Introduction

Navigating the world of student loan repayment can feel like solving a puzzle.

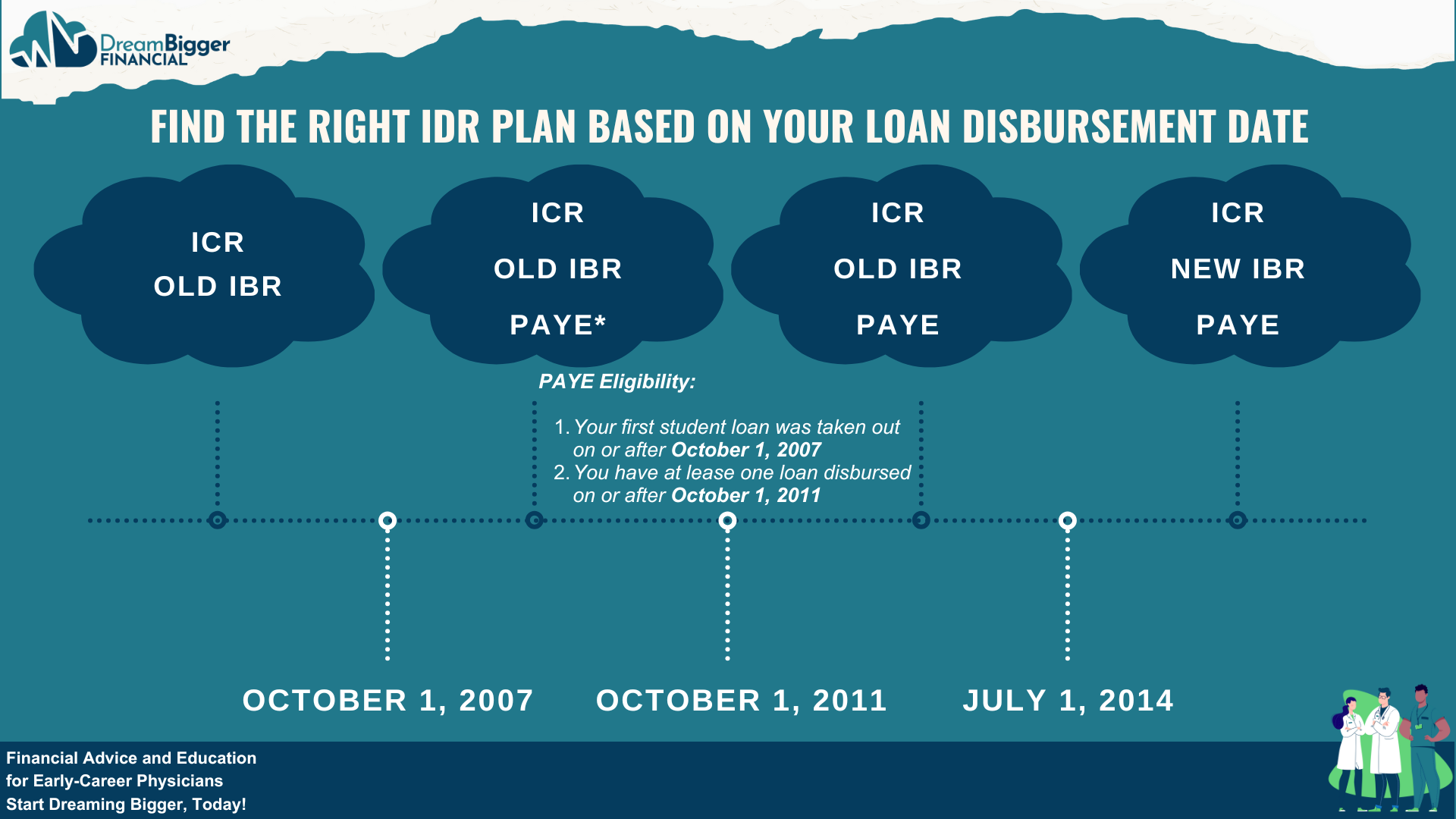

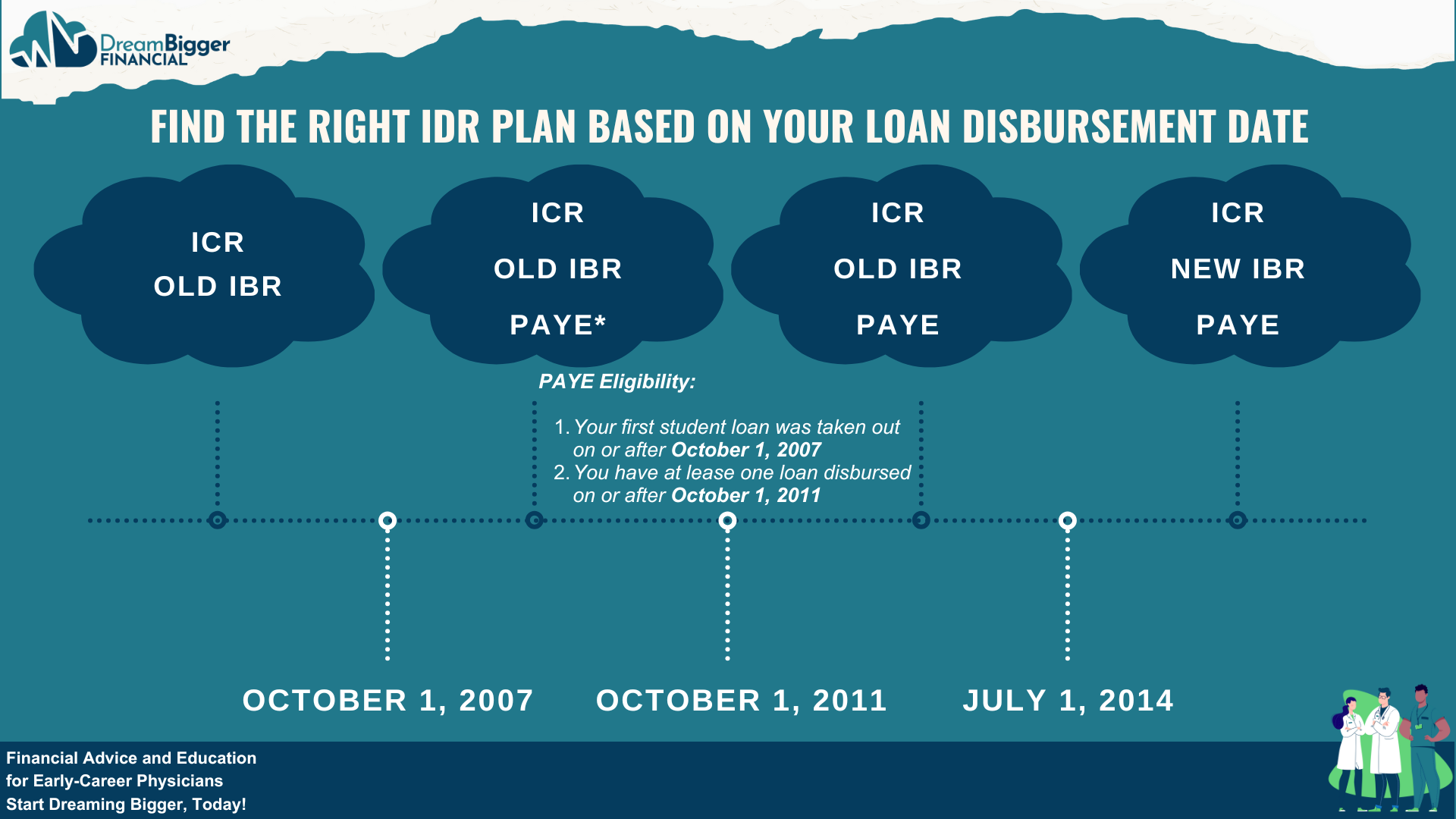

Whether you’re trying to navigate Old IBR, New IBR, PAYE, or ICR, eligibility often boils down to the date you took out your loans and your borrowing history.

Here’s a quick guide to help you figure out your options, plus some real-life examples to make it easy to follow.

Introduction

Navigating the world of student loan repayment can feel like solving a puzzle.

Whether you’re trying to navigate Old IBR, New IBR, PAYE, or ICR, eligibility often boils down to the date you took out your loans and your borrowing history.

Here’s a quick guide to help you figure out your options, plus some real-life examples to make it easy to follow.

Which IDR Plan Am I Eligible For?

Start by reviewing the key requirements for each plan:

Old Income-Based Repayment (Old IBR)

-

-

Eligibility: Borrowers who took out loans before July 1, 2014.

-

Requirement: You must demonstrate a Partial Financial Hardship, meaning your required payment under the 10-Year Standard Repayment Plan is higher than what you’d pay under Old IBR.

-

New Income-Based Repayment (New IBR)

-

-

Eligibility: Borrowers who took out loans on or after July 1, 2014.

-

Requirement: Similar to Old IBR, you must demonstrate a Partial Financial Hardship to qualify.

-

Click here to learn more about Income-Based Repayment.

Pay As You Earn (PAYE)

-

-

Eligibility Test:

-

1. Did you start borrowing after October 1, 2007?

2. Do you have at least one loan disbursed after October 1, 2011?

If you answer yes to both questions, you are eligible for the PAYE plan.

-

-

Requirement: You must demonstrate a Partial Financial Hardship to qualify for PAYE.

-

Important Notes:

-

-

Borrowers with loans taken out before October 1, 2007, are not eligible.

-

Consolidating loans won’t change eligibility.

-

Click here to learn more about Pay As You Earn.

Income-Contingent Repayment (ICR)

-

-

Eligibility: Available to all Direct Loan borrowers, regardless of loan disbursement dates.

-

Requirement: No Partial Financial Hardship is required.

-

Click here to learn more about Income Contingent Repayment.

Which IDR Plan Am I Eligible For?

Start by reviewing the key requirements for each plan:

Old Income-Based Repayment (Old IBR)

-

Eligibility: Borrowers who took out loans before July 1, 2014.

-

Requirement: You must demonstrate a Partial Financial Hardship, meaning your required payment under the 10-Year Standard Repayment Plan is higher than what you’d pay under Old IBR.

New Income-Based Repayment (New IBR)

-

Eligibility: Borrowers who took out loans on or after July 1, 2014.

-

Requirement: Similar to Old IBR, you must demonstrate a Partial Financial Hardship to qualify.

Click here to learn more about Income-Based Repayment.

Pay As You Earn (PAYE)

-

Eligibility Test:

1. Did you start borrowing after October 1, 2007?

2. Do you have at least one loan disbursed after October 1, 2011?

If you answer yes to both questions, you are eligible for the PAYE plan.

-

Requirement: You must demonstrate a Partial Financial Hardship to qualify for PAYE.

Important Notes:

-

Borrowers with loans taken out before October 1, 2007, are not eligible.

-

Consolidating loans won’t change eligibility.

Click here to learn more about Pay As You Earn.

Income-Contingent Repayment (ICR)

-

Eligibility: Available to all Direct Loan borrowers, regardless of loan disbursement dates.

-

Requirement: No Partial Financial Hardship is required.

Click here to learn more about Income Contingent Repayment.

Which IDR Plan Should I Choose?

For most borrowers, the hierarchy of IDR plan preference is:

New IBR > PAYE > Old IBR > ICR

Note: IBR is written into law, which provides better protection for both Old IBR and New IBR against future legal actions. PAYE is preferable to Old IBR because it offers a lower payment, which likely outweighs the risk of future legal challenges. ICR is the only plan available if you don’t have a Partial Financial Hardship.

Click here to learn more about Partial Financial Hardship.

Why New IBR May Be the Best Option

-

-

Lowest Payments: New IBR and PAYE often result in similar monthly payments.

-

Better Protections: New IBR is written into law, making it more secure against future changes compared to PAYE.

-

Why PAYE Is Better Than Old IBR

-

-

Lower Payments: PAYE typically offers lower payments than Old IBR, making it a better choice if you qualify.

-

Eligibility Window: PAYE is designed for borrowers who meet specific disbursement date requirements (loans after October 1, 2007, with at least one disbursed after October 1, 2011).

-

Old IBR and ICR: When They Make Sense

-

-

Old IBR: Suitable for borrowers with loans disbursed before July 1, 2014, when neither PAYE nor New IBR is an option. While payments under Old IBR are higher than PAYE, it remains a good fallback plan for eligible borrowers.

-

-

-

ICR: Ideal for borrowers who don’t qualify for any other IDR plan or need flexibility.

-

-

Do not qualify for a Partial Financial Hardship.

-

Have a high income compared to their loan balance.

-

Are high-income, low-debt borrowers.

-

-

-

Which IDR Plan Should I Choose?

For most borrowers, the hierarchy of IDR plan preference is:

New IBR > PAYE > Old IBR > ICR

Note: IBR is written into law, which provides better protection for both Old IBR and New IBR against future legal actions. PAYE is preferable to Old IBR because it offers a lower payment, which likely outweighs the risk of future legal challenges. ICR is the only plan available if you don’t have a Partial Financial Hardship.

Click here to learn more about Partial Financial Hardship.

Why New IBR May Be the Best Option

-

Lowest Payments: New IBR and PAYE often result in similar monthly payments.

-

Better Protections: New IBR is written into law, making it more secure against future changes compared to PAYE.

Why PAYE Is Better Than Old IBR

-

Lower Payments: PAYE typically offers lower payments than Old IBR, making it a better choice if you qualify.

-

Eligibility Window: PAYE is designed for borrowers who meet specific disbursement date requirements (loans after October 1, 2007, with at least one disbursed after October 1, 2011).

Old IBR and ICR: When They Make Sense

-

Old IBR: Suitable for borrowers with loans disbursed before July 1, 2014, when neither PAYE nor New IBR is an option. While payments under Old IBR are higher than PAYE, it remains a good fallback plan for eligible borrowers.

-

ICR: Ideal for borrowers who don’t qualify for any other IDR plan or need flexibility.

-

Do not qualify for a Partial Financial Hardship.

-

Have a high income compared to their loan balance.

-

Are high-income, low-debt borrowers.

-

Borrower’s Timeline: IDR Plan Eligibility

Borrower’s Timeline: IDR Plan Eligibility

Scenario 1: Loan Taken August 15, 2006

Eligible Plans: Old IBR, ICR

Why?

-

-

Old IBR: Loan was taken before July 1, 2014.

-

ICR: Open to all Direct Loan borrowers.

-

Tip: Old IBR could offer a lower payment if you qualify, but ICR might be worth exploring for PSLF eligibility if your financial situation changes.

Scenario 1: Loan Taken August 15, 2006

Eligible Plans: Old IBR, ICR

Why?

-

Old IBR: Loan was taken before July 1, 2014.

-

ICR: Open to all Direct Loan borrowers.

Tip: Old IBR could offer a lower payment if you qualify, but ICR might be worth exploring for PSLF eligibility if your financial situation changes.

Scenario 2: Loan Taken November 5, 2012

Eligible Plans: Old IBR, PAYE, ICR

Why?

-

-

Old IBR: Loan was disbursed before July 1, 2014.

-

PAYE: Borrowing started after October 1, 2007, with at least one loan disbursed after October 1, 2011.

-

ICR: Open to all Direct Loan borrowers.

-

Example: If you’re pursuing PSLF, PAYE might be your best option, it typically offers the lowest payments. If not, Old IBR is a solid fallback.

Scenario 2: Loan Taken November 5, 2012

Eligible Plans: Old IBR, PAYE, ICR

Why?

-

Old IBR: Loan was disbursed before July 1, 2014.

-

PAYE: Borrowing started after October 1, 2007, with at least one loan disbursed after October 1, 2011.

-

ICR: Open to all Direct Loan borrowers.

Example: If you’re pursuing PSLF, PAYE might be your best option, it typically offers the lowest payments. If not, Old IBR is a solid fallback.

Scenario 3: Loan Taken January 20, 2015

Eligible Plans: New IBR, PAYE, ICR

Why?

-

-

New IBR: Loans taken on or after July 1, 2014.

-

PAYE: Borrowing started after October 1, 2007, with at least one loan disbursed after October 1, 2011.

-

ICR: Open to all Direct Loan borrowers.

-

Pro Tip: New IBR often provides better legal protections compared to PAYE, making it worth considering if payments are similar.

Scenario 3: Loan Taken January 20, 2015

Eligible Plans: New IBR, PAYE, ICR

Why?

-

New IBR: Loans taken on or after July 1, 2014.

-

PAYE: Borrowing started after October 1, 2007, with at least one loan disbursed after October 1, 2011.

-

ICR: Open to all Direct Loan borrowers.

Pro Tip: New IBR often provides better legal protections compared to PAYE, making it worth considering if payments are similar.

Scenario 4: Loan Taken March 10, 2008

Eligible Plans: Old IBR, PAYE, ICR

Why?

-

-

Old IBR: Loan was taken before July 1, 2014.

-

PAYE: Eligibility depends on whether at least one loan was disbursed after October 1, 2011, and borrowing started after October 1, 2007.

-

ICR: Open to all Direct Loan borrowers.

-

Quick Note: Double-check your disbursement dates if you’re considering PAYE, it can make a big difference in your options!

Scenario 4: Loan Taken March 10, 2008

Eligible Plans: Old IBR, PAYE, ICR

Why?

-

Old IBR: Loan was taken before July 1, 2014.

-

PAYE: Eligibility depends on whether at least one loan was disbursed after October 1, 2011, and borrowing started after October 1, 2007.

-

ICR: Open to all Direct Loan borrowers.

Quick Note: Double-check your disbursement dates if you’re considering PAYE, it can make a big difference in your options!

Conclusion

Choosing the right IDR plan depends on your borrowing history, current financial situation, and long-term goals.

By understanding your eligibility and exploring options like Old IBR, New IBR, PAYE, or ICR, you can make a choice that aligns with your needs.

💡 Pro Tip: Use the scenarios above to identify your options, and don’t hesitate to seek professional advice if you’re feeling unsure. Out team is here to help!

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Conclusion

Choosing the right IDR plan depends on your borrowing history, current financial situation, and long-term goals.

By understanding your eligibility and exploring options like Old IBR, New IBR, PAYE, or ICR, you can make a choice that aligns with your needs.

💡 Pro Tip: Use the scenarios above to identify your options, and don’t hesitate to seek professional advice if you’re feeling unsure. Out team is here to help!

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Important Note: Student loan policies, including Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, are constantly evolving. I strive to keep this website up to date, but some information may become outdated or no longer relevant due to changes in student loan programs and Department of Education policies.

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

Start Dreaming Bigger,

Finally Take Control of Your Student Loans!

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.

It All Begins with a Diagnosis…

At Dream Bigger Financial, we’re dedicated to setting early-career physicians on the right financial treatment plan.

With a comprehensive diagnosis, we guide you towards financial peace of mind, ensuring you can be your best self for your loved ones and patients.

Considering financial planning?

We’re currently accepting new patients!

If you prefer self-diagnosing,

join us on social media!

We regularly share tips and tricks on lowering taxes, managing student loans, saving for retirement, and guiding you to live your best financial life.