Student Loans for Married Couples: How Tax Filing Status Impacts Payments

Last Updated: August 15, 2025

If you or your spouse have federal student loans, marriage can make repayment a lot more complicated.

Your tax filing status, Married Filing Jointly (MFJ) vs Married Filing Separately (MFS), can dramatically change your monthly payments under New IBR, PAYE, Old IBR, and RAP.

Important: It usually does not make sense for couples to file separately if both spouses have federal student loans. In most cases, the potential payment savings from filing separately are not significant enough to offset the tax cost because each spouse is already responsible for their own proportional share of the combined payment. There are exceptions, but they are less common and should be reviewed with a tax professional and a student loan specialist before making the switch.

This guide walks you through how each filing status works, including examples for:

-

-

Married Filing Jointly (MFJ)

-

Married Filing Separately in a non–community property state

-

Married Filing Separately in a community property state

-

By the end, you’ll understand how to choose the best strategy for your situation.

👇 Estimate Your Monthly Payment

Want to know what your student loan payment might look like?

Enter your info to estimate your monthly payment under each plan.

IDR Student Loan Calculator

Monthly Payments

| RAP | PAYE | New IBR | Old IBR | 10-Year Std | |

|---|---|---|---|---|---|

| You | $0 | $0 | $0 | $0 | $0 |

Calculations are believed to be correct. If you notice anything that doesn’t look right, please send an email to michael@dreambiggerfinancial.com.

Why Filing Status Matters for Student Loans

Income-Driven Repayment (IDR) plans base your payment on your income and family size.

When you get married, your spouse’s income may be counted toward your payment… sometimes increasing it significantly.

General rules:

-

-

Higher household income = higher IDR payment

-

Larger family size = lower IDR payment

-

Filing separately may exclude your spouse’s income (depending on your state)

-

Filing jointly combines both incomes but can still be beneficial in some cases

-

Choose Your IDR Plan

We’ll be focusing on four repayment plans for married borrowers:

-

-

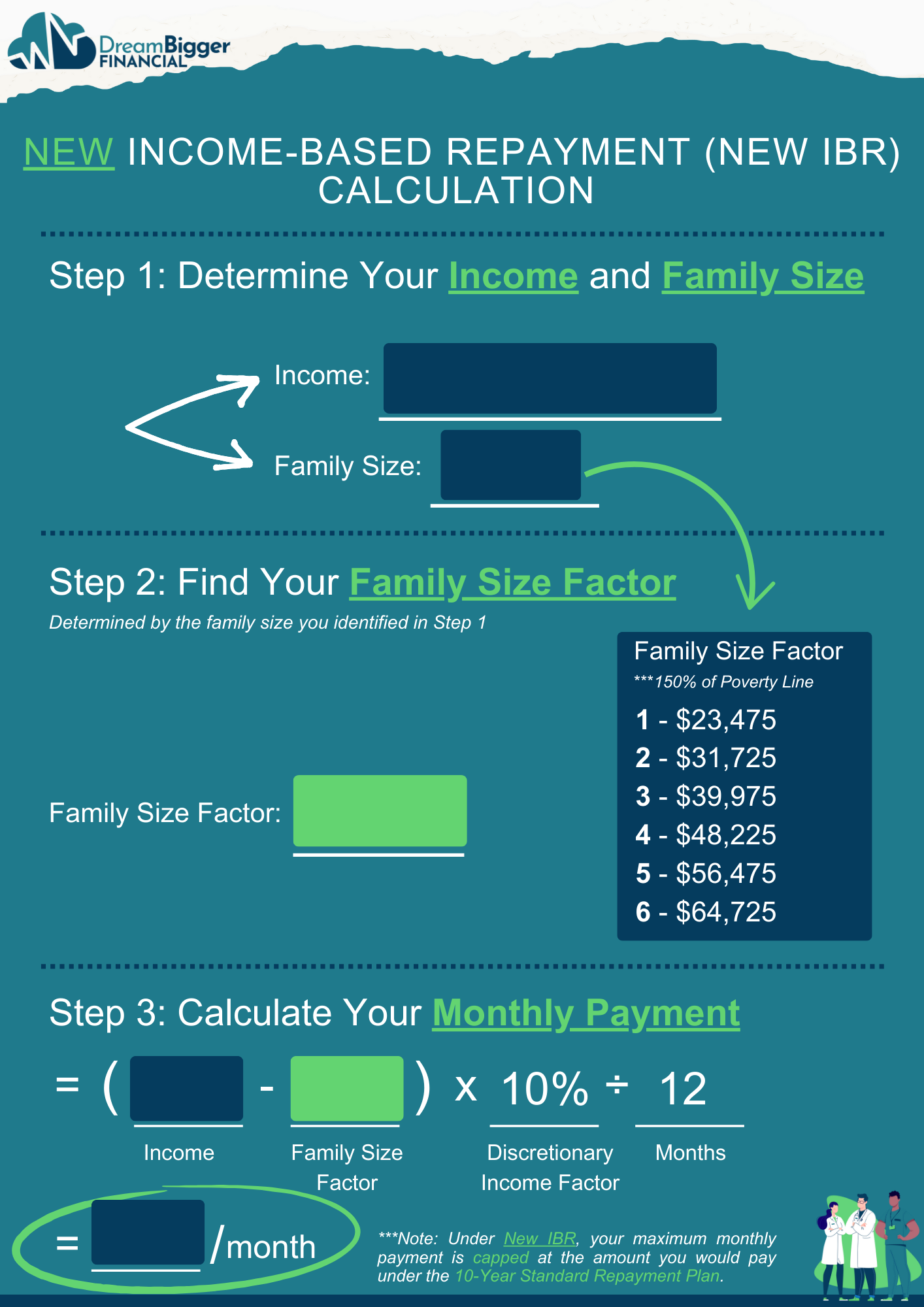

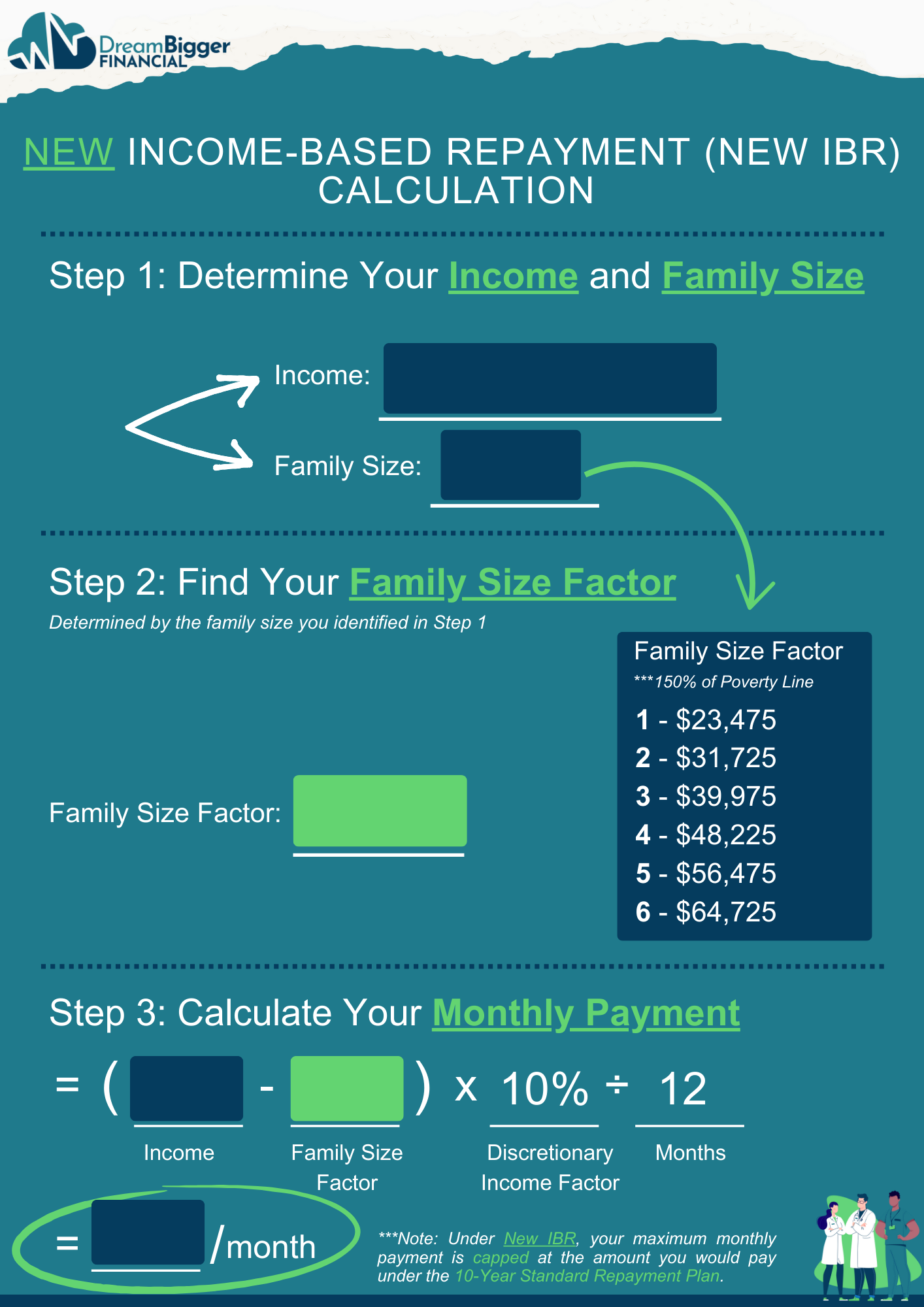

New IBR – Payments are 10% of your discretionary income, adjusted for your family size.

-

PAYE – Payments are 10% of your discretionary income, adjusted for your family size.

-

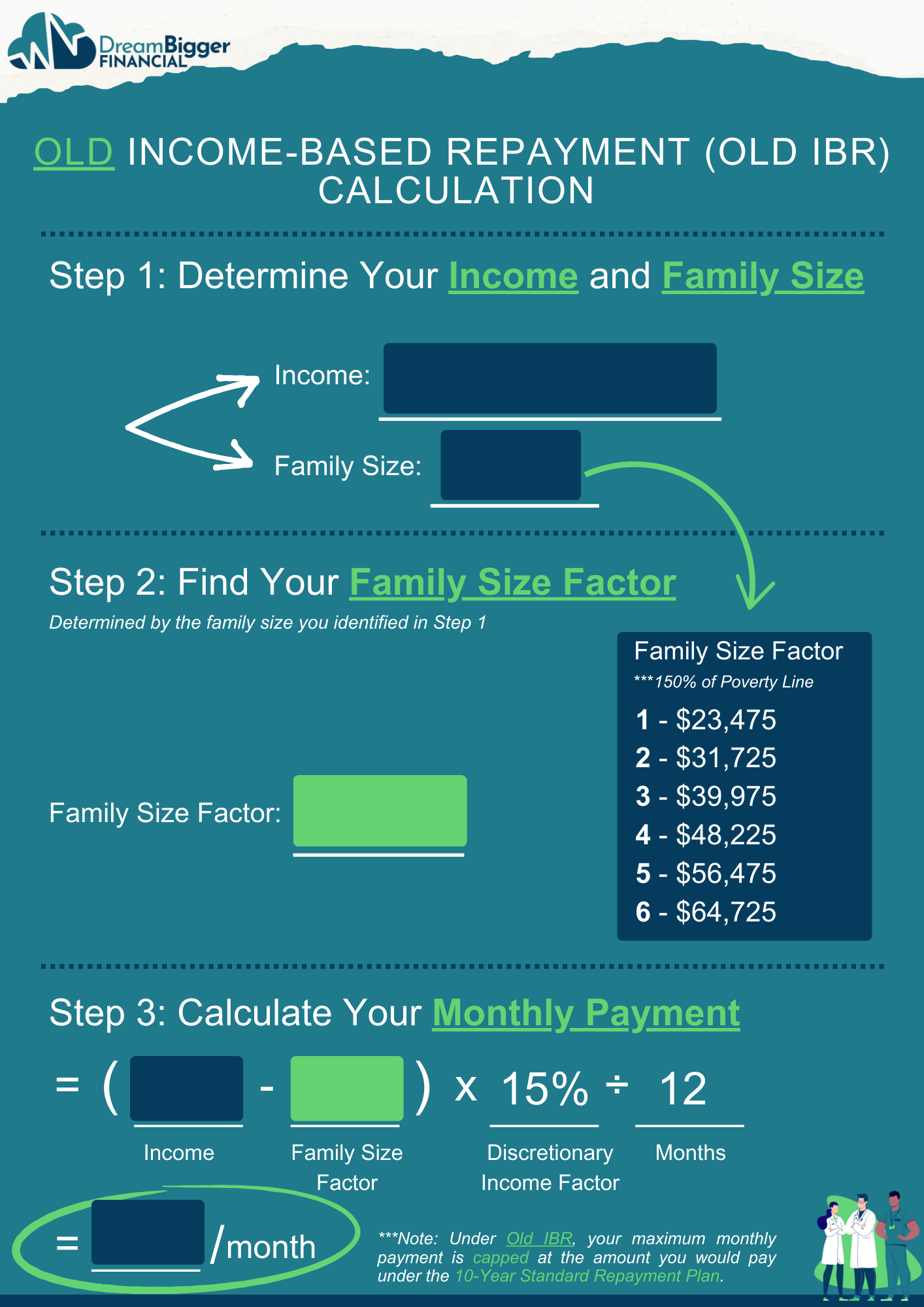

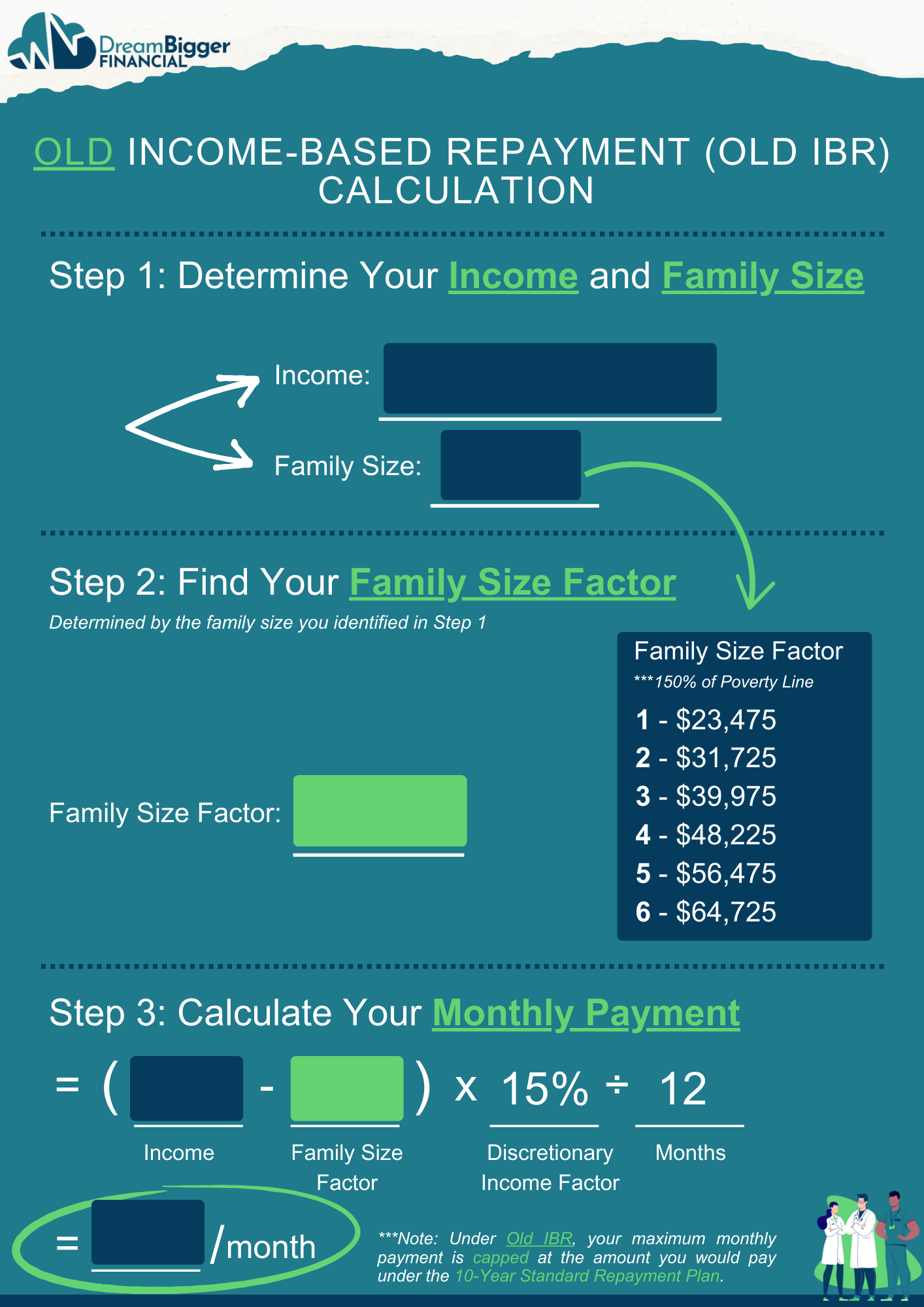

Old IBR – Payments are 15% of your discretionary income, adjusted for your family size.

-

RAP – Payments are based on your Adjusted Gross Income (AGI) with a deduction for each dependent child under age 17.

-

The plan you choose, combined with whether you file taxes as Married Filing Jointly or Separately, determines how your monthly student loan payment is calculated

Click a plan name to see how it works.

How Your New IBR/PAYE Payment Is Calculated

How Your Old IBR Payment Is Calculated

How Your RAP Payment Is Calculated

RAP payments are based on two things:

- Your Adjusted Gross Income (AGI)

- The number of dependents under age 17 in your household

The more you earn, the higher your payment. The more dependents you have, the lower your payment.

Step 1 – Find your AGI bracket:

-

- AGI ≤ $10,000: Flat $120 per year ($10/month)

- $10,001 to $20,000: 1% of AGI

- $20,001 to $30,000: 2% of AGI

- $30,001 to $40,000: 3% of AGI

- $40,001 to $50,000: 4% of AGI

- $50,001 to $60,000: 5% of AGI

- $60,001 to $70,000: 6% of AGI

- $70,001 to $80,000: 7% of AGI

- $80,001 to $90,000: 8% of AGI

- $90,001 to $100,000: 9% of AGI

- AGI over $100,000: 10% of AGI

Step 2 – Calculate your annual payment:

Multiply your AGI by the percentage for your bracket.

Step 3 – Convert to monthly:

Divide the annual amount by 12.

Step 4 – Apply the dependent deduction:

Subtract $50 for each dependent under 17.

Step 5 – Check the minimum:

Your payment can never be less than $10/month.

Scenario 1: Married Filing Jointly

When you file taxes as Married Filing Jointly, your combined household income is used to calculate student loan payments.

For New IBR and PAYE, if both spouses have federal student loans, the payment is split proportionally based on each person’s share of the total debt.

For RAP, there’s no proportional split. Each spouse’s payment is calculated using the full combined income, regardless of who owes more. This can cause a much higher total payment for dual-income couples… a situation known as the RAP marriage penalty.

Example:

- Household Income: $100,000

-

- Partner 1: $60,000

- Partner 2: $40,000

-

- Total Student Loans: $100,000

-

- Partner 1: $60,000 (60% of total debt)

- Partner 2: $40,000 (40% of total debt)

-

- Tax Filing Status: Married Filing Jointly (MFJ)

If Partner 1 chooses New IBR/PAYE (Combined Income):

-

- Income: $100,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $68,275

- Monthly Payment: $341 ($569 x 60%)

If Partner 1 chooses Old IBR (Combined Income):

-

- Income: $100,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $68,275

- Monthly Payment: $512 ($853 x 60%)

If Partner 1 chooses RAP (Combined Income):

-

- Income: $100,000

- Number of Dependents Under Age 17: 0

- Adjusted Gross Income (AGI): $100,000

- Monthly Payment: $750 ($750 x 100%)

If Partner 2 chooses New IBR/PAYE (Combined Income):

-

- Income: $100,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $68,275

- Monthly Payment: $228 ($569 x 40%)

If Partner 2 chooses Old IBR (Combined Income):

-

- Income: $100,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $68,275

- Monthly Payment: $341 ($853 x 40%)

If Partner 2 chooses RAP (Combined Income):

-

- Income: $100,000

- Number of Dependents Under Age 17: 0

- Adjusted Gross Income (AGI): $100,000

- Monthly Payment: $750 ($750 x 100%)

Takeaway: Under IBR and PAYE, payments are split based on each spouse’s share of the debt. Under RAP, each spouse’s payment is based on the full household income, which can significantly increase costs for dual-income couples.

What if We File Jointly and Only One Spouse Has Loans?

If your spouse doesn’t have federal student loan debt, you’re responsible for 100% of the monthly payment.

Since there’s no second borrower, your payment will not be prorated based on a share of the total debt.

When you file as Married Filing Jointly, your payment will still be calculated using combined household income.

That means your spouse’s income can increase your payment even though they don’t have loans.

This is why some couples compare joint vs separate filing to see if excluding the spouse’s income might lower the payment under certain IDR plans.

Example:

- Household Income: $100,000

-

- Partner 1: $60,000

- Partner 2: $40,000

-

- Total Student Loans: $100,000

-

- Partner 1: $100,000 (100% of total debt)

- Partner 2: $0 (0% of total debt)

-

- Tax Filing Status: Married Filing Jointly (MFJ)

If Partner 1 chooses New IBR/PAYE (Combined Income):

-

- Income: $100,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $68,275

- Monthly Payment: $569 ($569 x 100%)

If Partner 1 chooses Old IBR (Combined Income):

-

- Income: $100,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $68,275

- Monthly Payment: $853 ($853 x 100%)

If Partner 1 chooses RAP (Combined Income):

-

- Income: $100,000

- Number of Dependents Under Age 17: 0

- Adjusted Gross Income (AGI): $100,000

- Monthly Payment: $750 ($750 x 100%)

Takeaway: If only one spouse has federal student loans, that spouse is responsible for the entire monthly payment. Payments are not prorated, and when filing jointly, the calculation still uses combined household income, meaning the non-borrowing spouse’s income can increase the payment even though they don’t owe any loans.

Scenario 2: Married Filing Separately (Non–Community Property State)

When you file Married Filing Separately in a non–community property state, your IDR payment is calculated using only your income.

This can lower your payment if your spouse earns more than you do.

But your family size still matters… and this is where things can get tricky.

How Family Size Works in This Scenario

Family size directly impacts your payment. Under Department of Education rules, family size:

-

- Always includes you

- Includes your spouse if you’re married

- Includes your children (including one on the way) if they receive more than half their support from you

- Includes other dependents you support more than half the year

Support can be money, housing, food, clothes, medical care, or school costs.

The “weird” part: If you file separately and give IRS consent in your IDR online application, the system will pull your tax return to determine family size, often counting only you (unless you claimed dependents).

This is because your initial family size is based solely on the individuals listed on your most recent tax return.

If your tax return doesn’t include everyone who should be counted for IDR purposes, you can manually adjust your family size in the online application.

If you have children:

-

- When filing separately, both spouses can’t claim the same dependents on their returns.

- If only one spouse has loans, that spouse usually wants to claim all the kids.

- If both spouses have loans, one spouse usually claims all the kids, and the other must maunally adjust their family size in the online IDR application to reflect the correct number.

More information can be found here: Family Size in IDR Plans – Federal Student Aid

Online vs Paper Applications

Online IDR Application – studentaid.gov/idr

-

- Fastest option, completed entirely online

- Lets you grant IRS consent or manually override family size if needed

Paper IDR Application – Fillable PDF sent to your servicer

-

- Slower processing

- Requires your tax return or alternative income documentation

- Family size is self-reported

As of now: Even when filing separately, both online and paper applications are still counting your spouse in family size. This may change, and I’ll update this page if new guidance is released.

Example:

- Household Income: $100,000

-

- Partner 1: $60,000

- Partner 2: $40,000

-

- Total Student Loans: $100,000

-

- Partner 1: $60,000 (60% of total debt)

- Partner 2: $40,000 (40% of total debt)

-

- Tax Filing Status: Married Filing Separately (MFS)

-

- Family Size: 2

-

If Partner 1 chooses New IBR/PAYE (Separate Income):

-

- Income: $60,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $28,275

- Monthly Payment: $236 ($236 x 100%)

If Partner 1 chooses Old IBR (Separate Income):

-

- Income: $60,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $28,275

- Monthly Payment: $353 ($353 x 100%)

If Partner 1 chooses RAP (Separate Income):

-

- Income: $60,000

- Number of Dependents Under Age 17: 0

- Adjusted Gross Income (AGI): $60,000

- Monthly Payment: $250 ($750 x 100%)

If Partner 2 chooses New IBR/PAYE (Separate Income):

-

- Income: $40,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $8,275

- Monthly Payment: $69 ($69 x 100%)

If Partner 2 chooses Old IBR (Separate Income):

-

- Income: $40,000

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $8,275

- Monthly Payment: $103 ($103 x 100%)

If Partner 2 chooses RAP (Separate Income):

-

- Income: $40,000

- Number of Dependents Under Age 17: 0

- Adjusted Gross Income (AGI): $40,000

- Monthly Payment: $100 ($100 x 100%)

Takeaway: In a non–community property state, filing Married Filing Separately means your IDR payment is based only on your own income. This can lower payments if your spouse earns more than you. Family size rules still apply, and can be tricky when children are involved. If only one spouse has federal loans, there is no proportional split, that spouse is responsible for 100% of their own payment, regardless of filing status.

Scenario 3: Married Filing Separately (Community Property State)

When you file Married Filing Separately in a community property state, your IDR payment is usually based on 50% of your combined household income, regardless of who actually earned it.

This can help lower payments for the higher-earning spouse but can hurt the lower-earning spouse. For example:

-

-

Resident physician earns $60,000

-

IT professional spouse earns $140,000

-

Normally: $60,000 + $140,000 = $200,000, then split in half = each reports $100,000 as their IDR income.

-

If the higher-earning spouse has loans, this lowers their payment (from $140,000 to $100,000).

-

If the lower-earning spouse has loans, this increases their payment (from $60,000 to $100,000).

-

Using Alternative Documentation of Income (ADOI)

Borrowers in community property states may be able to submit alternative documentation of income to use their actual earnings instead of the split household income shown on a tax return.

From the Department of Education:

Your loan servicer may allow you to submit alternative documentation of your individual income that would be used instead of the adjusted gross income shown on your federal income tax return. Before you submit alternative documentation of your income, check with your loan servicer to see if this option is available.

In practice:

-

-

If the lower-earning spouse has loans, submitting ADOI (like a recent pay stub) can reduce their reported IDR income from the split amount back to their actual earnings.

-

The higher-earning spouse usually wouldn’t benefit from ADOI here, since the 50% split already lowers their reported income compared to their actual earnings.

-

Family Size in Community Property States

Family size rules are the same as in non–community property states (see above).

Example:

- Household Income: $100,000

-

- Partner 1: $60,000

- Partner 2: $40,000

-

- Total Student Loans: $100,000

-

- Partner 1: $60,000 (60% of total debt)

- Partner 2: $40,000 (40% of total debt)

-

- Tax Filing Status: Married Filing Separately (MFS)

-

- Family Size: 2

-

If Partner 1 or Partner 2 chooses New IBR/PAYE (Separate Income):

-

- Income: $50,000 ($100,000 ÷ 2)

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $18,275

- Monthly Payment: $152 ($152 x 100%)

***With Alternative Documentation of Income for Partner 2: Income = $40,000 → Payment = $69/month

If Partner 1 or Partner 2 chooses Old IBR (Separate Income):

-

- Income: $50,000 ($100,000 ÷ 2)

- Family Size: 2

- 150% of Poverty Line: $31,725

- Discretionary Income: $18,275

- Monthly Payment: $228 ($228 x 100%)

***With Alternative Documentation of Income for Partner 2: Income = $40,000 → Payment = $103/month

If Partner 1 or Partner 2 chooses RAP (Separate Income):

-

- Income: $50,000 ($100,000 ÷ 2)

- Number of Dependents Under Age 17: 0

- Adjusted Gross Income (AGI): $50,000

- Monthly Payment: $167 ($167 x 100%)

***With Alternative Documentation of Income for Partner 2: Income = $40,000 → Payment = $100/month

Takeaway: In a community property state, filing separately normally means both spouses use 50% of household income for IDR payments… even if one earns much less. This can help higher earners but hurt lower earners. If the lower-earning spouse has loans, they may be able to submit alternative documentation of income to report their actual earnings instead of the split income, lowering their payment.

Important Considerations

-

Form 8958 – If you live in a community property state and file separately, you must complete IRS Form 8958 to show how you’re splitting your income between spouses. This ensures your tax return is processed correctly.

Community Property States:

-

-

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

-

-

-

Tax Implications – Don’t choose Married Filing Jointly or Separately based only on lowering your student loan payment. Filing separately can increase your total tax bill or cause you to lose certain credits and deductions. Weigh the loan savings against the potential tax cost.

-

Repayment Plan Rules – Each plan (New IBR, PAYE, Old IBR, RAP) has different rules for calculating payments. Make sure you understand how each one works before deciding.

-

Get Professional Guidance – Work with a tax professional and a student loan specialist before deciding how to file and which repayment plan to choose. The right strategy depends on your income, state, and loan forgiveness goals.

Bringing It All Together

Your tax filing status can have a major impact on your student loan payments… sometimes for better, sometimes for worse.

Whether you file jointly or separately, live in a community property or non-community property state, or choose New IBR, PAYE, Old IBR, or RAP, the details matter.

The examples above show just how different your payments can be depending on:

-

-

Your income

-

Your spouse’s income

-

Whether you have children or other dependents

-

How family size is reported on your IDR application

-

Whether you can (and should) use alternative documentation of income

-

The right approach isn’t always obvious, and it’s rarely a one-size-fits-all decision.

For many couples, the smartest move is to compare multiple filing and repayment scenarios side by side before committing, ideally with help from both a tax professional and a student loan specialist.

Want Help With Your Student Loans?

Need a second set of eyes on your plan?

If you’re unsure which repayment strategy makes the most sense, I can help.

For $299, you’ll get a one on one session with a student loan pro (hi, that’s me — Michael Putterman, CFP®) and a and a custom repayment strategy that fits your life, not just your loans.

✅ Review your options

✅ Build a clear game plan

✅ Avoid the most expensive mistakes

Disclosure: This content is for informational purposes only and does not constitute personalized financial, tax, or student loan advice. Student loan programs and repayment rules change frequently, and while I strive to keep this page up to date, I can’t guarantee accuracy at all times. Please consult your tax or financial professional for guidance specific to your situation.

Meet Your Team

👋 Hi, I'm Michael.

I help early-career physicians feel confident about money without the jargon, overwhelm, or sales pitches.

I work alongside two highly enthusiastic (but not exactly qualified) team members:

🐶 That's Max on the left, our Pawsome Intern

🐶 And Ryder on the right, our Chief Barketing Officer

Together, we’re here to make financial planning feel less intimidating... and maybe even a little fun.

Ready to Chat?

We're currently accepting new ongoing financial planning clients!

Ongoing means we meet regularly and help with all parts of your financial life.

Not ready to chat?

Follow me on social for quick tips on loans, taxes, saving, and more.

Meet Your Team

👋 Hi, I'm Michael Putterman, CFP®.

I help early-career physicians feel confident about money without jargon, overwhelm, or sales pitches.

I work alongside two highly enthusiastic (but not exactly qualified) team members:

🐶 Max — Pawsome Intern

🐶 Ryder — Chief Barketing Officer

Together, we’re here to make financial planning feel less intimidating, and maybe even a little fun.

Ready to Chat?

We're currently accepting new ongoing financial planning clients!

Ongoing means we meet regularly and help with all parts of your financial life.

Not ready to chat?

Follow me on social for quick tips on loans, taxes, saving, and more.

☁ Virtually serving clients nationwide ☁