Income-Driven Repayment (IDR) Calculator for Student Loans

Last Updated: August 6, 2025

Not sure what your student loan payment should be?

This page can help.

Income-driven repayment (IDR) plans adjust your federal student loan payment based on your income and family size.

They’re not based on how much you owe or your interest rate.

That means even if you owe $200,000 or more, your payment could still be surprisingly low.

If your payments feel overwhelming or you’re planning on going for forgiveness, IDR might make things a whole lot easier.

👇 Try the IDR Calculator First

Want a quick idea of what your payment might be?

Start here:

IDR Student Loan Calculator

Monthly Payments

| RAP | PAYE | New IBR | Old IBR | 10-Year Std | |

|---|---|---|---|---|---|

| You | $0 | $0 | $0 | $0 | $0 |

How to Use This Calculator

This calculator is designed to give you a quick idea of what your monthly student loan payment might look like under each IDR plan.

It’s based on your AGI, family size, and a few other key inputs.

Your actual payment could vary slightly depending on how your loan servicer processes your application, but this should get you pretty close.

Calculations are believed to be correct. If you notice anything that doesn’t look right, please send an email to michael@dreambiggerfinancial.com.

So… How Does IDR Actually Work?

Let’s start with the basics.

Most people assume their student loan payment is based on how much they owe.

That’s true under the 10-Year Standard Repayment Plan, which is the default if you don’t take action after your you finish school.

Click here to learn more about the 10 Year Standard Repayment Plan.

But IDR plans work differently.

They’re based on:

-

-

Your income (the higher your income, the higher your payment)

-

Your family size (the bigger your family, the lower your payment)

-

It’s designed to adjust with your life.

Lower payments when you’re early in your career. Higher payments when your income grows.

Let’s meet Dr. Patel.

He’s a first year resident making $60,000. He has $200,000 in student loans.

Under IDR, his monthly payment is about $300.

That’s manageable, especially during training.

But once he becomes an attending and starts making $300,000, that same plan recalculates based on his new income.

Now his monthly payment jumps to more than $2,000.

That’s the tradeoff.

Your payment starts low, but it grows with your income.

The key is planning around that shift.

What If You Owe More Than Your Friends?

Here’s where it gets interesting.

Dr. Patel’s peer, Dr. Williams, is also in residency and earns the same $60,000.

But Dr. Williams has $500,000 in student loans instead of $200,000.

Guess what?

Their monthly payment is still the same.

Around $250 under RAP, $300 under PAYE/New IBR or $450 under Old IBR.

Because IDR plans look at income, not balance, two borrowers earning the same amount could have identical payments even if one owes way more, assuming the same family size…

Which IDR Plans Currently Exist?

The student loan system has gone through a lot of changes… and it’s probably not done yet.

Each new administration tends to bring updates, tweaks, and rule changes.

But for now, there are only three income-driven repayment plans most physicians really need to understand.

We’ll keep it simple here.

When you’re ready to go deeper, click below for the full breakdown.

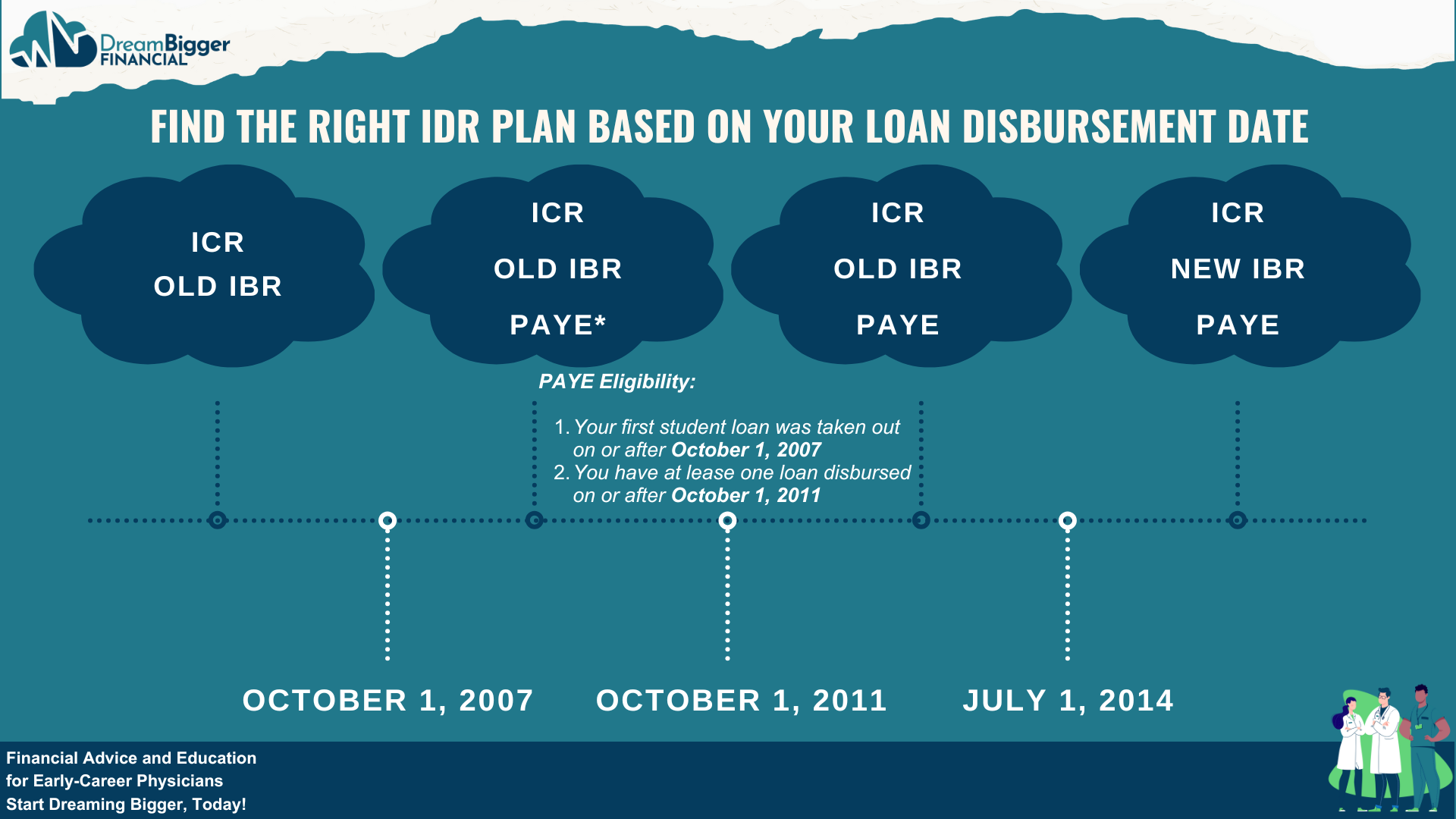

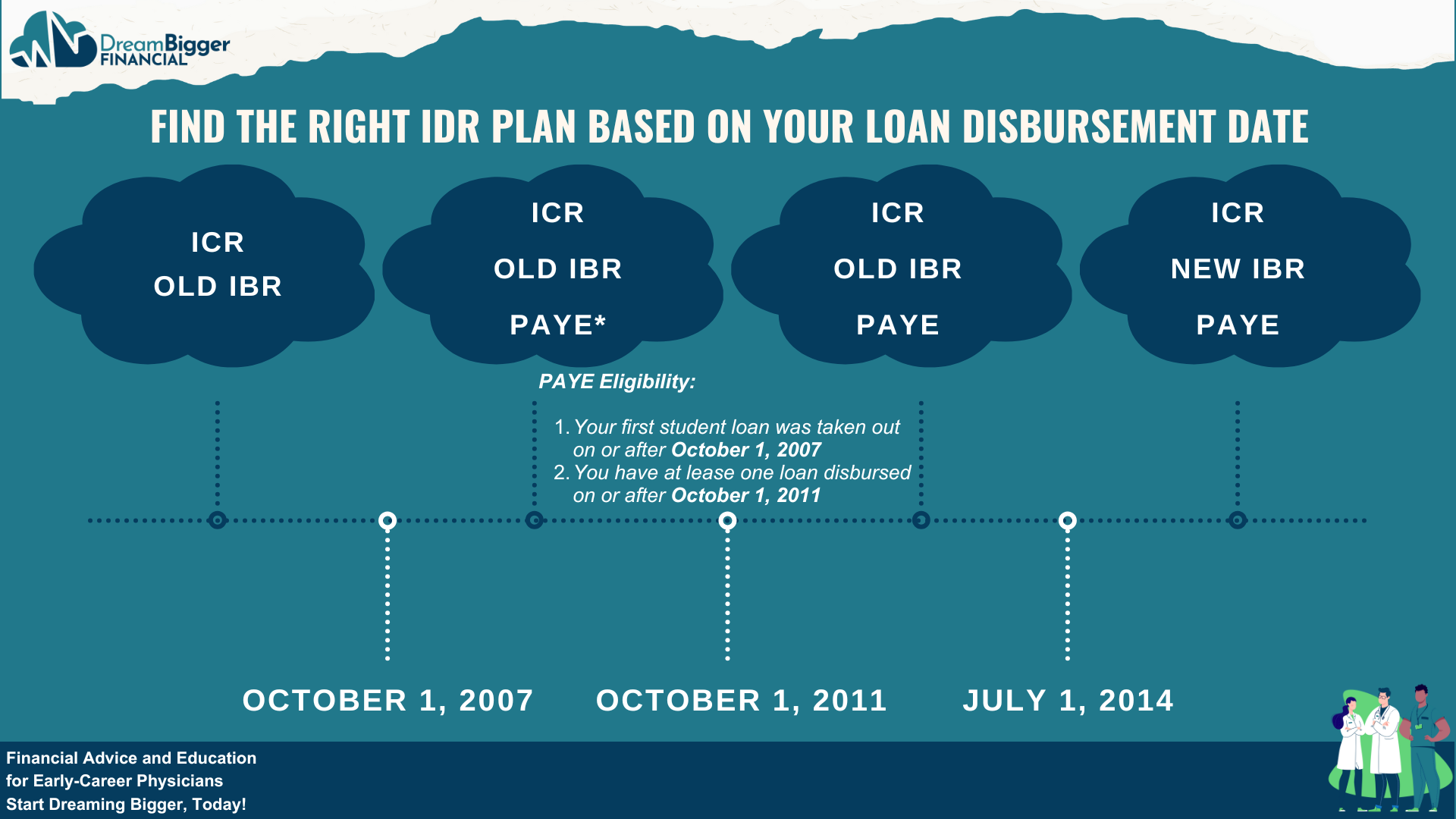

PAYE (Pay As You Earn)

Will be phased out by 2028 for current borrowers and closed to new borrowers starting July 1, 2026

Eligibility:

-

-

Your first federal student loan was taken out on or after October 1, 2007

-

You took out at least one loan on or after October 1, 2011

-

Plan Details:

-

-

10 percent of discretionary income

-

Forgiveness after 20 years

-

Monthly payment is capped at the 10-Year Standard amount

-

Uses full family size: you, your spouse, kids, and anyone you financially support

- Negative amortization can happen: if your monthly payment is less than the interest that accrues, your loan balance could grow over time

-

IBR (Income-Based Repayment)

Will be phased out by 2028 for current borrowers and closed to new borrowers starting July 1, 2026

New IBR (if you borrowed on or after July 1, 2014):

-

-

10 percent of discretionary income

-

Forgiveness after 20 years

-

Monthly payment is capped at the 10-Year Standard amount

-

Old IBR (if you borrowed before July 1, 2014):

-

-

15 percent of discretionary income

-

Forgiveness after 25 years

-

Monthly payment is capped at the 10-Year Standard amount

-

Additional Notes:

-

-

Family size includes you, your spouse, your kids, and anyone else you financially support

-

Negative amortization can happen: if your monthly payment is less than the interest that accrues, your loan balance could grow over time

-

RAP (Repayment Assistance Plan)

Will be the only available IDR plan for new borrowers who take out loans on or after July 1, 2026

Plan Details:

-

- Payments are 1% to 10% of your AGI, minus $50 for each dependent child under 17

- Uses your Adjusted Gross Income (AGI)

- Does not use a discretionary income formula (like PAYE and IBR)

- Family size only includes dependent children under 17

- No payment cap: higher income means higher payments

- Forgiveness after 30 years

- No negative amortization: if your payment doesn’t cover the interest, your balance won’t grow

How Much Could You Pay?

Let’s bring it back to Dr. Patel.

He has:

-

-

$250,000 in student loans

-

A 6 percent interest rate

-

Family size of 1

-

Under the 10 Year Standard Plan, his payment would be $2,777 per month.

Now let’s look at how his payments change with income:

When Income = $60,000

-

-

RAP: around $250

-

PAYE or New IBR: around $300

-

Old IBR: around $450

-

When Income = $300,000

-

-

RAP: around $2,500

-

PAYE or New IBR: around $2,300

-

Old IBR: capped at $2,777

-

When Income = $600,000

-

-

RAP: around $5,000

-

PAYE, New IBR and Old IBR: capped at $2,777

-

Notice how RAP keeps going up as income rises. There’s no ceiling…

PAYE and IBR, on the other hand, protect you with a payment cap tied to your loan balance.

Common Questions

Eligibility & Plan Access

What’s happening to repayment plans in the future?

The student loan system is changing. With new rules and new plans coming, it’s important to understand whether you’re considered a new borrower or an old borrower:

-

-

New borrowers: Anyone who takes out a federal student loan on or after July 1, 2026

-

Old borrowers: Anyone who took out all of their loans before July 1, 2026 and doesn’t borrow again after that date

-

What plans are available to new borrowers?

If you’re a new borrower, your options will be:

-

-

The Standard Plan, based on your loan balance and interest rate

-

The new RAP Plan, based on AGI and number of kids under 17

-

PAYE and IBR will no longer be available for new borrowers starting July 1, 2026.

What if I’m an old borrower?

If you don’t take out any new loans after July 1, 2026, you’ll still have access to PAYE, IBR, and the new RAP plan.

Both PAYE and IBR will be closed to new borrowers starting July 1, 2026. PAYE will also be phased out entirely by July 2028 for existing borrowers, unless they switch to IBR or RAP.

If you’re on IBR before that deadline, you can stay on it. But you won’t be able to stay on PAYE.

Plan Mechanics

Does IDR work for PSLF?

Yes. RAP, IBR, and PAYE are all eligible repayment plans for Public Service Loan Forgiveness (PSLF). If you work for a nonprofit hospital, university, or health system, this is likely the route you want to be on.

Which IDR plan should I pick?

It depends on your income, loan type, family situation, and long-term goals. The calculator above is a great starting point.

But if you want to get it right and avoid costly mistakes, let’s talk. We can build a custom game plan together.

If I’m married, does my partner’s income affect my payment?

Yes. If you file taxes jointly, your partner’s AGI is included in the income calculation.

For PAYE and IBR, your partner is also part of your family size.

Some physicians choose to file taxes separately to exclude their partner’s income.

That can lower your student loan payment… but it may increase your tax bill.

Not a decision to make lightly.

If you’re in this boat, let’s talk it through.

Understanding RAP

What’s so great about RAP?

RAP includes one major benefit: no negative amortization.

If your payment doesn’t fully cover your monthly interest, your loan balance won’t grow.

Let’s say you owe $250,000 at 6% interest. Your 10-Year Standard payment is $2,777, but as a resident earning $60,000, your RAP payment might only be $250. Under PAYE or IBR, the difference would be added to your balance. Under RAP, your balance stays flat.

Important: If you’re pursuing PSLF, it doesn’t matter how big your loan balance gets… it’ll be forgiven tax-free after 120 payments. So don’t pick RAP just to avoid balance growth if PSLF is your goal.

But if you’re not going for PSLF?

RAP can be a great fit during training. It keeps your payment low without ballooning your balance — giving you less to pay off once you’re making attending income.

Sounds great. What’s the catch?

RAP doesn’t include a payment cap.

PAYE and IBR cap your payment at the 10-Year Standard amount, about $2,777/month in our example.

But under RAP, your payment could keep growing as your income rises.

If your income hits $600,000, your RAP payment might hit $5,000/month or more.

RAP protects you early on… but can cost more later if your income climbs fast.

Want Help With Your Student Loans?

Not sure which plan is best?

Want to lower your student loan payment without messing up forgiveness?

Let’s talk.

For $299, you’ll get a one on one session with a student loan pro (hi, that’s me — Michael Putterman, CFP®) and a personalized repayment strategy that could save you thousands.

✅ Review your options

✅ Build a clear game plan

✅ Avoid the most expensive mistakes

Disclosure: This content is for informational purposes only and does not constitute personalized financial advice. We recommend consulting with your tax and financial professional for tailored guidance.

Meet Your Team

👋 Hi, I'm Michael.

I help early-career physicians feel confident about money without the jargon, overwhelm, or sales pitches.

I work alongside two highly enthusiastic (but not exactly qualified) team members:

🐶 That's Max on the left, our Pawsome Intern

🐶 And Ryder on the right, our Chief Barketing Officer

Together, we’re here to make financial planning feel less intimidating... and maybe even a little fun.

Ready to Chat?

We're currently accepting new ongoing financial planning clients!

Ongoing means we meet regularly and help with all parts of your financial life.

Not ready to chat?

Follow me on social for quick tips on loans, taxes, saving, and more.

Meet Your Team

👋 Hi, I'm Michael Putterman, CFP®.

I help early-career physicians feel confident about money without jargon, overwhelm, or sales pitches.

I work alongside two highly enthusiastic (but not exactly qualified) team members:

🐶 Max — Pawsome Intern

🐶 Ryder — Chief Barketing Officer

Together, we’re here to make financial planning feel less intimidating, and maybe even a little fun.

Ready to Chat?

We're currently accepting new ongoing financial planning clients!

Ongoing means we meet regularly and help with all parts of your financial life.

Not ready to chat?

Follow me on social for quick tips on loans, taxes, saving, and more.

☁ Virtually serving clients nationwide ☁