Overview

Many student loan borrowers experience sticker shock when their first payment comes due after graduation.

Why is that?

By default, upon graduating from college or medical school, you’re enrolled in the 10-Year Standard Repayment Plan.

For the average medical resident, this often means a massive payment that can take up as much as three-fourths of their take-home pay.

The good news? There are strategies to manage these hefty payments.

Let’s break down how the 10-Year Standard Repayment Plan is calculated.

Overview

Many student loan borrowers experience sticker shock when their first payment comes due after graduation.

Why is that?

By default, upon graduating from college or medical school, you’re enrolled in the 10-Year Standard Repayment Plan.

For the average medical resident, this often means a massive payment that can take up as much as three-fourths of their take-home pay.

The good news? There are strategies to manage these hefty payments.

Let’s break down how the 10-Year Standard Repayment Plan is calculated.

Many student loan borrowers experience sticker shock when their first payment comes due after graduation.

Why is that?

By default, upon graduating from college or medical school, you’re enrolled in the 10-Year Standard Repayment Plan.

For the average medical resident, this often means a massive payment that can take up as much as three-fourths of their take-home pay.

The good news? There are strategies to manage these hefty payments.

Let’s break down how the 10-Year Standard Repayment Plan is calculated.

What is the 10-Year Standard Repayment Plan?

After completing medical school, your student loans enter a six-month grace period.

During this time, no payments are required.

Once the grace period ends, your loans move into “In Repayment” status, and mandatory monthly payments begin.

By default, your payment is calculated using the 10-Year Standard Repayment Plan.

Much like a mortgage, this plan sets a fixed monthly payment designed to fully pay off your loan balance.

Unlike a mortgage, where payments are spread over 15 or 30 years, student loan payments under the Standard Repayment Plan are designed to pay off the entire balance in just 10 years.

This results in much higher monthly payments.

The amount is based on:

-

-

Total loan balance

-

Interest rate

-

What is the 10-Year Standard Repayment Plan?

After completing medical school, your student loans enter a six-month grace period.

During this time, no payments are required.

Once the grace period ends, your loans move into “In Repayment” status, and mandatory monthly payments begin.

By default, your payment is calculated using the 10-Year Standard Repayment Plan.

Much like a mortgage, this plan sets a fixed monthly payment designed to fully pay off your loan balance.

Unlike a mortgage, where payments are spread over 15 or 30 years, student loan payments under the Standard Repayment Plan are designed to pay off the entire balance in just 10 years.

This results in much higher monthly payments.

The amount is based on:

-

Total loan balance

-

Interest rate

Choosing the Right Repayment Plan for PSLF Success

Public Service Loan Forgiveness (PSLF) allows for tax-free forgiveness of remaining student loan balances on qualifying federal loans after 120 qualifying payments (10 years).

PSLF Eligibility Criteria:

1. Work for a qualifying employer (e.g., hospital or non-profit).

2. Have Direct Loans.

3. Make 120 qualifying payments.

4. Be on an Income-Driven Repayment (IDR) plan or the 10-Year Standard Repayment Plan.

Learn more about PSLF here.

While the 10-Year Standard Repayment Plan is PSLF-eligible, it’s not the best option for those pursuing forgiveness.

Since this plan fully pays off the loan in 10 years, there would be no remaining balance to forgive.

To maximize PSLF benefits, enrolling in an IDR plan is usually a better strategy.

Lower monthly payments allow more of the loan balance to be forgiven at the end of the PSLF period.

Choosing the Right Repayment Plan for PSLF Success

Public Service Loan Forgiveness (PSLF) allows for tax-free forgiveness of remaining student loan balances on qualifying federal loans after 120 qualifying payments (10 years).

PSLF Eligibility Criteria:

1. Work for a qualifying employer (e.g., hospital or non-profit).

2. Have Direct Loans.

3. Make 120 qualifying payments.

4. Be on an Income-Driven Repayment (IDR) plan or the 10-Year Standard Repayment Plan.

Learn more about PSLF here.

While the 10-Year Standard Repayment Plan is PSLF-eligible, it’s not the best option for those pursuing forgiveness.

Since this plan fully pays off the loan in 10 years, there would be no remaining balance to forgive.

To maximize PSLF benefits, enrolling in an IDR plan is usually a better strategy.

Lower monthly payments allow more of the loan balance to be forgiven at the end of the PSLF period.

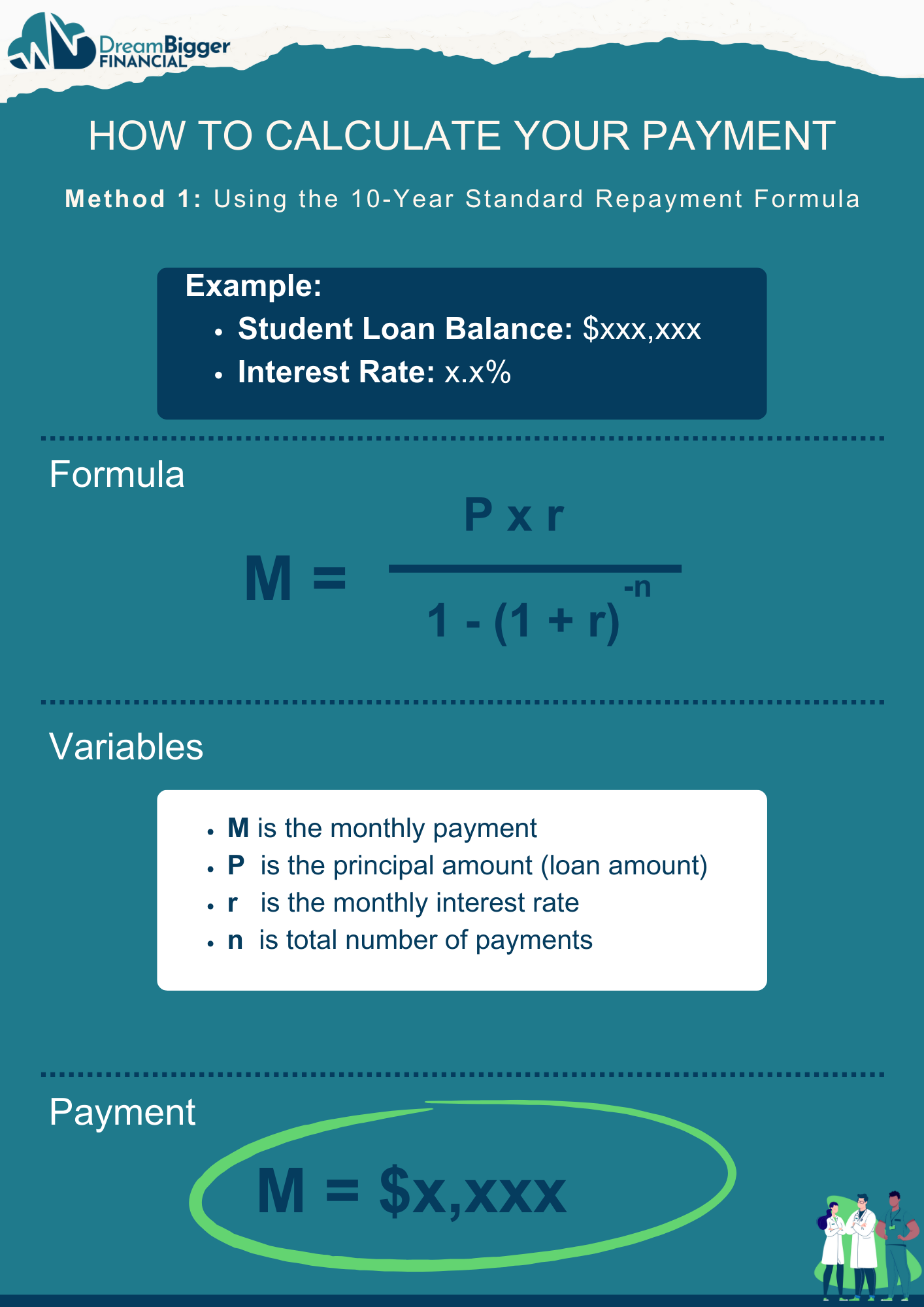

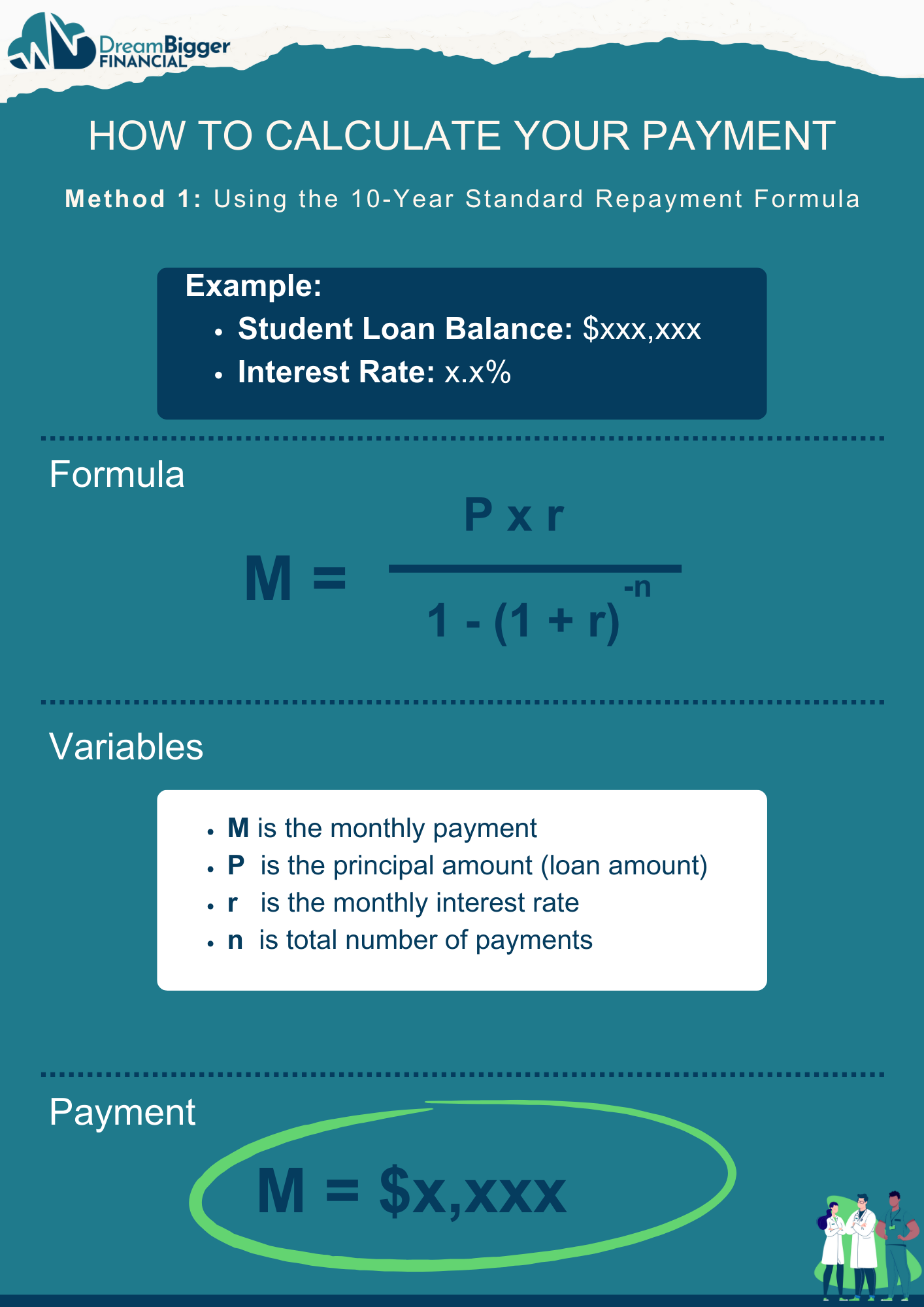

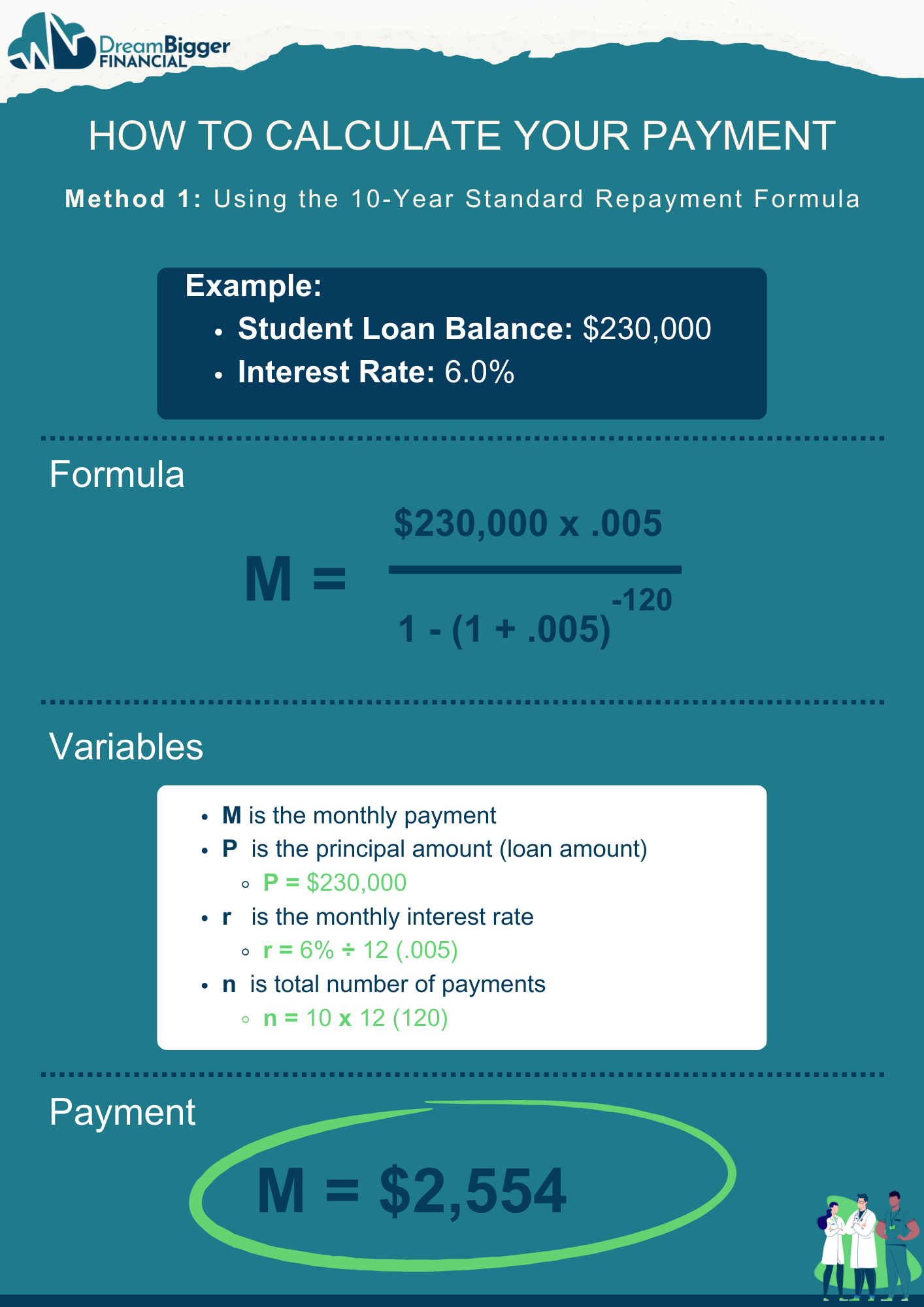

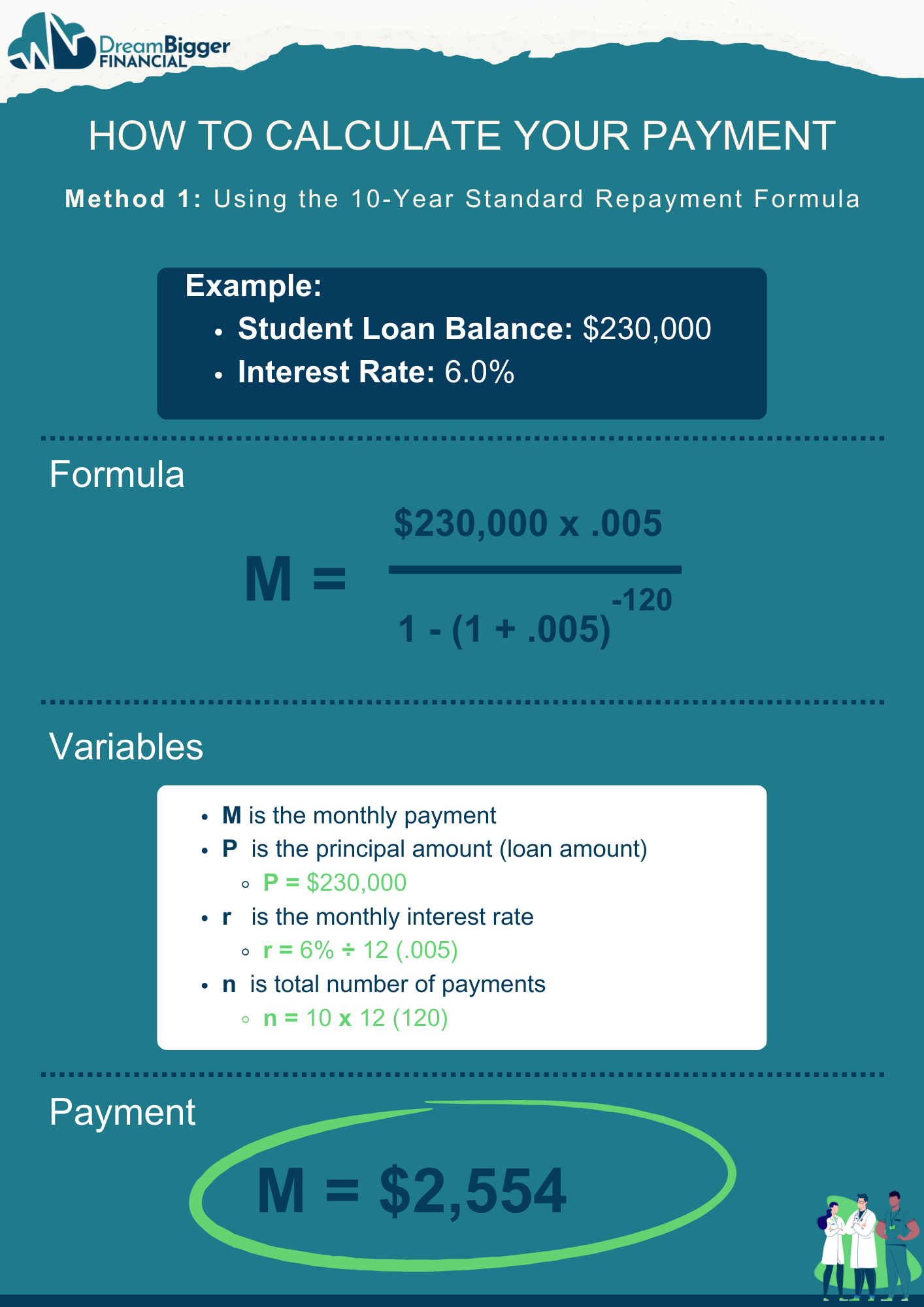

How to Calculate Your Payment

Method 1: Using the 10-Year Standard Repayment Formula

Use the following formula to estimate your monthly payment:

How to Calculate Your Payment

Method 1: Using the 10-Year Standard Repayment Formula

Use the following formula to estimate your monthly payment:

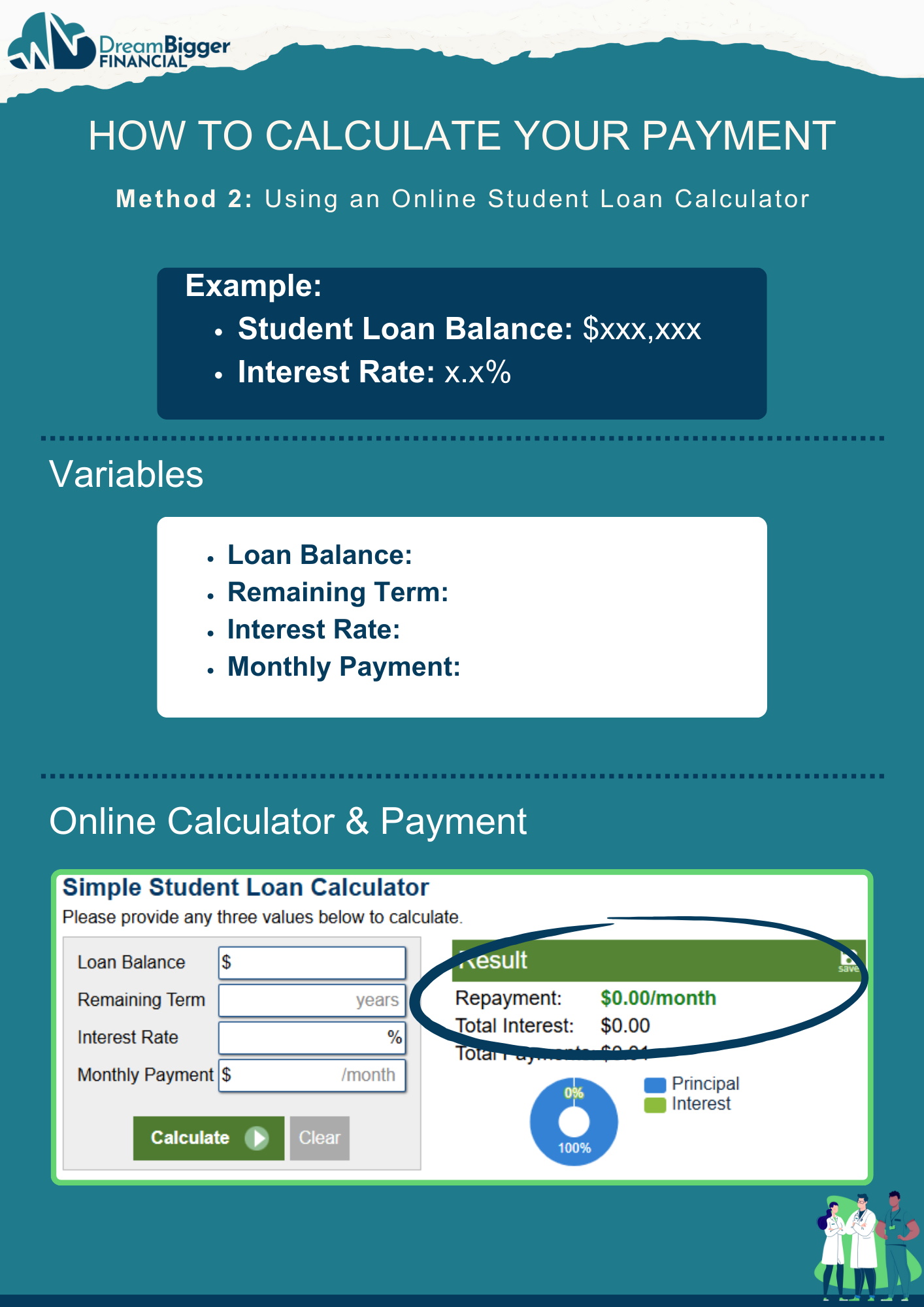

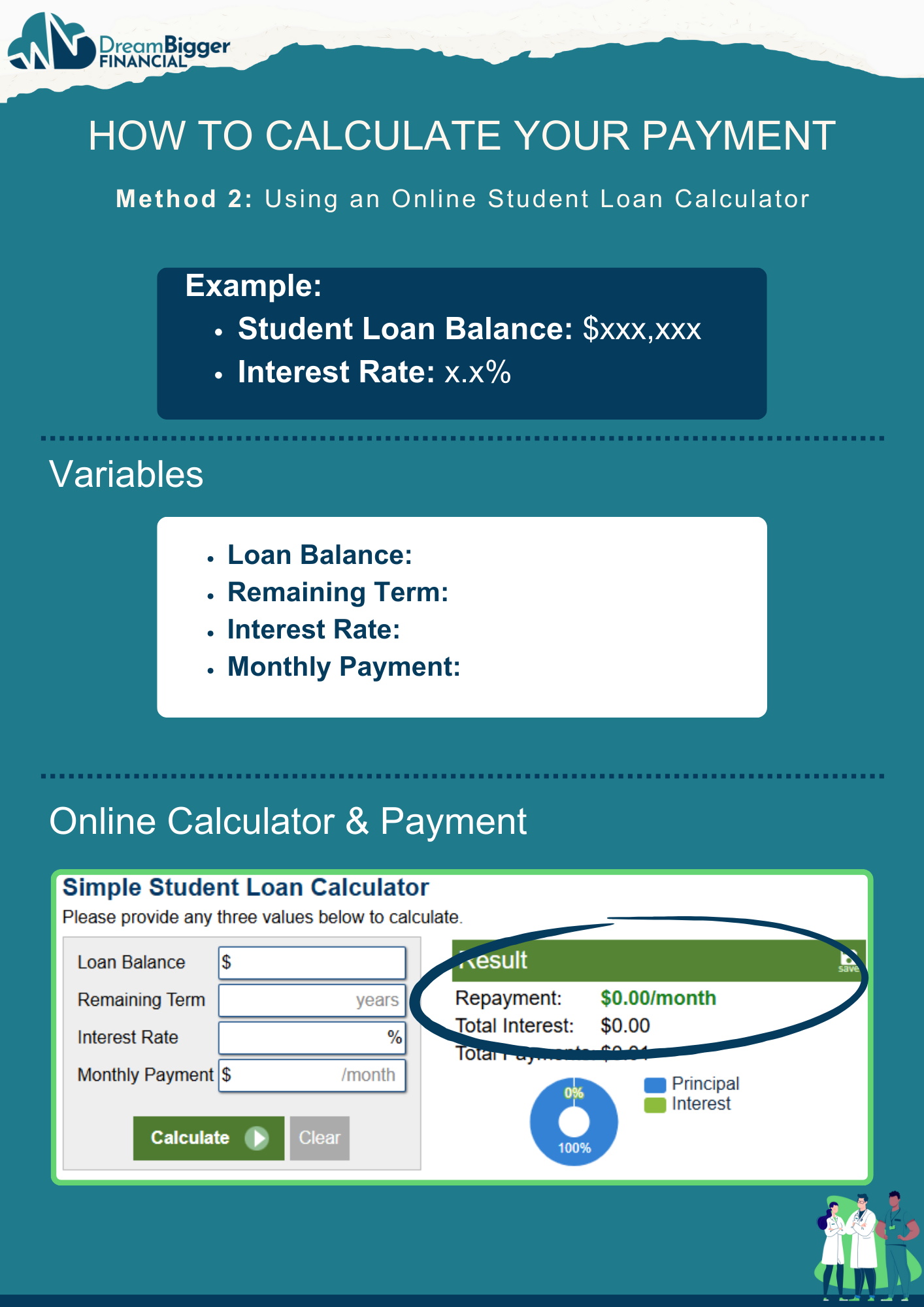

How to Calculate Your Payment

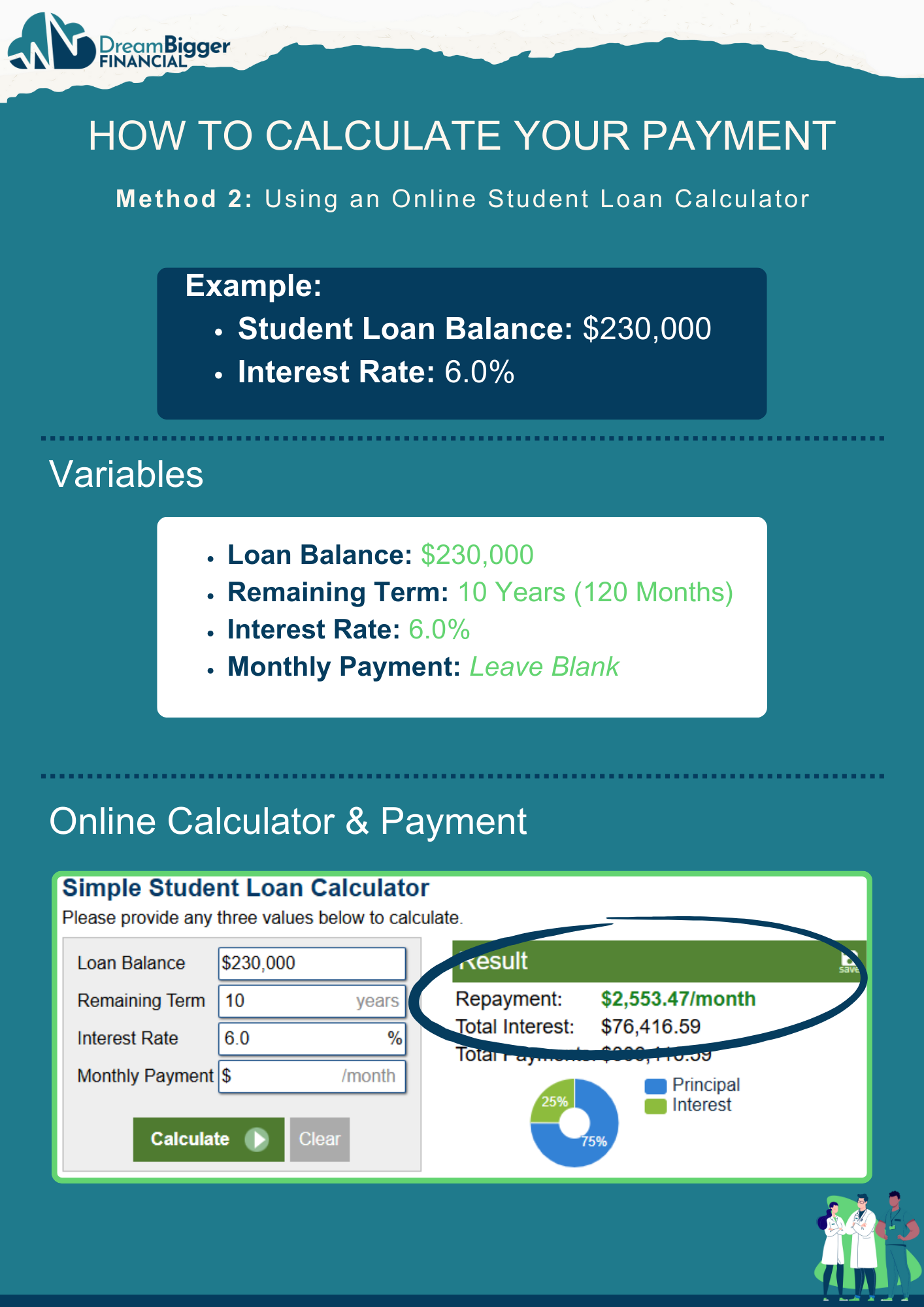

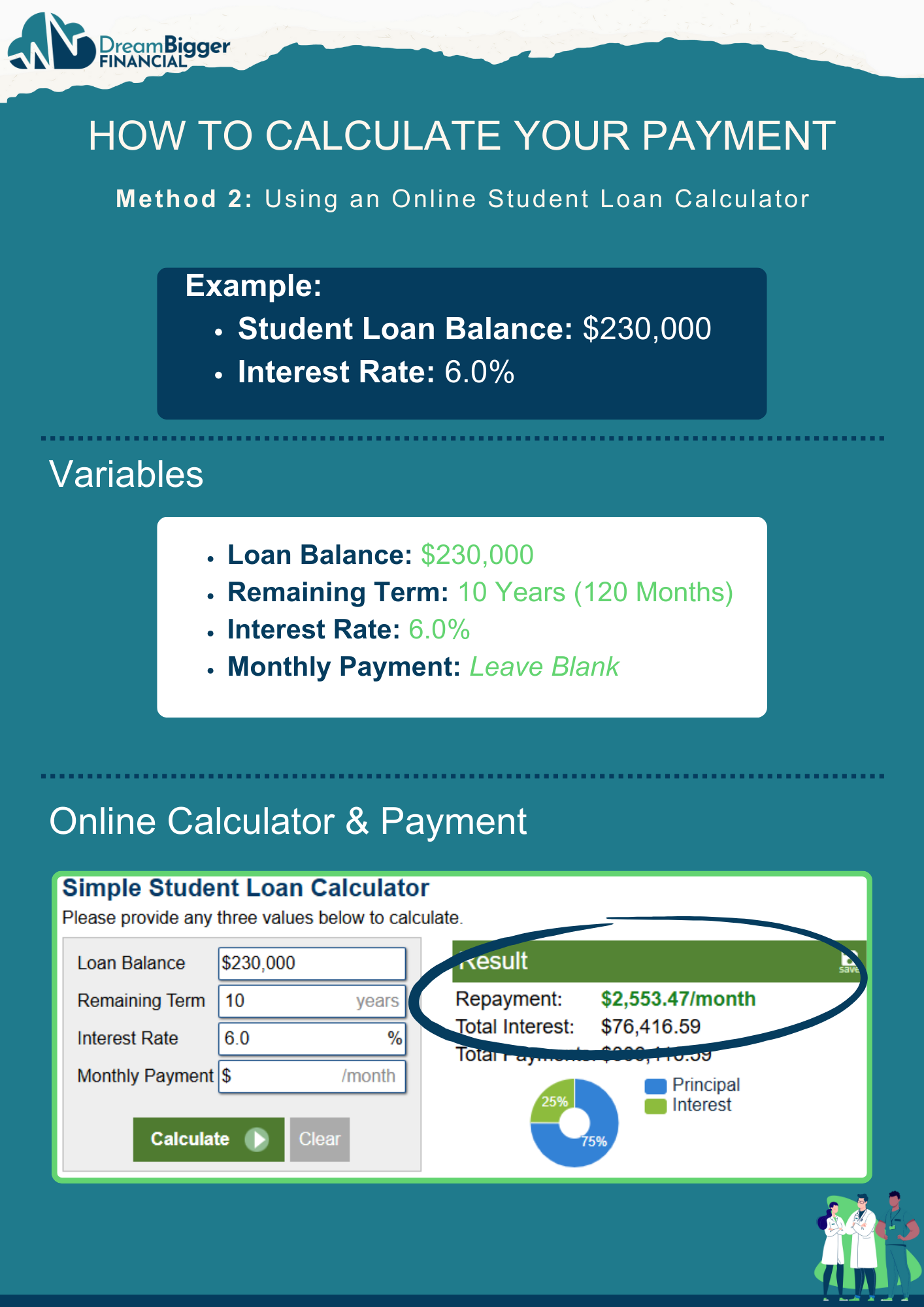

Method 2: Using an Online Student Loan Calculator

If you prefer an online tool, search for a “Student Loan Calculator.”

Websites like Calculator.net provide user-friendly calculators.

How to Calculate Your Payment

Method 2: Using an Online Student Loan Calculator

If you prefer an online tool, search for a “Student Loan Calculator.”

Websites like Calculator.net provide user-friendly calculators.

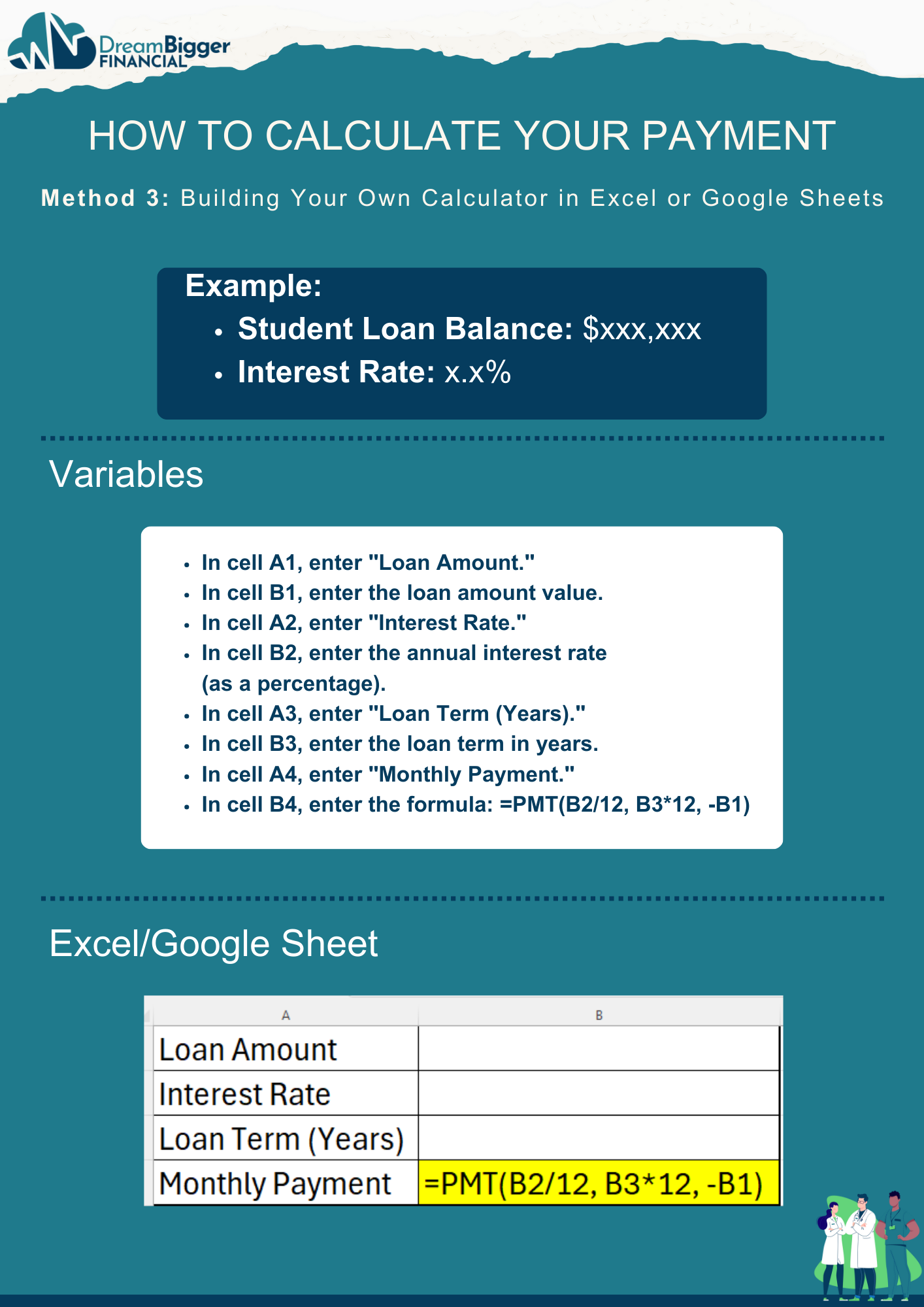

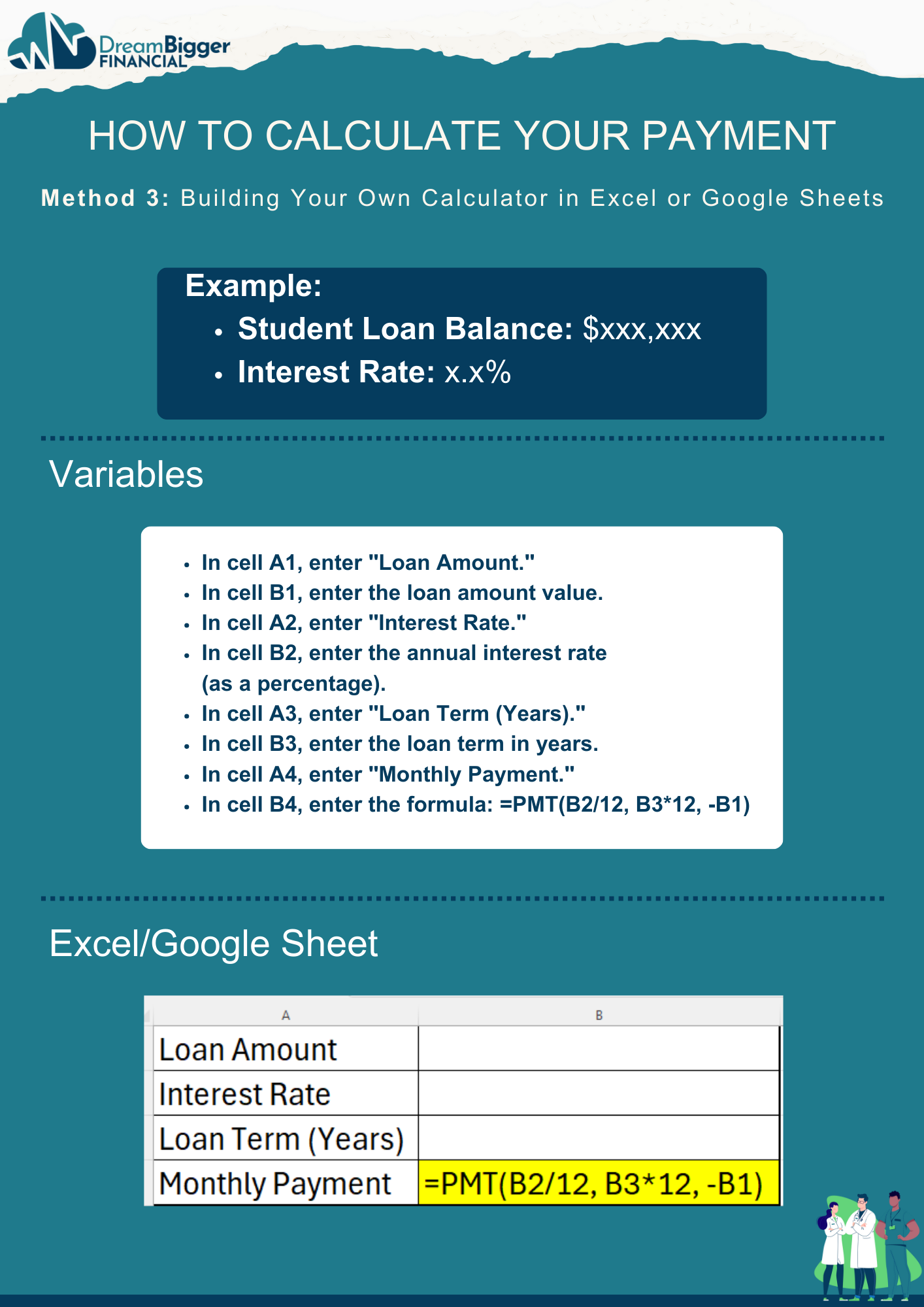

How to Calculate Your Payment

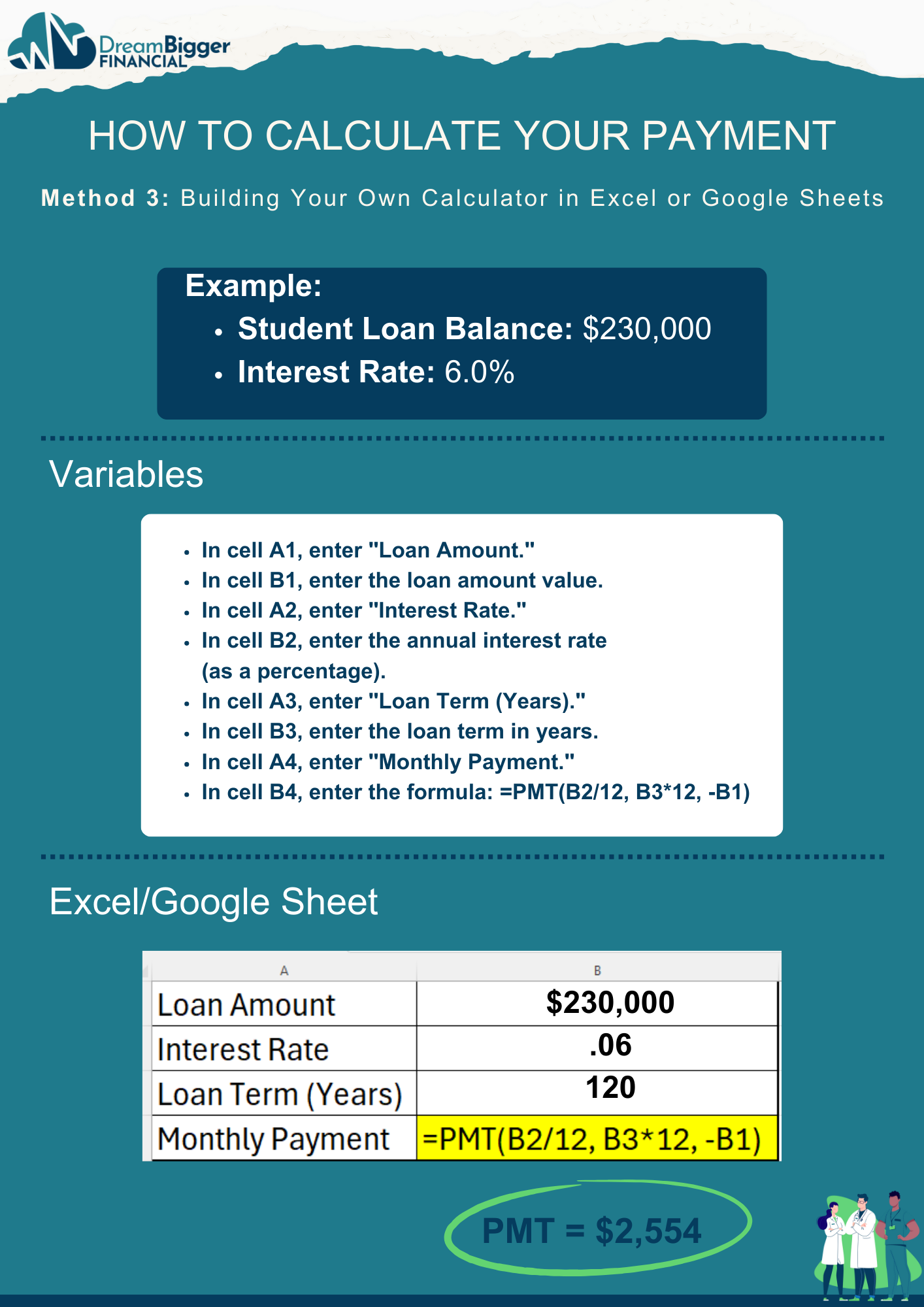

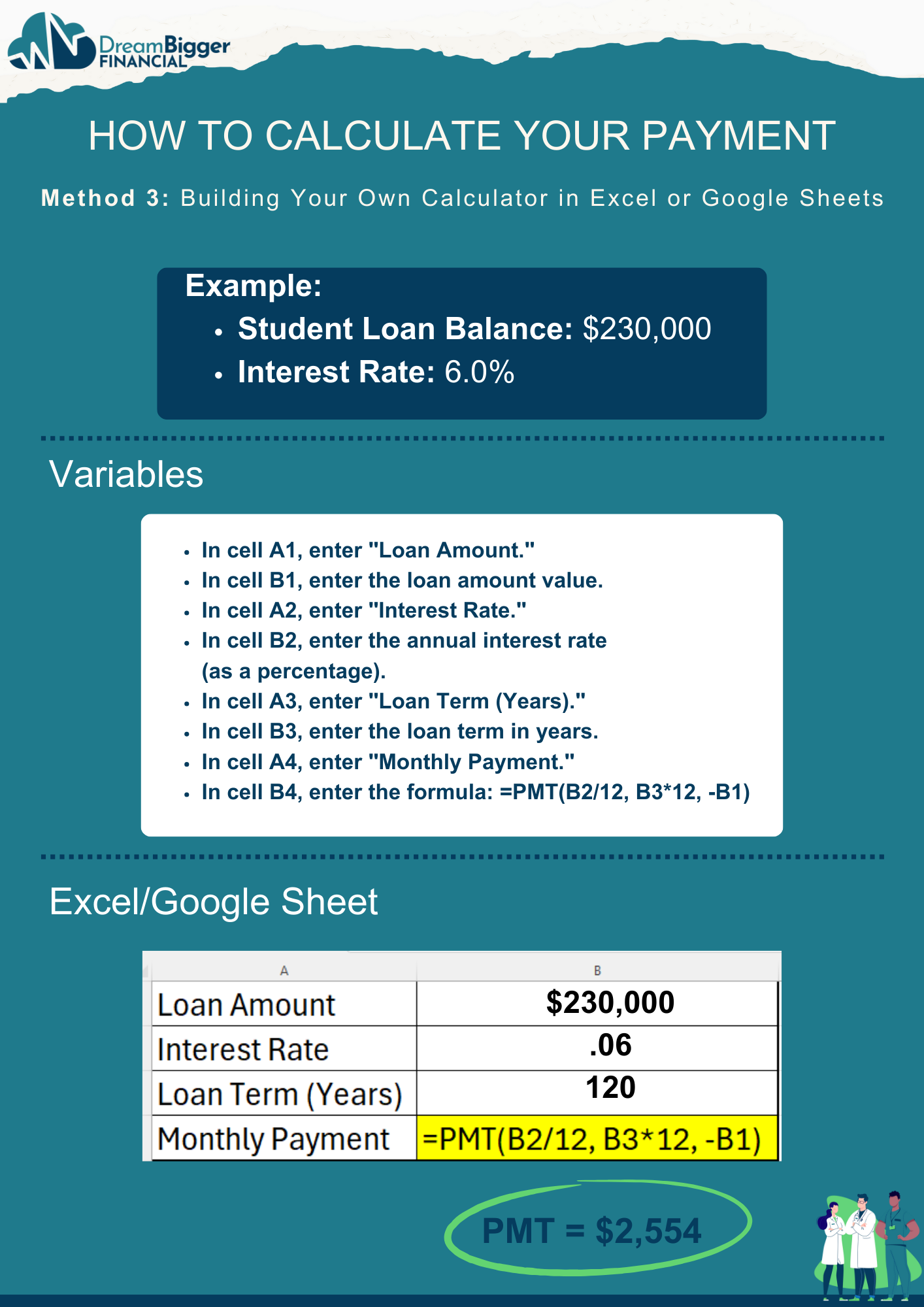

Method 3: Building Your Own Calculator in Excel or Google Sheets

For spreadsheet enthusiasts, use the PMT function in Excel or Google Sheets to set up a simple calculation.

How to Calculate Your Payment

Method 3: Building Your Own Calculator in Excel or Google Sheets

For spreadsheet enthusiasts, use the PMT function in Excel or Google Sheets to set up a simple calculation.

Meet Dr. Don!

Dr. Don, a recent medical school graduate, wants to understand his monthly payment under the 10-Year Standard Repayment Plan.

Let’s calculate using the three methods outlined above.

Dr. Don’s Loan Details:

-

Loan Balance: $230,000

-

Average Interest Rate: 6.0%

Meet Dr. Don!

Dr. Don, a recent medical school graduate, wants to understand his monthly payment under the 10-Year Standard Repayment Plan.

Let’s calculate using the three methods outlined above.

Dr. Don’s Loan Details:

-

Loan Balance: $230,000

-

Average Interest Rate: 6.0%

How to Calculate Your Payment (Example)

Method 1: Using the 10-Year Standard Repayment Formula

Use the following formula to estimate your monthly payment:

How to Calculate Your Payment (Example)

Method 1: Using the 10-Year Standard Repayment Formula

Use the following formula to estimate your monthly payment:

How to Calculate Your Payment (Example)

Method 2: Using an Online Student Loan Calculator

If you prefer an online tool, search for a “Student Loan Calculator.”

Websites like Calculator.net provide user-friendly calculators.

How to Calculate Your Payment (Example)

Method 2: Using an Online Student Loan Calculator

If you prefer an online tool, search for a “Student Loan Calculator.”

Websites like Calculator.net provide user-friendly calculators.

How to Calculate Your Payment (Example)

Method 3: Building Your Own Calculator in Excel or Google Sheets

For spreadsheet enthusiasts, use the PMT function in Excel or Google Sheets to set up a simple calculation.

How to Calculate Your Payment (Example)

Method 3: Building Your Own Calculator in Excel or Google Sheets

For spreadsheet enthusiasts, use the PMT function in Excel or Google Sheets to set up a simple calculation.

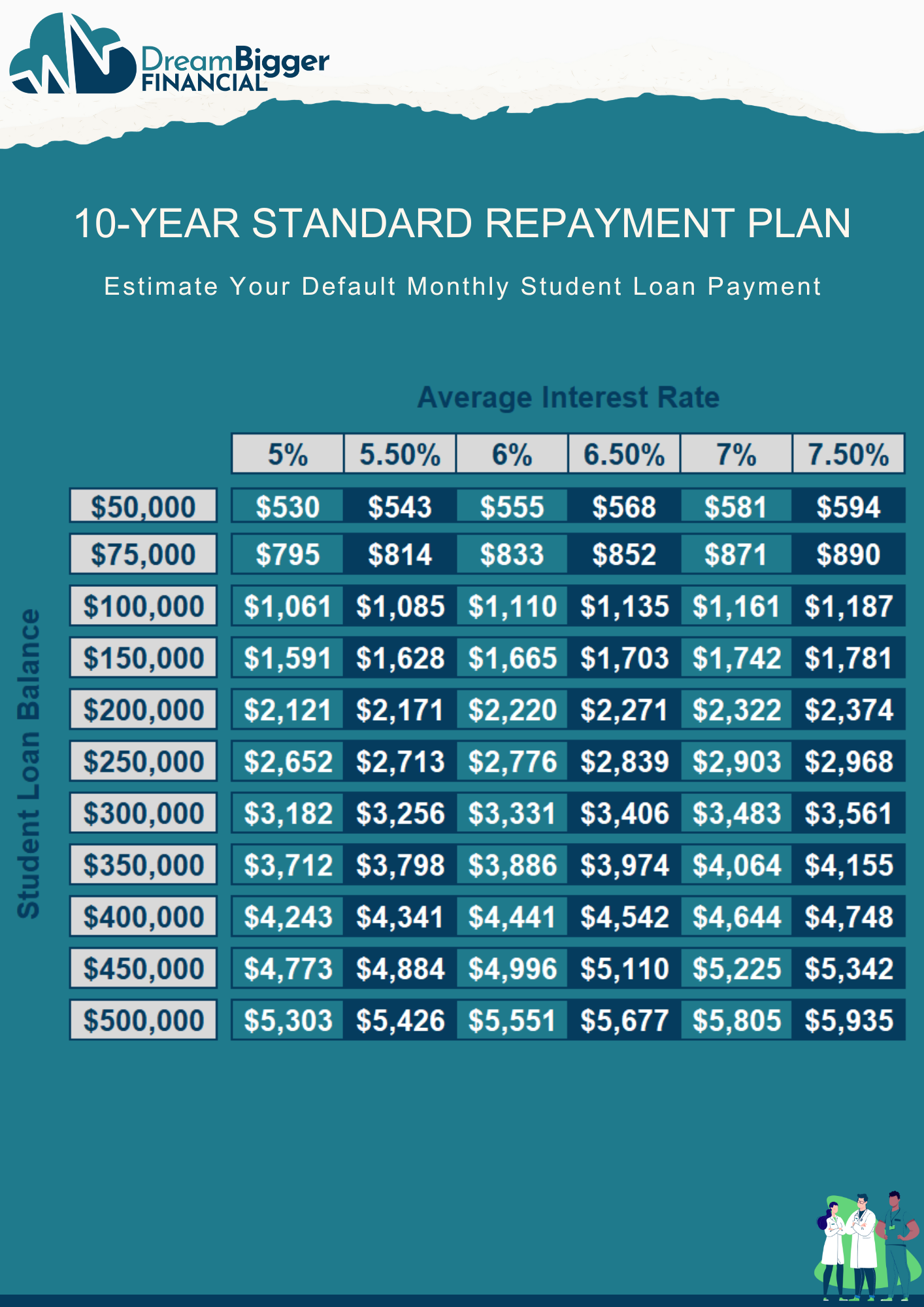

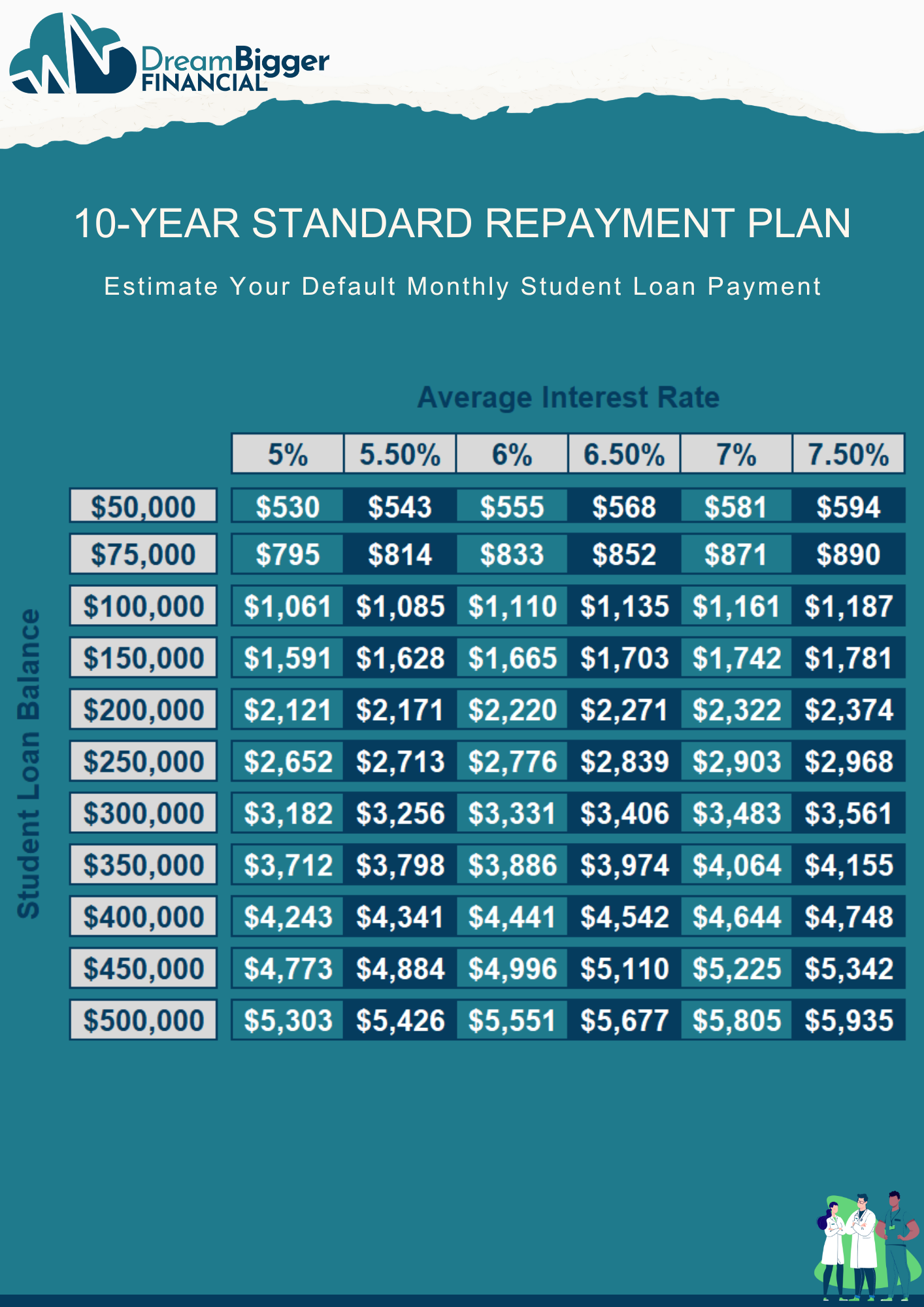

Estimate Your 10-Year Standard Payment

Use the table below to estimate your 10-Year Standard monthly payment:

Estimate Your 10-Year Standard Payment

Use the table below to estimate your 10-Year Standard monthly payment:

Conclusion

No matter which calculation method Dr. Don used, his monthly payment remains $2,554 under the 10-Year Standard Repayment Plan.

For most medical residents, earning an average salary of $60,000 with a take-home pay of $4,000 per month, this payment is simply not realistic.

The good news? Income-Driven Repayment (IDR) plans can drastically reduce payments. In many cases, monthly payments during residency can be as low as $0.

By enrolling in an IDR plan, you can manage cash flow effectively and position yourself for PSLF success.

Want to explore your best repayment strategy? Let’s chat.

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

FAQ: Common Questions About the 10-Year Standard Repayment Plan

Q: What is the 10-Year Standard Repayment Plan?

A: The 10-Year Standard Repayment Plan is the default repayment option for federal student loans. It has fixed monthly payments designed to fully repay the loan within 10 years.

Q: How are payments calculated under the 10-Year Standard Repayment Plan?

A: Payments are based on loan balance, interest rate, and a fixed 10-year term. For example, a $230,000 loan at 6.0% interest would have a monthly payment of approximately $2,550.

Q: Is the 10-Year Standard Repayment Plan a good option for PSLF?

A: No. While it’s PSLF-eligible, it fully repays loans in 10 years, leaving no balance for forgiveness. Income-Driven Repayment (IDR) is usually a better choice for PSLF.

Q: What happens if I switch from the 10-Year Standard Repayment Plan to an Income-Driven Repayment (IDR) plan?

A: If you switch to an IDR plan, your monthly payments will be recalculated based on your income and family size. This typically results in much lower payments, especially during residency. However, any unpaid interest may capitalize, increasing the total loan cost.

Q: Can I qualify for loan forgiveness under the 10-Year Standard Repayment Plan?

A: The 10-Year Standard Repayment Plan is PSLF-eligible, but it fully repays your loan in 10 years, leaving no balance for forgiveness. If you’re pursuing PSLF, switching to an Income-Driven Repayment (IDR) plan is usually a better strategy to maximize forgiveness.

FAQ: Common Questions About the 10-Year Standard Repayment Plan

Q: What is the 10-Year Standard Repayment Plan?

A: The 10-Year Standard Repayment Plan is the default repayment option for federal student loans. It has fixed monthly payments designed to fully repay the loan within 10 years.

Q: How are payments calculated under the 10-Year Standard Repayment Plan?

A: Payments are based on loan balance, interest rate, and a fixed 10-year term. For example, a $230,000 loan at 6.0% interest would have a monthly payment of approximately $2,550.

Q: Is the 10-Year Standard Repayment Plan a good option for PSLF?

A: No. While it’s PSLF-eligible, it fully repays loans in 10 years, leaving no balance for forgiveness. Income-Driven Repayment (IDR) is usually a better choice for PSLF.

Q: What happens if I switch from the 10-Year Standard Repayment Plan to an Income-Driven Repayment (IDR) plan?

A: If you switch to an IDR plan, your monthly payments will be recalculated based on your income and family size. This typically results in much lower payments, especially during residency. However, any unpaid interest may capitalize, increasing the total loan cost.

Q: Can I qualify for loan forgiveness under the 10-Year Standard Repayment Plan?

A: The 10-Year Standard Repayment Plan is PSLF-eligible, but it fully repays your loan in 10 years, leaving no balance for forgiveness. If you’re pursuing PSLF, switching to an Income-Driven Repayment (IDR) plan is usually a better strategy to maximize forgiveness.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.