Overview

The Saving on a Valuable Education (SAVE) plan is one of the most generous Income-Driven Repayment (IDR) options available.

For many new doctors, SAVE often results in the lowest monthly student loan payment.

One standout feature of SAVE is its 100% interest subsidy, which is especially appealing for physicians in training or those not pursuing loan forgiveness. If your monthly payment doesn’t cover the full interest, the difference is completely forgiven, preventing your loan balance from growing over time.

Let’s explore how the SAVE Repayment Plan is calculated and why it might be your best option moving forward.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Overview

The Saving on a Valuable Education (SAVE) plan is one of the most generous Income-Driven Repayment (IDR) options available.

For many new doctors, SAVE often results in the lowest monthly student loan payment.

One standout feature of SAVE is its 100% interest subsidy, which is especially appealing for physicians in training or those not pursuing loan forgiveness. If your monthly payment doesn’t cover the full interest, the difference is completely forgiven, preventing your loan balance from growing over time.

Let’s explore how the SAVE Repayment Plan is calculated and why it might be your best option moving forward.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Saving on a Valuable Education (SAVE)

Saving on a Valuable Education (SAVE) is an Income-Driven Repayment (IDR) plan that determines your monthly student loan payment based on your income and family size, unlike the 10-Year Standard Repayment plan, which calculates payments based on your loan balance and interest rate.

SAVE is often the preferred repayment plan, particularly for recent medical school graduates and early-career physicians.

Why?

It not only provides many physicians with the lowest monthly student loan payments but also includes a 100% interest subsidy if your payment falls short of covering the interest you owe.

Saving on a Valuable Education (SAVE)

Saving on a Valuable Education (SAVE) is an Income-Driven Repayment (IDR) plan that determines your monthly student loan payment based on your income and family size, unlike the 10-Year Standard Repayment plan, which calculates payments based on your loan balance and interest rate.

SAVE is often the preferred repayment plan, particularly for recent medical school graduates and early-career physicians.

Why?

It not only provides many physicians with the lowest monthly student loan payments but also includes a 100% interest subsidy if your payment falls short of covering the interest you owe.

☁️ Poverty Line Deduction: 225%

☁️ Payment & Timeline:

-

-

Undergraduate Loans: 5% of your discretionary income for 20 years

-

Graduate Loans: 10% of your discretionary income for 25 years

-

☁️ Payment Cap: None

☁️ Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

☁️ Interest Subsidy: Yes, 100% of any unpaid interest

☁️ Poverty Line Deduction: 225%

☁️ Payment & Timeline:

-

Undergraduate Loans: 5% of your discretionary income for 20 years

-

Graduate Loans: 10% of your discretionary income for 25 years

☁️ Payment Cap: None

☁️ Excludes Spouse’s Income if Filing Taxes Married Filing Separately: Yes

☁️ Interest Subsidy: Yes, 100% of any unpaid interest

☁️ The following Direct Federal Loans qualify for SAVE:

-

-

Subsidized Direct Loans

-

Unsubsidized Direct Loans

-

Direct Grad PLUS Loans

-

Direct Consolidation Loans

-

☁️ However, the following types of loans do not qualify for SAVE:

-

-

Parent PLUS Loans

-

FFEL (Federal Family Education Loan) Loans

-

Direct Loans in Default

-

Private Student Loans

-

It’s worth noting that FFEL loans can qualify if included in a Direct Consolidation Loan. Parent PLUS Loans can also qualify through the Double-Consolidation Loophole, involving two separate consolidations. If you are a Parent PLUS loan borrower, it is highly recommended to consult with someone who specializes in student loan planning.

☁️ The following Direct Federal Loans qualify for SAVE:

-

Subsidized Direct Loans

-

Unsubsidized Direct Loans

-

Direct Grad PLUS Loans

-

Direct Consolidation Loans

☁️ However, the following types of loans do not qualify for SAVE:

-

Parent PLUS Loans

-

FFEL (Federal Family Education Loan) Loans

-

Direct Loans in Default

-

Private Student Loans

It’s worth noting that FFEL loans can qualify if included in a Direct Consolidation Loan. Parent PLUS Loans can also qualify through the Double-Consolidation Loophole, involving two separate consolidations. If you are a Parent PLUS loan borrower, it is highly recommended to consult with someone who specializes in student loan planning.

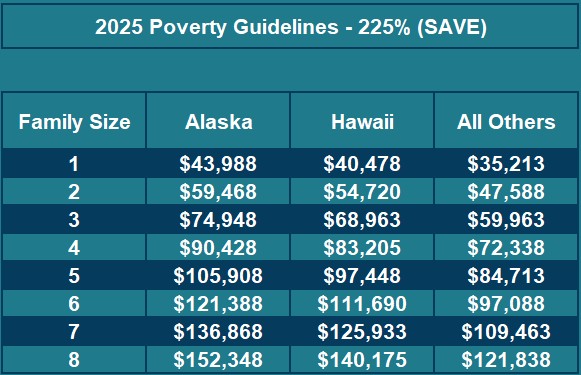

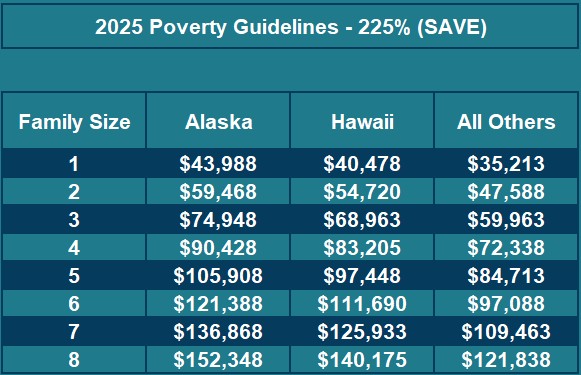

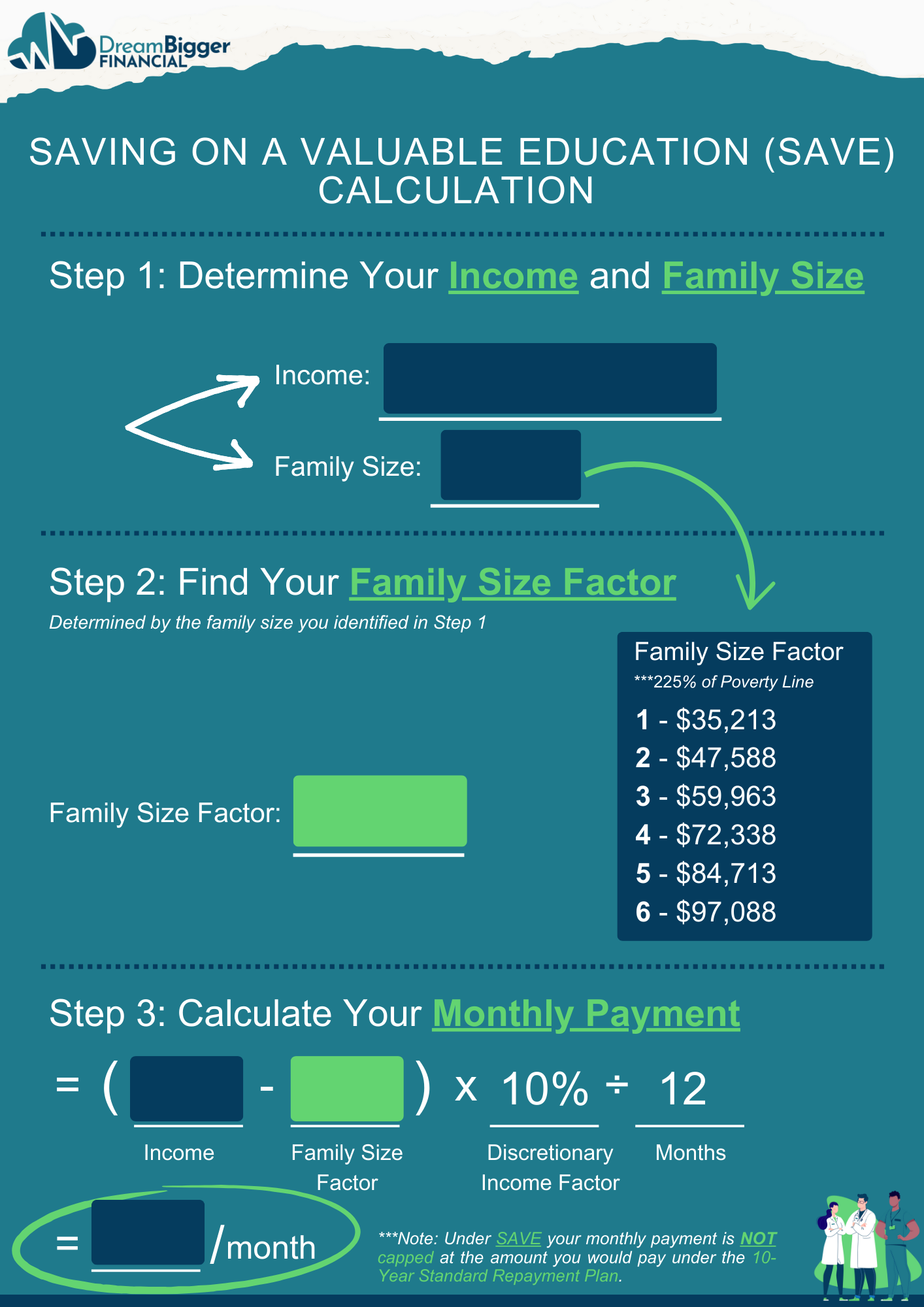

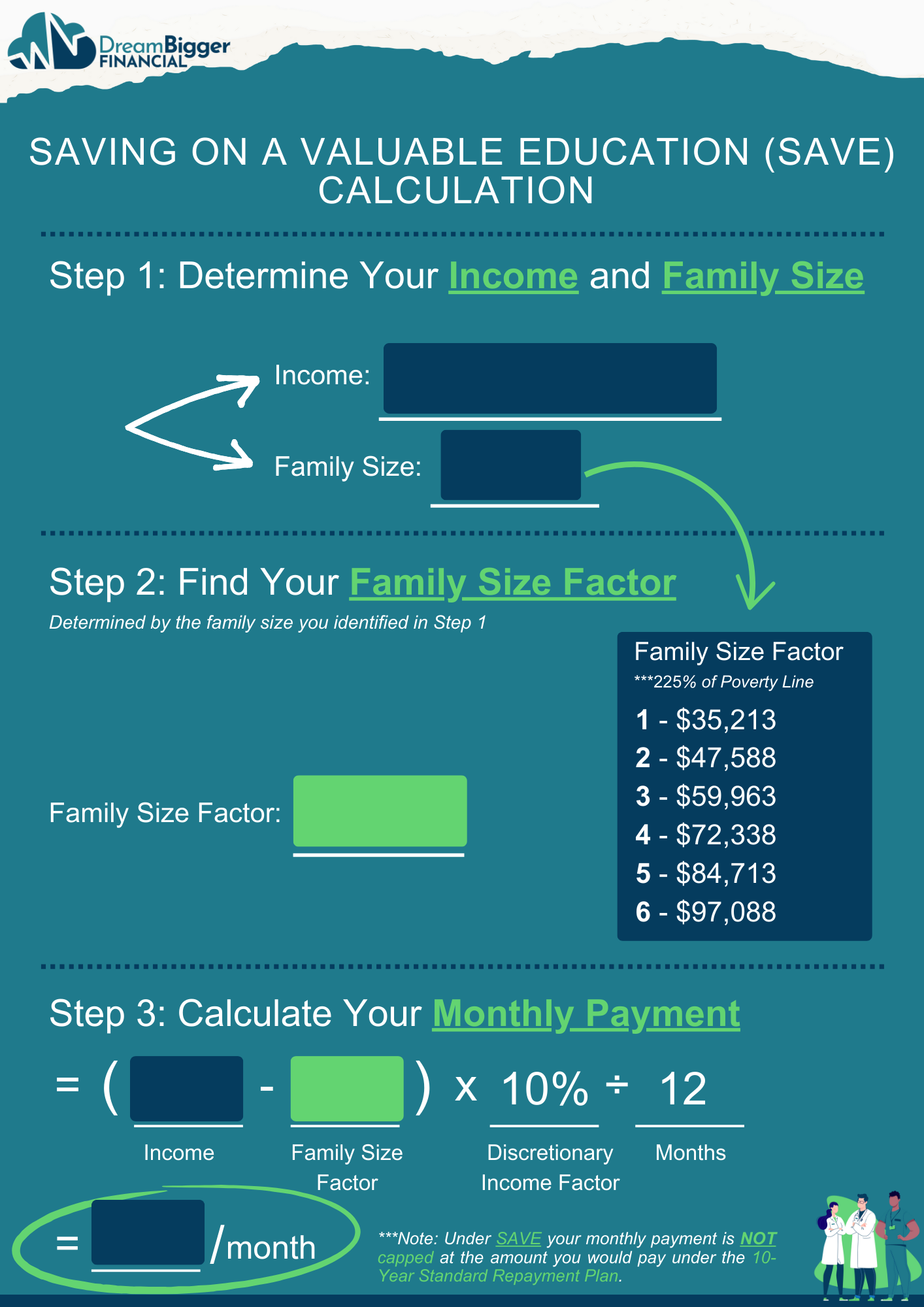

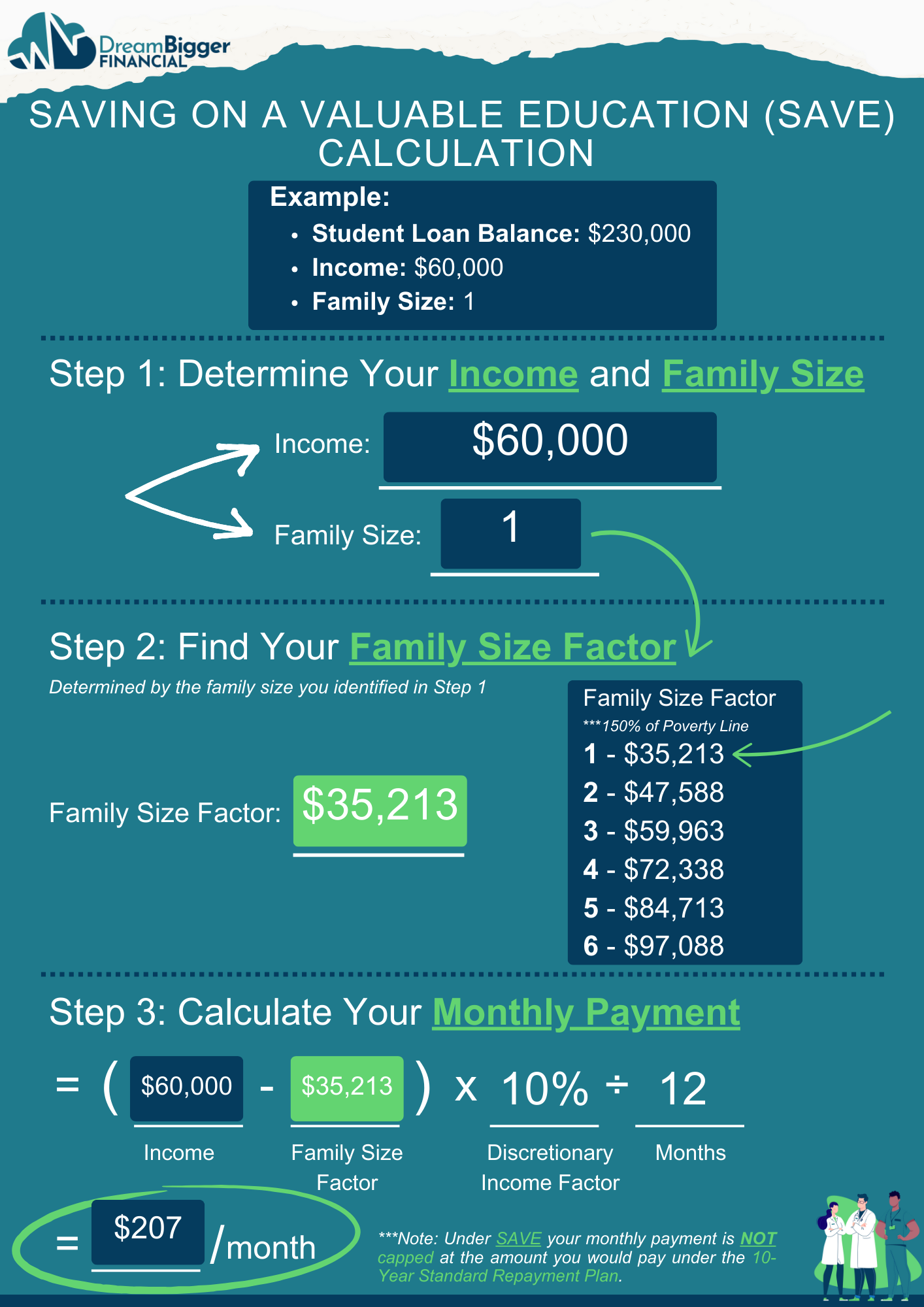

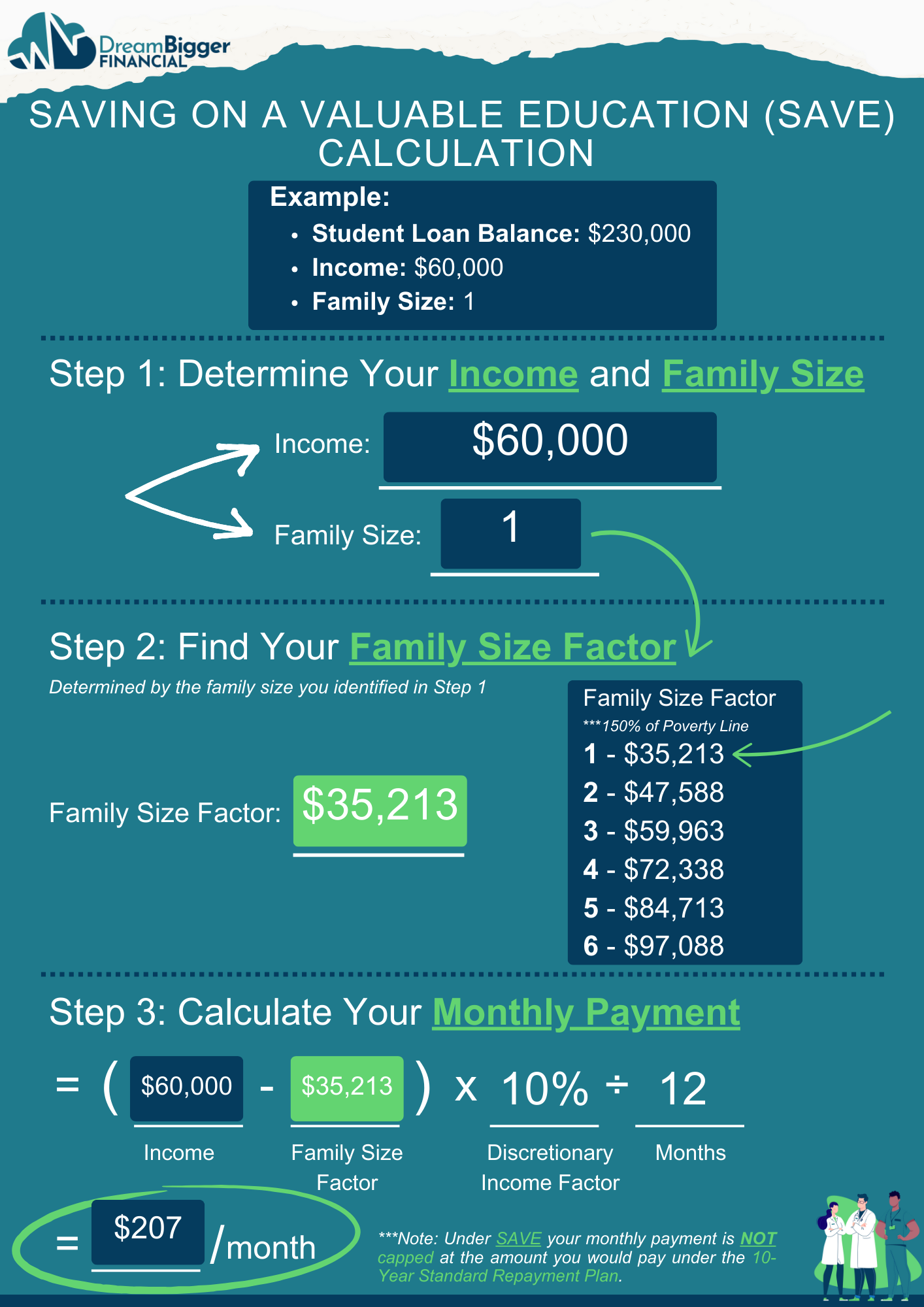

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

The Family Size Factor is calculated by multiplying the Poverty Guideline by 225%. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

Just as the standard deduction reduces your taxable income when filing your taxes, the poverty line deduction can lower your monthly student loan payment under Income-Driven Repayment (IDR) plans.

The Department of Education wants to make sure you can cover your basic necessities, so they let you set aside a portion of your income with the intent of covering those expenses. The remaining balance is then used to determine your income for an IDR plan.

The Family Size Factor is calculated by multiplying the Poverty Guideline by 225%. This resulting value is then subtracted from your income to determine your discretionary income, which is used in the calculation of your monthly student loan payment.

SAVE – Payment & Timeline

Saving on a Valuable Education (SAVE) plan:

-

-

Undergraduate Loans: 5% of your discretionary income for 20 years

-

Graduate Loans: 10% of your discretionary income for 25 years

-

While the SAVE plan offers forgiveness after 20 years for undergrad loans and 25 years for graduate loans, those working for a non-profit or a 501(c)(3) hospital can qualify for Public Service Loan Forgiveness (PSLF). This program allows for loan forgiveness after just 10 years of payments — tax-free.

Since many physicians will pay off their loans before reaching the 20 or 25-year mark, PSLF is an attractive option for eligible borrowers.

SAVE – Payment & Timeline

Saving on a Valuable Education (SAVE) plan:

-

Undergraduate Loans: 5% of your discretionary income for 20 years

-

Graduate Loans: 10% of your discretionary income for 25 years

While the SAVE plan offers forgiveness after 20 years for undergrad loans and 25 years for graduate loans, those working for a non-profit or a 501(c)(3) hospital can qualify for Public Service Loan Forgiveness (PSLF). This program allows for loan forgiveness after just 10 years of payments — tax-free.

Since many physicians will pay off their loans before reaching the 20 or 25-year mark, PSLF is an attractive option for eligible borrowers.

SAVE – Payment Cap

The Payment Cap is the maximum monthly payment under Income-Driven Repayment plans, specifically for IBR and PAYE. This cap is especially beneficial for higher-earning physicians.

For example, if you have a $230,000 student loan balance at a 6.0% interest rate, your monthly payment under the 10-Year Standard Repayment Plan would be $2,554. By enrolling in IBR or PAYE, you ensure that your monthly payment never exceeds this amount.

In contrast, the Saving on a Valuable Education (SAVE) Income-Driven Repayment plan does NOT have a payment cap, meaning your monthly payments could be significantly higher, particularly if you’re a high-earning physician.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, IBR and PAYE are likely your best option due to this payment cap.

However, during training, everyone is likely to benefit from SAVE as it offers the lowest monthly payment.

SAVE – Payment Cap

The Payment Cap is the maximum monthly payment under Income-Driven Repayment plans, specifically for IBR and PAYE. This cap is especially beneficial for higher-earning physicians.

For example, if you have a $230,000 student loan balance at a 6.0% interest rate, your monthly payment under the 10-Year Standard Repayment Plan would be $2,554. By enrolling in IBR or PAYE, you ensure that your monthly payment never exceeds this amount.

In contrast, the Saving on a Valuable Education (SAVE) Income-Driven Repayment plan does NOT have a payment cap, meaning your monthly payments could be significantly higher, particularly if you’re a high-earning physician.

Rule of thumb: If you’re single or married filing separately and your current income, or future income if you are in training is expected to exceed $100,000 of your student loan balance, IBR and PAYE are likely your best option due to this payment cap.

However, during training, everyone is likely to benefit from SAVE as it offers the lowest monthly payment.

If you’re enrolled in SAVE, you can choose to file your taxes separately from your partner, which is a strategy many physicians use to reduce their monthly payments.

When filing Married Filing Separately (MFS), you cannot claim any dependents that someone else has already claimed. This opens up various planning opportunities.

Filing as Married Filing Jointly (MFJ) provides a straightforward calculation for family size. However, if you opt for MFS to lower your student loan payments, it’s crucial that the spouse with the student loans claims the dependents. Otherwise, you might end up paying more on your loans.

For example, consider a family of four where Spouse 1 has $230,000 in student loans, and Spouse 2 has none. If they file MFS, it’s beneficial for Spouse 1 to claim the children. Under the Income-Driven Repayment plan, a larger family size leads to a lower monthly payment.

If Spouse 2 claims the kids, Spouse 1’s family size is 1, resulting in a deduction of $35,213 for their student loan payment under IBR. However, if Spouse 1 claims the kids, their family size increases to 3 (excluding Spouse 1), yielding a deduction of $59,963. This switch can save Spouse 1 about $135 per month, or $1,620 per year!

If you find yourself in this situation, it’s wise to consult a financial professional specializing in student loans, as this strategy is often misunderstood by many tax professionals.

If you’re enrolled in SAVE, you can choose to file your taxes separately from your partner, which is a strategy many physicians use to reduce their monthly payments.

When filing Married Filing Separately (MFS), you cannot claim any dependents that someone else has already claimed. This opens up various planning opportunities.

Filing as Married Filing Jointly (MFJ) provides a straightforward calculation for family size. However, if you opt for MFS to lower your student loan payments, it’s crucial that the spouse with the student loans claims the dependents. Otherwise, you might end up paying more on your loans.

For example, consider a family of four where Spouse 1 has $230,000 in student loans, and Spouse 2 has none. If they file MFS, it’s beneficial for Spouse 1 to claim the children. Under the Income-Driven Repayment plan, a larger family size leads to a lower monthly payment.

If Spouse 2 claims the kids, Spouse 1’s family size is 1, resulting in a deduction of $35,213 for their student loan payment under IBR. However, if Spouse 1 claims the kids, their family size increases to 3 (excluding Spouse 1), yielding a deduction of $59,963. This switch can save Spouse 1 about $135 per month, or $1,620 per year!

If you find yourself in this situation, it’s wise to consult a financial professional specializing in student loans, as this strategy is often misunderstood by many tax professionals.

SAVE – Interest Rate Subsidy

Interest Rate Subsidies: IBR and PAYE vs. SAVE

Unlike IBR and PAYE, the SAVE offers a 100% interest rate subsidy. This feature often makes SAVE the preferred choice for early-career physicians and those still in training.

Under the SAVE plan, if your monthly payment doesn’t cover the full interest owed, the remaining unpaid interest is completely forgiven.

For instance, if your calculated payment under SAVE is $300 but the actual interest is $1,000, the $700 difference is fully forgiven. This forgiven interest does not add to your student loan balance, keeping it stable even if your payment is less than what you owe.

This feature is particularly beneficial for physicians who are not pursuing Public Service Loan Forgiveness (PSLF) and for those in training. The key advantage is that unpaid interest does not increase your loan balance, allowing you to pay less toward your student loans without worrying about accruing additional interest.

Important Note: In contrast, if you are enrolled in IBR or PAYE and have a shortfall (like the $700 in our example), that amount accumulates on your student loan balance, increasing the total amount you owe. However, if you are pursuing PSLF, this is less of a concern since your full remaining balance is forgiven tax-free after 120 qualifying payments.

SAVE – Interest Rate Subsidy

Interest Rate Subsidies: IBR and PAYE vs. SAVE

Unlike IBR and PAYE, the SAVE offers a 100% interest rate subsidy. This feature often makes SAVE the preferred choice for early-career physicians and those still in training.

Under the SAVE plan, if your monthly payment doesn’t cover the full interest owed, the remaining unpaid interest is completely forgiven.

For instance, if your calculated payment under SAVE is $300 but the actual interest is $1,000, the $700 difference is fully forgiven. This forgiven interest does not add to your student loan balance, keeping it stable even if your payment is less than what you owe.

This feature is particularly beneficial for physicians who are not pursuing Public Service Loan Forgiveness (PSLF) and for those in training. The key advantage is that unpaid interest does not increase your loan balance, allowing you to pay less toward your student loans without worrying about accruing additional interest.

Important Note: In contrast, if you are enrolled in IBR or PAYE and have a shortfall (like the $700 in our example), that amount accumulates on your student loan balance, increasing the total amount you owe. However, if you are pursuing PSLF, this is less of a concern since your full remaining balance is forgiven tax-free after 120 qualifying payments.

SAVE – Calculating Your Monthly Payment

SAVE – Calculating Your Monthly Payment

SAVE – How to Calculate Income

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

You have two ways to calculate your income for an IDR Plan: Adjusted Gross Income (AGI) or an Alternative Documentation of Income, usually your paystub.

Way 1: Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

Important Note for MS4s!

Even if you had no income during medical school, e-Filing a tax return in your MS4 year showing as little as $1 of income is a elite student loan planning strategy. This often enables tou to qualify for $0/month student loan payments intern year!

For married individuals, the household income is taken into account when calculating payments. You might consider filing taxes as Married Filing Separately (MFS) to potentially lower your student loan payments. However, it’s essential to carefully weigh the pros and cons of this strategy before proceeding.

Click here to learn more about this strategy.

Way 2: Alternative Documentation of Income

If you didn’t file a tax return, you’ll need to use Alternative Documentation of Income, usually a paystub, to certify your income. Your paystub serves as the basis for extrapolating your income for a full year, determining the income used in calculating your monthly student loan payment. As a PGY1, if your salary is $60,000, this amount becomes the cornerstone for your student loan payment calculation in an IDR plan.

SAVE – How to Calculate Income

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is determined by your income and family size.

In simple terms: the higher your income, the larger your monthly payment; the lower your income, the smaller your monthly payment.

You have two ways to calculate your income for an IDR Plan: Adjusted Gross Income (AGI) or an Alternative Documentation of Income, usually your paystub.

Way 1: Adjusted Gross Income (AGI)

Your AGI, found on line 11 of IRS Form 1040 from your prior year’s tax return, is any income earned in the prior year minus specific eligible deductions. Examples of income include job earnings, self-employment income, dividends, and interest.

Having a tax return on file is required to use AGI to calculate your monthly student loan payment.

Important Note for MS4s!

Even if you had no income during medical school, e-Filing a tax return in your MS4 year showing as little as $1 of income is a elite student loan planning strategy. This often enables tou to qualify for $0/month student loan payments intern year!

For married individuals, the household income is taken into account when calculating payments. You might consider filing taxes as Married Filing Separately (MFS) to potentially lower your student loan payments. However, it’s essential to carefully weigh the pros and cons of this strategy before proceeding.

Click here to learn more about this strategy.

Way 2: Alternative Documentation of Income

If you didn’t file a tax return, you’ll need to use Alternative Documentation of Income, usually a paystub, to certify your income. Your paystub serves as the basis for extrapolating your income for a full year, determining the income used in calculating your monthly student loan payment. As a PGY1, if your salary is $60,000, this amount becomes the cornerstone for your student loan payment calculation in an IDR plan.

SAVE – How to Determine Your Family Size

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is calculated based on your income and family size.

In simple terms: the bigger your family, the smaller your monthly student loan payment; the smaller your family, the bigger your monthly student loan payment.

Your family size for the purposes of Income-Driven Repayment plans includes: You, your spouse, any dependents/family that receives more than half of their support from you. Additionally, any unborn children also count when calculating your family size.

SAVE – How to Determine Your Family Size

On an Income-Driven Repayment (IDR) plan, your monthly student loan payment is calculated based on your income and family size.

In simple terms: the bigger your family, the smaller your monthly student loan payment; the smaller your family, the bigger your monthly student loan payment.

Your family size for the purposes of Income-Driven Repayment plans includes: You, your spouse, any dependents/family that receives more than half of their support from you. Additionally, any unborn children also count when calculating your family size.

SAVE Example

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $230,000

-

Average Interest Rate: 6.0%

-

Income (PGY1): $60,000

-

Family Size: 1

-

All student loans are from medical school (graduate loans)

-

Dr. Don, a recent medical school graduate, was initially burdened with a monthly student loan payment of $2,554 under the 10-Year Standard Repayment plan, considering his $230,000 loan balance and a 6.0% interest rate.

In search of a more manageable option, Dr. Don explored SAVE.

Considering his income ($60,000) and family size (1), his SAVE payment significantly dropped to $167/month, leading to substantial savings of $2,387/month!

As a reminder, the $167/month payment under SAVE may not reduce Dr. Don’s student loan balance, and any unpaid interest does NOT accumulates on his $230,000 student loan balance. This means any unpaid interst does NOT make his student loan balance grow.

Note: If Dr. Don had undergrad loans, he would pay 5% of his discretionary income for a repayment term of 20 years. Additionally, if he lives in Alaska or Hawaii, he will use a different family size factor, which will affect his payment calculation.

SAVE Example

Introducing Dr. Don!

Dr. Don’s Details:

-

-

Loan Balance: $230,000

-

Average Interest Rate: 6.0%

-

Income (PGY1): $60,000

-

Family Size: 1

-

All student loans are from medical school (graduate loans)

-

Dr. Don, a recent medical school graduate, was initially burdened with a monthly student loan payment of $2,554 under the 10-Year Standard Repayment plan, considering his $230,000 loan balance and a 6.0% interest rate.

In search of a more manageable option, Dr. Don explored SAVE.

Considering his income ($60,000) and family size (1), his SAVE payment significantly dropped to $167/month, leading to substantial savings of $2,387/month!

As a reminder, the $167/month payment under SAVE may not reduce Dr. Don’s student loan balance, and any unpaid interest does NOT accumulates on his $230,000 student loan balance. This means any unpaid interst does NOT make his student loan balance grow.

Note: If Dr. Don had undergrad loans, he would pay 5% of his discretionary income for a repayment term of 20 years. Additionally, if he lives in Alaska or Hawaii, he will use a different family size factor, which will affect his payment calculation.

Conclusion

Saving on a Valuable Education (SAVE) offers a flexible way to manage your student loan payments based on your income and family size.

By understanding how SAVE works, including the potential for $0 payments early in your career and the importance of tax filing strategies, you can navigate your student loan repayment journey more effectively.

Consider consulting a financial professional specializing in tax management and student loan planning to tailor your repayment strategy to your unique situation and goals.

If you’re looking for a personalized plan, our team is here to help!

Disclosure: This content is for informational purposes only and should not be considered personalized financial advice. Please consult with your tax or financial professional for guidance tailored to your specific situation.

Conclusion

Saving on a Valuable Education (SAVE) offers a flexible way to manage your student loan payments based on your income and family size.

By understanding how SAVE works, including the potential for $0 payments early in your career and the importance of tax filing strategies, you can navigate your student loan repayment journey more effectively.

Consider consulting a financial professional specializing in tax management and student loan planning to tailor your repayment strategy to your unique situation and goals.

If you’re looking for a personalized plan, our team is here to help!

Disclosure: This content is for informational purposes only and should not be considered personalized financial advice. Please consult with your tax or financial professional for guidance tailored to your specific situation.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.