Introduction

Managing student loans can be overwhelming, especially with all the different repayment options.

One surprising fact?

There are actually two ways to calculate the 10-Year Standard Repayment Plan for student loans. 🤯

Let’s break it down and explain why this matters, especially if you’re pursuing Public Service Loan Forgiveness (PSLF).

Introduction

Managing student loans can be overwhelming, especially with all the different repayment options.

One surprising fact?

There are actually two ways to calculate the 10-Year Standard Repayment Plan for student loans. 🤯

Let’s break it down and explain why this matters, especially if you’re pursuing Public Service Loan Forgiveness (PSLF).

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Subscribe to The Dream Bigger – Physician Edition Newsetter

A weekly newsletter designed for early-career physicians and anyone looking to enhance their financial well-being.

Discover helpful tips, strategies, and insights to dream bigger and take control of your financial future. 🥼

Get student loan updates, money-saving tips, and financial strategies – all delivered to your inbox.

Why Does This Matter?

As of today (September 2024), the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan has been temporarily blocked by a Missouri court. The legality of the plan is under review, with oral arguments scheduled for October 24, 2024, and a final ruling expected by late November.

If you’re on the SAVE plan, you are not able to make payments during this injunction, and this time doesn’t count toward the 120 payments required for PSLF. Since PSLF is all about making qualifying payments, some borrowers are considering switching to the 10-Year Standard Repayment Plan to ensure their payments count.

Let’s explore the two types of 10-Year Standard Repayment Plans—and why one of them could lead to paying off your entire loan, leaving nothing to forgive under PSLF.

Why Does This Matter?

As of today (September 2024), the Saving on a Valuable Education (SAVE) Income-Driven Repayment (IDR) plan has been temporarily blocked by a Missouri court. The legality of the plan is under review, with oral arguments scheduled for October 24, 2024, and a final ruling expected by late November.

If you’re on the SAVE plan, you are not able to make payments during this injunction, and this time doesn’t count toward the 120 payments required for PSLF. Since PSLF is all about making qualifying payments, some borrowers are considering switching to the 10-Year Standard Repayment Plan to ensure their payments count.

Let’s explore the two types of 10-Year Standard Repayment Plans—and why one of them could lead to paying off your entire loan, leaving nothing to forgive under PSLF.

How to Qualify for PSLF

To have your loans forgiven through PSLF, you must:

1. Work for a qualifying employer (such as a hospital or non-profit).

2. Have Direct Loans.

3. Make 120 qualifying payments.

4. Be on an IDR plan or the 10-Year Standard Repayment Plan.

Learn more about PSLF here: Public Service Loan Forgiveness

With the SAVE plan blocked, some of you might be thinking about switching to the 10-Year Standard Repayment Plan. But here’s why that may not be the best idea.

How to Qualify for PSLF

To have your loans forgiven through PSLF, you must:

1. Work for a qualifying employer (such as a hospital or non-profit).

2. Have Direct Loans.

3. Make 120 qualifying payments.

4. Be on an IDR plan or the 10-Year Standard Repayment Plan.

Learn more about PSLF here: Public Service Loan Forgiveness

With the SAVE plan blocked, some of you might be thinking about switching to the 10-Year Standard Repayment Plan. But here’s why that may not be the best idea.

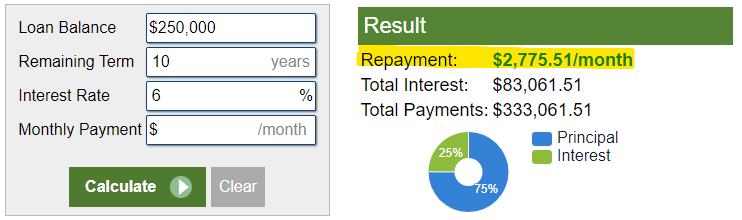

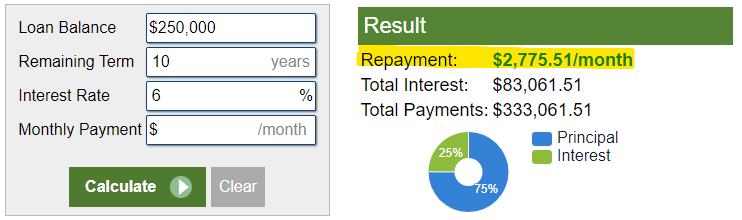

Way #1: Traditional 10-Year Standard Repayment

This is the typical plan most people think of when they hear “10-Year Repayment Plan.” Here’s how it works:

-

-

Grace Period: After graduation, you get a 6-month grace period before payments begin.

-

Payment Calculation: Your monthly payment is based on your loan balance and interest rate, spread evenly over 10 years.

-

Example:

For a $250,000 loan with a 6% interest rate, your monthly payment would be around $2,775.51.

This high payment is why many borrowers opt for an IDR plan to reduce their monthly payments.

Way #1: Traditional 10-Year Standard Repayment

This is the typical plan most people think of when they hear “10-Year Repayment Plan.” Here’s how it works:

-

Grace Period: After graduation, you get a 6-month grace period before payments begin.

-

Payment Calculation: Your monthly payment is based on your loan balance and interest rate, spread evenly over 10 years.

Example:

For a $250,000 loan with a 6% interest rate, your monthly payment would be around $2,775.51.

This high payment is why many borrowers opt for an IDR plan to reduce their monthly payments.

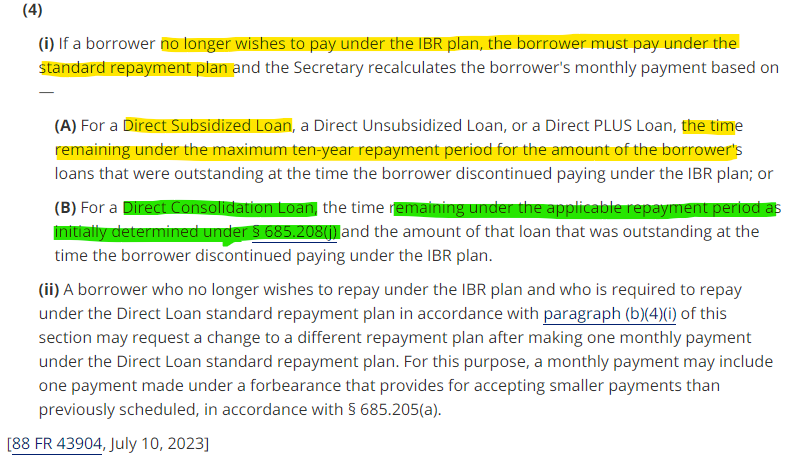

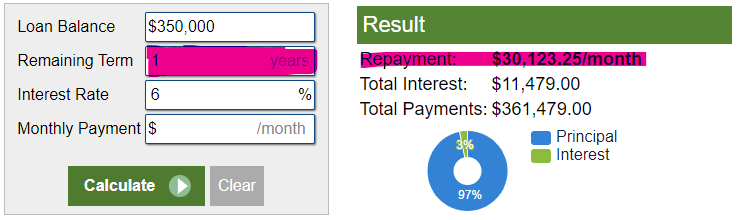

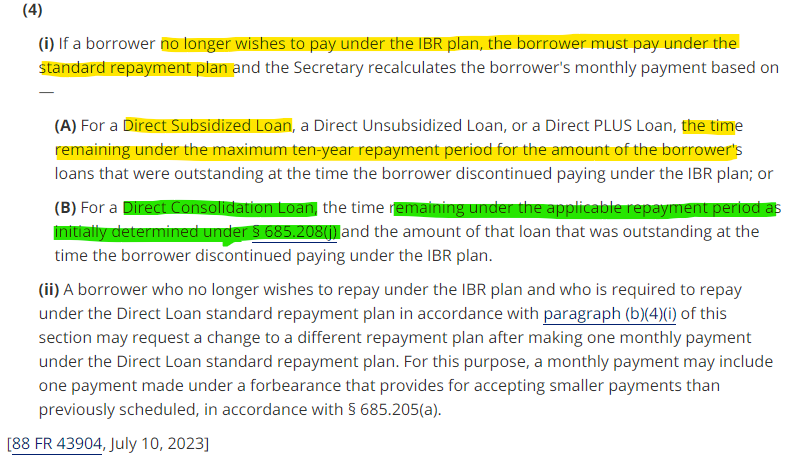

Way #2: The “Other” 10-Year Standard Repayment

There’s another, less common way the 10-Year Standard Plan works. This comes into play if you switch from an IDR plan to the 10-Year Standard Plan after making payments for several years.

-

-

Switching from IDR to 10-Year Standard: If you’ve been on an IDR plan with low monthly payments and then switch to the 10-Year Standard Plan, your new payment will be based on how much time is left in the original 10-year term.

-

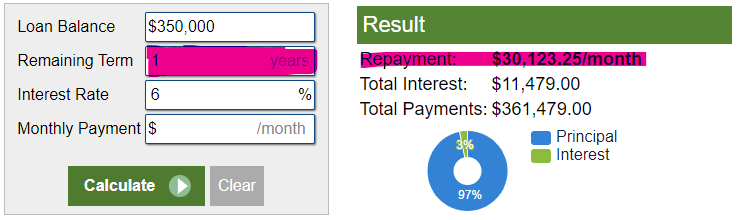

Example:

If you’ve been making payments for 9 years and your loan balance has grown to $350,000, your new payment would be $30,123.25/month—because you only have 1 year left to pay off the balance.

In this case, you could end up paying off the entire loan, leaving nothing to be forgiven under PSLF.

Way #2: The “Other” 10-Year Standard Repayment

There’s another, less common way the 10-Year Standard Plan works. This comes into play if you switch from an IDR plan to the 10-Year Standard Plan after making payments for several years.

-

Switching from IDR to 10-Year Standard: If you’ve been on an IDR plan with low monthly payments and then switch to the 10-Year Standard Plan, your new payment will be based on how much time is left in the original 10-year term.

Example:

If you’ve been making payments for 9 years and your loan balance has grown to $350,000, your new payment would be $30,123.25/month—because you only have 1 year left to pay off the balance.

In this case, you could end up paying off the entire loan, leaving nothing to be forgiven under PSLF.

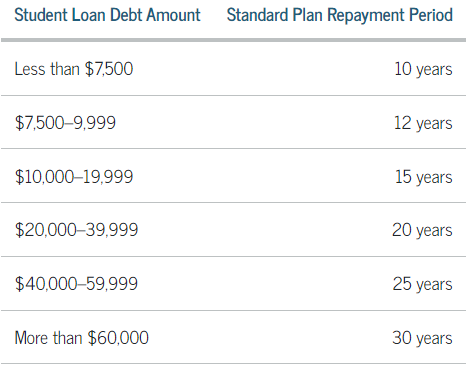

Important Notes on Loan Consolidation

Consolidation: If you consolidate your loans, you cannot use the 10-Year Standard Repayment Plan for PSLF. Instead, you’ll be placed on a new Standard Repayment Plan based on your total loan amount.

Important Notes on Loan Consolidation

Consolidation: If you consolidate your loans, you cannot use the 10-Year Standard Repayment Plan for PSLF. Instead, you’ll be placed on a new Standard Repayment Plan based on your total loan amount.

Current Student Loan Situation (As of September 2024)

Due to the court order blocking the SAVE plan, several key student loan functions have been paused:

☁️ Consolidation Blocked: You cannot combine multiple loans into a single loan.

☁️ IDR Online Blocked: Online applications for IDR plans are not being processed.

☁️ IDR PDF Application Delays: PDF applications for IDR plans are facing significant delays.

What Should You Do?

For now, the best advice is to stay patient. Hopefully, by the end of November, we’ll have a clearer picture of what’s happening with the SAVE plan. Even if you wanted to switch to the 10-Year Standard Repayment Plan, loan servicers are not processing new applications at this time.

Keep checking back for updates. I’ll keep this page updated with the latest information.

Current Student Loan Situation (As of September 2024)

Due to the court order blocking the SAVE plan, several key student loan functions have been paused:

☁️ Consolidation Blocked: You cannot combine multiple loans into a single loan.

☁️ IDR Online Blocked: Online applications for IDR plans are not being processed.

☁️ IDR PDF Application Delays: PDF applications for IDR plans are facing significant delays.

What Should You Do?

For now, the best advice is to stay patient. Hopefully, by the end of November, we’ll have a clearer picture of what’s happening with the SAVE plan. Even if you wanted to switch to the 10-Year Standard Repayment Plan, loan servicers are not processing new applications at this time.

Keep checking back for updates. I’ll keep this page updated with the latest information.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.