Introduction

If you’ve been following recent updates in the student loan repayment landscape, you may have found yourself enrolled in the new SAVE (Saving on a Valuable Education) plan, only to realize it may not be as beneficial for your long-term repayment strategy as you hoped.

The SAVE Plan, designed to lower monthly payments for borrowers, has created confusion, especially among those pursuing Public Service Loan Forgiveness (PSLF).

Understanding how this plan interacts with PSLF and other Income-Driven Repayment (IDR) plans is important for managing your loan strategy effectively.

Introduction

If you’ve been following recent updates in the student loan repayment landscape, you may have found yourself enrolled in the new SAVE (Saving on a Valuable Education) plan, only to realize it may not be as beneficial for your long-term repayment strategy as you hoped.

The SAVE Plan, designed to lower monthly payments for borrowers, has created confusion, especially among those pursuing Public Service Loan Forgiveness (PSLF).

Understanding how this plan interacts with PSLF and other Income-Driven Repayment (IDR) plans is important for managing your loan strategy effectively.

Student Loan Environment Updates as of December 15, 2024

Several pivotal changes are shaping the current student loan landscape:

👎 SAVE IDR Plan: “BLOCKED”

Enrollment is technically possible, but this plan is not eligible for PSLF and is likely to lose eligibility as a repayment option altogether.

👍 IBR, PAYE, and ICR Plans: AVAILABLE

Open for enrollment and eligible for PSLF.

👍 Switching IDR Plans: AVAILABLE

Borrowers can enroll in or switch between Income-Driven Repayment (IDR) plans.

👍 Student Loan Consolidation: AVAILABLE

Consolidation remains accessible.

👍 Public Service Loan Forgiveness (PSLF): AVAILABLE

Applications are being accepted, but significant delays should be expected.

👍 PSLF Buyback Program: AVAILABLE

If you hit 120 qualifying payments or would have reached it had SAVE been eligible, you can “buy back” missed months. More information below.

Important Update:

According to a December 18, 2024, press release from the Department of Education, servicers will begin processing IDR applications “in the coming weeks.” However, based on past experience, “coming weeks” may evolve into “coming months.”

Applications for IBR, PAYE, and ICR plans will be prioritized over SAVE, signaling that the Department expects SAVE to lose its status as an eligible IDR plan.

Student Loan Environment Updates as of December 15, 2024

Several pivotal changes are shaping the current student loan landscape:

👎 SAVE IDR Plan: “BLOCKED”

Enrollment is technically possible, but this plan is not eligible for PSLF and is likely to lose eligibility as a repayment option altogether.

👍 IBR, PAYE, and ICR Plans: AVAILABLE

Open for enrollment and eligible for PSLF.

👍 Switching IDR Plans: AVAILABLE

Borrowers can enroll in or switch between Income-Driven Repayment (IDR) plans.

👍 Student Loan Consolidation: AVAILABLE

Consolidation remains accessible.

👍 Public Service Loan Forgiveness (PSLF): AVAILABLE

Applications are being accepted, but significant delays should be expected.

👍 PSLF Buyback Program: AVAILABLE

If you hit 120 qualifying payments or would have reached it had SAVE been eligible, you can “buy back” missed months. More information below.

Important Update:

According to a December 18, 2024, press release from the Department of Education, servicers will begin processing IDR applications “in the coming weeks.” However, based on past experience, “coming weeks” may evolve into “coming months.”

Applications for IBR, PAYE, and ICR plans will be prioritized over SAVE, signaling that the Department expects SAVE to lose its status as an eligible IDR plan.

The PSLF Dilemma

As of December 15, 2024, there are three Income-Driven Repayment (IDR) Plans eligible for Public Service Loan Forgiveness (PSLF):

-

-

Income-Based Repayment (IBR)

-

Pay As You Earn (PAYE)

-

Income-Contingent Repayment (ICR)

-

Previously, the Saving on a Valuable Education (SAVE) plan was eligible for PSLF, but due to a court injunction in July 2024, SAVE is no longer eligible for PSLF.

Payments made under SAVE after that date will not count toward the PSLF requirements.

Key Updates:

As of December 15, 2024, PAYE and ICR have reopened for enrollment. Both were discontinued on July 1, 2024, but have since been reinstated.

The Department of Education has confirmed that SAVE is now ineligible for PSLF and is prioritizing the processing of IBR, PAYE, and ICR applications for a smoother transition.

What This Means for Borrowers:

If you are on the SAVE plan, it’s important to act now and consider switching to an eligible plan (IBR, PAYE, or ICR) to ensure your payments count toward PSLF and that you don’t lose progress.

The Department of Education is working to transition borrowers to eligible plans as quickly as possible, so switching now could save you from future headaches and setbacks.

The PSLF Dilemma

As of December 15, 2024, there are three Income-Driven Repayment (IDR) Plans eligible for Public Service Loan Forgiveness (PSLF):

-

Income-Based Repayment (IBR)

-

Pay As You Earn (PAYE)

-

Income-Contingent Repayment (ICR)

Previously, the Saving on a Valuable Education (SAVE) plan was eligible for PSLF, but due to a court injunction in July 2024, SAVE is no longer eligible for PSLF.

Payments made under SAVE after that date will not count toward the PSLF requirements.

Key Updates:

As of December 15, 2024, PAYE and ICR have reopened for enrollment. Both were discontinued on July 1, 2024, but have since been reinstated.

The Department of Education has confirmed that SAVE is now ineligible for PSLF and is prioritizing the processing of IBR, PAYE, and ICR applications for a smoother transition.

What This Means for Borrowers:

If you are on the SAVE plan, it’s important to act now and consider switching to an eligible plan (IBR, PAYE, or ICR) to ensure your payments count toward PSLF and that you don’t lose progress.

The Department of Education is working to transition borrowers to eligible plans as quickly as possible, so switching now could save you from future headaches and setbacks.

Should I Switch to IBR, PAYE, or ICR If I’m Currently on or Applying for SAVE?

Maybe… It depends on your situation.

What Is SAVE Forbearance?

SAVE forbearance temporarily pauses payments and impacts both interest accrual and forgiveness eligibility. There are two types:

Interest-Free Forbearance (on SAVE Plan):

-

-

No interest accrues, so your loan balance stays the same.

-

However, this period does not count toward Public Service Loan Forgiveness (PSLF) or other forgiveness programs.

-

General Forbearance (SAVE Application Pending, aka “SAVE LIMBO”):

-

-

Interest does accrue, increasing your loan balance over time.

-

Like interest-free forbearance, this period does not count toward PSLF or forgiveness.

-

When SAVE Forbearance Could Be Beneficial

If you’re not pursuing PSLF, SAVE forbearance can work in your favor:

-

-

You pause payments temporarily.

-

In interest-free forbearance, your loan balance remains stable (or grows in general forbearance).

-

You can redirect funds to other priorities or build savings for future payments.

-

The Drawbacks If You’re Pursuing PSLF

If you’re working toward PSLF, forbearance (interest-free or general) can be costly:

-

-

Time spent in forbearance does not count toward the 120 qualifying PSLF payments.

-

Missing these payments could delay forgiveness and extend your repayment timeline.

-

This is especially significant if you’re in training, as you’re missing out on low monthly payments that would count toward forgiveness.

Bottom Line

-

Not pursuing PSLF? Staying on the SAVE plan might be a helpful break.

-

Pursuing PSLF? Switch to an eligible plan like IBR, PAYE, or ICR to ensure your payments count and avoid losing progress.

Note: If you’re close to receiving PSLF, the PSLF Buyback Program may help recover missed months. In such cases, switching off SAVE could do more harm than good. Additional guidance below.

Should I Switch to IBR, PAYE, or ICR If I’m Currently on or Applying for SAVE?

Maybe… It depends on your situation.

What Is SAVE Forbearance?

SAVE forbearance temporarily pauses payments and impacts both interest accrual and forgiveness eligibility. There are two types:

Interest-Free Forbearance (on SAVE Plan):

-

No interest accrues, so your loan balance stays the same.

-

However, this period does not count toward Public Service Loan Forgiveness (PSLF) or other forgiveness programs.

General Forbearance (SAVE Application Pending, aka “SAVE LIMBO”):

-

Interest does accrue, increasing your loan balance over time.

-

Like interest-free forbearance, this period does not count toward PSLF or forgiveness.

When SAVE Forbearance Could Be Beneficial

If you’re not pursuing PSLF, SAVE forbearance can work in your favor:

-

You pause payments temporarily.

-

In interest-free forbearance, your loan balance remains stable (or grows in general forbearance).

-

You can redirect funds to other priorities or build savings for future payments.

The Drawbacks If You’re Pursuing PSLF

If you’re working toward PSLF, forbearance (interest-free or general) can be costly:

-

Time spent in forbearance does not count toward the 120 qualifying PSLF payments.

-

Missing these payments could delay forgiveness and extend your repayment timeline.

This is especially significant if you’re in training, as you’re missing out on low monthly payments that would count toward forgiveness.

Bottom Line

Not pursuing PSLF? Staying on the SAVE plan might be a helpful break.

Pursuing PSLF? Switch to an eligible plan like IBR, PAYE, or ICR to ensure your payments count and avoid losing progress.

Note: If you’re close to receiving PSLF, the PSLF Buyback Program may help recover missed months. In such cases, switching off SAVE could do more harm than good. Additional guidance below.

Understanding the Cost of SAVE Forbearance

Income-Driven Repayment (IDR) Plans:

When you start residency (or leave school), you are automatically enrolled in the 10-Year Standard Repayment Plan.

This plan works similarly to a mortgage, calculating your monthly student loan payment based on your loan balance and interest rate.

For example, if your student loan balance is $260,000 with an interest rate of 6%, your monthly payment would be a hefty $2,887!

However, enrolling in an Income-Driven Repayment (IDR) plan can dramatically reduce your monthly student loan payments.

Unlike the 10-Year Standard Repayment Plan, which calculates payments based on your loan balance and interest rate, IDR plans base your payment on your income and family size.

-

-

Lower Income = Lower Payments: The lower your income, the smaller your monthly payment will be.

-

Larger Family Size = Lower Payments: A larger family size also reduces your payment.

-

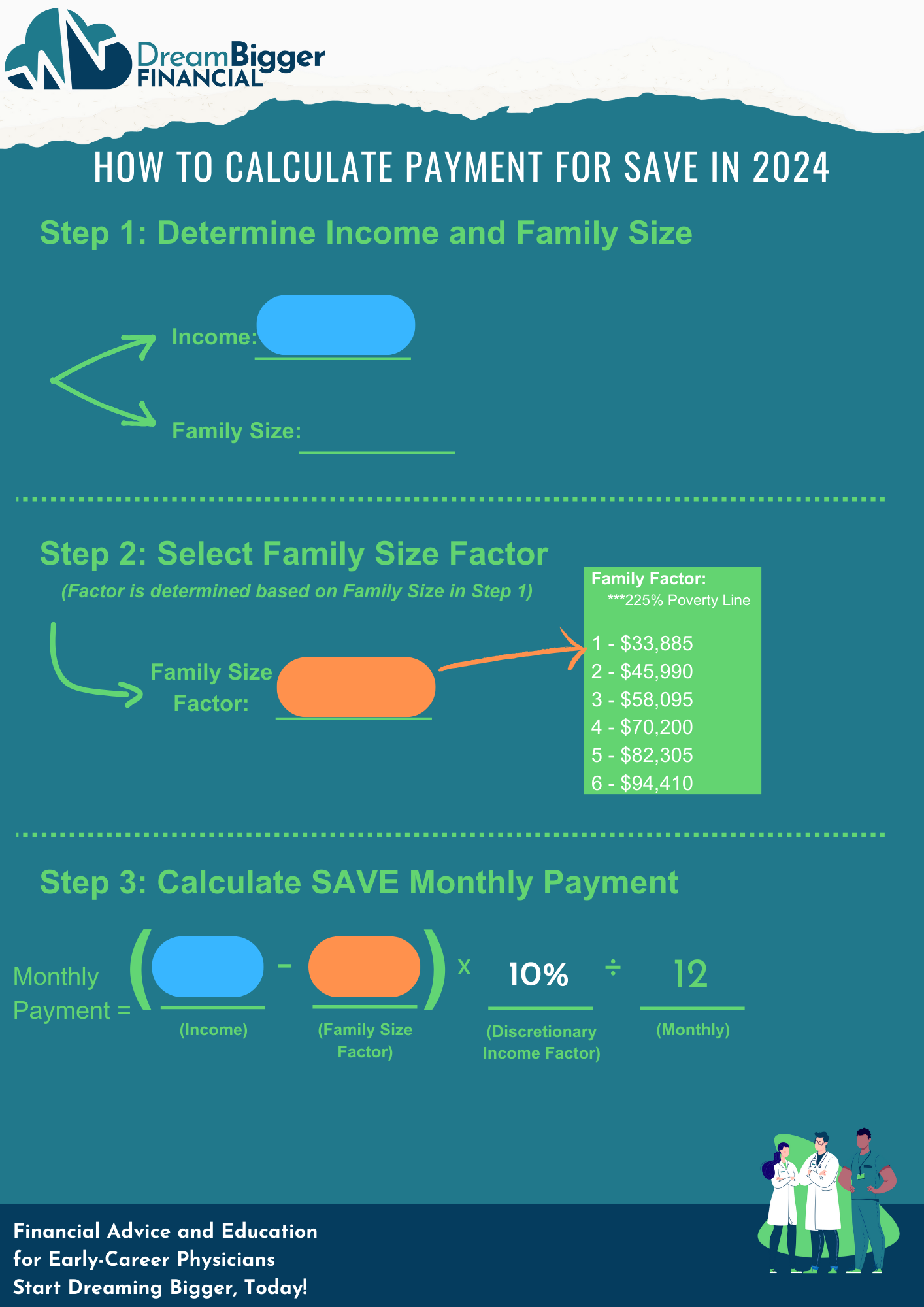

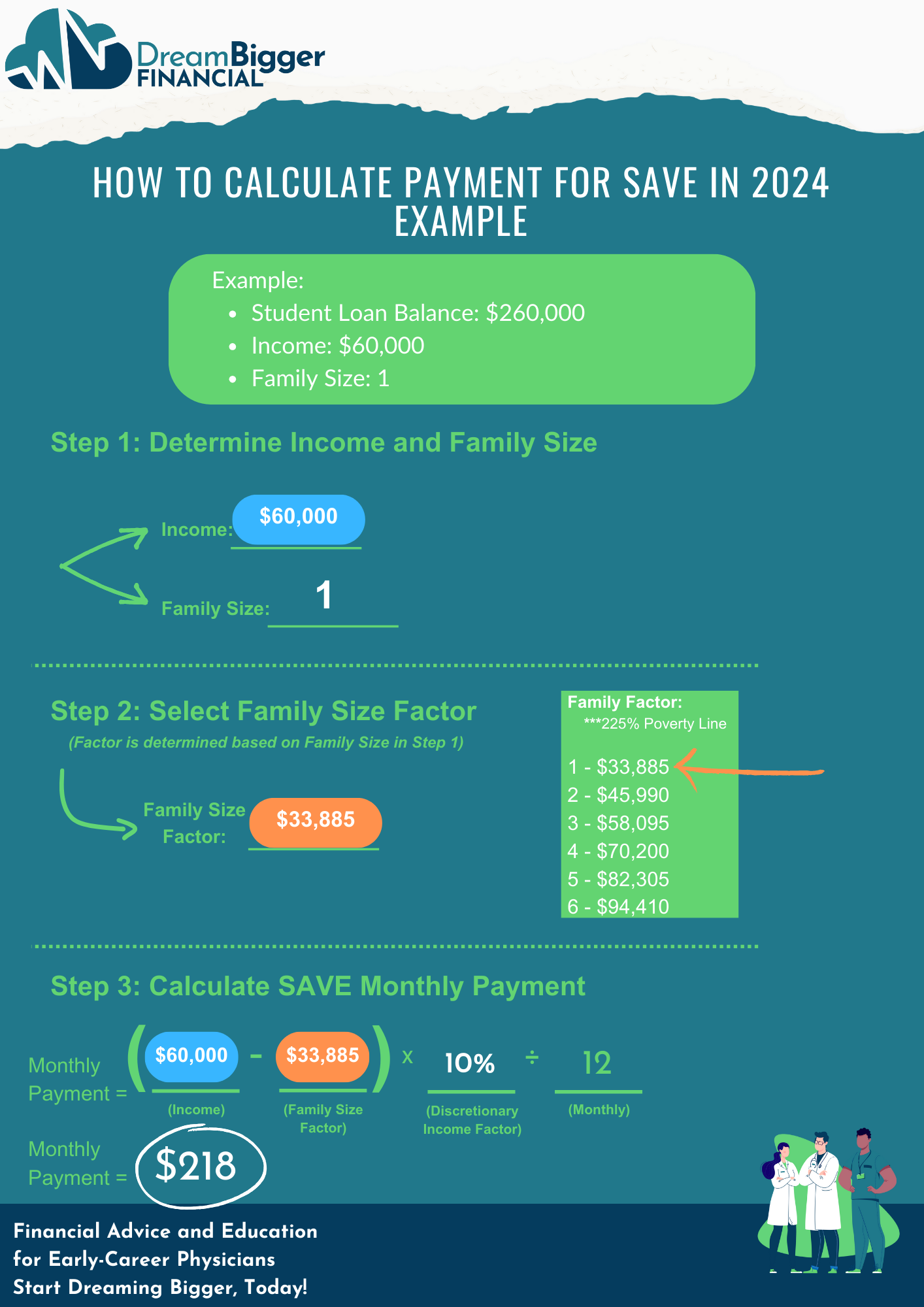

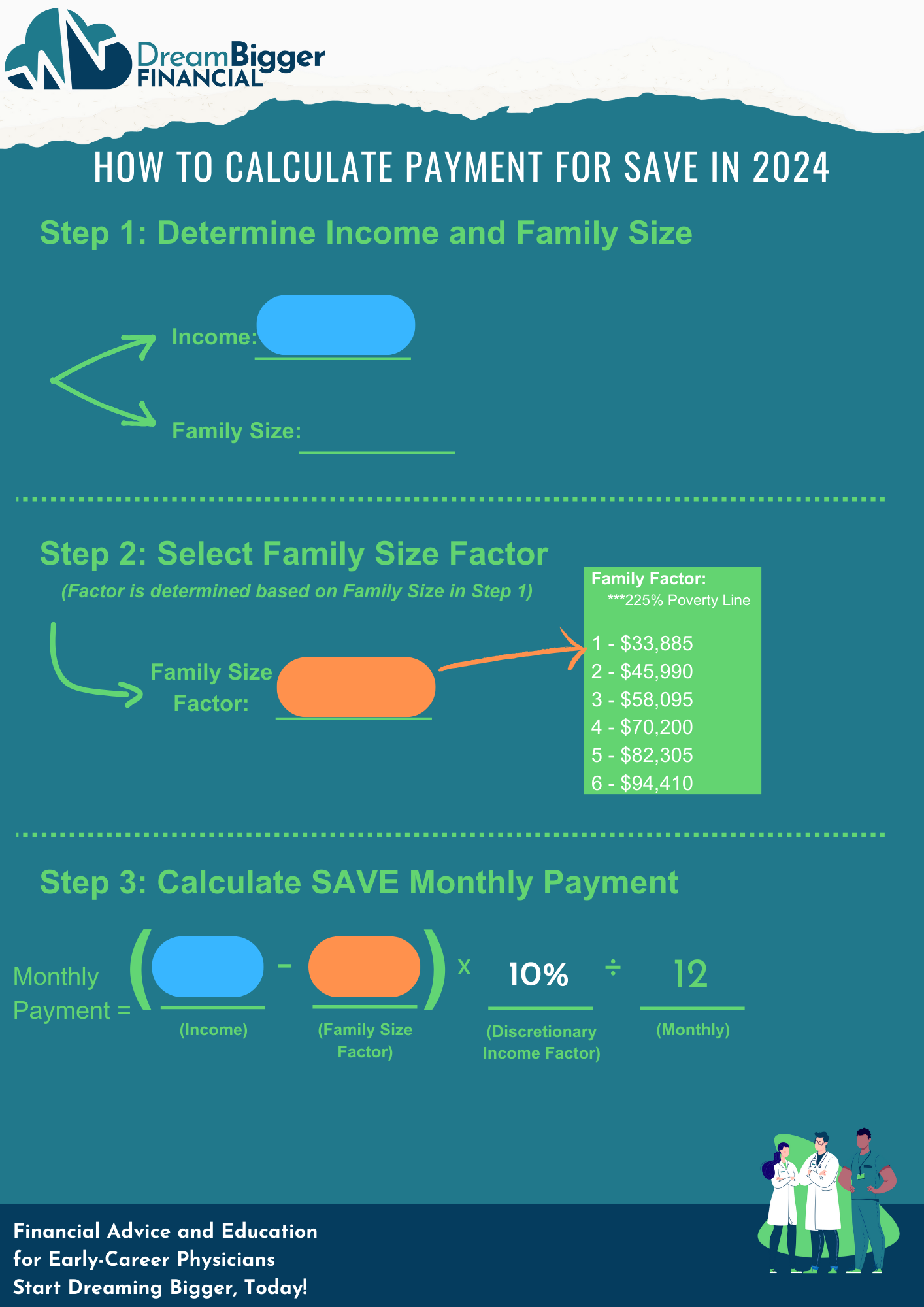

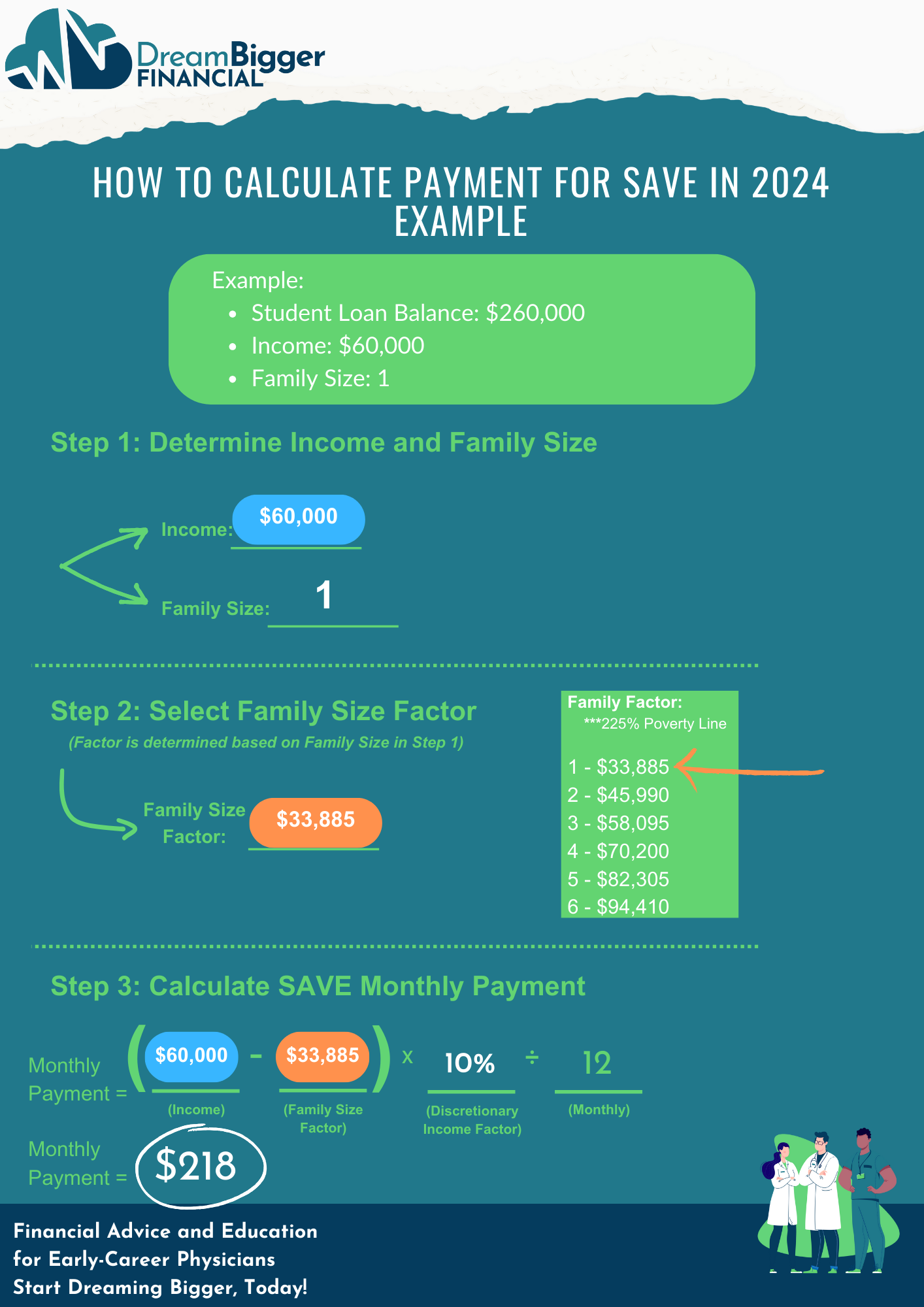

Example: IDR Payment Under The SAVE Plan (Resident)

Note: This strategy applies to other IDR plans as well, but the calculation will differ.

-

-

Loan Balance: $260,000

-

Resident Income: $60,000

-

Attending Income: $300,000

-

Under Public Service Loan Forgiveness (PSLF), you need to make 120 qualifying payments.

It doesn’t matter if your income is $60,000 or $300,000… each payment counts the same.

As a resident with a salary of $60,000, your monthly payment under the SAVE plan could be as low as $218.

If SAVE were still an eligible PSLF repayment plan, every $218 payment would count toward your 120 qualifying PSLF payments.

Example: IDR Payment Under The SAVE Plan (Attending)

Now, fast forward to when you’re earning $300,000 as an attending.

At that point, your monthly payment would rise to $2,218.

The Cost of Remaining on SAVE if Pursuing Forgiveness

If you’re on the SAVE plan, in training, and currently in forbearance, this time does not count toward PSLF.

This means you won’t benefit from low payments based on your training salary and may face significantly higher payments in the future once you transition to attending-level income.

In our example, this could cost you an extra $2,000 per month. The cost could rise even further if SAVE is eliminated and you need to switch to a different repayment plan.

If you remain in forbearance for six months, that’s an additional $12,000 ($2,000 x 6) in loan payments you will have to make once the freeze ends.

The higher your future income, the greater the financial impact.

The longer everything remains frozen, the heavier the burden on your finances.

Understanding the Cost of SAVE Forbearance

Income-Driven Repayment (IDR) Plans:

When you start residency (or leave school), you are automatically enrolled in the 10-Year Standard Repayment Plan.

This plan works similarly to a mortgage, calculating your monthly student loan payment based on your loan balance and interest rate.

For example, if your student loan balance is $260,000 with an interest rate of 6%, your monthly payment would be a hefty $2,887!

However, enrolling in an Income-Driven Repayment (IDR) plan can dramatically reduce your monthly student loan payments.

Unlike the 10-Year Standard Repayment Plan, which calculates payments based on your loan balance and interest rate, IDR plans base your payment on your income and family size.

-

-

Lower Income = Lower Payments: The lower your income, the smaller your monthly payment will be.

-

Larger Family Size = Lower Payments: A larger family size also reduces your payment.

-

Example: IDR Payment Under The SAVE Plan (Resident)

Note: This strategy applies to other IDR plans as well, but the calculation will differ.

-

Loan Balance: $260,000

-

Resident Income: $60,000

-

Attending Income: $300,000

Under Public Service Loan Forgiveness (PSLF), you need to make 120 qualifying payments.

It doesn’t matter if your income is $60,000 or $300,000… each payment counts the same.

As a resident with a salary of $60,000, your monthly payment under the SAVE plan could be as low as $218.

If SAVE were still an eligible PSLF repayment plan, every $218 payment would count toward your 120 qualifying PSLF payments.

Example: IDR Payment Under The SAVE Plan (Attending)

Now, fast forward to when you’re earning $300,000 as an attending.

At that point, your monthly payment would rise to $2,218.

The Cost of Remaining on SAVE if Pursuing Forgiveness

If you’re on the SAVE plan, in training, and currently in forbearance, this time does not count toward PSLF.

This means you won’t benefit from low payments based on your training salary and may face significantly higher payments in the future once you transition to attending-level income.

In our example, this could cost you an extra $2,000 per month. The cost could rise even further if SAVE is eliminated and you need to switch to a different repayment plan.

If you remain in forbearance for six months, that’s an additional $12,000 ($2,000 x 6) in loan payments you will have to make once the freeze ends.

The higher your future income, the greater the financial impact.

The longer everything remains frozen, the heavier the burden on your finances.

What is Income-Based Repayment?

Income-Based Repayment (IBR) is an Income-Driven Repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

IBR is one of the three IDR plans currently accepting new applicants and qualifies for Public Service Loan Forgiveness (PSLF).

Keep in mind, payments under IBR are generally higher than those calculated under the SAVE plan.

There are two versions of IBR, depending on when you first took out your student loans:

-

-

New IBR:

-

-

You pay 10% of your discretionary income for undergraduate and graduate loans.

-

Repayment term is 20 years.

-

After 20 years, any remaining balance is forgiven, though this forgiveness may be taxable.

-

-

-

-

-

Old IBR:

-

-

You pay 15% of your discretionary income.

-

Repayment term is 25 years.

-

Any remaining balance is forgiven after 25 years, but this may also be taxable.

-

-

-

Click here to learn more about Income-Based Repayment.

Here is the kicker…

To qualify for IBR, you need to demonstrate a Partial Financial Hardship.

This is determined by comparing your monthly payment under IBR (using 15% of your discretionary income) to the payment you’d make under the 10-Year Standard Repayment Plan.

For many currently on an IDR plan, the last income certification was in 2018. If your income is high relative to your student loan balance, there’s a chance you may not be eligible to enroll in IBR.

Click here to learn more about Partial Financial Hardship.

What is Income-Based Repayment?

Income-Based Repayment (IBR) is an Income-Driven Repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

IBR is one of the three IDR plans currently accepting new applicants and qualifies for Public Service Loan Forgiveness (PSLF).

Keep in mind, payments under IBR are generally higher than those calculated under the SAVE plan.

There are two versions of IBR, depending on when you first took out your student loans:

-

New IBR:

-

You pay 10% of your discretionary income for undergraduate and graduate loans.

-

Repayment term is 20 years.

-

After 20 years, any remaining balance is forgiven, though this forgiveness may be taxable.

-

-

Old IBR:

-

You pay 15% of your discretionary income.

-

Repayment term is 25 years.

-

Any remaining balance is forgiven after 25 years, but this may also be taxable.

-

Click here to learn more about Income-Based Repayment.

Here is the kicker…

To qualify for IBR, you need to demonstrate a Partial Financial Hardship.

This is determined by comparing your monthly payment under IBR (using 15% of your discretionary income) to the payment you’d make under the 10-Year Standard Repayment Plan.

For many currently on an IDR plan, the last income certification was in 2018. If your income is high relative to your student loan balance, there’s a chance you may not be eligible to enroll in IBR.

Click here to learn more about Partial Financial Hardship.

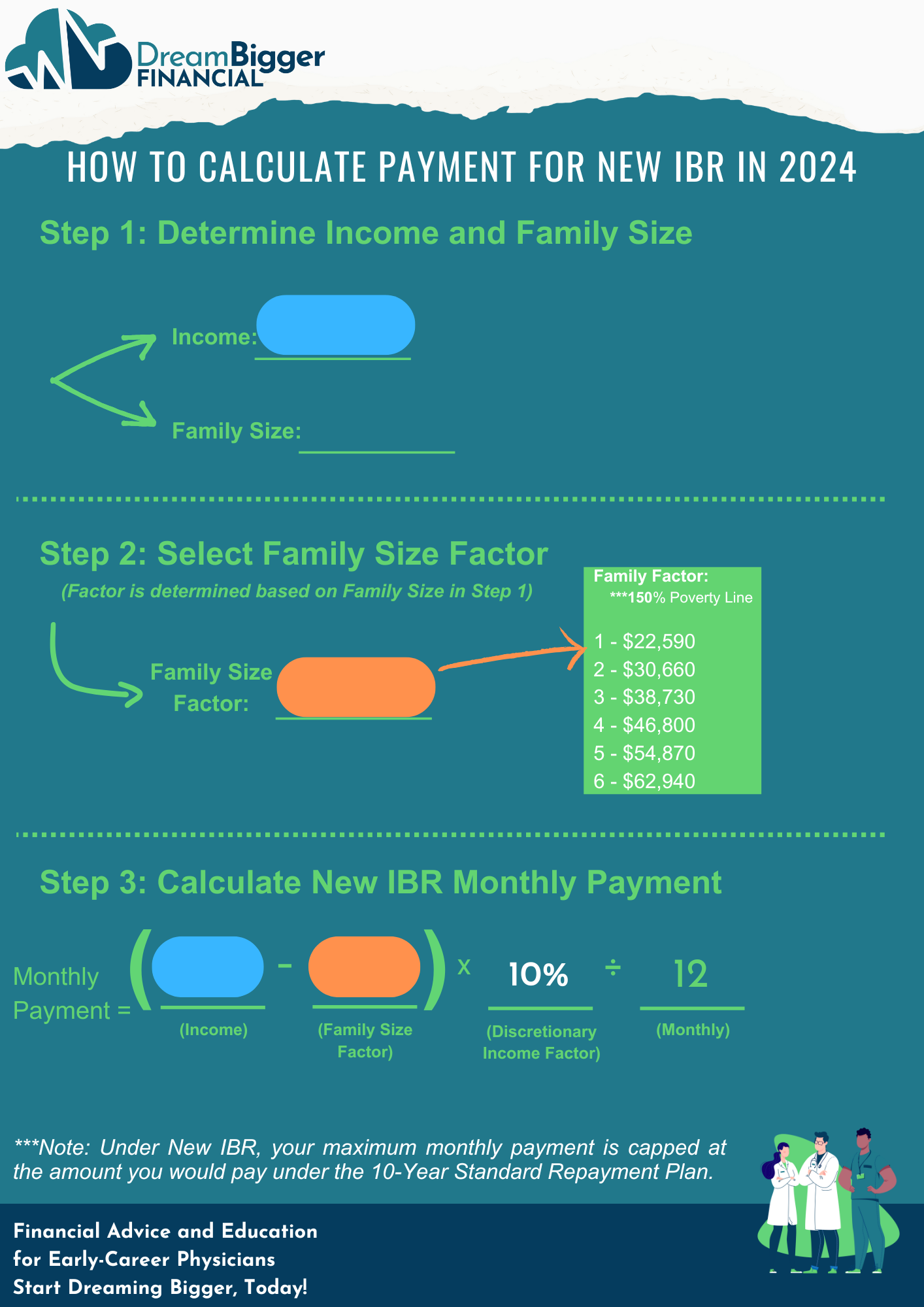

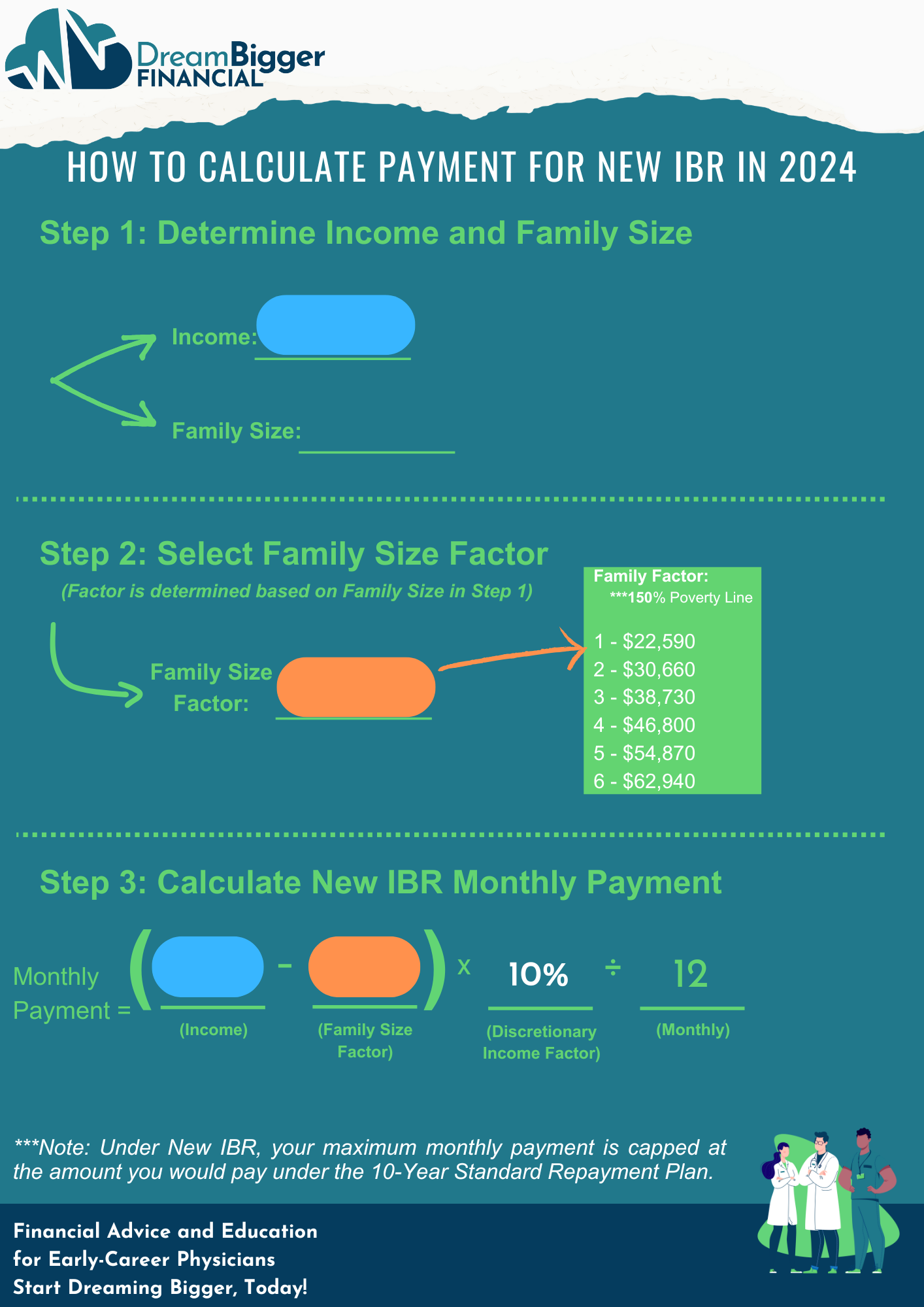

New IBR – Calculating Your Monthly Payment

New IBR – Calculating Your Monthly Payment

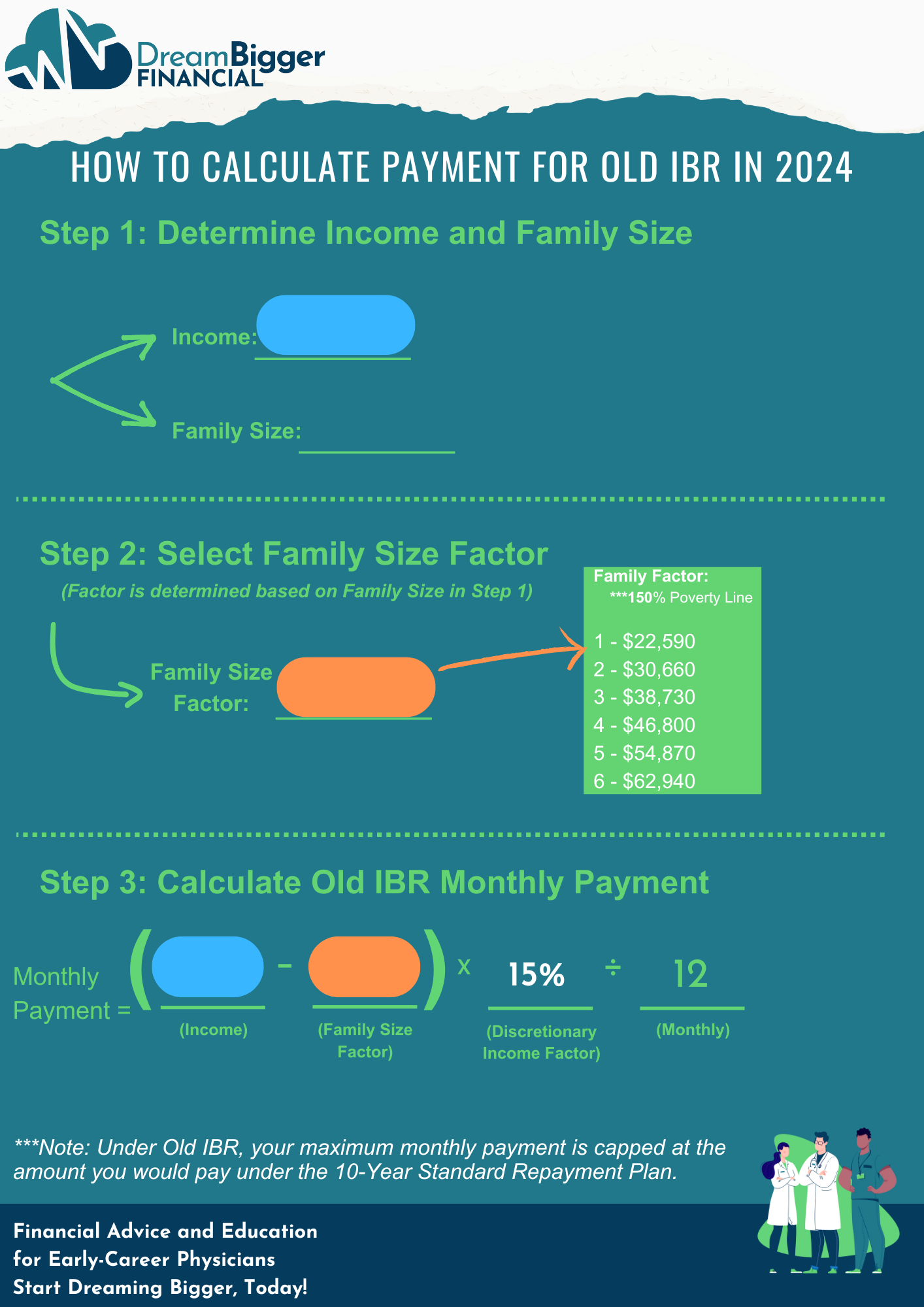

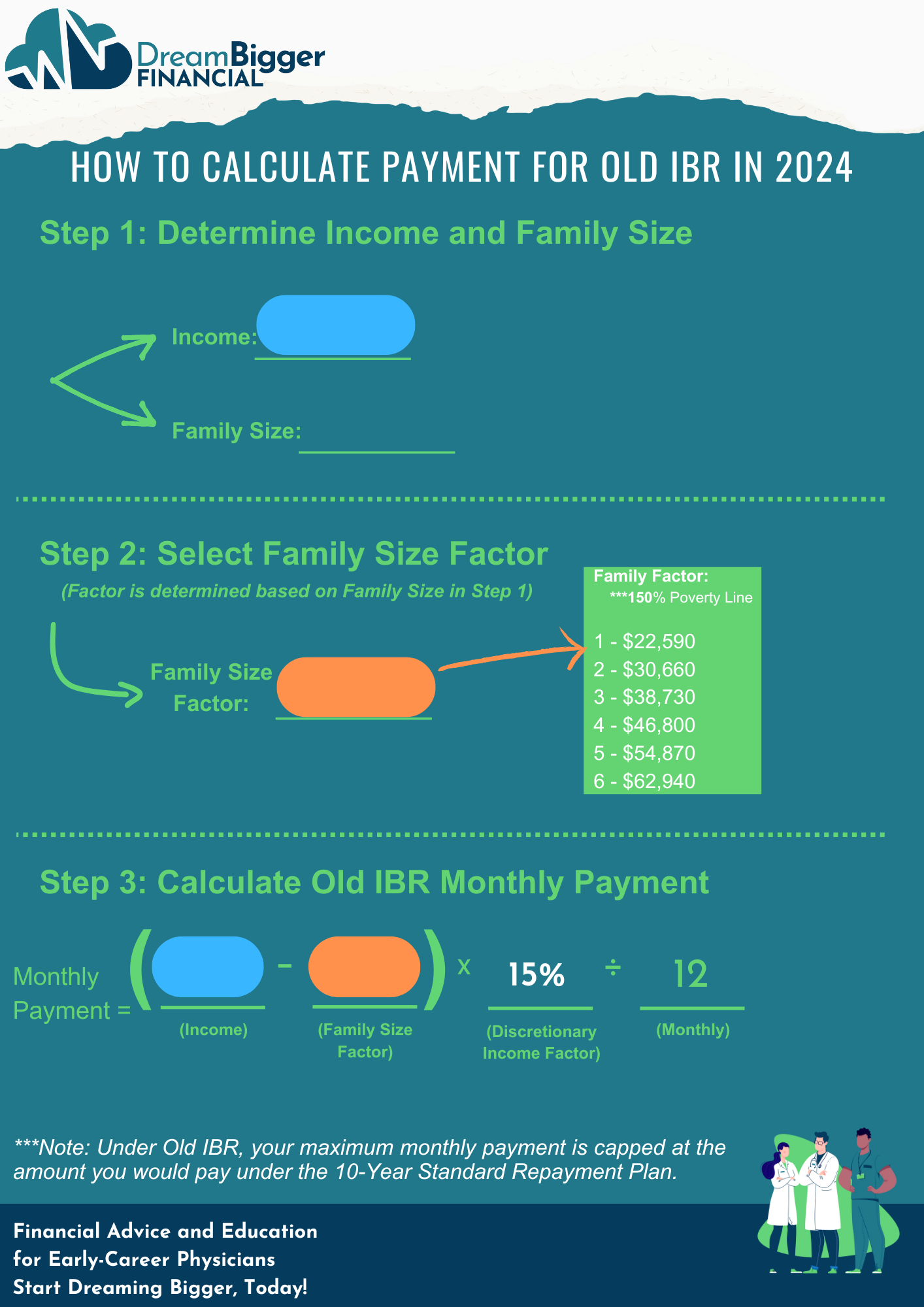

Old IBR – Calculating Your Monthly Payment

Old IBR – Calculating Your Monthly Payment

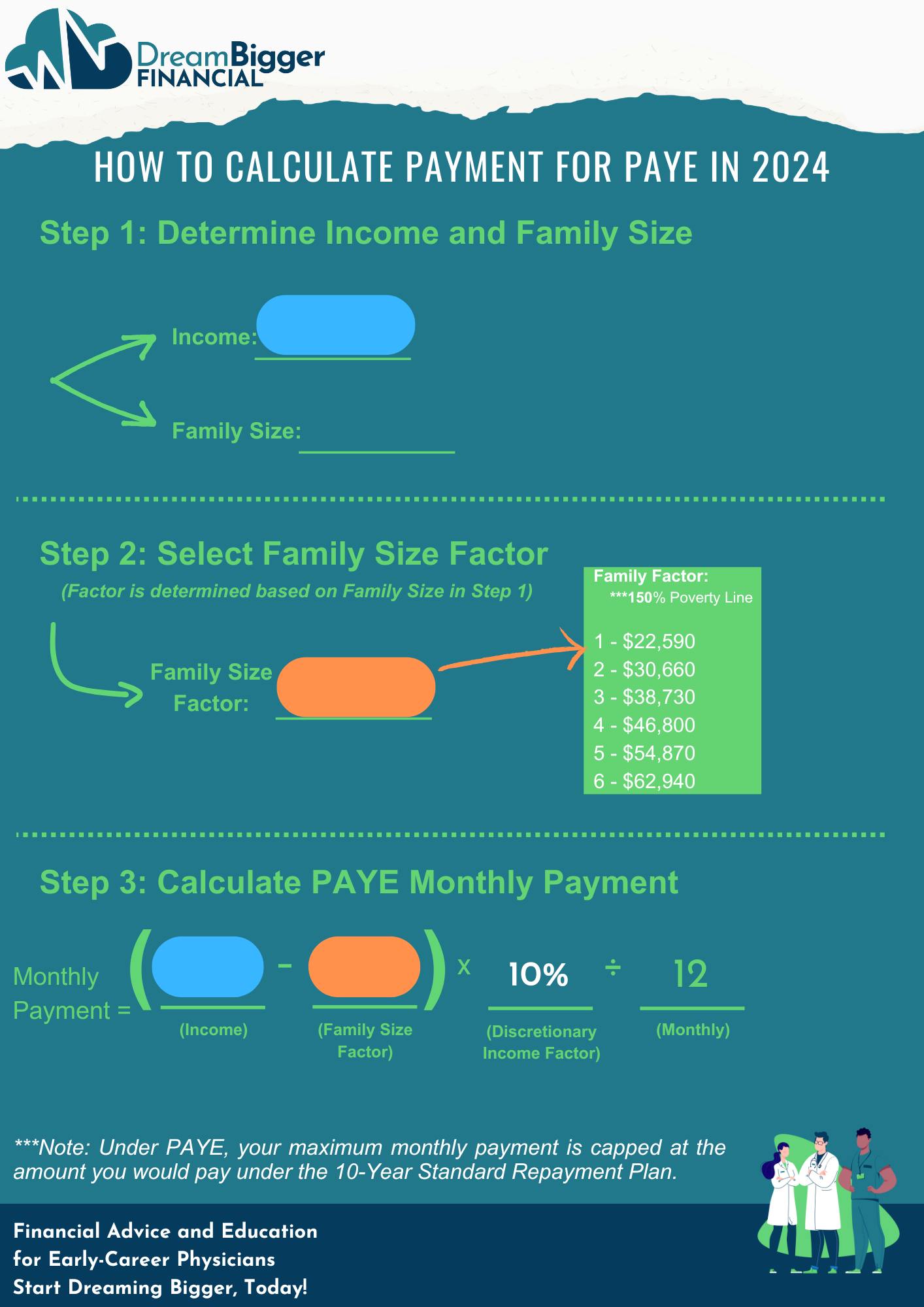

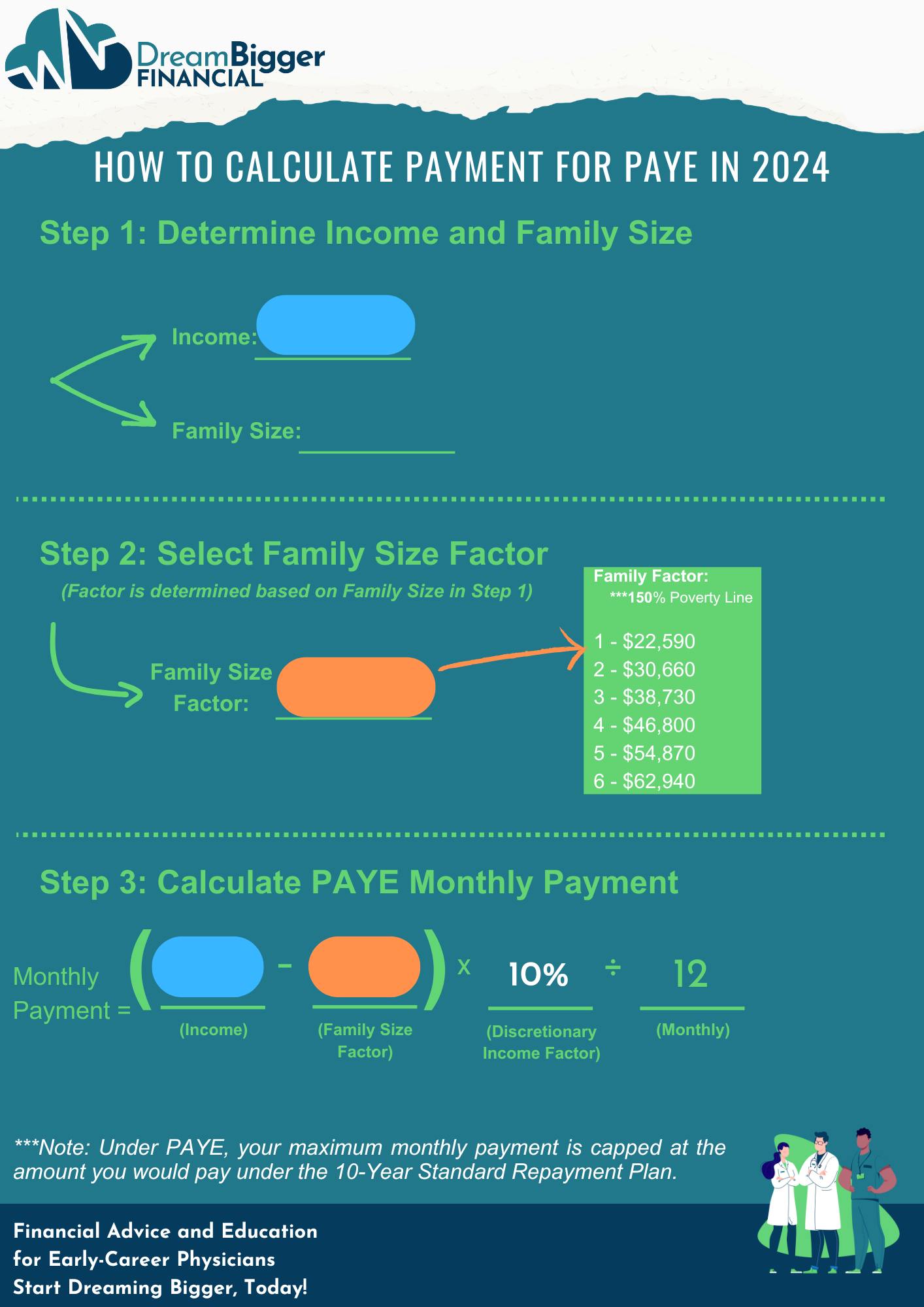

What is Pay As You Earn?

Pay As You Earn (PAYE) is an Income-Driven Repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

PAYE is one of the three IDR plans currently accepting new applicants and qualifies for Public Service Loan Forgiveness (PSLF).

Keep in mind, payments under PAYE are generally higher than those calculated under the SAVE plan.

PAYE looks a lot like New IBR:

-

-

PAYE:

-

-

You pay 10% of your discretionary income for undergraduate and graduate loans.

-

Repayment term is 20 years.

-

After 20 years, any remaining balance is forgiven, though this forgiveness may be taxable.

-

-

-

Click here to learn more about Pay As You Earn.

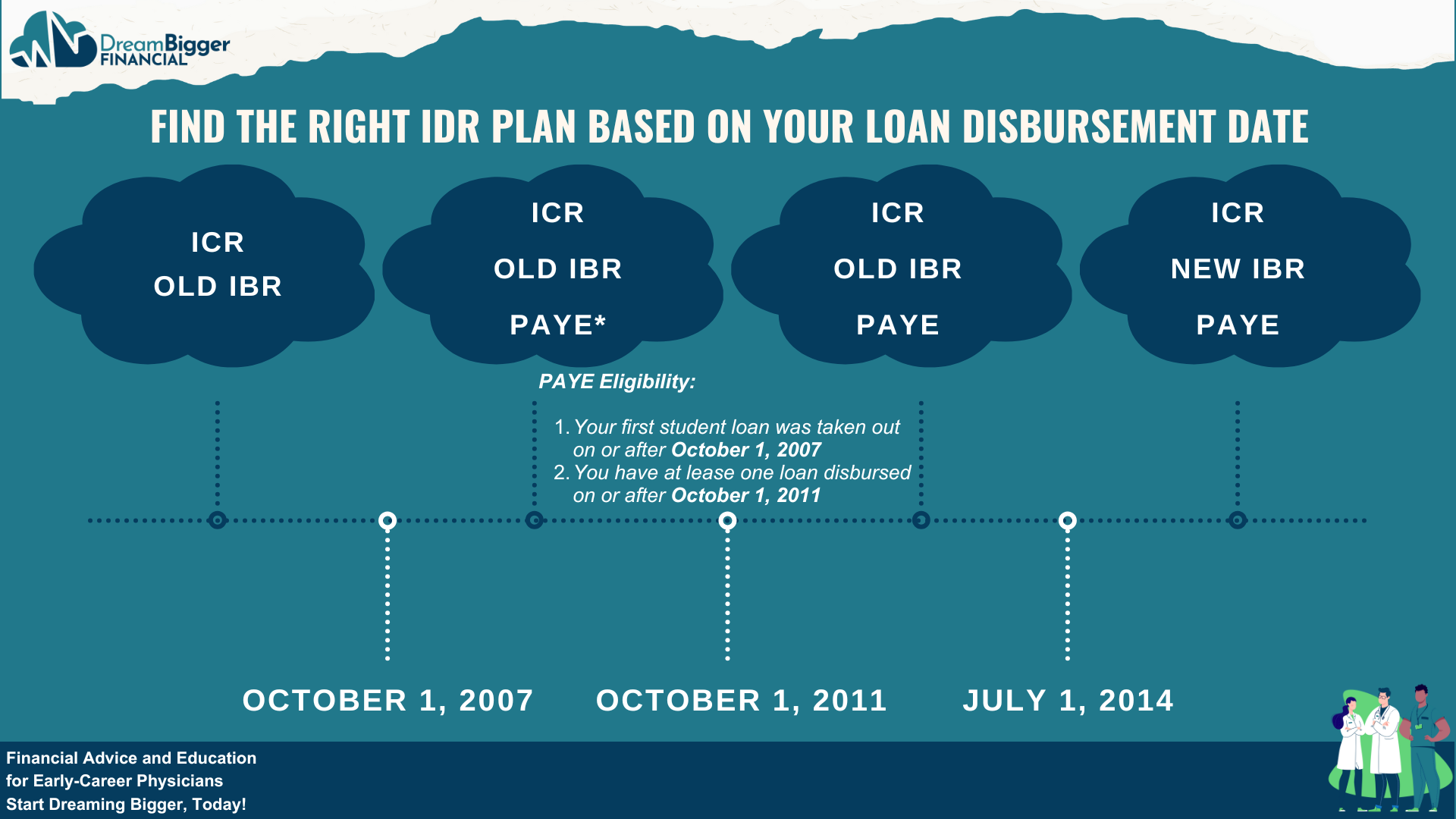

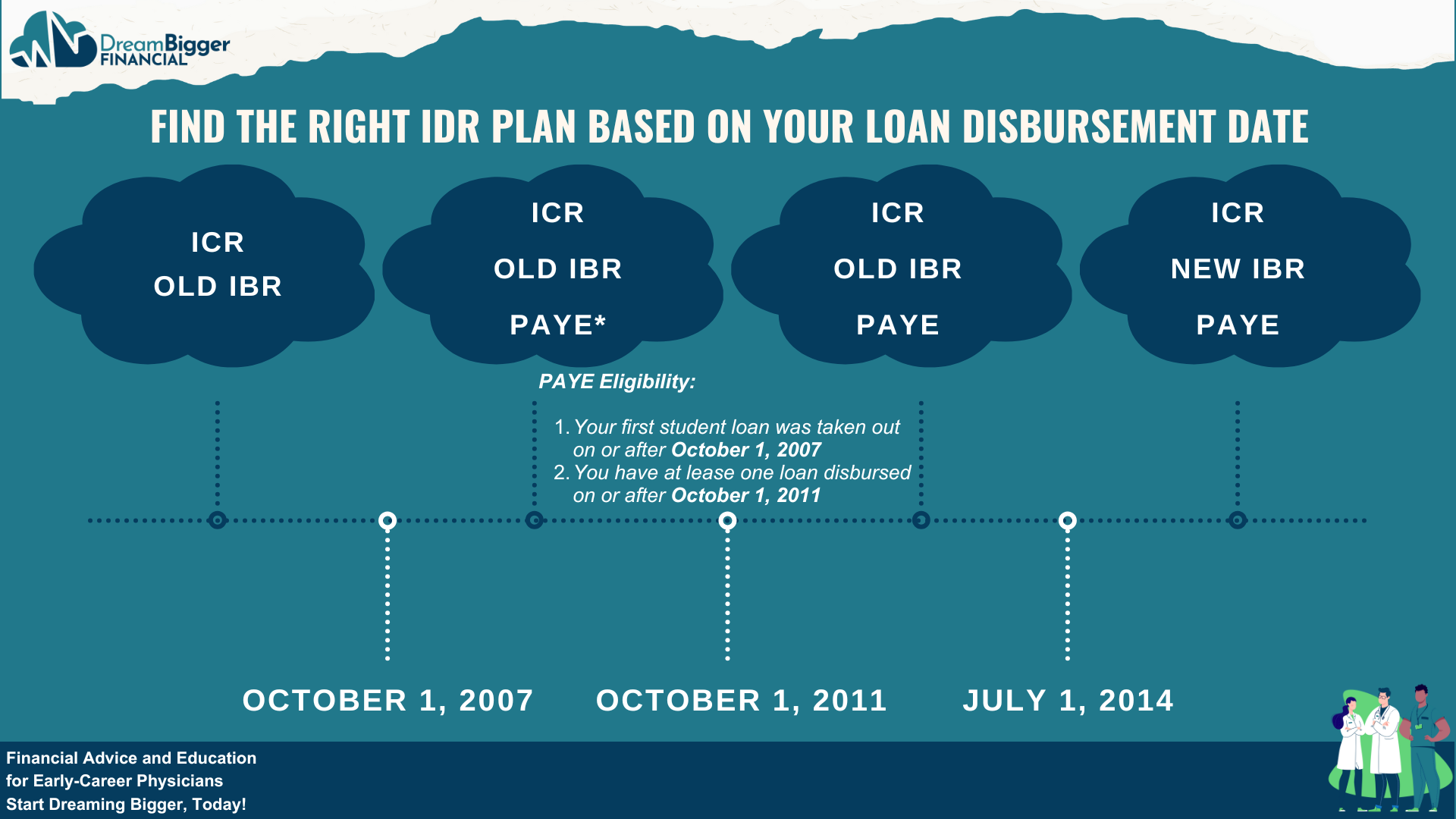

Eligibility for PAYE

Like IBR, to be eligible for PAYE, you must demonstrate a Partial Financial Hardship.

This means if your income is high relative to your loan balance, you may not be eligible to enroll in PAYE.

What is Pay As You Earn?

Pay As You Earn (PAYE) is an Income-Driven Repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

PAYE is one of the three IDR plans currently accepting new applicants and qualifies for Public Service Loan Forgiveness (PSLF).

Keep in mind, payments under PAYE are generally higher than those calculated under the SAVE plan.

PAYE looks a lot like New IBR:

-

-

PAYE:

-

-

You pay 10% of your discretionary income for undergraduate and graduate loans.

-

Repayment term is 20 years.

-

After 20 years, any remaining balance is forgiven, though this forgiveness may be taxable.

-

-

-

Click here to learn more about Pay As You Earn.

Eligibility for PAYE

Like IBR, to be eligible for PAYE, you must demonstrate a Partial Financial Hardship.

This means if your income is high relative to your loan balance, you may not be eligible to enroll in PAYE.

PAYE – Calculating Your Monthly Payment

PAYE – Calculating Your Monthly Payment

What is Income-Contingent Repayment?

Income-Contingent Repayment (ICR) is an Income-Driven Repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

ICR is one of the three IDR plans currently accepting new applicants and qualifies for Public Service Loan Forgiveness (PSLF).

Note: The calculation for ICR payments is more complex than other IDR plans.

-

-

ICR:

-

-

Calculated payments under ICR are the lesser of

-

-

20% of your discretionary income; or

-

The amount you would pay under a fixed 12-year repayment plan, adjusted by a factor based on your adjusted gross income (AGI).

-

-

-

Repayment term is 25 years.

-

After 25 years, any remaining balance is forgiven, though this forgiveness may be taxable.

-

-

-

Note: The calculation for Income-Contingent Repayment (ICR) is more complex than other IDR plans.

Click here to learn more about ICR and how to calculate your payment.

Eligibility for ICR

If your income is high relative to your loan balance, ICR may be the only IDR plan available to you that qualifies for PSLF.

However, for most borrowers, ICR payments are significantly higher than other IDR plans, especially for attendings and households with very high incomes relative to their student loan balance.

Exploring Better Options

If this applies to you, there may be strategies to lower your income and qualify for Partial Financial Hardship, granting you access to the more favorable payments of IBR or PAYE.

I encourage you to schedule a loan consultation with me or another financial planner who specializes in student loans to explore your options.

What is Income-Contingent Repayment?

Income-Contingent Repayment (ICR) is an Income-Driven Repayment (IDR) plan that adjusts your monthly payments based on your income and family size.

ICR is one of the three IDR plans currently accepting new applicants and qualifies for Public Service Loan Forgiveness (PSLF).

Note: The calculation for ICR payments is more complex than other IDR plans.

-

ICR:

-

Calculated payments under ICR are the lesser of

-

20% of your discretionary income; or

-

The amount you would pay under a fixed 12-year repayment plan, adjusted by a factor based on your adjusted gross income (AGI).

-

-

Repayment term is 25 years.

-

After 25 years, any remaining balance is forgiven, though this forgiveness may be taxable.

-

-

Note: The calculation for Income-Contingent Repayment (ICR) is more complex than other IDR plans.

Click here to learn more about ICR and how to calculate your payment.

Eligibility for ICR

If your income is high relative to your loan balance, ICR may be the only IDR plan available to you that qualifies for PSLF.

However, for most borrowers, ICR payments are significantly higher than other IDR plans, especially for attendings and households with very high incomes relative to their student loan balance.

Exploring Better Options

If this applies to you, there may be strategies to lower your income and qualify for Partial Financial Hardship, granting you access to the more favorable payments of IBR or PAYE.

I encourage you to schedule a loan consultation with me or another financial planner who specializes in student loans to explore your options.

What Happens When You Switch Income-Driven Repayment Plans?

When you switch Income-Driven Repayment (IDR) plans, two key things happen:

1. Payment Recalculation

Your monthly payment is adjusted based on:

-

-

Your most recent income.

-

Your family size.

-

The new plan’s specific formula.

-

2. Loan Capitalization

-

-

Any unpaid interest may be added to your loan balance, increasing the total amount owed.

-

Exception: If you’re pursuing Public Service Loan Forgiveness (PSLF) or are on the SAVE plan (where interest doesn’t accrue), capitalization won’t impact you significantly, since at the end of forgiveness your remaining balance will be forgiven.

-

What Happens When You Switch Income-Driven Repayment Plans?

When you switch Income-Driven Repayment (IDR) plans, two key things happen:

1. Payment Recalculation

Your monthly payment is adjusted based on:

-

Your most recent income.

-

Your family size.

-

The new plan’s specific formula.

2. Loan Capitalization

-

Any unpaid interest may be added to your loan balance, increasing the total amount owed.

-

Exception: If you’re pursuing Public Service Loan Forgiveness (PSLF) or are on the SAVE plan (where interest doesn’t accrue), capitalization won’t impact you significantly, since at the end of forgiveness your remaining balance will be forgiven.

Choosing the Right Income-Driven Repayment Plan

Choosing the Right Income-Driven Repayment Plan

Scenario 1: Currently on SAVE (Interest-Free Forbearance), Not Pursuing PSLF

Key Points:

-

-

No payments required

-

Loan balance remains unchanged (no interest accrues)

-

What This Means for You:

This interest-free forbearance is beneficial if your goal is to pay off your loans. Since no interest is accruing, your balance stays the same.

What You Might Consider:

-

-

If you can afford it, making payments during this time can help you pay down your loan principal faster.

-

With no interest accruing, 100% of your payment will go toward reducing your balance, helping you become debt-free quicker.

-

Scenario 1: Currently on SAVE (Interest-Free Forbearance), Not Pursuing PSLF

Key Points:

-

No payments required

-

Loan balance remains unchanged (no interest accrues)

What This Means for You:

This interest-free forbearance is beneficial if your goal is to pay off your loans. Since no interest is accruing, your balance stays the same.

What You Might Consider:

-

If you can afford it, making payments during this time can help you pay down your loan principal faster.

-

With no interest accruing, 100% of your payment will go toward reducing your balance, helping you become debt-free quicker.

Scenario 2: In “SAVE Limbo” (General Forbearance), Not Pursuing PSLF

Key Points:

-

-

No payments required

-

Interest is accruing on your loans, increasing your balance over time

-

What This Means for You:

If you’re waiting for more details about the SAVE plan or deciding on your next steps, it might make sense to wait. However, you should be aware that:

-

-

The longer you wait, the more interest your loan will accrue.

-

This means your loan balance will increase over time.

-

What You Might Consider:

-

-

If you can afford it, making payments now can help minimize the long-term cost of your loans.

-

Your payments will first cover accrued interest, and any amount beyond that will reduce the loan principal, preventing the balance from growing further.

-

Scenario 2: In “SAVE Limbo” (General Forbearance), Not Pursuing PSLF

Key Points:

-

No payments required

-

Interest is accruing on your loans, increasing your balance over time

What This Means for You:

If you’re waiting for more details about the SAVE plan or deciding on your next steps, it might make sense to wait. However, you should be aware that:

-

The longer you wait, the more interest your loan will accrue.

-

This means your loan balance will increase over time.

What You Might Consider:

-

If you can afford it, making payments now can help minimize the long-term cost of your loans.

-

Your payments will first cover accrued interest, and any amount beyond that will reduce the loan principal, preventing the balance from growing further.

Scenario 3: Currently on SAVE (Interest-Free Forbearance)/In “SAVE Limbo” (General Forbearance) Pursuing PSLF (2–10 Years Away)

Key Points:

-

-

No payments required

-

On SAVE: Loan balance remains unchanged (no interest accrues)

-

In “SAVE Limbo”: Interest is accruing on your loans, increasing your balance over time

-

What This Means for You:

Forbearance prevents you from making qualifying PSLF payments, delaying progress toward forgiveness. However, since your loans will be forgiven tax-free, it won’t matter if interest accrues because it will be forgiven with your loan balance.

What You Might Consider:

You could consider enrolling in a different IDR plan to start making qualifying payments.

-

-

Best Option: New IBR

-

Second Choice: PAYE

-

Third Choice: Old IBR

-

Last Resort: ICR

-

Note: If your current income is too high compared to your loan balance, you may not qualify for a Partial Financial Hardship, making ICR your only option to receive qualifying PSLF payments.

Scenario 3: Currently on SAVE (Interest-Free Forbearance)/In “SAVE Limbo” (General Forbearance) Pursuing PSLF (2–10 Years Away)

Key Points:

-

No payments required

-

On SAVE: Loan balance remains unchanged (no interest accrues)

-

In “SAVE Limbo”: Interest is accruing on your loans, increasing your balance over time

What This Means for You:

Forbearance prevents you from making qualifying PSLF payments, delaying progress toward forgiveness. However, since your loans will be forgiven tax-free, it won’t matter if interest accrues because it will be forgiven with your loan balance.

What You Might Consider:

You could consider enrolling in a different IDR plan to start making qualifying payments.

-

Best Option: New IBR

-

Second Choice: PAYE

-

Third Choice: Old IBR

-

Last Resort: ICR

Note: If your current income is too high compared to your loan balance, you may not qualify for a Partial Financial Hardship, making ICR your only option to receive qualifying PSLF payments.

Scenario 4: Currently on SAVE (Interest-Free Forbearance)/In “SAVE Limbo” (General Forbearance) Pursuing PSLF (0–2 Years Away)

Key Points:

-

-

No payments required

-

On SAVE: Loan balance remains unchanged (no interest accrues)

-

In “SAVE Limbo”: Interest is accruing on your loans, increasing your balance over time

-

What This Means for You:

If you’re close to PSLF forgiveness, this period of forbearance likely won’t hurt you financially. Since your loans will be forgiven tax-free, the accrued interest doesn’t matter. The balance will be forgiven when you reach the 120 qualifying payments.

What You Might Consider:

You could leverage the PSLF Buyback Program to retroactively count missed payments during forbearance as qualifying PSLF months.

What Is the PSLF Buyback Program?

The PSLF Buyback Program allows borrowers to retroactively count months spent in forbearance or deferment toward their 120 qualifying PSLF payments. However, this program comes with specific eligibility criteria:

-

-

Eligibility Timing: You can apply once you’ve reached your 120 qualifying payments, or when you would have reached them had you been making payments.

-

Lump-Sum Payment Requirement: If approved, you must make a lump-sum payment for missed months within 90 days of approval.

-

Limitations:

-

-

Forbearance or deferment must meet specific criteria to qualify.

-

The program may not be available indefinitely, so relying on it if you’re years away from forgiveness could be risky.

-

Who Benefits Most?

This program is most beneficial for borrowers who are just shy of reaching PSLF forgiveness and want to count missed months to expedite forgiveness.

What You Might Do Now:

-

-

Set aside savings equal to what your payments would have been during forbearance to prepare for the lump-sum payment if you qualify.

-

Start strategizing a savings plan to cover all missed months within the 90-day window.

-

Scenario 4: Currently on SAVE (Interest-Free Forbearance)/In “SAVE Limbo” (General Forbearance) Pursuing PSLF (0–2 Years Away)

Key Points:

-

No payments required

-

On SAVE: Loan balance remains unchanged (no interest accrues)

-

In “SAVE Limbo”: Interest is accruing on your loans, increasing your balance over time

What This Means for You:

If you’re close to PSLF forgiveness, this period of forbearance likely won’t hurt you financially. Since your loans will be forgiven tax-free, the accrued interest doesn’t matter. The balance will be forgiven when you reach the 120 qualifying payments.

What You Might Consider:

You could leverage the PSLF Buyback Program to retroactively count missed payments during forbearance as qualifying PSLF months.

What Is the PSLF Buyback Program?

The PSLF Buyback Program allows borrowers to retroactively count months spent in forbearance or deferment toward their 120 qualifying PSLF payments. However, this program comes with specific eligibility criteria:

-

Eligibility Timing: You can apply once you’ve reached your 120 qualifying payments, or when you would have reached them had you been making payments.

-

Lump-Sum Payment Requirement: If approved, you must make a lump-sum payment for missed months within 90 days of approval.

Limitations:

-

Forbearance or deferment must meet specific criteria to qualify.

-

The program may not be available indefinitely, so relying on it if you’re years away from forgiveness could be risky.

Who Benefits Most?

This program is most beneficial for borrowers who are just shy of reaching PSLF forgiveness and want to count missed months to expedite forgiveness.

What You Might Do Now:

-

Set aside savings equal to what your payments would have been during forbearance to prepare for the lump-sum payment if you qualify.

-

Start strategizing a savings plan to cover all missed months within the 90-day window.

Scenario 5: Currently on PAYE, Pursuing PSLF

Key Points:

-

-

Payments are currently required

-

Payments count toward PSLF

-

What This Means for You:

If you’re on PAYE, you’re required to make monthly payments, and those payments count toward PSLF. You might be considering switching to New IBR, but doing so could result in a higher payment.

What You Might Consider:

-

-

Wait until the next time you need to recertify your income. If eligible for New IBR at that time, it would be a good idea to switch since you’ll already be required to recertify your income.

-

Scenario 5: Currently on PAYE, Pursuing PSLF

Key Points:

-

Payments are currently required

-

Payments count toward PSLF

What This Means for You:

If you’re on PAYE, you’re required to make monthly payments, and those payments count toward PSLF. You might be considering switching to New IBR, but doing so could result in a higher payment.

What You Might Consider:

-

Wait until the next time you need to recertify your income. If eligible for New IBR at that time, it would be a good idea to switch since you’ll already be required to recertify your income.

Conclusion

Deciding whether to switch from the SAVE plan to a different IDR plan requires a careful evaluation of your current financial situation and long-term goals, particularly if you’re aiming for Public Service Loan Forgiveness (PSLF). The scenarios we’ve discussed highlight just a few potential paths, your situation is unique, and there are many factors to consider.

If you’re in training or early in your attending career, understanding how these repayment plans impact both your monthly payments and your future financial health is crucial. By making informed decisions now, you can set yourself up for greater financial success in the years to come.

Consider consulting a financial professional specializing in tax management and student loan planning to tailor your repayment strategy to your specific circumstances and objectives. If you’re looking for a personalized plan, our team is here to help!

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Conclusion

Deciding whether to switch from the SAVE plan to a different IDR plan requires a careful evaluation of your current financial situation and long-term goals, particularly if you’re aiming for Public Service Loan Forgiveness (PSLF). The scenarios we’ve discussed highlight just a few potential paths, your situation is unique, and there are many factors to consider.

If you’re in training or early in your attending career, understanding how these repayment plans impact both your monthly payments and your future financial health is crucial. By making informed decisions now, you can set yourself up for greater financial success in the years to come.

Consider consulting a financial professional specializing in tax management and student loan planning to tailor your repayment strategy to your specific circumstances and objectives. If you’re looking for a personalized plan, our team is here to help!

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.