Introduction

Studentaid.gov serves as your central hub for all federal student loan-related matters. For inquiries, this is the ideal starting point.

Within studentaid.gov, you can download your National Student Loan Data System (NSLDS) My Aid Data file—a comprehensive .txt document detailing every aspect of your student loans.

When collaborating with a professional to develop a personalized student loan strategy, this file is typically the initial requirement. Alongside your employment history, it assists the student loan professional in tailoring a strategy that aligns with your specific needs.

Buried within your My Aid Data file, you’ll find everything you need to know about your student loans, including your Income-Driven Repayment Anniversary Date. This date is crucial because it marks the deadline for annually recertifying your income and family size when you’re on an Income-Driven Repayment plan.

Introduction

Studentaid.gov serves as your central hub for all federal student loan-related matters. For inquiries, this is the ideal starting point.

Within studentaid.gov, you can download your National Student Loan Data System (NSLDS) My Aid Data file—a comprehensive .txt document detailing every aspect of your student loans.

When collaborating with a professional to develop a personalized student loan strategy, this file is typically the initial requirement. Alongside your employment history, it assists the student loan professional in tailoring a strategy that aligns with your specific needs.

Buried within your My Aid Data file, you’ll find everything you need to know about your student loans, including your Income-Driven Repayment Anniversary Date. This date is crucial because it marks the deadline for annually recertifying your income and family size when you’re on an Income-Driven Repayment plan.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

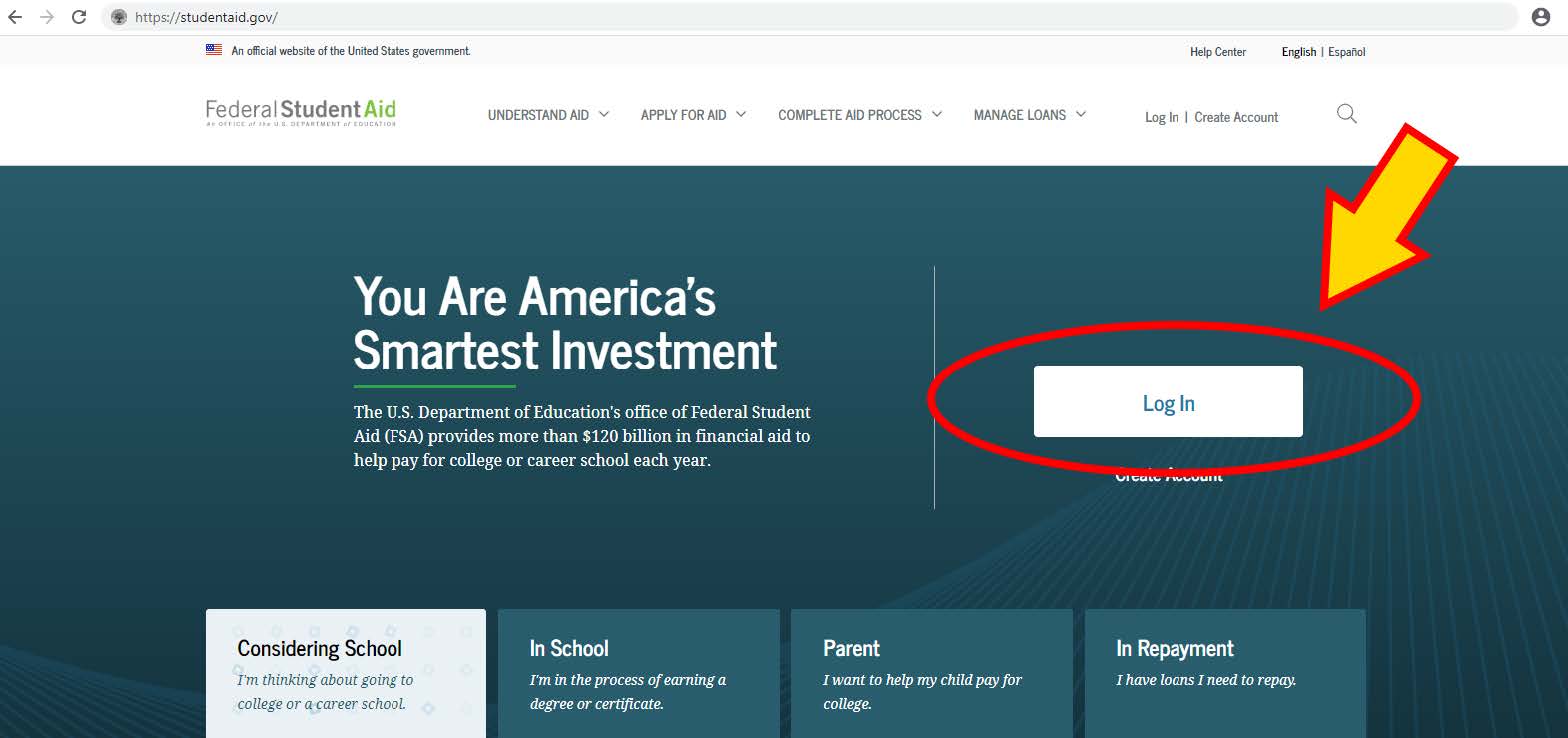

How to Download Your NSLDS .txt File

How to Download Your NSLDS .txt File

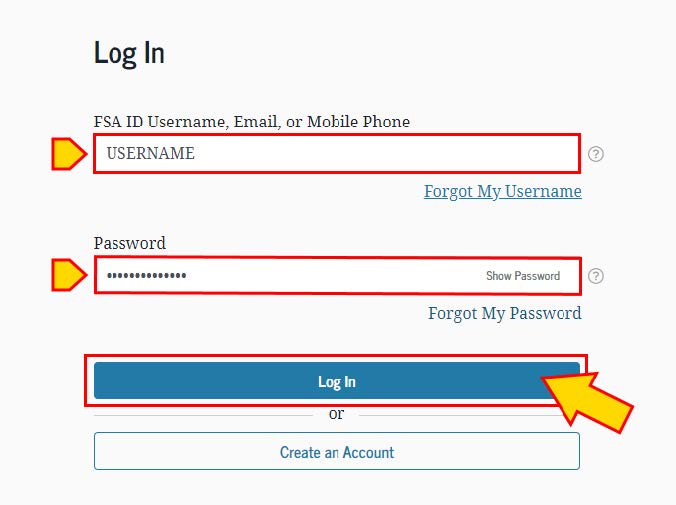

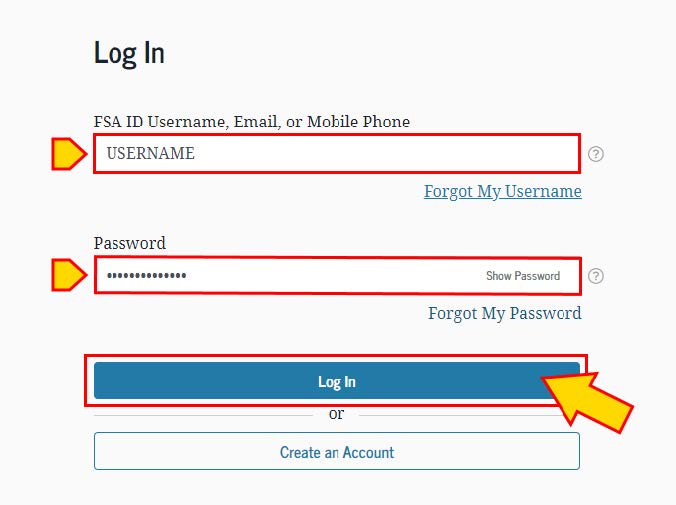

Provide your FSA ID and Password, then click “Log In”

Provide your FSA ID and Password, then click “Log In”

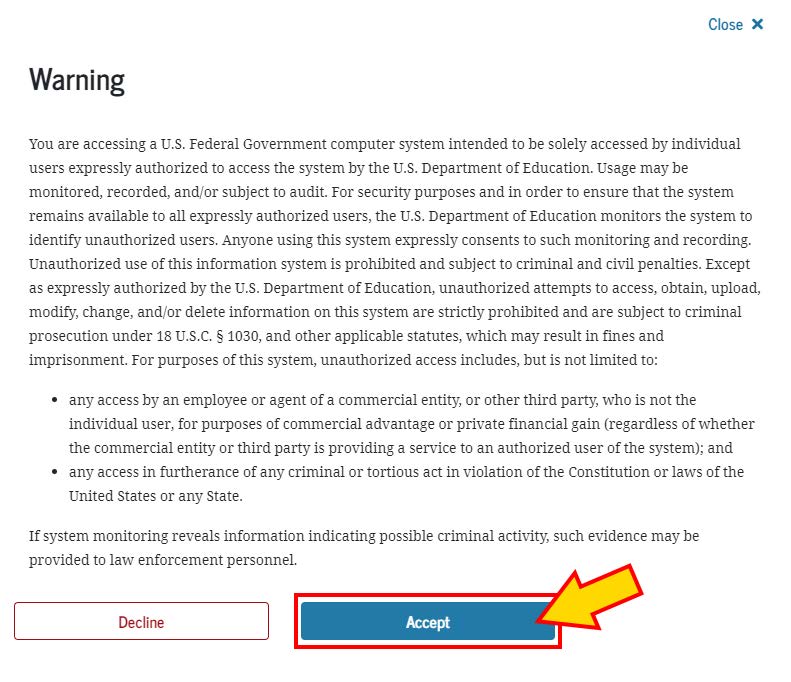

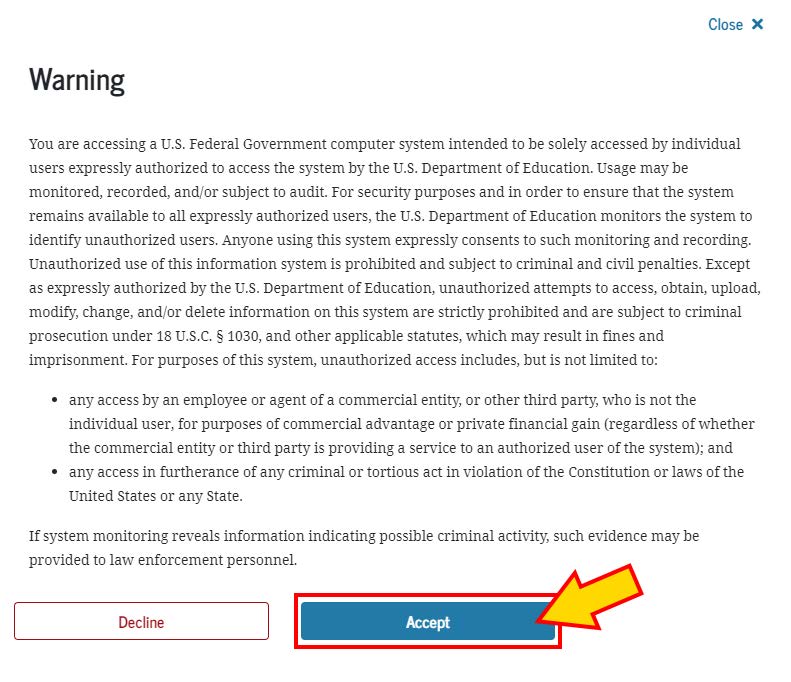

Review the warning and click “Accept.”

Review the warning and click “Accept.”

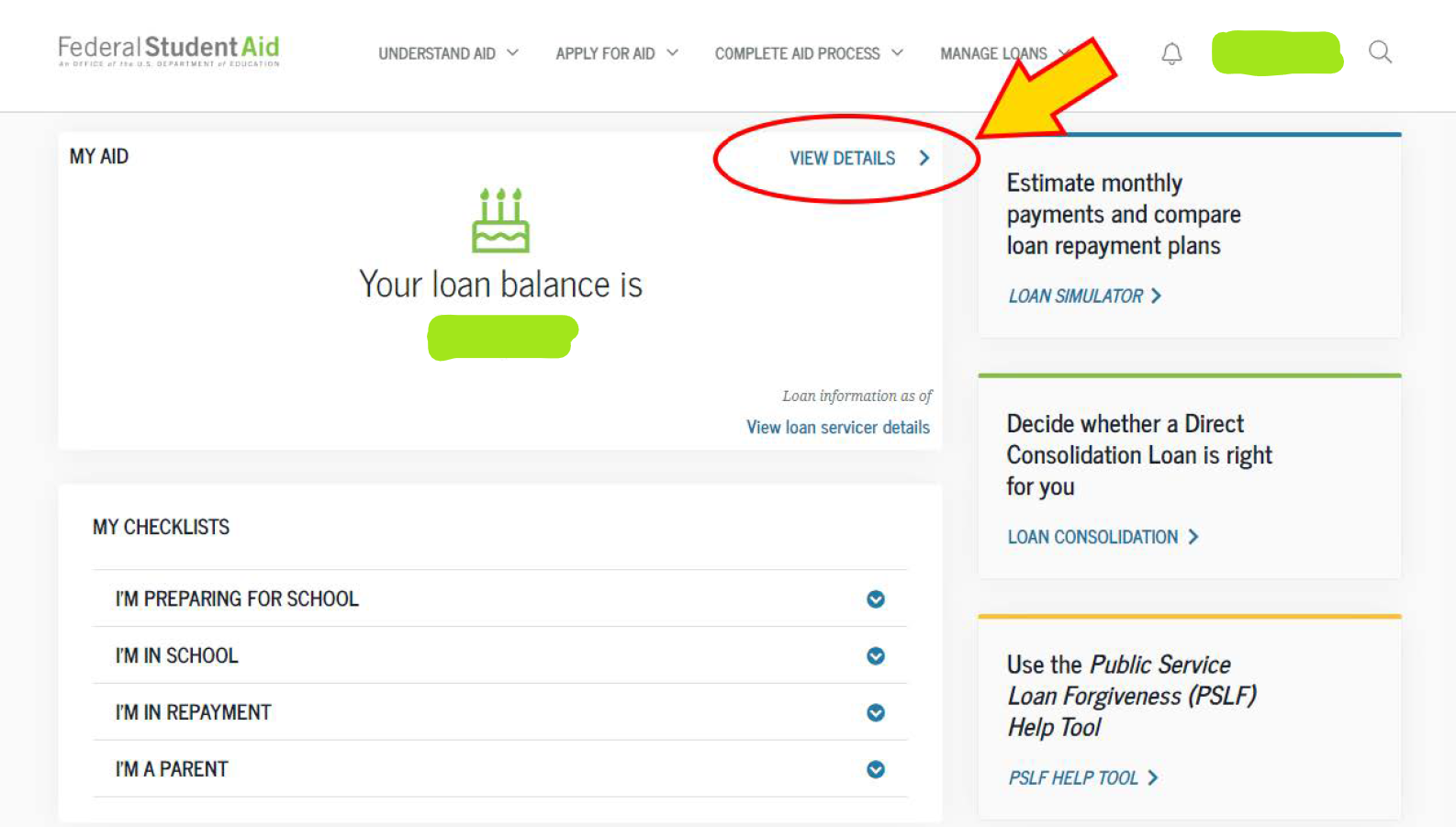

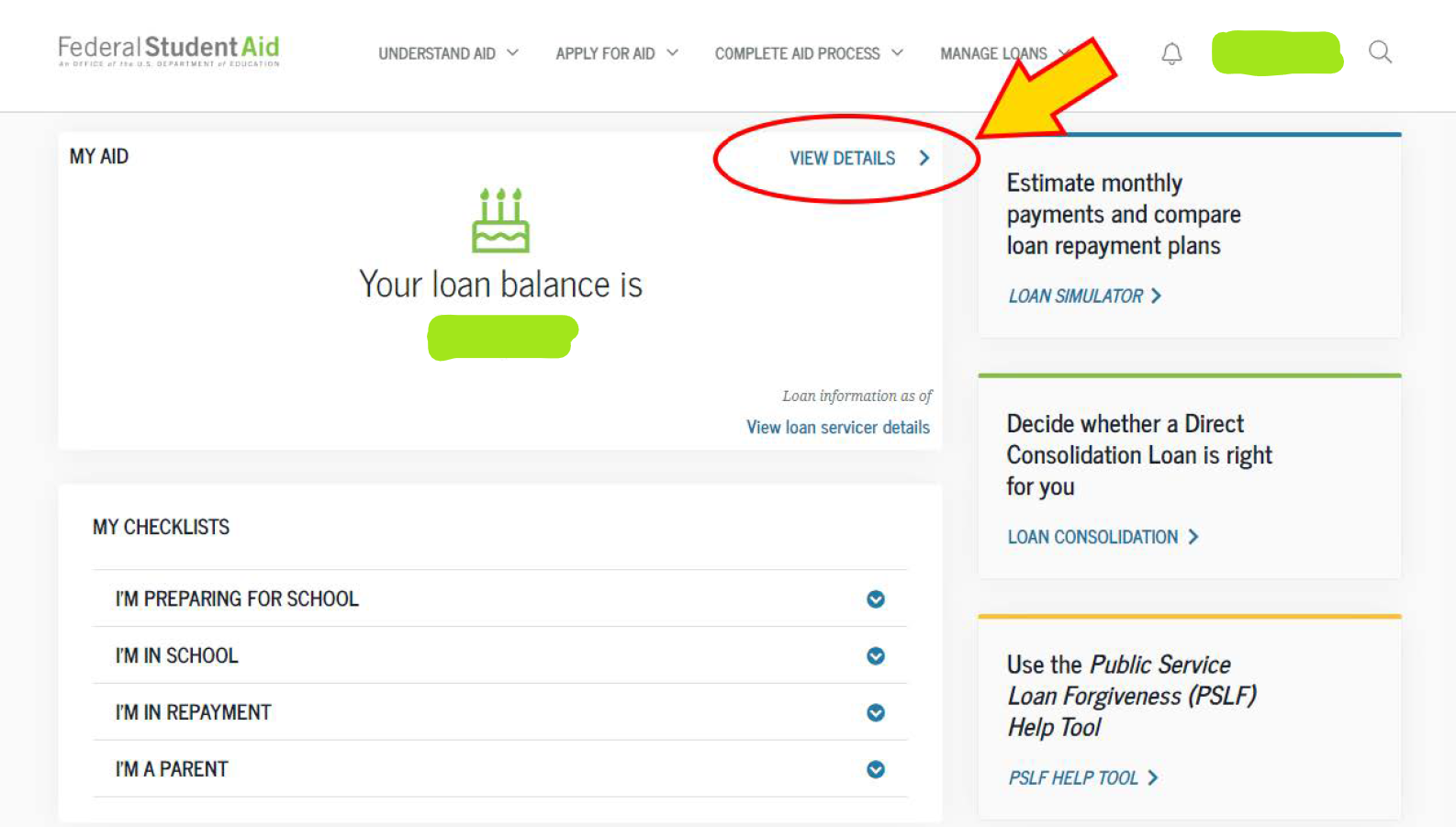

On the Student Aid Dashboard, select “View Details”

On the Student Aid Dashboard, select “View Details”

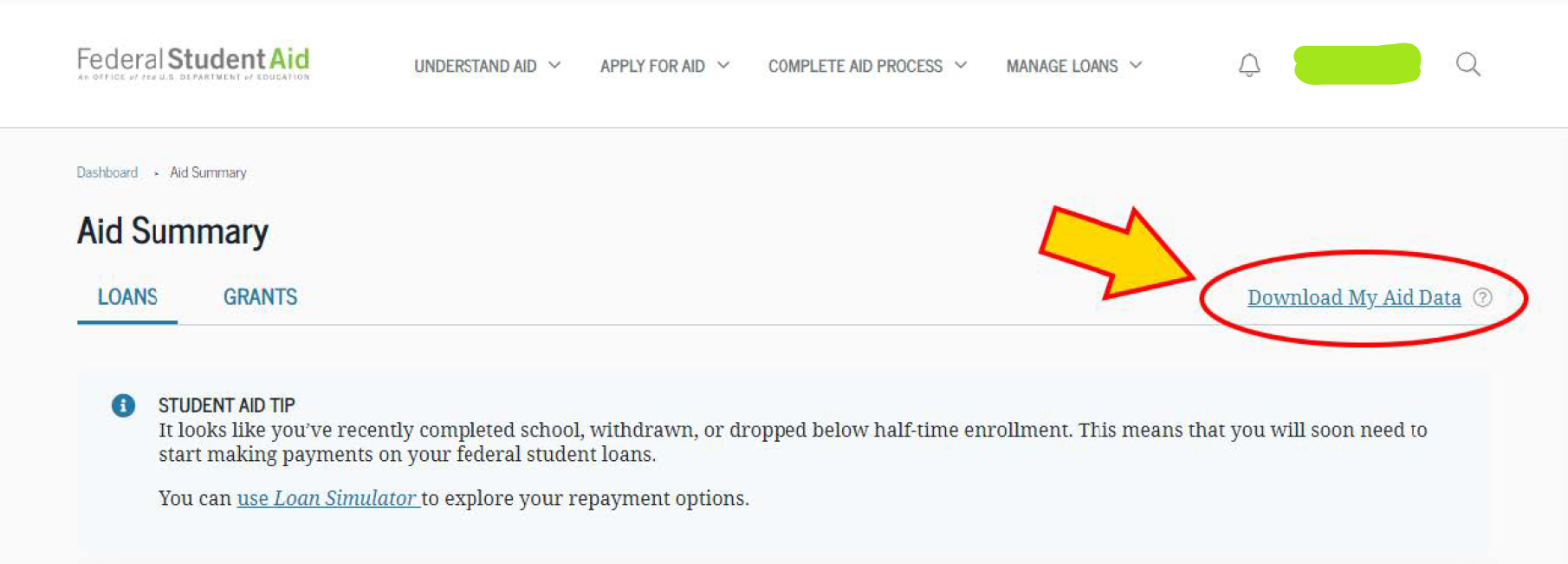

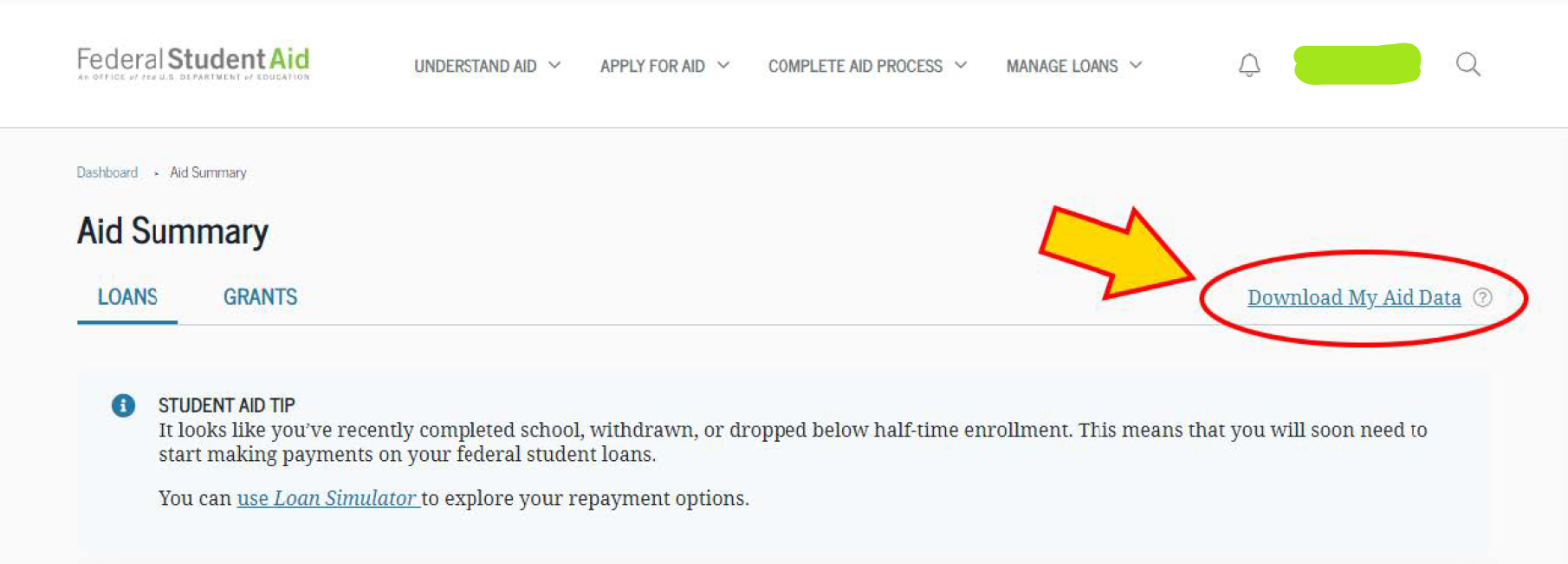

Download the My Aid Data file, an extensive .txt document containing comprehensive information about your student loans.

Ensure you save the file in a location you can easily locate.

Download the My Aid Data file, an extensive .txt document containing comprehensive information about your student loans.

Ensure you save the file in a location you can easily locate.

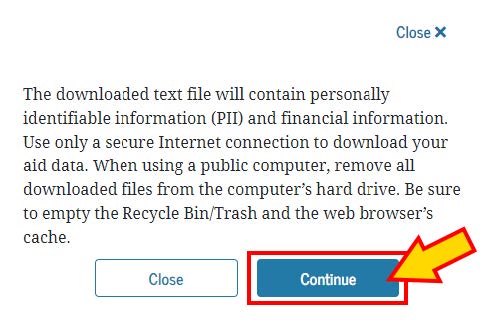

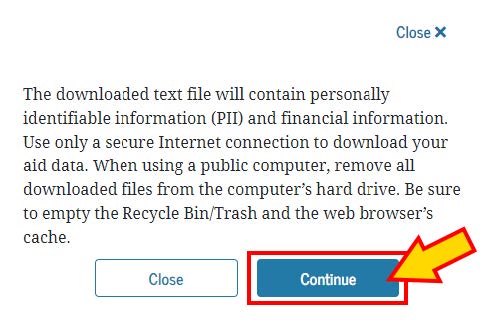

Read the displayed disclosure regarding your text file, personally identifiable information (PII), and financial details.

Click “Continue” to download your NSLDS.txt file.

Read the displayed disclosure regarding your text file, personally identifiable information (PII), and financial details.

Click “Continue” to download your NSLDS.txt file.

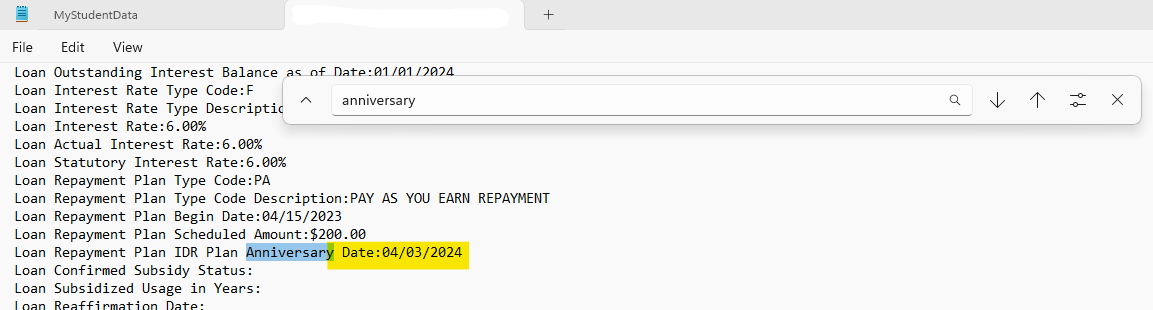

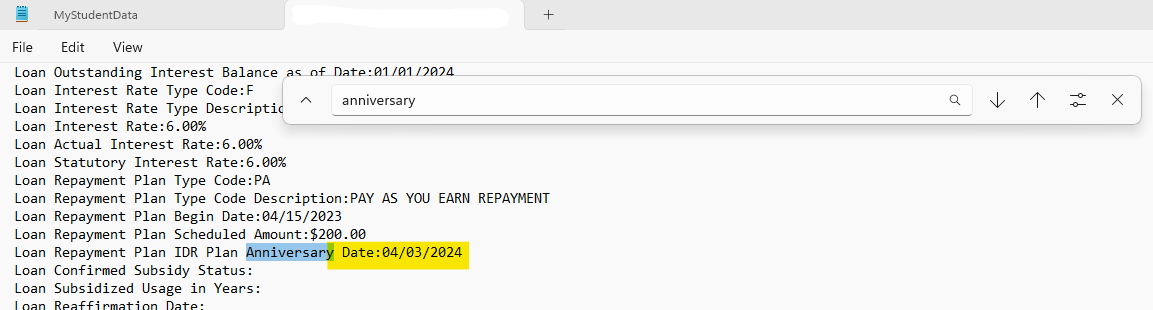

Open the My Aid Data .txt file you just downloaded.

Press (“Control” + “F”) to open the search box.

In the search box, type “anniversary” and press enter.

This will direct you to your Income-Driven Repayment Anniversary Date. This date signifies when you’re required to annually recertify your income and family sizes. If you don’t find an Income-Driven Repayment Anniversary Date, it’s probable that you’re not currently enrolled in an Income-Driven Repayment plan.

In the example below, the Income-Driven Repayment Anniversary Date is April 3, 2024. Remember, without making any changes to your student loan repayment plan, every April 3rd, you’ll need to recertify your income and family size.

Open the My Aid Data .txt file you just downloaded.

Press (“Control” + “F”) to open the search box.

In the search box, type “anniversary” and press enter.

This will direct you to your Income-Driven Repayment Anniversary Date. This date signifies when you’re required to annually recertify your income and family sizes. If you don’t find an Income-Driven Repayment Anniversary Date, it’s probable that you’re not currently enrolled in an Income-Driven Repayment plan.

In the example below, the Income-Driven Repayment Anniversary Date is April 3, 2024. Remember, without making any changes to your student loan repayment plan, every April 3rd, you’ll need to recertify your income and family size.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.