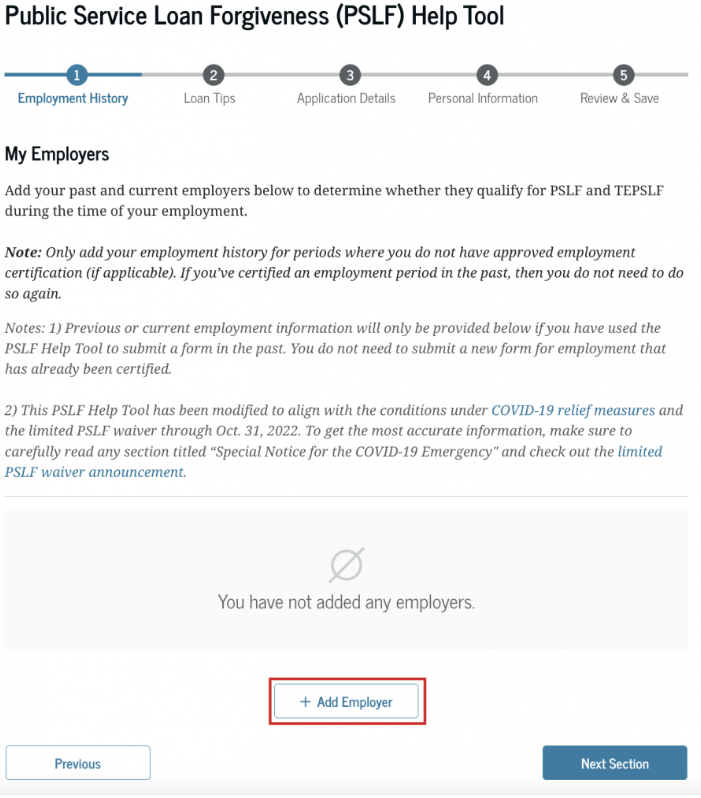

Include your employment history on the form.

If required, revisit prior employers to complete this step.

Ensure the completion of this process for every past employer eligible for PSLF. Avoid combining them on the same certification.

Fill out a separate certification (PSLF Help Tool Application) for each employer.

Include your employment history on the form.

If required, revisit prior employers to complete this step.

Ensure the completion of this process for every past employer eligible for PSLF. Avoid combining them on the same certification.

Fill out a separate certification (PSLF Help Tool Application) for each employer.

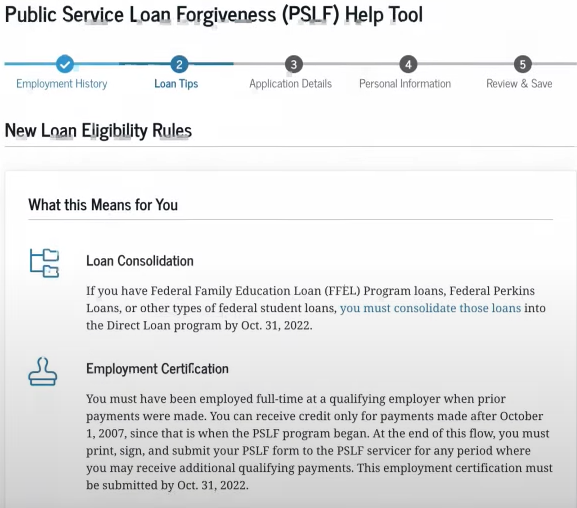

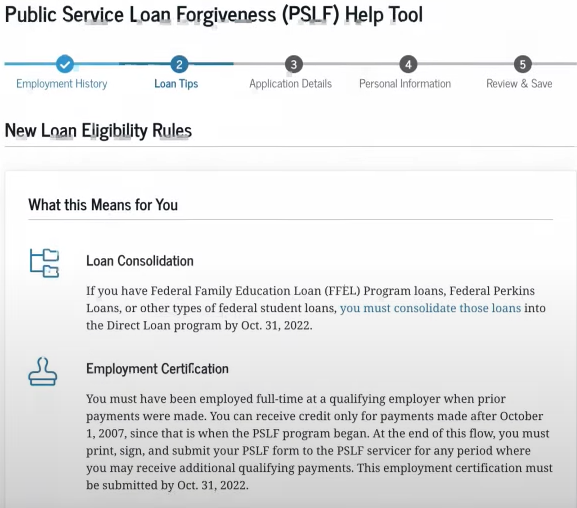

This section offers various loan strategies for your consideration. Here are some references:

- Public Service Loan Forgiveness (PSLF) Requirements

- Direct Loan Consolidation

- Saving on a Valuable Education (SAVE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

This section offers various loan strategies for your consideration. Here are some references:

- Public Service Loan Forgiveness (PSLF) Requirements

- Direct Loan Consolidation

- Saving on a Valuable Education (SAVE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

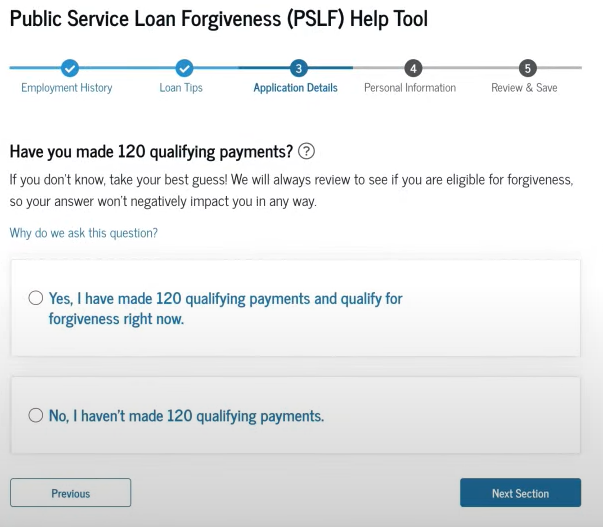

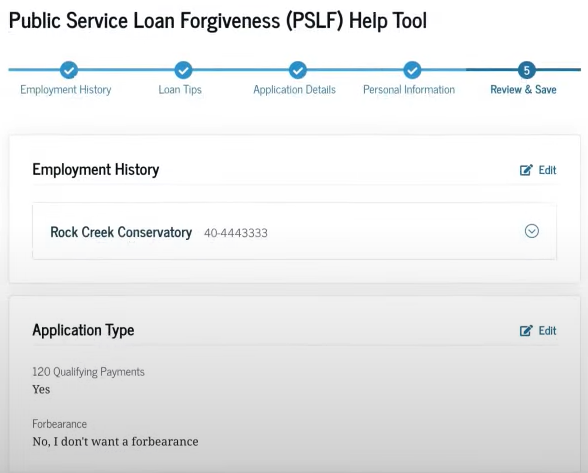

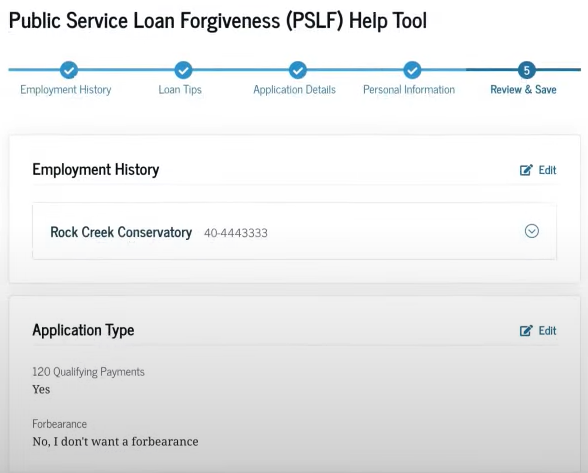

Choose in this section: if you’ve made 120 qualifying payments and are applying for PSLF forgiveness, or if you haven’t reached 120 payments and are using this to track your progress towards PSLF.

Choose in this section: if you’ve made 120 qualifying payments and are applying for PSLF forgiveness, or if you haven’t reached 120 payments and are using this to track your progress towards PSLF.

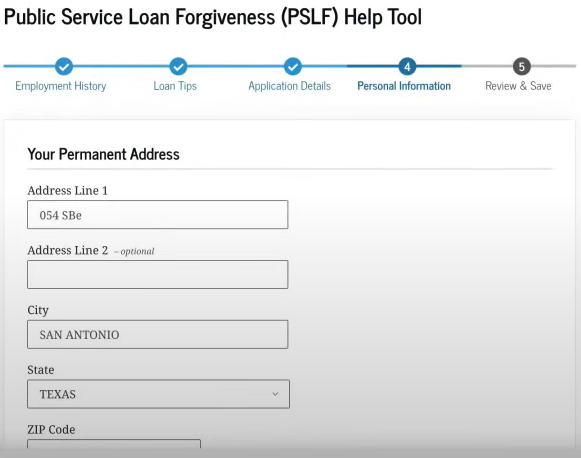

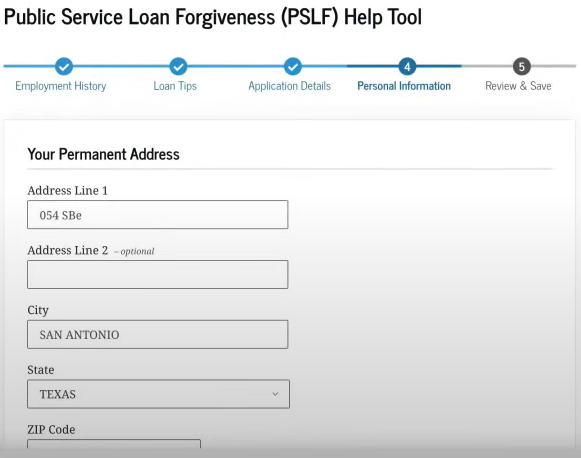

Provide your personal information.

Provide your personal information.

Review your details and choose “Save” to generate your pre-filled PSLF certification form for your employer’s signature.

Review your details and choose “Save” to generate your pre-filled PSLF certification form for your employer’s signature.

Submit the populated form to your employer for their signature.

Before completing this section, reach out to your GME or HR Department to confirm the designated signatory for the PSLF certification. Inform them that they will receive an email from DocuSign (dse@docusign.net) on your behalf. Note that your employer has 60 days to sign the form.

Submit the populated form to your employer for their signature.

Before completing this section, reach out to your GME or HR Department to confirm the designated signatory for the PSLF certification. Inform them that they will receive an email from DocuSign (dse@docusign.net) on your behalf. Note that your employer has 60 days to sign the form.

Conclusion

The PSLF Help Tool simplifies loan forgiveness for public service professionals.

By updating your employment and income annually, you’ll stay on track toward PSLF.

With each step completed, you’ll be ready to apply for tax-free loan forgiveness after 120 qualifying payments—making the path to debt relief straightforward and manageable.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Conclusion

The PSLF Help Tool simplifies loan forgiveness for public service professionals.

By updating your employment and income annually, you’ll stay on track toward PSLF.

With each step completed, you’ll be ready to apply for tax-free loan forgiveness after 120 qualifying payments—making the path to debt relief straightforward and manageable.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.